Leading India Fund DSP Takes Cautious Stance, Raises Cash Levels Amid Market Uncertainty

Table of Contents

Keywords: DSP, India fund, market uncertainty, cash levels, cautious stance, investment strategy, risk management, Indian equity market, fund manager, Indian mutual funds, investment portfolio

The Indian equity market, a beacon of growth in recent years, is currently navigating a period of significant uncertainty. Leading India fund manager, DSP, has responded to this volatile climate by adopting a cautious stance and raising its cash levels. This strategic move reflects a broader trend among fund managers grappling with global economic headwinds and geopolitical risks. Understanding DSP's approach and its implications is crucial for investors navigating the complexities of the current market.

H2: DSP's Cautious Approach to Current Market Conditions

The Indian market, while exhibiting long-term growth potential, faces several challenges. Global factors significantly impact the Indian economy.

- High inflation impacting investor sentiment: Persistent inflation erodes purchasing power and dampens investor confidence, leading to increased market volatility.

- Geopolitical risks creating market volatility: The ongoing geopolitical landscape, marked by international conflicts and trade tensions, introduces significant uncertainty into global markets, directly affecting India's economic outlook.

- Concerns about global economic growth affecting Indian markets: Slowing global growth negatively impacts exports and foreign investment, creating ripple effects throughout the Indian economy.

These factors have prompted DSP to adopt a more cautious investment strategy. This reflects a prudent approach to risk management, prioritizing capital preservation in the face of market uncertainty. For investors, this implies a potential shift towards a more conservative portfolio allocation in the short term.

H2: Increased Cash Levels: A Strategic Move by DSP

DSP's response to market uncertainty involves a significant increase in its cash holdings. While precise figures haven't been publicly released, industry sources suggest a substantial percentage increase in cash reserves compared to previous quarters.

- Percentage increase in cash holdings: Although the exact percentage remains undisclosed, the increase is understood to be significant, reflecting a proactive risk management approach.

- Reasons for increasing cash: This strategic move aims to mitigate potential losses stemming from market volatility. The increased liquidity provides a buffer against unforeseen downturns, allowing DSP to capitalize on potential future opportunities that may emerge from market corrections. It's a clear defensive positioning.

- Comparison to previous cash holding levels: This represents a notable departure from previous strategies, highlighting the severity of the perceived market risks.

While maintaining higher cash levels offers greater liquidity and risk mitigation, it also carries potential drawbacks. Holding significant cash means foregoing potential gains from investments in equities during periods of market growth. The short-term impact on fund performance might show lower returns, but the long-term implications focus on preserving capital and positioning for future growth.

H2: Implications for Investors in DSP Funds

The increased cash levels in DSP funds have clear implications for investors.

- Potential for lower short-term returns: Investors might experience lower short-term returns compared to periods when the fund was more heavily invested in equities.

- Enhanced protection against market downturns: The higher cash reserves provide a safety net, potentially mitigating losses during market corrections or downturns.

- Long-term investment strategy remains unchanged: DSP's long-term investment philosophy remains focused on generating consistent returns for its investors, and this strategy is seen as a short-term adjustment to navigate current market headwinds.

Investors may have concerns about the short-term impact on their returns. It's vital to remember that this is a temporary strategic adjustment aimed at protecting the long-term value of the investment portfolio. Investors are advised to maintain a long-term perspective and review their investment goals with a financial advisor.

H3: Alternative Investment Strategies During Market Uncertainty

During periods of market uncertainty, investors may consider alternative strategies to manage risk and potentially enhance returns.

- Diversification across asset classes: Diversifying investments across various asset classes like equities, bonds, real estate, and gold can help reduce overall portfolio volatility.

- Increased allocation to fixed income securities: Fixed income instruments like government bonds generally offer greater stability during periods of market turbulence.

- Focus on value investing: Identifying undervalued companies can provide opportunities for long-term growth even amidst market uncertainty.

Conclusion

DSP's decision to increase cash levels reflects a prudent and strategic response to the current market uncertainty affecting the Indian equity market. While this may result in lower short-term returns, it also offers enhanced protection against potential market downturns, safeguarding investors' capital. The long-term outlook for the Indian market remains positive, and this adjustment is a temporary measure to navigate current volatility. Stay informed about market fluctuations and consult with a financial advisor to determine the best investment strategy for your portfolio during periods of uncertainty. Learn more about DSP's investment approach and other leading India funds to make informed investment decisions.

Featured Posts

-

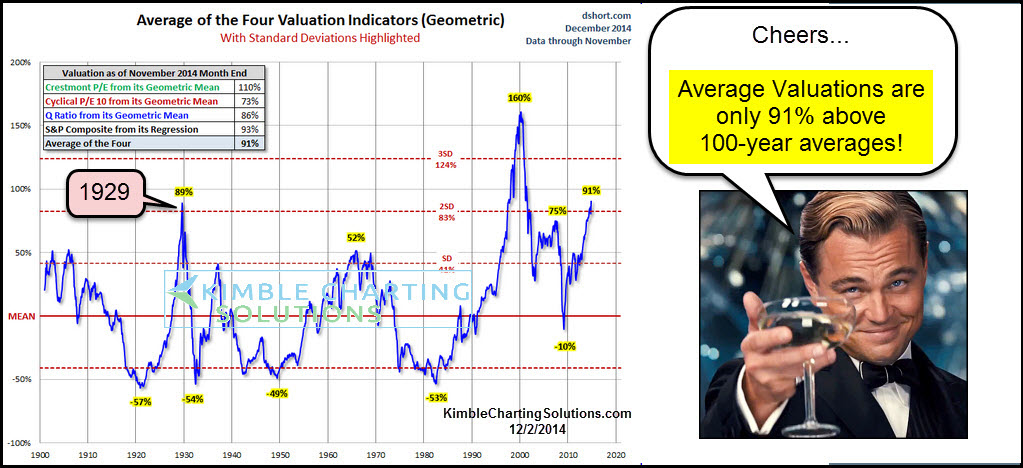

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 29, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

Ftcs Appeal Future Of Microsoft Activision Merger Uncertain

Apr 29, 2025

Ftcs Appeal Future Of Microsoft Activision Merger Uncertain

Apr 29, 2025 -

Israel Under Pressure To Reopen Aid Channels To Gaza Strip

Apr 29, 2025

Israel Under Pressure To Reopen Aid Channels To Gaza Strip

Apr 29, 2025 -

Rising Costs Prompt Lynas Rare Earths To Seek Us Assistance For Texas Plant

Apr 29, 2025

Rising Costs Prompt Lynas Rare Earths To Seek Us Assistance For Texas Plant

Apr 29, 2025

Latest Posts

-

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025 -

Magnificent Seven Stocks 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025

Magnificent Seven Stocks 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025 -

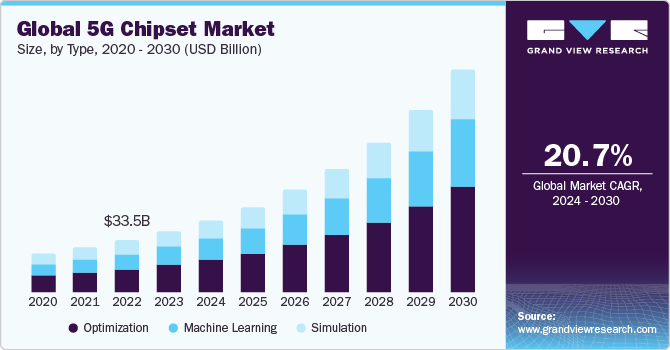

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025 -

Exclusive Huaweis Ai Chipset Aims To Disrupt The Global Market

Apr 29, 2025

Exclusive Huaweis Ai Chipset Aims To Disrupt The Global Market

Apr 29, 2025 -

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025