Navigating High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

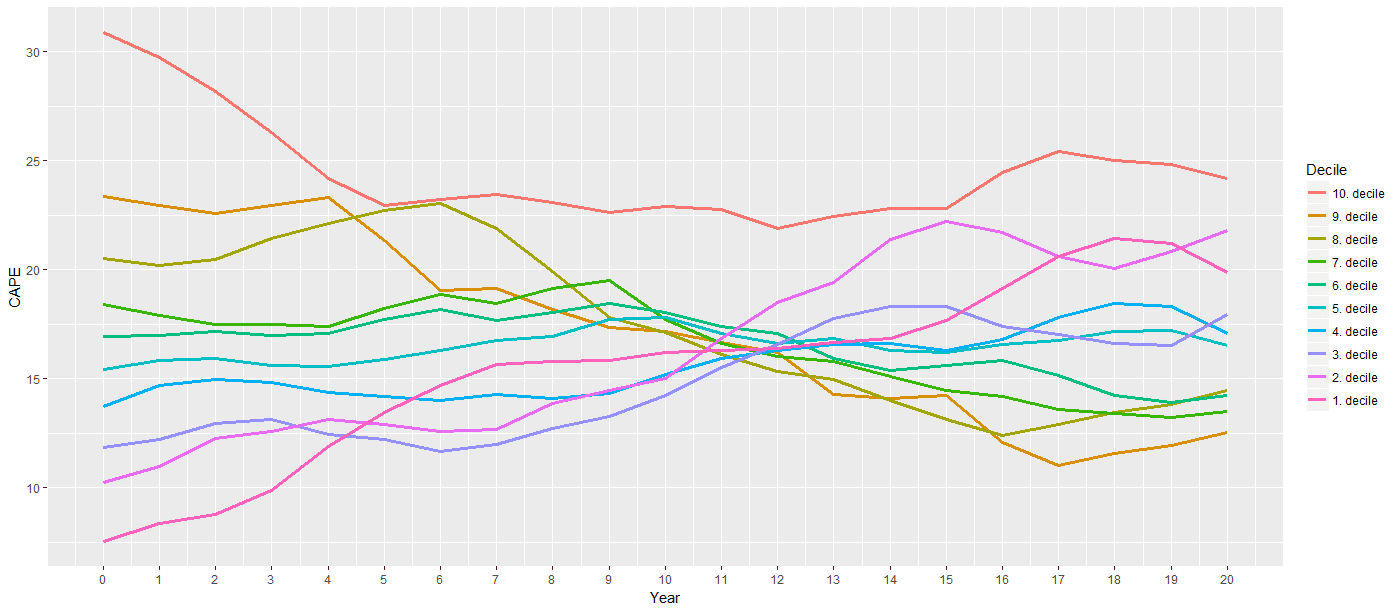

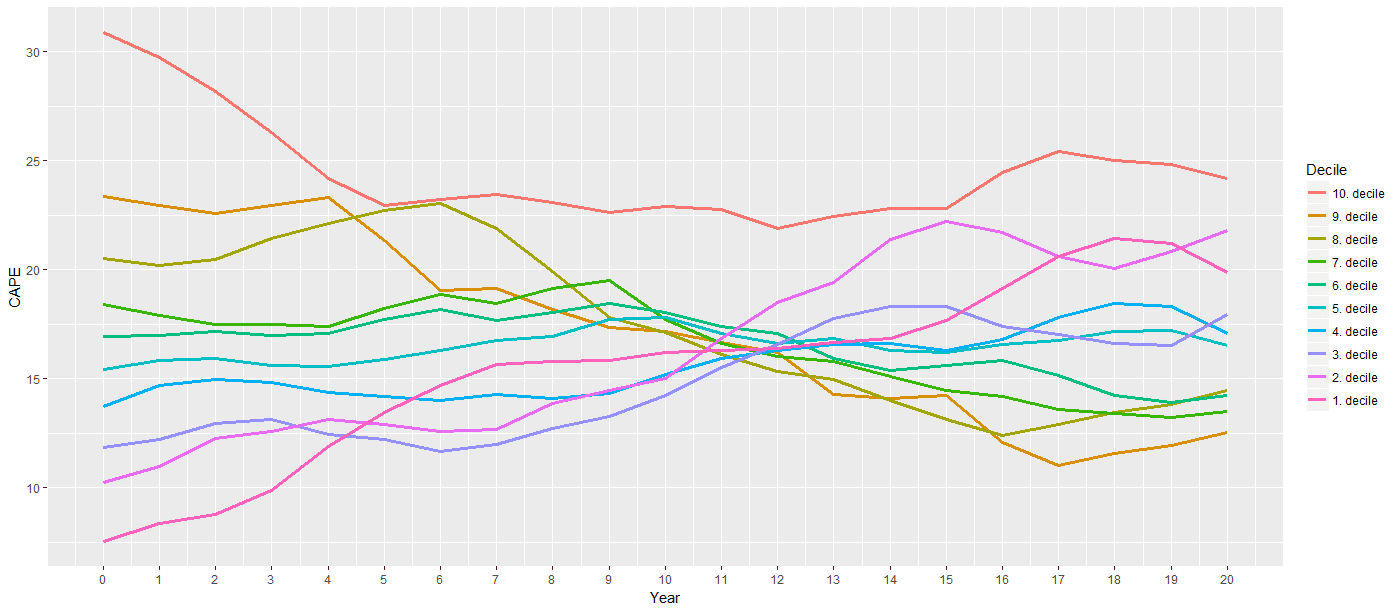

Bank of America's recent reports and analyses offer valuable insights into the current state of the stock market. They frequently utilize metrics such as the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE) to assess market valuations. These metrics help determine whether the market is overvalued relative to historical trends and future earnings expectations.

-

BofA's predicted market trajectory: BofA's outlook, while nuanced and subject to change, often incorporates a range of possibilities, considering factors like economic growth, inflation, and interest rate adjustments. Their predictions are usually presented with varying degrees of probability, reflecting the inherent uncertainty of market forecasting.

-

Key economic indicators BofA is tracking: BofA closely monitors several crucial economic indicators, including inflation rates (CPI and PPI), interest rate adjustments by the Federal Reserve, GDP growth, and unemployment figures. Changes in these indicators significantly influence their valuation assessments and market projections.

-

BofA's assessment of potential risks and opportunities: BofA's analysis typically highlights potential risks such as increased market volatility, the potential for a market correction, and the impact of rising interest rates on specific sectors. At the same time, they often identify opportunities within specific sectors showing strong fundamentals despite overall high valuations.

Identifying Potential Risks Associated with High Valuations

Investing in a highly valued market comes with inherent risks. It's crucial to understand these risks before making any investment decisions.

-

Increased market volatility and potential for corrections: High valuations often precede market corrections or even crashes. The higher the valuation, the greater the potential for a significant price drop.

-

The impact of rising interest rates on stock prices: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing the attractiveness of stocks relative to bonds. This can lead to a decrease in stock prices, especially for growth stocks.

-

The risk of overvalued assets and potential for losses: When the market is overvalued, there's a higher likelihood of individual assets being overvalued as well. Investing in these overvalued assets carries a substantial risk of losses if the market corrects.

-

Market bubbles and their consequences: History is replete with examples of market bubbles, periods of extreme overvaluation driven by speculation rather than fundamentals. The bursting of these bubbles often results in significant market declines and investor losses. Understanding the signs of a bubble is critical for risk management.

Strategies for Navigating High Stock Market Valuations

Even in a market characterized by high valuations, investors can employ strategies to mitigate risk and potentially capitalize on opportunities.

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of a downturn in any single area. This is a cornerstone of effective risk management.

-

Value investing: Focus on identifying undervalued companies with strong fundamentals. These companies may offer better risk-adjusted returns compared to their highly valued peers.

-

Long-term investment horizons: A long-term perspective helps weather short-term market volatility. Focusing on the long-term growth potential of your investments can reduce the impact of short-term fluctuations.

-

Alternative asset classes: Consider diversifying into asset classes that may be less correlated with the stock market, such as bonds or real estate, to further reduce overall portfolio risk.

-

Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market price, helps mitigate the risk of investing a lump sum at a market peak.

The Role of Sector-Specific Analysis

Understanding sector-specific performance is crucial in a highly valued market. Some sectors may be less susceptible to valuation corrections than others due to strong fundamentals and growth prospects.

-

Identifying strong sectors: Focus on sectors with robust earnings growth, strong balance sheets, and resilient business models. This requires thorough fundamental analysis.

-

Analyzing sector-specific growth potential: Examine the long-term growth potential of different sectors, considering factors such as technological innovation, demographic shifts, and regulatory changes.

-

BofA's sector insights: BofA often provides sector-specific analyses and recommendations in their reports. Utilizing their research can help identify potentially less vulnerable sectors.

Monitoring Key Economic Indicators

Continuous market monitoring is essential for adapting your investment strategy. Key economic indicators provide valuable insights into the direction of the market.

-

Key indicators to watch: Closely monitor inflation, unemployment, GDP growth, and consumer sentiment data.

-

Utilizing BofA's research: BofA regularly publishes reports and analyses incorporating these key indicators. Leverage these resources to inform your investment decisions.

-

Adjusting your strategy: Be prepared to adjust your investment strategy in response to significant shifts in economic conditions.

Conclusion

Navigating high stock market valuations requires a cautious yet proactive approach. BofA's insights, combined with a well-defined investment strategy emphasizing diversification, value investing, and a long-term perspective, are crucial. Remember to closely monitor key economic indicators and adjust your portfolio accordingly. Successfully navigating high stock market valuations demands continuous assessment and adaptation. Utilize BofA's research and these strategies to build a resilient portfolio and confidently manage your investments during periods of high valuations. Learn more about managing high stock market valuations by exploring BofA's latest market analysis.

Featured Posts

-

The Complete Guide To The New Dexter Funko Pop Collection

May 22, 2025

The Complete Guide To The New Dexter Funko Pop Collection

May 22, 2025 -

Googles Ai A Critical Evaluation For Investors

May 22, 2025

Googles Ai A Critical Evaluation For Investors

May 22, 2025 -

Airlines Confront Summer Travel Surge Potential Disruptions And Solutions

May 22, 2025

Airlines Confront Summer Travel Surge Potential Disruptions And Solutions

May 22, 2025 -

Wtt Announces Groundbreaking Competitive Model At Press Conference

May 22, 2025

Wtt Announces Groundbreaking Competitive Model At Press Conference

May 22, 2025 -

Wtt Chennai Arunas Tournament Ends Prematurely

May 22, 2025

Wtt Chennai Arunas Tournament Ends Prematurely

May 22, 2025

Latest Posts

-

Wyoming Otter Management A Critical Shift

May 22, 2025

Wyoming Otter Management A Critical Shift

May 22, 2025 -

A Turning Point For Otter Management In Wyoming

May 22, 2025

A Turning Point For Otter Management In Wyoming

May 22, 2025 -

Large Zebra Mussel Colony Found On Casper Boat Lift

May 22, 2025

Large Zebra Mussel Colony Found On Casper Boat Lift

May 22, 2025 -

Casper Resident Uncovers Massive Zebra Mussel Infestation

May 22, 2025

Casper Resident Uncovers Massive Zebra Mussel Infestation

May 22, 2025 -

Casper Faces Zebra Mussel Infestation A Local Discovery

May 22, 2025

Casper Faces Zebra Mussel Infestation A Local Discovery

May 22, 2025