Is Uber Technologies (UBER) A Smart Investment?

Table of Contents

Uber's Financial Performance and Growth Trajectory

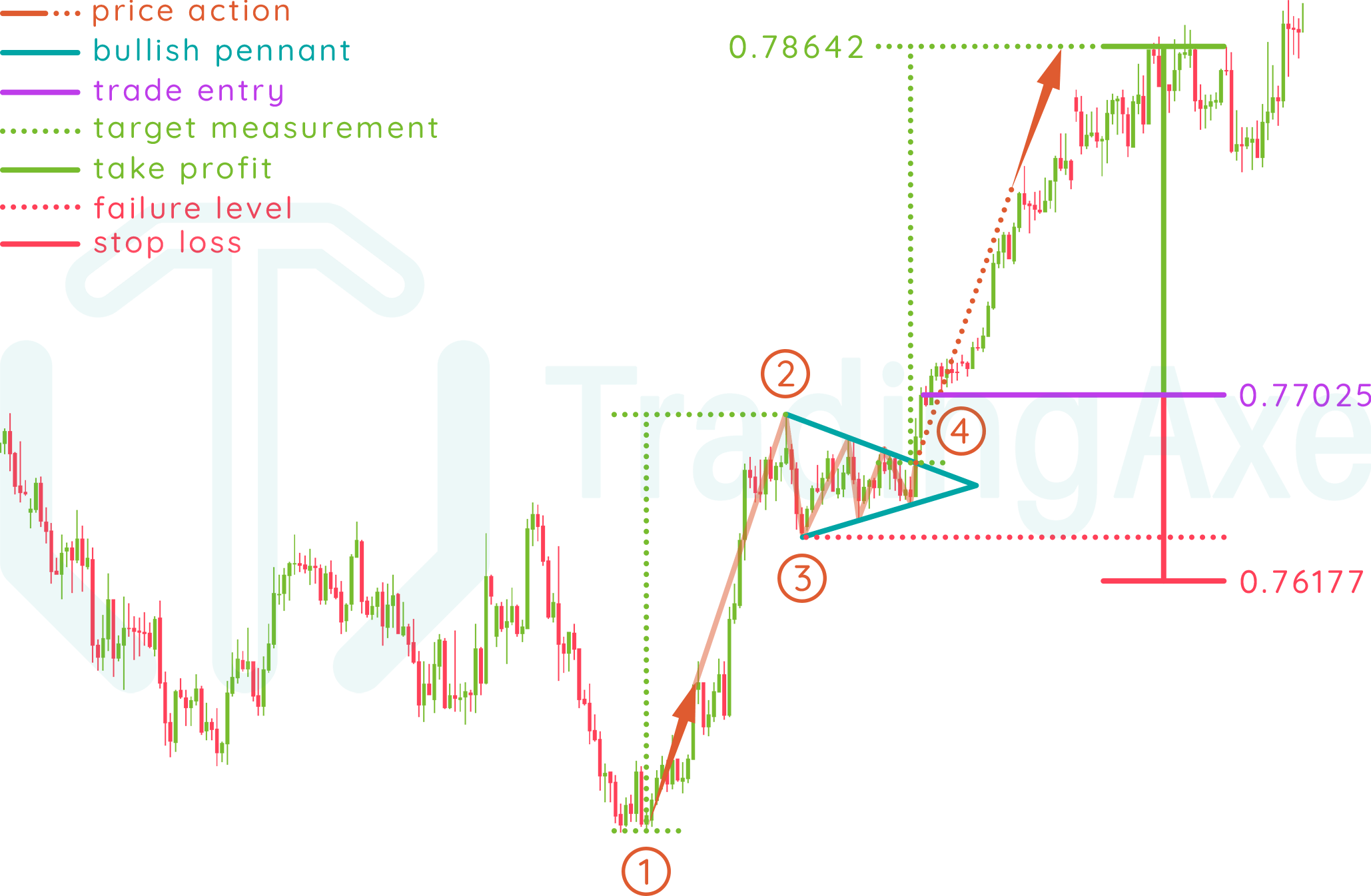

Uber's financial health is a cornerstone of any UBER stock evaluation. Examining recent financial reports reveals a mixed bag. While revenue has shown consistent growth, driven by expansion into new markets and services like Uber Eats and Uber Freight, profitability remains a challenge. Analyzing key financial metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income provides a clearer picture of Uber's financial performance. Charts and graphs illustrating revenue growth and profitability trends over time would offer valuable insights.

Growth strategies are central to Uber's future. The company continues to expand geographically, targeting underserved markets globally. Technological advancements, such as improvements to its ride-matching algorithms and delivery optimization software, aim to boost efficiency and profitability. Diversification beyond its core ride-sharing business is another key strategy.

- Revenue streams beyond ride-sharing: Uber Eats, Uber Freight, and other emerging services significantly contribute to overall revenue and mitigate reliance on a single source.

- Profitability trends and projections: While Uber is not yet consistently profitable, projections suggest a path to profitability as operational efficiencies increase and new revenue streams mature.

- Impact of economic factors: Economic downturns can significantly impact demand for ride-sharing and delivery services, affecting Uber's bottom line.

- Analysis of key financial ratios: Examining the P/E ratio, debt-to-equity ratio, and other relevant ratios provides crucial information on the financial health and stability of the company.

Competitive Landscape and Market Share

The ride-sharing market is fiercely competitive. Uber faces significant competition from Lyft, traditional taxis, public transportation systems, and emerging ride-sharing services, particularly in specific geographic regions. Analyzing Uber's market share in key regions is vital. A deep dive into competitive strategies, including pricing models, promotional offers, and technological innovation, helps determine Uber's competitive positioning.

- Strengths and weaknesses of Uber: Uber's strengths include its brand recognition, extensive technological infrastructure, and global reach. Weaknesses include regulatory challenges and ongoing disputes with drivers.

- Potential for increased competition: The entry of new players or the expansion of existing competitors could intensify competition and pressure Uber's market share.

- Uber's strategic advantages: Network effects (more drivers attract more riders, and vice versa) and technological investments provide a strong foundation for continued growth.

Future Growth Potential and Technological Advancements

Uber's future growth hinges significantly on its ability to capitalize on technological advancements. The development of autonomous vehicles, drone delivery, and other emerging technologies holds immense potential for transforming Uber's business model and profitability. However, these advancements also present considerable risks.

- Potential for expansion into new geographic markets: Untapped markets worldwide present significant opportunities for revenue growth.

- Development of new services and revenue streams: Exploring areas like logistics, micro-mobility, and other transportation-related services can diversify revenue streams.

- The role of autonomous driving: Successfully integrating autonomous vehicles could revolutionize Uber's operations, reducing costs and improving efficiency. However, significant regulatory and technological hurdles remain.

- Investment in research and development: Continued investment in R&D is essential for staying ahead of the competition and adapting to evolving market demands.

Risks and Challenges Facing Uber Technologies

Investing in UBER stock carries inherent risks. Regulatory hurdles, varying from city to city and country to country, are a significant concern. Driver relations, including compensation and working conditions, represent a constant challenge. Safety concerns also impact public perception and regulatory scrutiny. Finally, economic downturns can directly impact demand, affecting Uber's revenue and profitability.

- Regulatory changes: Shifting regulations can impact operations, potentially leading to increased costs or limitations on services.

- Potential legal challenges and lawsuits: Ongoing litigation and regulatory investigations pose financial and reputational risks.

- Concerns regarding driver compensation and working conditions: Negative publicity surrounding driver issues could damage Uber's brand image and attract further regulatory attention.

- Economic downturns: Recessions can significantly reduce demand for ride-sharing and delivery services.

Conclusion: Is Investing in Uber the Right Ride for You?

Uber Technologies presents a compelling investment opportunity, driven by its strong brand recognition, global reach, and diversification into multiple sectors. However, substantial risks, including regulatory uncertainty, competition, and profitability challenges, must be carefully considered. Weighing the potential for significant growth against the inherent risks is paramount. This analysis provides a framework; however, conducting thorough due diligence, including a comprehensive review of Uber's financial statements and industry trends, is crucial before making any investment decisions related to UBER stock or other ride-sharing investments. Further investigation into UBER stock performance and future projections is strongly recommended.

Featured Posts

-

Ethereums Bullish Run Analyzing Price Strength And Future Trends

May 08, 2025

Ethereums Bullish Run Analyzing Price Strength And Future Trends

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Tfsylat

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Tfsylat

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Missing Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Missing Payments

May 08, 2025 -

Sufian Commends Gcci President For Successful Expo 2025 Organization

May 08, 2025

Sufian Commends Gcci President For Successful Expo 2025 Organization

May 08, 2025 -

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025