Ethereum's Bullish Run: Analyzing Price Strength And Future Trends

Table of Contents

Analyzing Current Price Strength of Ethereum

To understand Ethereum's bullish run, we need to examine its current price strength through various lenses.

Technical Indicators

Technical indicators provide valuable insights into the momentum and potential direction of ETH's price. Analyzing key indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages helps gauge the strength of the current rally and identify potential support and resistance levels.

- RSI above 70 suggests overbought conditions: While a high RSI can indicate strong upward momentum, it also suggests the market may be susceptible to a short-term correction. Traders should watch for signs of a potential pullback.

- MACD bullish crossover indicates upward momentum: A bullish crossover, where the MACD line crosses above the signal line, is a classic bullish signal, suggesting a potential continuation of the upward trend.

- 200-day moving average acts as a key support level: The 200-day moving average is a significant long-term trend indicator. If the price remains above this level, it suggests strong underlying support for the bullish trend. A break below this level could signal a weakening of the bullish momentum.

Market Sentiment and Trading Volume

Gauging market sentiment and analyzing trading volume provide additional context to the technical analysis. Positive sentiment coupled with high volume often signifies strong buying pressure and a sustained bullish run.

- Increased trading volume during price rallies indicates strong buying pressure: High volume confirms the price movement, suggesting that the rally is not solely driven by speculation but by genuine demand.

- Positive social media sentiment suggests growing investor confidence: Monitoring social media platforms like Twitter and Reddit can offer insights into the overall sentiment towards ETH. Positive sentiment often precedes price increases.

- News regarding ETH 2.0 and DeFi applications impacts market sentiment: Positive news related to Ethereum's development and adoption within the DeFi ecosystem typically boosts investor confidence and fuels price appreciation. Conversely, negative news can lead to price corrections.

On-Chain Metrics

On-chain metrics provide a deeper understanding of the network's health and activity, which often correlates with price movements.

- Increasing active addresses indicate growing network adoption: A rising number of active addresses suggests increased participation and use of the Ethereum network, potentially driving up demand for ETH.

- High transaction fees suggest high demand for ETH: High gas fees often indicate high network congestion and strong demand for Ethereum's services, implying a bullish sentiment.

- Rising gas usage reflects increased network activity and potential for price appreciation: Increased network activity often translates into higher demand for ETH, which can drive price appreciation.

Key Factors Driving Ethereum's Bullish Run

Several key factors contribute to Ethereum's current bullish run.

Ethereum 2.0 and Staking

The transition to a Proof-of-Stake (PoS) consensus mechanism through Ethereum 2.0 is a significant catalyst for the bullish trend.

- Staking reduces ETH supply, potentially driving price upwards: By staking their ETH, users lock their tokens, reducing the circulating supply and potentially increasing its value.

- Staking rewards incentivize holding ETH: The staking rewards incentivize users to hold onto their ETH, reducing selling pressure and further supporting the price.

- Successful implementation of ETH 2.0 boosts investor confidence: The successful roll-out of ETH 2.0 milestones reinforces investor confidence in Ethereum's long-term prospects.

Decentralized Finance (DeFi) Growth

The explosive growth of the DeFi ecosystem built on Ethereum is a major driver of ETH's price appreciation.

- Increased DeFi activity leads to higher demand for ETH: DeFi applications require ETH for transaction fees and interacting with various protocols, creating significant demand.

- Yield farming and lending platforms attract capital to the Ethereum network: Attractive yields offered by DeFi protocols draw substantial capital to the Ethereum network, increasing demand for ETH.

- Popular DeFi tokens often have strong correlations with ETH price: The performance of many popular DeFi tokens is closely tied to the price of ETH, indicating a synergistic relationship.

Institutional Adoption

The growing interest from institutional investors is another significant factor bolstering Ethereum's bullish run.

- Grayscale Ethereum Trust holdings as an indicator of institutional interest: The increasing holdings of Grayscale Ethereum Trust reflect institutional investor confidence and allocation towards ETH.

- Large financial institutions increasing their ETH allocations: Major financial institutions are increasingly incorporating ETH into their portfolios, recognizing its potential as a store of value and a key asset in the digital economy.

- Regulatory clarity impacting institutional investment decisions: Increasing regulatory clarity around cryptocurrencies is making institutional investment in ETH more attractive and reducing perceived risks.

Predicting Future Trends for Ethereum

Predicting future price movements is inherently speculative, but analyzing current trends and potential catalysts allows for informed speculation.

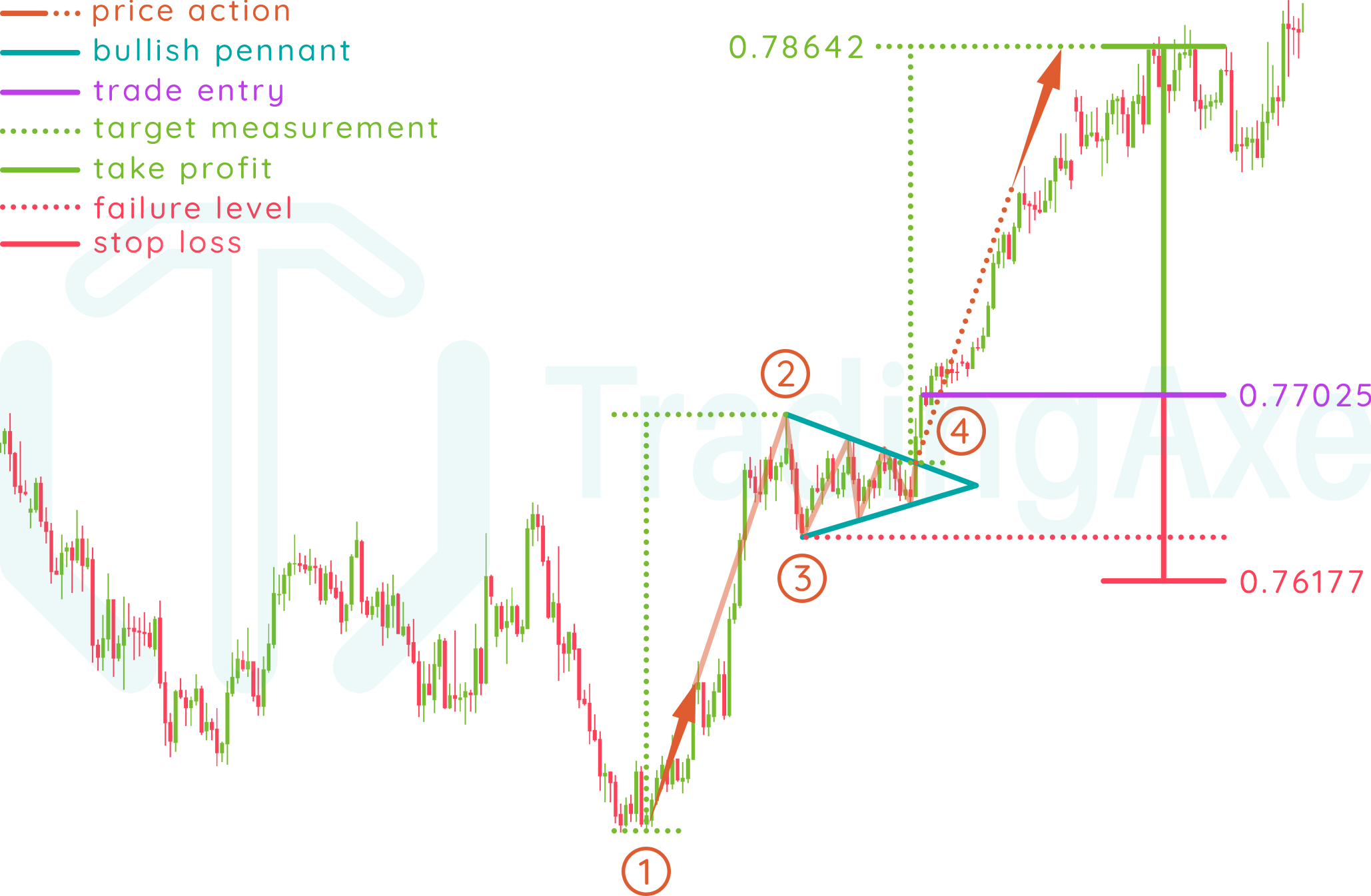

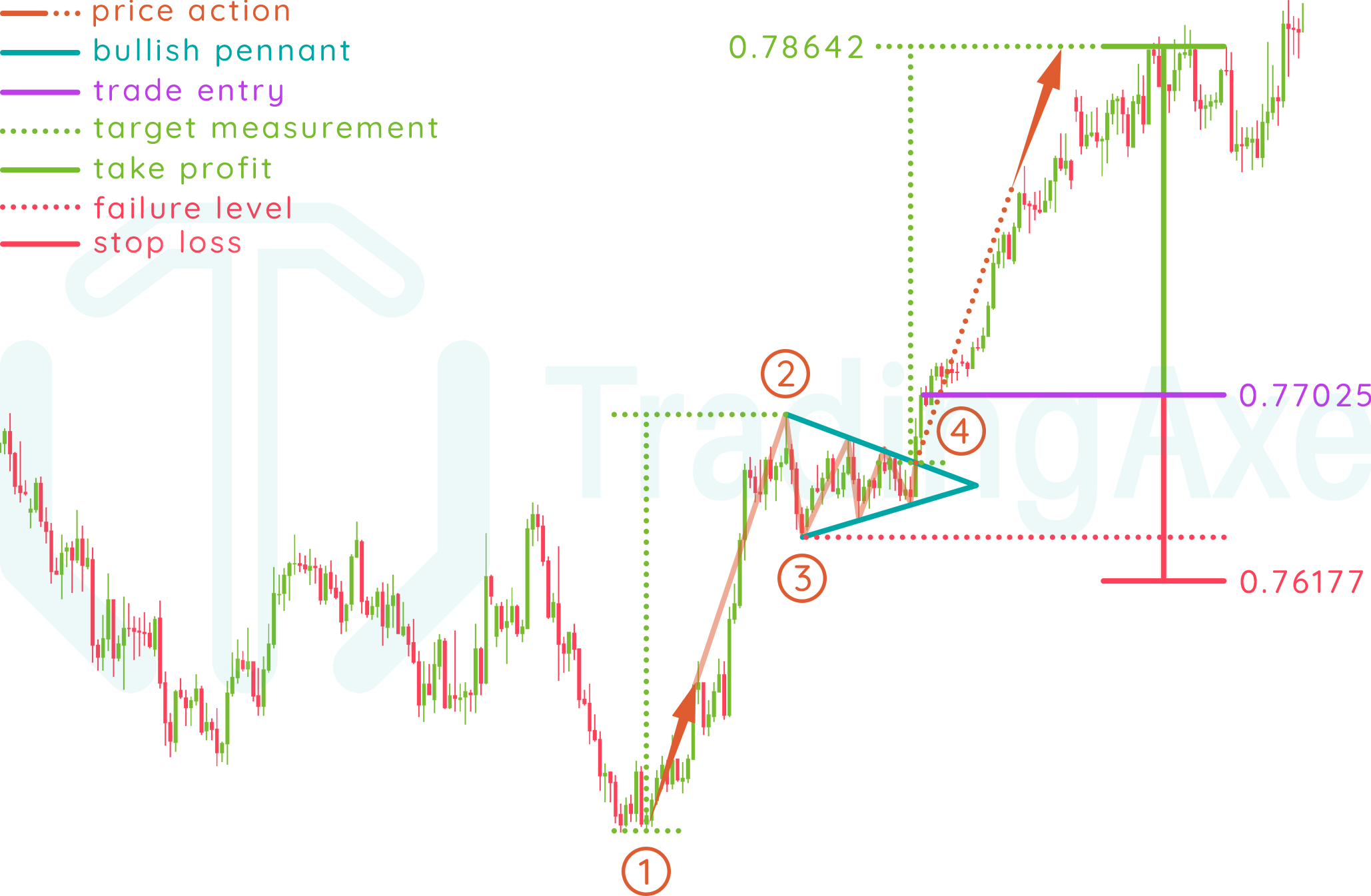

Potential Price Targets and Resistance Levels

Based on technical analysis and market conditions, various price targets and resistance levels are possible. However, these predictions should be treated with caution and considered alongside other factors.

Risks and Challenges

Despite the positive outlook, several risks and challenges could affect Ethereum's bullish run:

- Regulatory uncertainty: Changes in regulatory landscapes could impact the price and adoption of Ethereum.

- Competition from other blockchains: Emerging competitors could erode Ethereum's market share and impact its price.

- Market volatility: The cryptocurrency market is inherently volatile, and unexpected events can cause significant price swings.

Conclusion

Ethereum's bullish run is driven by a confluence of factors, including the ongoing progress of Ethereum 2.0, the booming DeFi ecosystem, and increasing institutional adoption. While predicting the future is challenging, a careful analysis of technical indicators, market sentiment, and on-chain metrics suggests a positive outlook. However, investors should remain aware of potential risks and challenges. Stay informed on the latest developments to navigate the exciting world of Ethereum's bullish run and make informed investment decisions concerning Ethereum price and its future trends. Remember to conduct your own thorough research before making any investment decisions related to Ethereum's bullish run.

Featured Posts

-

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025 -

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025 -

Choosing Credible Sources For Accurate Crypto Information

May 08, 2025

Choosing Credible Sources For Accurate Crypto Information

May 08, 2025 -

Dont Let Revisionist History Fool You The Thunder Bulls Offseason Trade

May 08, 2025

Dont Let Revisionist History Fool You The Thunder Bulls Offseason Trade

May 08, 2025 -

The Loonies High Value Challenges And Solutions For The Canadian Economy

May 08, 2025

The Loonies High Value Challenges And Solutions For The Canadian Economy

May 08, 2025