110% Growth Potential: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

Unparalleled Growth Potential: A Deep Dive into Returns

This BlackRock ETF has demonstrated impressive historical returns, significantly outperforming many of its peers. While past performance doesn't guarantee future results, analyzing historical data offers valuable insights into its potential. [Insert chart or graph showing historical returns here]. Several factors contribute to this high-growth potential:

-

Strong Underlying Asset Performance: The ETF's success is often tied to the performance of its underlying assets. This could involve exposure to rapidly growing sectors like technology, renewable energy, or healthcare, benefiting from technological advancements and increasing demand. Successful investments in innovative companies are a significant driver of growth.

-

Effective Investment Strategy: The ETF's investment strategy plays a crucial role. Whether it's an actively managed fund with expert portfolio managers or a passively managed index fund tracking a specific market index, the strategy's effectiveness in identifying and capitalizing on market opportunities is key.

-

Market Trends and Their Impact: The ETF's performance is also influenced by broader market trends. Positive economic indicators, technological breakthroughs, and shifting investor sentiment can all contribute to its growth trajectory. Understanding these trends and their potential impact is crucial for assessing risk and reward.

Comparing this BlackRock ETF's performance to similar ETFs in the market reveals its superior growth trajectory. [Insert comparative data here]. This superior performance underscores its potential as a powerful tool for wealth accumulation.

Why Billionaires Are Taking Notice: The Appeal of This BlackRock ETF

The interest from billionaire investors isn't arbitrary; it's driven by sound financial reasoning. Several key factors explain their attraction to this BlackRock ETF:

-

Diversification and Risk Management: Billionaires understand the importance of diversification. This ETF might offer exposure to a range of assets, reducing overall portfolio risk while still maintaining high growth potential. This aligns with sophisticated risk management strategies.

-

Long-Term Growth Potential and Wealth Accumulation: Billionaires often focus on long-term growth, aiming for substantial wealth accumulation over decades. The ETF's historical performance and future potential strongly appeal to this long-term investment horizon.

-

Alignment with Billionaire Investment Philosophies: The ETF's investment strategy might align with established billionaire investment philosophies, such as value investing, growth investing, or a blend of both. This congruence attracts investors who share similar investment approaches.

While specific examples of billionaire investments in this particular ETF may not be publicly available due to privacy concerns, the general trend of high-net-worth individuals seeking high-growth, diversified investments is well-documented.

Understanding the Investment Strategy: A Look Under the Hood

The success of any BlackRock ETF hinges on its underlying investment strategy. A detailed understanding of this strategy is crucial for potential investors. [Explain the specific investment strategy in clear, concise terms here, including sector focus, geographic diversification, etc.]. The ETF might have unique features, such as a focus on ESG (environmental, social, and governance) factors, that contribute to its success and appeal to ethically conscious investors.

However, it's crucial to acknowledge the risks:

-

Market Volatility and Potential for Losses: No investment is without risk. Market volatility can lead to significant fluctuations in the ETF's value, resulting in potential losses.

-

Specific Risks Associated with the ETF's Investment Strategy: The specific investment strategy carries its own inherent risks. For example, a focus on a particular sector exposes the ETF to sector-specific risks.

-

Importance of Conducting Thorough Due Diligence Before Investing: Before investing, thorough research and due diligence are paramount. Understanding the ETF's investment strategy, risks, and historical performance is crucial for making an informed investment decision.

Accessing This High-Growth Investment: A Step-by-Step Guide

Investing in this BlackRock ETF is generally straightforward, but it requires careful planning.

-

Open a Brokerage Account: If you don't already have one, open a brokerage account with a reputable firm. This account will allow you to buy and sell ETFs.

-

Search for the ETF: Locate the ETF using its ticker symbol on your brokerage platform.

-

Place Your Order: Specify the number of shares you wish to purchase.

-

Monitor Your Investment: Regularly monitor your investment's performance and make adjustments as needed.

Remember that fees and commissions may apply. Always consult with a qualified financial advisor before making any investment decisions to ensure the investment aligns with your personal financial goals and risk tolerance.

Conclusion

This BlackRock ETF presents a compelling investment opportunity with significant high-growth potential, attracting the attention of billionaire investors. Its success stems from a robust investment strategy, a focus on high-growth sectors, and its ability to navigate market trends effectively. While past performance is not indicative of future results, understanding the ETF’s strategy, risk profile, and the factors driving its growth are crucial for informed decision-making. Don't miss out on the potential for significant financial growth! Learn more about similar BlackRock ETFs and start building your portfolio today. Remember to conduct thorough due diligence and consider consulting a financial advisor before investing in any BlackRock ETF or other investment vehicle.

Featured Posts

-

Play Station Podcast 512 True Blue A Full Breakdown

May 08, 2025

Play Station Podcast 512 True Blue A Full Breakdown

May 08, 2025 -

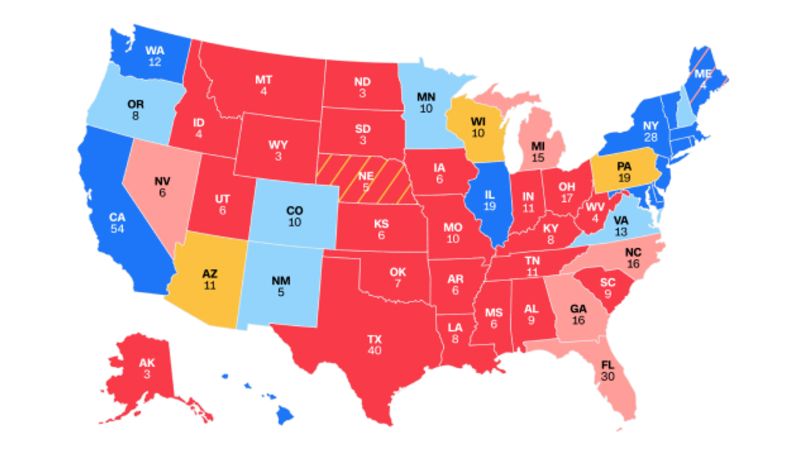

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025 -

Analyzing Xrp Ripple A Path To Financial Independence

May 08, 2025

Analyzing Xrp Ripple A Path To Financial Independence

May 08, 2025 -

160 Year Old Pierce County House To Be Demolished For New Park

May 08, 2025

160 Year Old Pierce County House To Be Demolished For New Park

May 08, 2025 -

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025