Lion Electric's Future Uncertain: Liquidation Imminent?

Table of Contents

Lion Electric's Mounting Financial Difficulties

Lion Electric's recent performance paints a concerning picture. Declining revenue, mounting losses, and dwindling cash reserves raise serious questions about the company's long-term viability.

Declining Revenue and Profitability

Lion Electric's financial reports reveal a worrying trend of shrinking revenues and increasing losses.

- Q[Insert Quarter] 2023 Revenue: [Insert Specific Revenue Figure] – a significant decrease compared to the same period last year.

- Net Loss Q[Insert Quarter] 2023: [Insert Specific Net Loss Figure] – highlighting unsustainable operational costs.

- Negative Cash Flow: Consistent negative cash flow indicates an inability to generate sufficient funds to cover operational expenses and debt obligations.

These figures reflect a broader struggle within the EV sector, compounded by increased competition, supply chain disruptions, and escalating raw material costs, all impacting Lion Electric's profitability.

Mounting Debt and Liquidity Concerns

Lion Electric's significant debt burden poses a substantial threat to its financial stability.

- Total Debt: [Insert Total Debt Figure] – representing a considerable financial liability.

- Credit Rating: [Insert Current Credit Rating, if available] – indicating increasing risk for lenders.

- Debt Maturity Schedule: [Insert Details on upcoming debt maturities if available] – highlighting potential short-term liquidity crunches.

The company's ability to meet its debt obligations is increasingly uncertain, further fueling concerns about potential default and subsequent bankruptcy proceedings. Access to further financing appears increasingly difficult given the current financial climate.

Failed Attempts at Restructuring or Fundraising

Lion Electric has explored various avenues to address its financial woes, but these attempts have yielded limited success.

- Equity Offering Results: [Insert Details on any recent equity offerings and their success/failure].

- Debt Restructuring Negotiations: [Insert Information on any debt restructuring efforts and their outcome].

- Strategic Partnerships: [Insert Information on any attempts at strategic partnerships and mergers/acquisitions].

The lack of substantial progress in securing additional funding or restructuring its debt significantly increases the likelihood of more drastic measures.

Indicators Suggesting Imminent Lion Electric Liquidation

Several alarming indicators point towards the possibility of imminent Lion Electric liquidation.

Credit Rating Downgrades

Several credit rating agencies have downgraded Lion Electric's credit rating, reflecting a heightened risk of default.

- Moody's Rating: [Insert Moody's Rating, if available].

- S&P Rating: [Insert S&P Rating, if available].

- Fitch Rating: [Insert Fitch Rating, if available].

These downgrades severely restrict Lion Electric's access to credit markets, making it harder to secure the necessary financing to stay afloat.

Delays and Cancellations of Orders

Reports suggest delays and cancellations of orders, further impacting the company's revenue streams and exacerbating its cash flow problems.

- Number of Delayed Orders: [Insert data if available].

- Value of Cancelled Orders: [Insert data if available].

- Reasons for Delays/Cancellations: [Insert reasons if known, e.g., supply chain issues, customer concerns].

These setbacks directly translate to reduced revenue, making it harder for Lion Electric to meet its financial obligations.

Legal Actions and Lawsuits

Potential legal actions and lawsuits could further drain Lion Electric's resources and complicate its already precarious financial situation. [Insert details on any legal actions or lawsuits if available. If unavailable, state that this information is not publicly accessible]. This uncertainty adds another layer of risk to the company’s already challenging circumstances.

Alternative Scenarios and Potential Outcomes

While Lion Electric liquidation appears a significant threat, alternative scenarios remain possible, albeit less likely.

Successful Restructuring

Lion Electric might still achieve a successful restructuring of its debt and operations, avoiding liquidation. This would require:

- Debt renegotiation with creditors.

- Significant operational cost reductions.

- A robust plan to improve revenue generation.

The feasibility of this scenario hinges on the cooperation of creditors and the company's ability to implement drastic changes rapidly.

Acquisition by a Larger Company

Acquisition by a larger automotive manufacturer or technology company remains a possibility. This would offer a lifeline, but several factors would determine its success:

- Finding a willing buyer.

- Negotiating a favorable acquisition price.

- Integrating Lion Electric's operations smoothly.

The likelihood of this scenario depends heavily on the attractiveness of Lion Electric's assets and technology to potential acquirers.

Conclusion: The Future of Lion Electric – A Looming Liquidation?

The evidence strongly suggests that Lion Electric faces an extremely challenging financial situation. Declining revenue, mounting debt, failed fundraising efforts, and credit rating downgrades all point toward a significant risk of Lion Electric liquidation. While a successful restructuring or acquisition remains theoretically possible, these scenarios appear less likely given the current circumstances. The specter of Lion Electric bankruptcy looms large. The coming months will be critical in determining the ultimate fate of the company. Stay informed about further developments in the Lion Electric financial crisis. Share your thoughts and analysis of the potential for Lion Electric liquidation in the comments below. Further research into Lion Electric's financial statements and recent news is encouraged.

Featured Posts

-

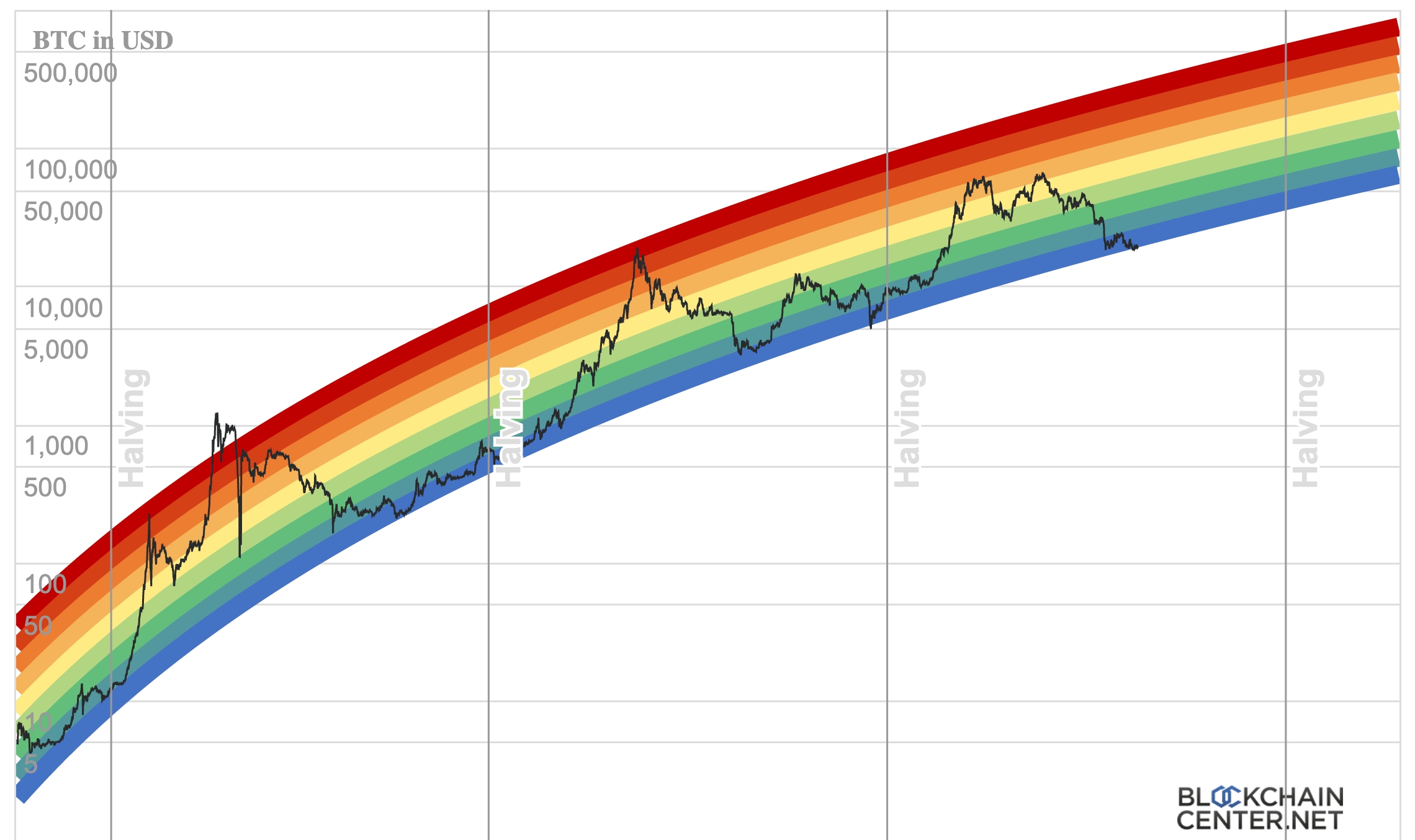

Bitcoin Price Update 10 Week High Broken Approaching Us 100 000

May 07, 2025

Bitcoin Price Update 10 Week High Broken Approaching Us 100 000

May 07, 2025 -

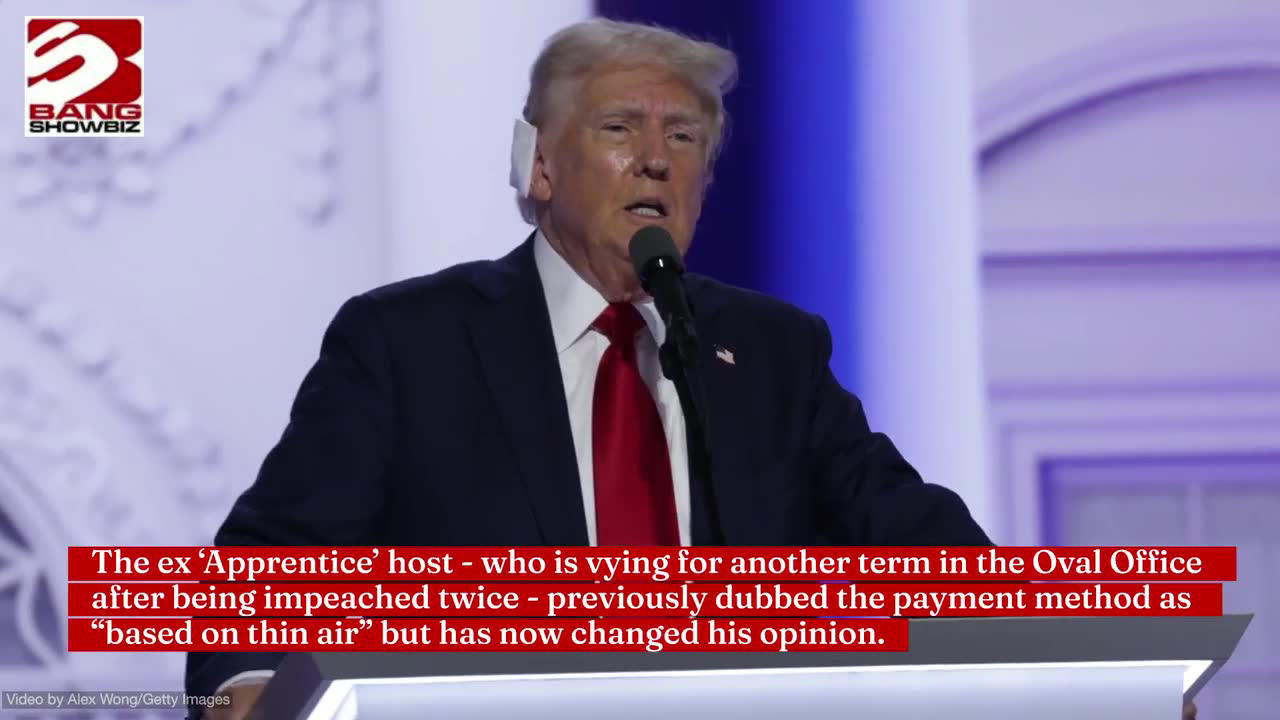

Is Trumps Xrp Endorsement Driving Institutional Investment

May 07, 2025

Is Trumps Xrp Endorsement Driving Institutional Investment

May 07, 2025 -

Jenna Ortegas Top Secret Movie Role With Glen Powell What We Know

May 07, 2025

Jenna Ortegas Top Secret Movie Role With Glen Powell What We Know

May 07, 2025 -

Anthony Edwards Adidas 2 Release Date Specs And More

May 07, 2025

Anthony Edwards Adidas 2 Release Date Specs And More

May 07, 2025 -

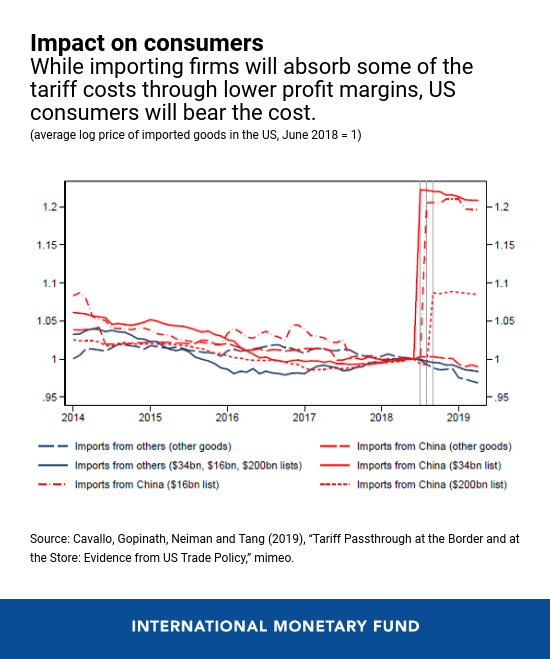

Impact Of Us China Trade Talks And Economic Data On The Chinese Stock Market

May 07, 2025

Impact Of Us China Trade Talks And Economic Data On The Chinese Stock Market

May 07, 2025

Latest Posts

-

500 000 Evro Za Zhersona Zenit Delaet Predlozhenie

May 08, 2025

500 000 Evro Za Zhersona Zenit Delaet Predlozhenie

May 08, 2025 -

Ubers Pet Transportation Service Launches In Delhi And Mumbai

May 08, 2025

Ubers Pet Transportation Service Launches In Delhi And Mumbai

May 08, 2025 -

Ubers New Cash Only Auto Service What You Need To Know

May 08, 2025

Ubers New Cash Only Auto Service What You Need To Know

May 08, 2025 -

Zherson I Zenit Kontrakt Na 500 000 Evro Pravda Ili Slukhi

May 08, 2025

Zherson I Zenit Kontrakt Na 500 000 Evro Pravda Ili Slukhi

May 08, 2025 -

Door Dash Faces Lawsuit From Uber Examining The Allegations Of Anti Competitive Conduct

May 08, 2025

Door Dash Faces Lawsuit From Uber Examining The Allegations Of Anti Competitive Conduct

May 08, 2025