Should Investors Worry About Elevated Stock Market Valuations? BofA's Take

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations considers both specific sectors and broader macroeconomic factors. Their analysis helps investors understand the potential risks and opportunities in the market.

Identifying Overvalued Sectors

BofA's research likely employs a variety of valuation metrics to identify potentially overvalued sectors. They might use traditional methods like Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and Price-to-Book (P/B) ratios, comparing current valuations to historical averages and industry benchmarks. This helps them assess whether a sector's price reflects its underlying fundamentals.

- Specific sectors identified as potentially overvalued (hypothetical examples based on typical BofA analysis): Technology, particularly within specific sub-sectors showing rapid growth but potentially unsustainable valuations; certain consumer discretionary sectors driven by pandemic-related demand; and possibly some segments of the real estate market. It's important to note these are examples and BofA's specific findings may vary.

- Key valuation metrics used in BofA's analysis: P/E ratios, P/S ratios, P/B ratios, dividend yield, and forward-looking metrics that consider projected earnings growth.

- Explanation of how these metrics indicate overvaluation: High P/E ratios relative to historical averages or industry peers, combined with decelerating earnings growth, might signal overvaluation. Similarly, high P/S ratios in sectors with low profit margins can raise concerns.

Macroeconomic Factors Influencing Valuations

BofA's perspective considers how macroeconomic factors significantly influence stock market valuations.

- Impact of inflation on stock valuations: High inflation erodes corporate profits and investor purchasing power, potentially leading to lower stock valuations. BofA would likely analyze the impact of inflation on earnings forecasts and discount rates used in valuation models.

- Influence of interest rate hikes on market sentiment: Rising interest rates increase borrowing costs for companies and make bonds a more attractive alternative to stocks, potentially reducing stock prices and valuations. BofA will consider the Federal Reserve's monetary policy and its anticipated impact on market liquidity and investor sentiment.

- BofA's forecasts for economic growth and their implications for valuations: Strong economic growth can support higher valuations, while forecasts of slowing growth or recession can lead to lower valuations. BofA's economic forecasts and their impact on corporate earnings are central to their valuation analysis.

BofA's Recommendations for Investors

Considering the elevated valuations, BofA likely offers investors strategies to mitigate risks and identify potential opportunities.

Strategies for Mitigating Valuation Risks

For investors concerned about elevated stock market valuations, BofA probably suggests a cautious approach.

- Diversification across asset classes and sectors: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of any single sector's underperformance.

- Identifying undervalued companies and sectors: BofA might recommend focusing on companies with strong fundamentals and attractive valuations relative to their peers. This involves in-depth research and analysis.

- Adjusting investment portfolios to manage risk: This might involve reducing overall equity exposure or shifting investments towards less volatile assets. Regular portfolio rebalancing is crucial.

Opportunities Within a High-Valuation Market

Despite elevated valuations, BofA may highlight potential opportunities for strategic investors.

- Sectors showing resilience despite high valuations: Some sectors might demonstrate resilience even with high valuations due to strong growth prospects or a unique competitive advantage. BofA’s research may highlight such sectors.

- Identifying companies with strong growth prospects: Even in a high-valuation market, companies with exceptionally strong growth prospects may still offer attractive investment opportunities. Thorough due diligence is crucial here.

- Strategies for capitalizing on market corrections: BofA may suggest strategies to exploit potential market corrections, which could create buying opportunities for undervalued assets. Having cash reserves for such opportunities is important.

Comparing BofA's Analysis to Other Market Perspectives

To provide a complete picture, it's crucial to compare BofA's view with other prominent financial institutions.

- Summarize the opinions of other financial analysts and institutions: Other institutions may have varying perspectives on the extent of overvaluation and the potential risks. Some might be more bullish, while others might share BofA's concerns.

- Highlight points of agreement and disagreement with BofA's analysis: Identifying areas of consensus and divergence helps investors form a balanced perspective.

- Discuss the overall consensus regarding market valuations: Understanding the broader market sentiment is vital for making informed investment decisions.

Conclusion

BofA's analysis of elevated stock market valuations highlights the importance of considering both sector-specific risks and the influence of macroeconomic factors. Their recommendations emphasize diversification, identifying undervalued assets, and strategically managing risk within a potentially volatile market. Remember, while concerns about elevated stock market valuations are valid, understanding various perspectives, including BofA's insights, is crucial.

Call to Action: While navigating the complexities of elevated stock market valuations, conducting thorough due diligence and consulting with a financial advisor is essential to develop a sound investment strategy tailored to your risk tolerance. Don't ignore the potential risks associated with high stock market valuations – proactively manage your portfolio to successfully navigate current market conditions.

Featured Posts

-

The Goldbergs Lasting Legacy Impact And Cultural Relevance

May 22, 2025

The Goldbergs Lasting Legacy Impact And Cultural Relevance

May 22, 2025 -

Bbc Breakfast Guests Live Broadcast Interruption Sparks Discussion

May 22, 2025

Bbc Breakfast Guests Live Broadcast Interruption Sparks Discussion

May 22, 2025 -

New Orleans Sheriffs Reelection Bid In Jeopardy After Jail Escape

May 22, 2025

New Orleans Sheriffs Reelection Bid In Jeopardy After Jail Escape

May 22, 2025 -

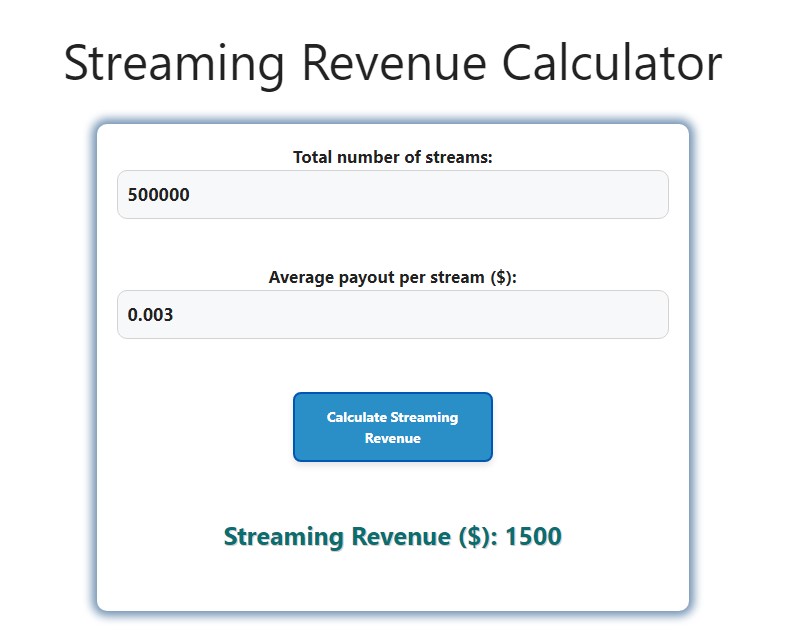

Streaming Revenue Good News For Creators Challenges For Consumers

May 22, 2025

Streaming Revenue Good News For Creators Challenges For Consumers

May 22, 2025 -

Is The Goldbergs Ending Soon A Look At The Future Of The Show

May 22, 2025

Is The Goldbergs Ending Soon A Look At The Future Of The Show

May 22, 2025

Latest Posts

-

Core Weave Inc Crwv Analyzing Thursdays Sharp Stock Price Appreciation

May 22, 2025

Core Weave Inc Crwv Analyzing Thursdays Sharp Stock Price Appreciation

May 22, 2025 -

Why Did Core Weave Crwv Stock Price Increase Significantly On Thursday

May 22, 2025

Why Did Core Weave Crwv Stock Price Increase Significantly On Thursday

May 22, 2025 -

Blake Lively And Taylor Swift Reconciling Amidst Recent Legal Troubles

May 22, 2025

Blake Lively And Taylor Swift Reconciling Amidst Recent Legal Troubles

May 22, 2025 -

Did Blake Lively And Taylor Swift Recover Their Friendship Following Lawsuit Allegations

May 22, 2025

Did Blake Lively And Taylor Swift Recover Their Friendship Following Lawsuit Allegations

May 22, 2025 -

Core Weave Inc Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Core Weave Inc Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025