Impact Of US-China Trade Talks And Economic Data On The Chinese Stock Market

Table of Contents

The Influence of US-China Trade Talks on Chinese Stock Market Sentiment

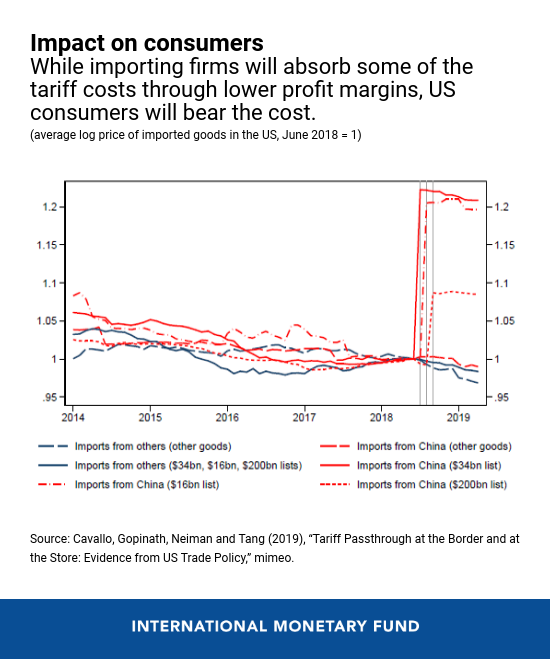

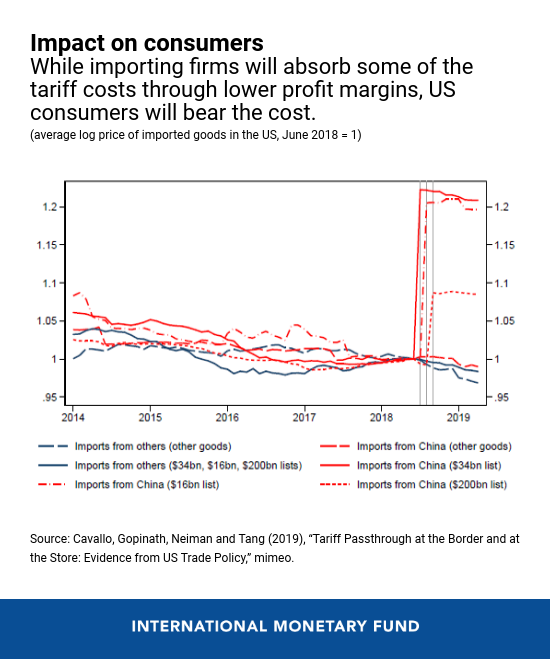

The rollercoaster ride of US-China trade relations significantly impacts investor sentiment towards the Chinese stock market. Periods of escalating trade tensions, marked by the imposition of tariffs and the threat of a full-blown trade war, generally lead to decreased investor confidence and market downturns. Uncertainty reigns supreme, as businesses grapple with unpredictable costs and disrupted supply chains. Keywords like "US-China trade war" and "trade negotiations" become synonymous with market volatility.

Conversely, periods of de-escalation and positive developments in trade agreements often translate into a surge in investor optimism, boosting market sentiment and potentially leading to significant upturns. The release of positive news regarding trade talks can trigger a wave of buying, pushing stock prices higher.

Specific examples: The 2018-2020 trade war between the US and China provides a stark illustration of this relationship. Escalation of tariffs led to considerable volatility in the Chinese stock market, while periods of negotiation and truce brought temporary relief.

- Increased uncertainty leads to capital flight. Investors often withdraw their investments from perceived riskier markets, seeking safer havens.

- Specific sectors (technology, manufacturing) are disproportionately affected. Industries heavily reliant on US-China trade are particularly vulnerable to disruptions caused by trade disputes.

- Positive news from trade talks boosts investor optimism. Announcements of progress in trade negotiations or the signing of trade agreements often lead to significant rallies in the Chinese stock market.

Economic Data and its Correlation with Chinese Stock Market Performance

Key economic indicators are crucial barometers of the Chinese economy’s health, directly influencing the performance of its stock market. The relationship between these indicators and stock market movements is generally positive; strong economic data often translates into rising stock prices, and vice versa. Keywords such as "GDP growth," "inflation," "PMI," and "Chinese economic indicators" are essential for understanding this correlation. "Stock market prediction," while not perfectly achievable, becomes more accurate with the proper analysis of these indicators.

However, unexpected data releases can introduce significant volatility. A surprisingly low GDP growth figure, for instance, can trigger a sharp market sell-off, while unexpectedly strong inflation data might lead to concerns about interest rate hikes, negatively impacting stock valuations.

- Strong GDP growth usually boosts market confidence. A healthy growth rate signifies economic strength and potential for corporate earnings growth.

- High inflation can lead to increased interest rates and negatively impact stock valuations. Higher interest rates make borrowing more expensive, reducing corporate investment and potentially slowing economic growth.

- PMI data reflects manufacturing activity and influences investor sentiment. The Purchasing Managers' Index (PMI) provides a snapshot of the manufacturing sector, a crucial component of the Chinese economy.

Analyzing Specific Sectors: Differential Impacts on Chinese Stocks

The Chinese stock market is not a monolith; different sectors react differently to US-China relations and economic data. A sectoral analysis reveals a nuanced picture. Keywords like "Technology stocks China," "consumer staples China," and "real estate China" are vital for understanding these differences.

Technology companies, for example, are particularly vulnerable to trade restrictions and sanctions imposed by the US government. Consumer staples, on the other hand, often demonstrate more resilience during economic downturns, as consumers continue to purchase essential goods. The real estate sector, meanwhile, is sensitive to both economic cycles and government policies.

- Technology sector's sensitivity to US sanctions and trade tensions. US restrictions on Chinese technology firms can significantly impact their stock prices.

- Consumer staples' relative stability during economic uncertainty. Demand for essential goods remains relatively stable, even during economic downturns.

- Real estate's susceptibility to interest rate changes and government regulations. Changes in interest rates and government policies significantly influence the real estate sector's performance.

The Role of Government Intervention and Policy in Mitigating Risks

The Chinese government plays a significant role in managing the market's response to both internal and external factors. Through monetary and fiscal policies, the government can intervene to stabilize the market during periods of uncertainty. Keywords such as "Chinese government policy," "monetary policy," and "fiscal policy" are key here. "Market regulation" also plays a substantial role.

Government stimulus packages, for instance, can help boost economic growth and improve investor sentiment. Adjustments to monetary policy, such as changes in interest rates, can influence inflation and investment behavior. Regulatory interventions can help address specific market vulnerabilities.

- Government stimulus packages to boost economic growth. Fiscal policies can inject liquidity into the economy, stimulating growth and boosting market confidence.

- Monetary policy adjustments to manage inflation and interest rates. The central bank uses monetary policy tools to control inflation and influence borrowing costs.

- Regulatory interventions to address market volatility. The government can intervene to prevent excessive market fluctuations and protect investor interests.

Conclusion: Understanding the Interplay for Informed Investment Decisions

The impact of US-China trade talks and economic data on the Chinese stock market is complex and multifaceted. Understanding the interplay between trade relations, key economic indicators, sectoral dynamics, and government policies is vital for navigating this dynamic market. Monitoring both US-China relations and key economic indicators is crucial for developing informed investment strategies.

To make sound investment decisions in the Chinese stock market, stay informed about the latest developments in US-China trade relations, closely follow key economic indicators, and understand the unique characteristics of different sectors. Continue your research using reputable financial news sources and analytical reports to stay abreast of these crucial factors. Remember, a well-informed investment strategy is a key component to successful navigating the complexities of the Chinese stock market.

Featured Posts

-

10 Filmes De Isabela Merced Para Entender Sua Performance Em The Last Of Us

May 07, 2025

10 Filmes De Isabela Merced Para Entender Sua Performance Em The Last Of Us

May 07, 2025 -

Victor Robles Oracle Park Injury Details On The Diving Catch And Aftermath

May 07, 2025

Victor Robles Oracle Park Injury Details On The Diving Catch And Aftermath

May 07, 2025 -

Anthony Edwards And The Baby Mama Drama A Social Media Frenzy

May 07, 2025

Anthony Edwards And The Baby Mama Drama A Social Media Frenzy

May 07, 2025 -

Nhl Hvezdy Na Ms Svedsko S Dominantni Sestavou Nemecko S Omezenymi Moznostmi

May 07, 2025

Nhl Hvezdy Na Ms Svedsko S Dominantni Sestavou Nemecko S Omezenymi Moznostmi

May 07, 2025 -

Papezevo Zdravstveno Stanje Stabilno A Prognoza Negotova

May 07, 2025

Papezevo Zdravstveno Stanje Stabilno A Prognoza Negotova

May 07, 2025

Latest Posts

-

12 Inch Surface Pro Performance And Portability

May 08, 2025

12 Inch Surface Pro Performance And Portability

May 08, 2025 -

Surface Pro 12 Inch Price Specs And Review

May 08, 2025

Surface Pro 12 Inch Price Specs And Review

May 08, 2025 -

Investigation Reveals Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 08, 2025

Investigation Reveals Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 08, 2025 -

Massive Office365 Data Breach Leads To Millions In Losses

May 08, 2025

Massive Office365 Data Breach Leads To Millions In Losses

May 08, 2025 -

Cybercriminals Office365 Infiltration Results In Multi Million Dollar Loss

May 08, 2025

Cybercriminals Office365 Infiltration Results In Multi Million Dollar Loss

May 08, 2025