High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's analysis counters the immediate panic surrounding high stock market valuations. Their arguments suggest that current valuations, while elevated, aren't necessarily indicative of an imminent market crash. Instead, they point to several factors supporting continued market strength, albeit with inherent risks.

-

Strong Corporate Earnings Growth: Despite high valuations, many companies are reporting robust earnings growth. This suggests that the market's optimism is, at least partially, justified by underlying company performance. Sustained profitability can support current price levels and even justify further growth.

-

Low Interest Rates: The prevailing low-interest-rate environment continues to support equity markets. Low borrowing costs make investing in stocks relatively more attractive than fixed-income instruments, driving capital into the equity markets. This boosts stock prices and contributes to higher valuations.

-

Potential for Continued Economic Expansion: BofA analysts foresee continued economic expansion, albeit perhaps at a slower pace than previously witnessed. Sustained economic growth generally supports corporate profitability and, subsequently, higher stock prices. This positive outlook contributes to their relatively bullish stance.

-

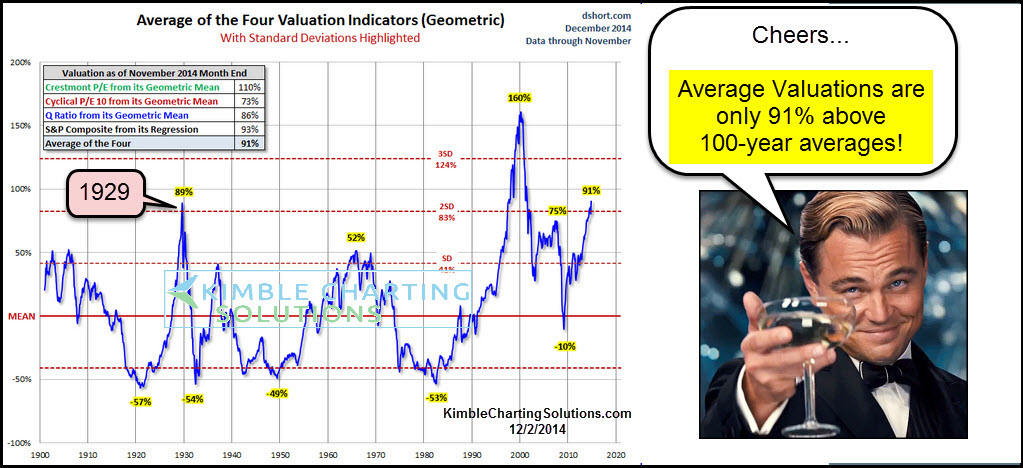

Historical Context: BofA's research points to historical periods with similarly high stock market valuations that did not immediately result in significant market corrections. This historical context suggests that high valuations alone are not a reliable predictor of an impending crash. While past performance doesn’t guarantee future results, it adds a layer of nuance to the conversation.

-

BofA Reports and Analyst Quotes: (Note: This section would ideally include links to specific BofA reports and quotes from their analysts supporting the above points. Due to the dynamic nature of financial information, these links would need to be updated regularly.)

Understanding the Factors Contributing to High Stock Market Valuations

Several economic and market forces contribute to the current high stock market valuations. Understanding these underlying factors is crucial for informed investment decisions.

-

Low Interest Rates and Discounted Cash Flow Valuations: Low interest rates directly impact discounted cash flow (DCF) valuations, a common method used to estimate a company's value. Lower discount rates lead to higher present values of future cash flows, thus inflating valuations.

-

Strong Investor Confidence: High investor confidence, driven by factors like economic growth and low interest rates, fuels demand for stocks, further pushing up prices and valuations. Positive investor sentiment significantly impacts market performance.

-

Increased Corporate Profitability: Rising corporate profitability directly supports higher market capitalization, as investors are willing to pay more for companies generating greater earnings. Profit growth underpins market valuation increases.

-

Technological Advancements and Future Growth Expectations: Technological advancements contribute to expectations of future growth, often justifying higher valuations for companies in innovative sectors. The potential for disruptive technologies significantly impacts stock market valuations.

-

Multiple Expansion: Multiple expansion refers to an increase in valuation multiples (like the price-to-earnings ratio) without a corresponding increase in earnings. This can be a symptom of heightened investor optimism or speculative activity and is a key factor in the current high valuations.

Strategies for Navigating High Stock Market Valuations

Given the current market conditions characterized by high stock market valuations, a balanced approach is essential. This doesn't necessarily mean selling off holdings but rather adopting a more cautious and strategic investment plan.

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk in a potentially volatile market. Diversification reduces the impact of potential losses in any single asset class.

-

Long-Term Investment Horizon: Maintaining a long-term investment perspective is key. Short-term market fluctuations should be viewed within the context of a longer-term investment strategy. Long-term investors are less susceptible to short-term volatility.

-

Selective Stock Picking: Focus on fundamental analysis to identify undervalued companies with strong potential for long-term growth. Thorough due diligence is crucial for identifying quality investments.

-

Value Investing: Consider employing value investing strategies to identify companies trading below their intrinsic value. Value investing can offer opportunities even in a market with high overall valuations.

-

Risk Management and Asset Allocation: Regularly review your risk tolerance and adjust your asset allocation accordingly. Proper risk management is critical in navigating market uncertainty.

Addressing Investor Concerns: Common Fears and BofA's Rebuttals

High stock market valuations naturally trigger anxieties among investors. BofA addresses these concerns by offering a balanced perspective.

-

Market Bubbles: While the possibility of a market bubble exists, BofA's analysis suggests that the current situation isn't solely driven by speculative exuberance but also by factors like strong corporate earnings and low interest rates.

-

Impending Corrections: BofA acknowledges the potential for short-term corrections, but emphasizes that these are a normal part of market cycles and doesn't necessarily signal a major crash. Short-term volatility should be expected, not feared.

-

Long-Term vs. Short-Term Trends: The firm distinguishes between short-term market volatility and long-term market trends, arguing that focusing on the long-term picture is crucial for rational investment decisions.

-

The Bigger Economic Picture: BofA stresses the importance of considering macroeconomic factors, such as economic growth and inflation, when assessing the outlook for the stock market. A holistic perspective is crucial for effective decision-making.

Conclusion: High Stock Market Valuations: Maintaining a Balanced Perspective

BofA's analysis suggests that while high stock market valuations are a legitimate concern, they don't necessarily signal an impending market crash. Strong corporate earnings, low interest rates, and potential for continued economic expansion offer counterpoints to the prevailing anxieties. Maintaining a long-term investment strategy, diversification, and careful stock selection are key to navigating these challenging market conditions. Understanding high stock market valuations requires careful consideration of various economic factors and a balanced perspective. Conduct your own thorough research, consult with a financial advisor, and make informed decisions about managing your portfolio during high stock market valuations.

Featured Posts

-

Temu Price Hikes The Impact Of Trump Era Tariffs On Us Consumers

Apr 29, 2025

Temu Price Hikes The Impact Of Trump Era Tariffs On Us Consumers

Apr 29, 2025 -

Nine Killed In Vancouver Filipino Festival Car Crash

Apr 29, 2025

Nine Killed In Vancouver Filipino Festival Car Crash

Apr 29, 2025 -

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6 Falsehoods Allegations

Apr 29, 2025

Ray Epps Sues Fox News For Defamation Jan 6 Falsehoods Allegations

Apr 29, 2025 -

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Latest Posts

-

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025 -

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025 -

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025