SEC Acknowledges Grayscale XRP ETF Filing: XRP Price Surges Past Bitcoin

Table of Contents

Grayscale's XRP ETF Filing: A Game Changer for XRP?

Grayscale Investments, a prominent player in the digital asset management space, has submitted an application for an XRP exchange-traded fund (ETF). This move, following Grayscale's successful Bitcoin and Ethereum ETF filings, is potentially game-changing for XRP. The filing signifies Grayscale's belief in XRP's long-term viability and its potential to become a mainstream asset. The specifics of the filing include a detailed proposal outlining how the ETF will be structured, managed, and regulated. The implications are far-reaching, promising to bring increased legitimacy and accessibility to XRP.

An approved XRP ETF offers several key benefits:

- Increased Liquidity: An ETF would significantly increase the liquidity of XRP, making it easier to buy and sell.

- Institutional Investment: Institutional investors, who often shy away from directly holding cryptocurrencies, are more likely to invest through a regulated ETF.

- Price Stability: While not guaranteeing stability, an ETF could contribute to a more regulated and potentially less volatile XRP market.

Further benefits include:

- Increased regulatory clarity for XRP.

- Potential for mainstream adoption by a wider range of investors.

- Attraction of significant institutional investment capital, boosting its market capitalization.

XRP Price Surge: Outperforming Bitcoin

Following the SEC's acknowledgment of Grayscale's filing, the price of XRP surged dramatically. We witnessed a [Insert precise percentage]% increase in a matter of [Insert timeframe], outpacing Bitcoin's relatively stagnant performance during the same period. While the SEC acknowledgment is a major contributing factor, other elements fueled this price surge:

- Trading Volume Spikes: Trading volume on major exchanges saw a dramatic increase, indicating heightened investor interest and activity.

- Social Media Sentiment Analysis: Positive sentiment surrounding XRP significantly increased across various social media platforms, reflecting investor optimism.

- Market Speculation and Anticipation: Market speculation about the potential approval of the XRP ETF and its subsequent impact on the price played a crucial role. The anticipation of future gains drove further investment.

The SEC's Role and Potential Implications

The SEC's previous stance on XRP has been cautious, even adversarial. However, the acknowledgment of Grayscale's ETF application suggests a potential shift in perspective. While approval isn't guaranteed, this acknowledgment signals a willingness to consider XRP within a regulated framework. The timeline for approval or rejection remains uncertain, potentially taking several months or even longer.

The SEC's decision will have broader implications:

- Increased regulatory scrutiny on cryptocurrencies: This event underscores the increasing regulatory attention focused on the crypto market.

- Potential for future ETF approvals for other crypto assets: A positive outcome for the XRP ETF could pave the way for similar approvals for other cryptocurrencies.

- Impact on the overall crypto market capitalization: The success of an XRP ETF could significantly impact the overall market cap and influence the adoption of other digital assets.

Investing in XRP: Risks and Opportunities

Investing in XRP, like any cryptocurrency, carries significant risks:

- Volatility of the cryptocurrency market: Crypto prices are notoriously volatile, and XRP is no exception.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving and remains uncertain.

- Potential for high returns but also significant losses: While the potential for high returns exists, investors should be prepared for the possibility of substantial losses.

Despite these risks, the current market situation presents potential opportunities. The SEC's acknowledgment and the price surge indicate a growing belief in XRP's potential. However, a balanced approach is crucial. Careful research, diversification, and risk management are essential for any XRP investment strategy.

Conclusion: The Future of XRP and the Impact of ETF Approval

The recent XRP price surge, driven by the SEC's acknowledgment of Grayscale's XRP ETF filing, represents a pivotal moment for XRP and the broader crypto market. The potential approval of the ETF could significantly increase liquidity, attract institutional investment, and potentially lead to greater price stability. However, regulatory uncertainty and market volatility remain inherent risks. The SEC's ultimate decision will have far-reaching consequences.

Stay informed about the evolving landscape of XRP and the potential impact of the Grayscale XRP ETF filing. Conduct thorough research before making any investment decisions in the volatile cryptocurrency market. Consider consulting with a financial advisor before investing in XRP or any other cryptocurrency. Understanding the risks and opportunities associated with XRP investment is crucial for navigating this dynamic market.

Featured Posts

-

Stephen Kings The Long Walk First Look At The Film Adaptation

May 08, 2025

Stephen Kings The Long Walk First Look At The Film Adaptation

May 08, 2025 -

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025 -

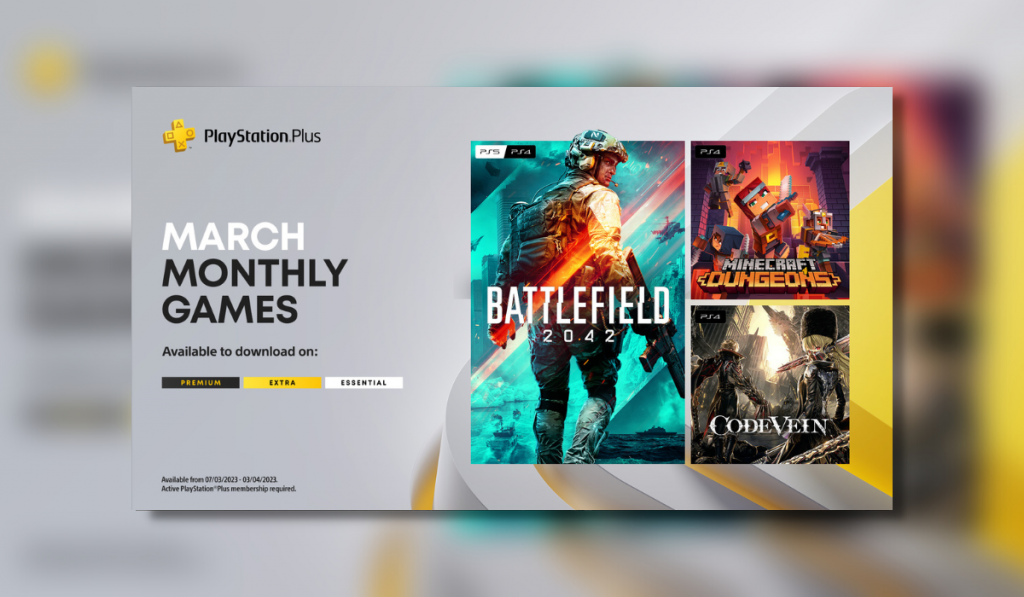

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025 -

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Astqbal

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Astqbal

May 08, 2025 -

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025

The Hunger Games Directors Stephen King Horror Movie A 2025 Release

May 08, 2025