Is XRP A Commodity? The SEC's Decision And Ongoing Debate

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP's Classification

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple illegally offered and sold XRP as an unregistered security. The SEC argues that XRP, despite its decentralized nature, functioned as an investment contract, meeting the criteria of the Howey Test. This landmark test determines whether an investment constitutes a security based on factors like investment of money, common enterprise, expectation of profits, and the efforts of others.

-

Summary of the SEC's argument regarding the Howey Test and its application to XRP: The SEC contends that Ripple's sale of XRP to institutional investors and the general public, coupled with Ripple's active promotion and development of the XRP ecosystem, created a reasonable expectation of profit derived from Ripple's efforts. This, they argue, satisfies the requirements of the Howey Test.

-

Key aspects of Ripple's defense strategy: Ripple counters that XRP is a decentralized digital asset, operating independently of Ripple's actions. They emphasize XRP's utility as a payment currency on the XRP Ledger, arguing it doesn't function as an investment contract.

-

The impact of the lawsuit on XRP's price and market sentiment: The lawsuit significantly impacted XRP's price and market sentiment, causing volatility and uncertainty among investors. Many exchanges delisted XRP, further highlighting the regulatory uncertainty surrounding the digital asset.

-

Mention key legal arguments used by both sides, like the “investment contract” definition: The central debate revolves around the interpretation of "investment contract" within the Howey Test. The SEC argues that Ripple's actions created an investment contract, while Ripple maintains that XRP's functionality and decentralized nature negate this classification.

Arguments for XRP as a Commodity

Several arguments support XRP's classification as a commodity, rather than a security. These arguments center on XRP's functionality and the decentralized nature of the XRP Ledger.

-

Decentralization of XRP Ledger and its operational independence from Ripple: Proponents argue that the XRP Ledger operates independently of Ripple, with a distributed consensus mechanism securing its transactions. Ripple does not control the ledger or the XRP tokens themselves.

-

Focus on XRP's utility as a payment mechanism within the XRP Ledger ecosystem: XRP's primary use case is facilitating fast and low-cost transactions on the XRP Ledger. This functionality aligns with the characteristics of a commodity, like gold or oil, which serve as mediums of exchange.

-

Comparison with other cryptocurrencies considered commodities (e.g., Bitcoin): Bitcoin, often considered a commodity, shares similar characteristics with XRP in terms of decentralization and utility as a store of value and medium of exchange.

-

Expert opinions supporting the commodity classification: Many legal experts and crypto analysts have voiced opinions supporting the commodity classification of XRP, citing its decentralized nature and utility.

-

Mention the role of the XRP Ledger's open-source nature: The open-source nature of the XRP Ledger strengthens the argument for decentralization and independence from Ripple's control.

Arguments Against XRP as a Commodity

Conversely, compelling arguments exist against XRP's classification as a commodity. These arguments hinge on Ripple's actions and the potential for XRP to be used as an investment.

-

Ripple's initial distribution of XRP and its control over a significant portion of the total supply: Ripple initially held a significant portion of the total XRP supply, leading to concerns about centralized control and potential manipulation of the market.

-

Ripple's involvement in promoting XRP and its partnerships with financial institutions: Ripple's active promotion of XRP and partnerships with financial institutions could be interpreted as creating an expectation of profit for investors.

-

The potential for XRP to be used as an investment vehicle, attracting investors seeking profits: Many investors purchased XRP with the expectation of future price appreciation, fulfilling the "expectation of profits" element of the Howey Test.

-

Counterarguments to the decentralization claim: Critics argue that despite the technical decentralization of the XRP Ledger, Ripple's influence and control over a large portion of XRP supply still affect the market significantly.

-

Expert opinions against the commodity classification: Several legal experts maintain that XRP's characteristics align more closely with a security due to Ripple's actions and the role of investor expectations.

The Ongoing Debate and Future Outlook for XRP's Legal Status

The legal battle between the SEC and Ripple is ongoing, with significant implications for XRP's future and the broader cryptocurrency landscape.

-

Potential outcomes of the SEC lawsuit and their implications for XRP's classification: The outcome could set a crucial precedent for how other cryptocurrencies are regulated. A ruling in favor of the SEC could lead to stricter regulations on other digital assets.

-

The role of judicial precedent and regulatory clarity in shaping future decisions: The court's decision will significantly influence future regulatory actions and judicial interpretations of the Howey Test.

-

Impact on other cryptocurrencies facing similar regulatory scrutiny: The outcome of the case will heavily influence how regulators approach other digital assets, particularly those with similar centralized elements.

-

Discussion on the potential for legislative action to clarify cryptocurrency regulations: The uncertainty surrounding XRP's status underscores the need for clear and comprehensive cryptocurrency regulations.

-

Mention the impact of global regulatory differences on XRP’s classification: Regulatory frameworks vary globally, adding another layer of complexity to the debate surrounding XRP's classification.

Conclusion

The debate surrounding whether XRP is a commodity or a security is complex and multifaceted. The SEC's lawsuit against Ripple highlights the inherent challenges of applying traditional securities laws to the innovative and rapidly evolving world of cryptocurrencies. The arguments for and against XRP's classification as a commodity center on the balance between its decentralized technology and Ripple's role in its development and promotion. The outcome of this legal battle will significantly impact the future of crypto regulation.

Call to Action: Stay informed on the ongoing legal developments surrounding XRP and its potential classification. Further research into the arguments surrounding “XRP Commodity” is crucial for understanding the future of crypto regulation. Continue to follow the latest news and analysis to stay ahead of the curve in the ever-changing world of cryptocurrency.

Featured Posts

-

Economic Hardship Jeopardizes Annual Indigenous Arts Celebration

May 01, 2025

Economic Hardship Jeopardizes Annual Indigenous Arts Celebration

May 01, 2025 -

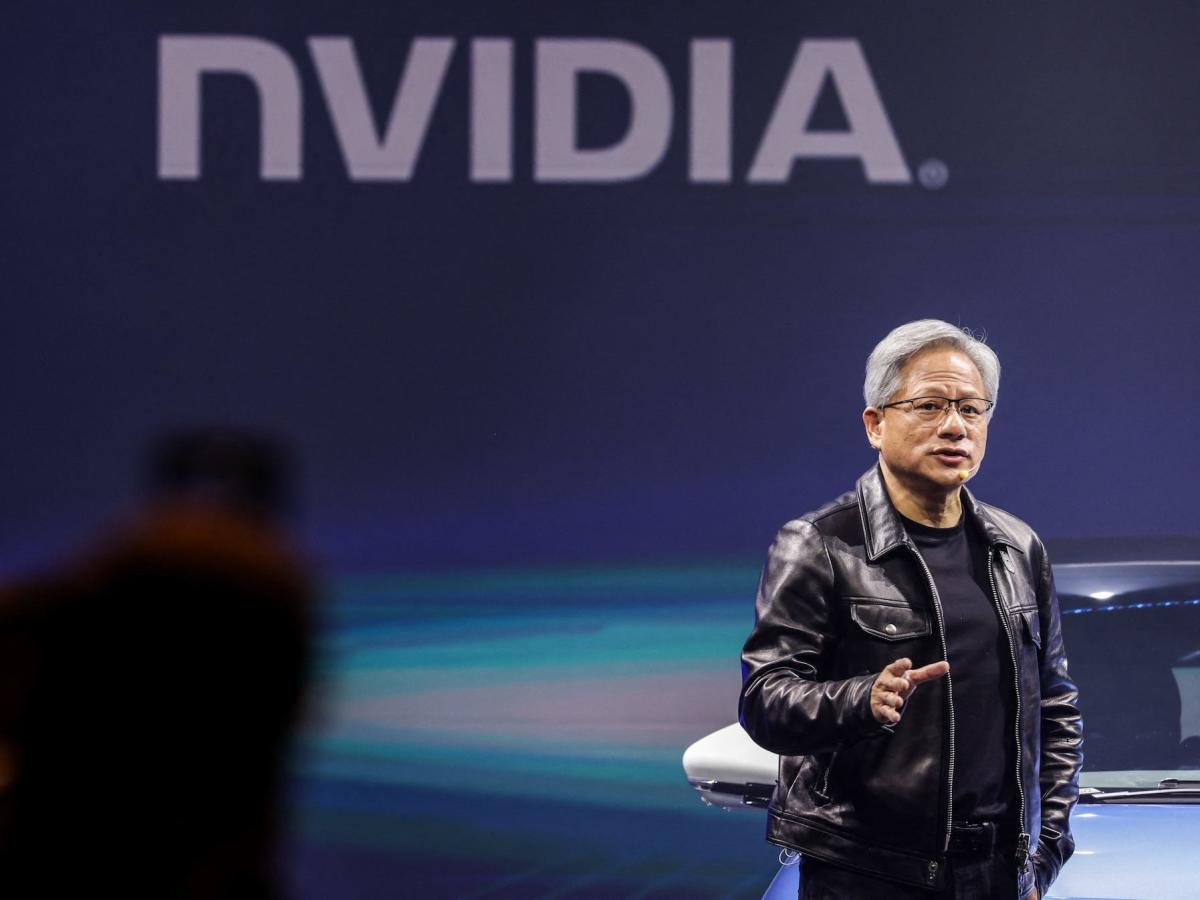

The Wider Implications Of Nvidias China Related Concerns

May 01, 2025

The Wider Implications Of Nvidias China Related Concerns

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025 -

The 1 Million Gift Michael Sheen Faces Backlash Over New Documentary

May 01, 2025

The 1 Million Gift Michael Sheen Faces Backlash Over New Documentary

May 01, 2025 -

Is Xrp A Commodity The Secs Decision And Ongoing Debate

May 01, 2025

Is Xrp A Commodity The Secs Decision And Ongoing Debate

May 01, 2025

Latest Posts

-

Nothing Phone 2 Exploring The Potential Of Modular Phone Technology

May 01, 2025

Nothing Phone 2 Exploring The Potential Of Modular Phone Technology

May 01, 2025 -

Nothings Phone 2 A Deep Dive Into Its Modular System

May 01, 2025

Nothings Phone 2 A Deep Dive Into Its Modular System

May 01, 2025 -

Guilty Plea Lab Owner Admits To Covid 19 Testing Scheme

May 01, 2025

Guilty Plea Lab Owner Admits To Covid 19 Testing Scheme

May 01, 2025 -

Review Nothing Phone 2 S Innovative Modular Approach

May 01, 2025

Review Nothing Phone 2 S Innovative Modular Approach

May 01, 2025 -

Pandemic Fraud Lab Owner Convicted Of Faking Covid Test Results

May 01, 2025

Pandemic Fraud Lab Owner Convicted Of Faking Covid Test Results

May 01, 2025