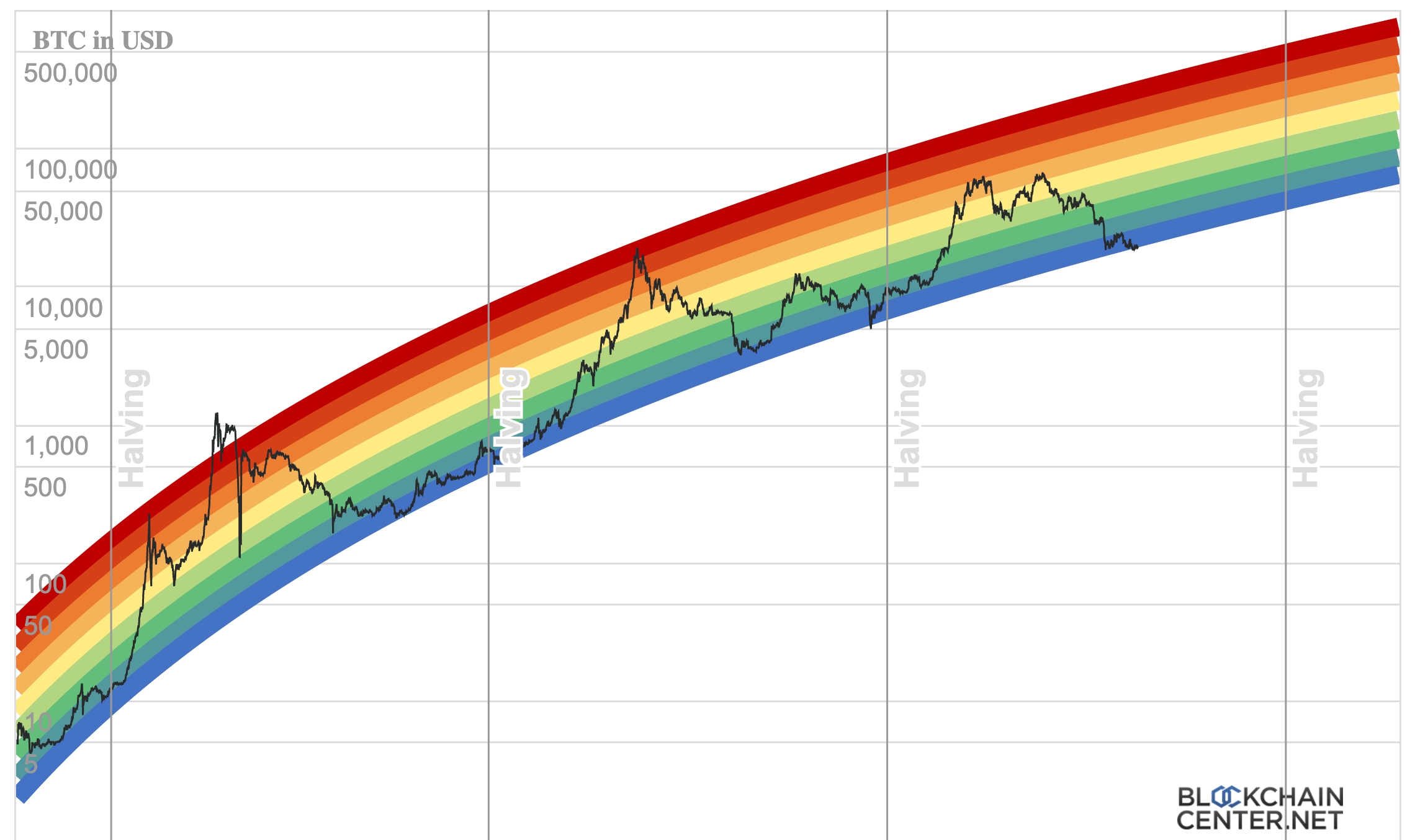

Bitcoin Price Update: 10-Week High Broken, Approaching US$100,000

Table of Contents

Recent Price Surge Analysis

The recent surge in the Bitcoin price is supported by a confluence of factors, reflected in both technical indicators and market sentiment.

Technical Indicators

Positive technical indicators strongly suggest bullish momentum for Bitcoin.

- The 200-day moving average has been decisively broken, a strong bullish signal indicating sustained upward price pressure.

- Trading volume has significantly increased during the recent price surge, confirming the strength of the rally. High volume breakouts often signal a continuation of the trend.

- Key support levels have held, demonstrating buying pressure and a strong foundation for further price increases. The price has successfully bounced off crucial support levels, indicating strong underlying demand.

[Insert chart showing RSI, MACD, and moving averages with clear upward trends]

Market Sentiment & News

Positive news and improved market sentiment have played a crucial role in the Bitcoin price increase.

- Positive regulatory news: Recent statements from major financial institutions like Blackrock regarding Bitcoin ETFs have fueled investor confidence and reduced regulatory uncertainty.

- Increased institutional adoption: More and more institutional investors are adding Bitcoin to their portfolios, driving demand and supporting price appreciation. This signifies a growing acceptance of Bitcoin as a legitimate asset class.

- Positive market sentiment indicators: Social media sentiment and other market sentiment gauges show a significant shift towards bullishness, further contributing to the price surge. Increased positive news coverage also fuels this sentiment.

Whale Activity

Large Bitcoin transactions, often associated with "whales" (high-net-worth investors), have also impacted the price.

- On-chain data reveals increased accumulation by large holders, suggesting further price increases. These large buys often signal confidence in the long-term outlook for Bitcoin.

- Large buy orders have been observed pushing the price upwards, showcasing the significant buying power of these major players in the market.

Factors Contributing to Bitcoin's Price Increase

Several interconnected factors have contributed to Bitcoin's recent price appreciation.

Macroeconomic Factors

Global macroeconomic conditions are playing a role in Bitcoin's appeal as a safe-haven asset.

- Concerns about persistent inflation: Investors are seeking alternatives to traditional assets, leading to increased demand for Bitcoin, which is seen as a hedge against inflation.

- Uncertainty in the global economy: Geopolitical instability and economic uncertainty drive investors towards Bitcoin's decentralized and secure nature. This makes Bitcoin an attractive asset during times of uncertainty.

- Interest rate hikes: While interest rate increases can affect cryptocurrency markets, the current situation sees investors seeking diversification, and Bitcoin is a potential beneficiary.

Institutional Adoption and Investment

Increased institutional interest is a key driver of the Bitcoin price increase.

- MicroStrategy's continued Bitcoin accumulation demonstrates growing institutional confidence. This significant player in the space continues to show faith in the long-term potential of Bitcoin.

- Numerous applications for Bitcoin ETFs are under review, suggesting further institutional investment is on the horizon. The approval of these ETFs would significantly increase the accessibility of Bitcoin to institutional investors.

- Corporate adoption of Bitcoin as a treasury asset is rising, providing further support for the price. More companies are starting to hold Bitcoin as a part of their reserves, showing confidence in its long-term value.

Technological Developments

Advancements in Bitcoin's underlying technology are also contributing to its price appreciation.

- The ongoing development of the Lightning Network is improving Bitcoin’s transaction speed and scalability, addressing some of its previous limitations. This improvement in efficiency makes Bitcoin more appealing for daily use.

- Upcoming upgrades and enhancements to the Bitcoin protocol will continue to improve its functionality and security, attracting more users and investment.

Potential Challenges and Risks

Despite the current bullish trend, several challenges and risks could impact the Bitcoin price.

Regulatory Uncertainty

Regulatory uncertainty remains a potential headwind for Bitcoin.

- Stricter regulations in certain jurisdictions could negatively impact Bitcoin's price. The regulatory landscape is evolving and uncertain, representing a significant risk factor.

- Varying regulatory approaches across different countries create complexity and uncertainty for investors.

Market Volatility

The inherent volatility of the cryptocurrency market is a major risk factor.

- Despite the recent gains, Bitcoin’s price remains volatile and subject to significant swings. Investors need to be prepared for potential price corrections.

- Unexpected market events can cause significant price fluctuations. This necessitates careful risk management strategies.

Competition from Other Cryptocurrencies

The emergence of new cryptocurrencies presents a challenge to Bitcoin's dominance.

- The emergence of new cryptocurrencies with innovative features presents a challenge to Bitcoin’s dominance. Competition in the cryptocurrency space is intense and ever-evolving.

- Altcoins with unique features might attract investors away from Bitcoin. Investors need to monitor developments in the broader cryptocurrency landscape.

Conclusion

The Bitcoin price has recently broken a 10-week high, fueled by a combination of positive technical indicators, favorable market sentiment, and increased institutional adoption. While the path to US$100,000 is not without challenges, the current trajectory is bullish. However, investors should remain aware of the inherent risks and volatility associated with Bitcoin. Stay informed with regular Bitcoin price updates and conduct thorough research before making any investment decisions. Keep track of the latest developments in the Bitcoin price and related cryptocurrency price movements to make informed decisions in this exciting and dynamic market. Monitor the BTC price closely and consider diversifying your investments.

Featured Posts

-

The Fantastic Four And Superman A Box Office Prediction Featuring Pedro Pascal And Isabela Merced

May 07, 2025

The Fantastic Four And Superman A Box Office Prediction Featuring Pedro Pascal And Isabela Merced

May 07, 2025 -

James Gunns Hawkgirl Reveal An Intriguing Superman Detail

May 07, 2025

James Gunns Hawkgirl Reveal An Intriguing Superman Detail

May 07, 2025 -

A Comprehensive Guide To The Papal Conclave

May 07, 2025

A Comprehensive Guide To The Papal Conclave

May 07, 2025 -

Using Ai To Create Engaging Podcasts From Repetitive Scatological Data

May 07, 2025

Using Ai To Create Engaging Podcasts From Repetitive Scatological Data

May 07, 2025 -

Lakers Randle Problem Timberwolves Exploit Physical Advantage

May 07, 2025

Lakers Randle Problem Timberwolves Exploit Physical Advantage

May 07, 2025

Latest Posts

-

Cavaliers Vs Spurs Injury Report Game On March 27th

May 07, 2025

Cavaliers Vs Spurs Injury Report Game On March 27th

May 07, 2025 -

Nba Playoffs Ashley Holder Gets The Inside Scoop From Donovan Mitchell

May 07, 2025

Nba Playoffs Ashley Holder Gets The Inside Scoop From Donovan Mitchell

May 07, 2025 -

Cavs Vs Spurs Injury News Full Report For March 27th Game On Fox Sports 1340 Wnco

May 07, 2025

Cavs Vs Spurs Injury News Full Report For March 27th Game On Fox Sports 1340 Wnco

May 07, 2025 -

Donovan Mitchells Playoff Outlook A 1 On 1 With Ashley Holder

May 07, 2025

Donovan Mitchells Playoff Outlook A 1 On 1 With Ashley Holder

May 07, 2025 -

Fox Sports 980 Wone Cavaliers Vs Spurs Injury Update March 27th

May 07, 2025

Fox Sports 980 Wone Cavaliers Vs Spurs Injury Update March 27th

May 07, 2025