India's Large-Cap Stocks: How Reliance Earnings Influence Performance

Table of Contents

Reliance Industries: A Heavyweight in India's Stock Market

Reliance Industries' market capitalization is staggering, solidifying its position as a dominant force within the Indian large-cap segment. Its immense Reliance Industries market cap contributes significantly to the Nifty 50 weight, making it a key component of any index fund focused on Indian equities. This dominance stems from its incredibly diversified portfolio, spanning across vital sectors including:

- Telecom: Jio Platforms' disruptive entry into the telecom sector has reshaped the landscape, impacting competitors and influencing overall market dynamics.

- Retail: Reliance Retail's expansive network and innovative strategies have solidified its position as a retail giant, significantly influencing consumer behavior and impacting the performance of other retail players.

- Energy: Reliance's significant presence in the energy sector, including its oil refining and petrochemical businesses, positions it as a key player within this crucial industry.

This diversification makes Reliance a key Indian economy barometer. Positive performance from Reliance often signals broader economic health and confidence, while underperformance can trigger concerns.

Analyzing the Correlation Between Reliance Earnings and Large-Cap Stock Performance

To understand the relationship between Reliance's earnings and the broader large-cap market, we employed a robust correlation analysis. This involved a statistical analysis of stock price movements of major large-cap companies in the days leading up to and following Reliance's earnings announcements. Our analysis revealed a significant positive correlation:

- Positive Earnings Surprises: When Reliance exceeded earnings expectations, there was a general upward trend in the stock prices of many other large-cap companies, indicating a positive earnings impact. For instance, the strong Q3 2023 results led to a broader market rally.

- Negative Earnings Surprises: Conversely, instances of lower-than-expected earnings from Reliance often led to a more cautious market sentiment, with a noticeable dip in the stock prices of several large-cap companies. This highlights the substantial impact of stock price movement based on Reliance's performance.

The statistical significance of this correlation underscores the importance of monitoring Reliance's financial performance when assessing the potential performance of your portfolio. The strength of the correlation varied slightly depending on the sector, as detailed in the following section.

Sector-Specific Impacts of Reliance Earnings

Reliance's influence isn't uniform across all sectors. Its performance in specific areas has a disproportionately large impact on related large-cap companies.

- Telecom Sector: Jio's performance directly impacts its competitors. Strong earnings from Jio often lead to increased competition and pressure on other telecom players, while weak earnings can temporarily alleviate some pressure. This competitor analysis is vital for understanding the sectoral impact.

- Retail Sector: Reliance Retail's performance influences the entire retail landscape. Its expansion and innovations put pressure on competitors, impacting their stock price movement. Positive earnings generally lead to increased competition and downward pressure on competitors, while weaker results can offer temporary relief.

- Energy Sector: Reliance's performance in the energy sector has wide-ranging ripple effects, impacting not only direct competitors but also related industries such as logistics and manufacturing.

Understanding these sectoral impacts allows investors to make more informed decisions based on Reliance's performance.

Investor Sentiment and Reliance's Influence

Reliance's earnings reports significantly shape investor sentiment towards the broader Indian market. Positive news from Reliance often boosts overall investor confidence, leading to higher market valuations. Conversely, negative news can trigger a sell-off and increased market volatility, impacting the overall market outlook. The impact is not just limited to the day of the announcement; the sentiment persists, influencing trading patterns for days and even weeks after the release of the results. This affects the overall confidence index for the market. The market volatility increases proportionally to the significance of the earnings report.

Conclusion: Understanding the Reliance Effect on India's Large-Cap Stocks

In summary, our analysis confirms a strong correlation between Reliance's earnings and the performance of India's large-cap stocks. Reliance Industries serves as a powerful bellwether, significantly impacting both investor sentiment and market performance across various sectors. Monitoring Reliance earnings is crucial for investors interested in the large-cap space. This information allows investors to refine their investment strategy based on the predicted impact on the market. Remember to conduct thorough market analysis before making any investment decisions and seek professional financial advice when needed. Stay informed about Reliance's performance and its impact to make strategic choices in your investment portfolio of India's large-cap stocks.

Featured Posts

-

Vancouver Festival Hit By Car Crash Injuries Reported After Vehicle Strikes Crowd

Apr 29, 2025

Vancouver Festival Hit By Car Crash Injuries Reported After Vehicle Strikes Crowd

Apr 29, 2025 -

Black Hawk Helicopter Crash In Wichita Final Flight Details

Apr 29, 2025

Black Hawk Helicopter Crash In Wichita Final Flight Details

Apr 29, 2025 -

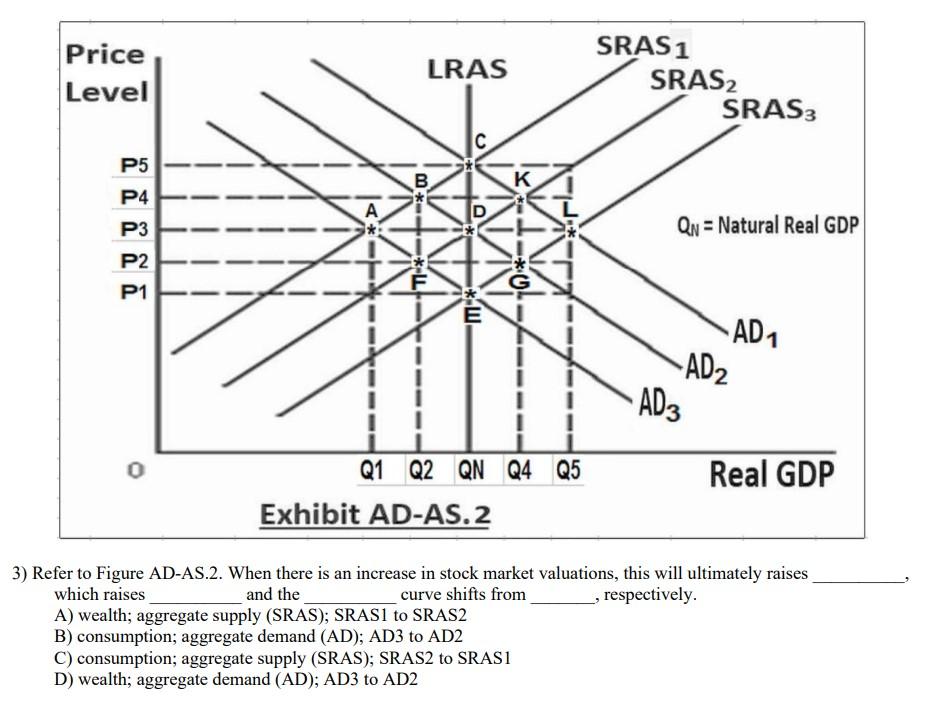

Bof As View Understanding And Managing High Stock Market Valuations

Apr 29, 2025

Bof As View Understanding And Managing High Stock Market Valuations

Apr 29, 2025 -

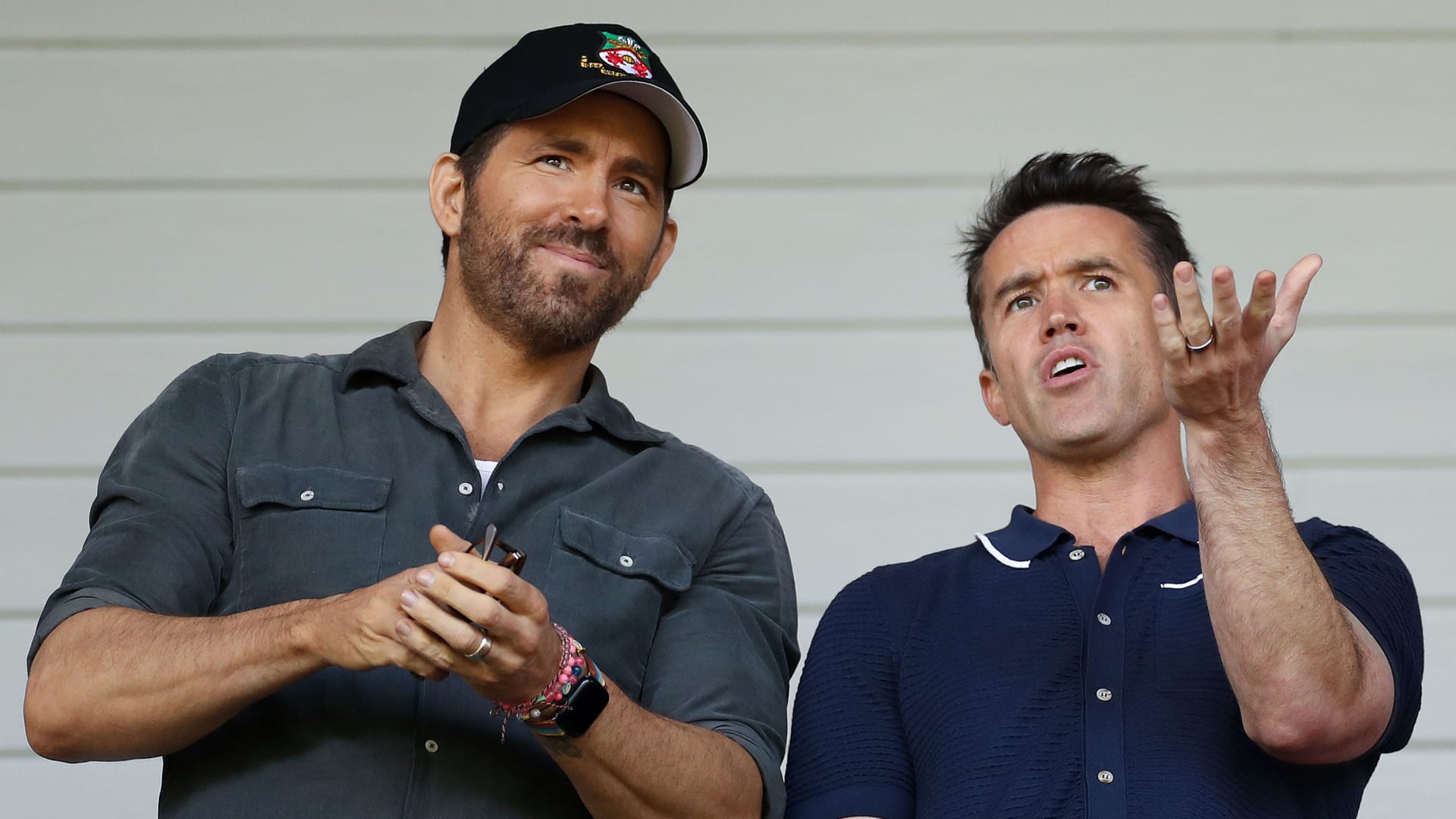

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025 -

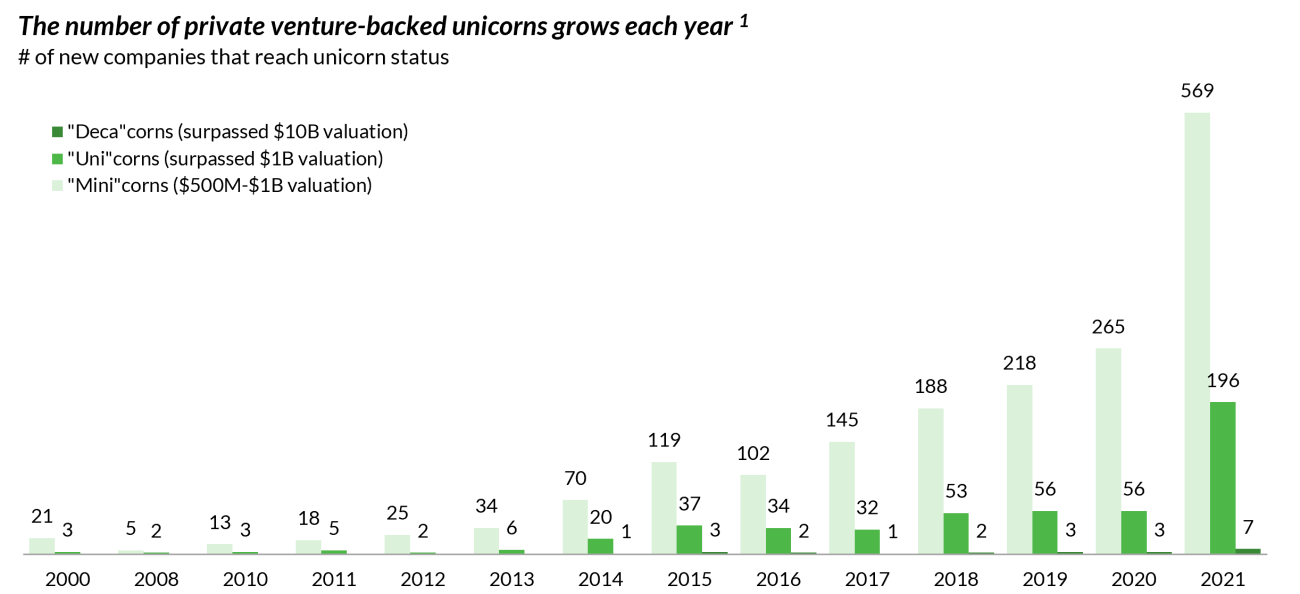

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025

Latest Posts

-

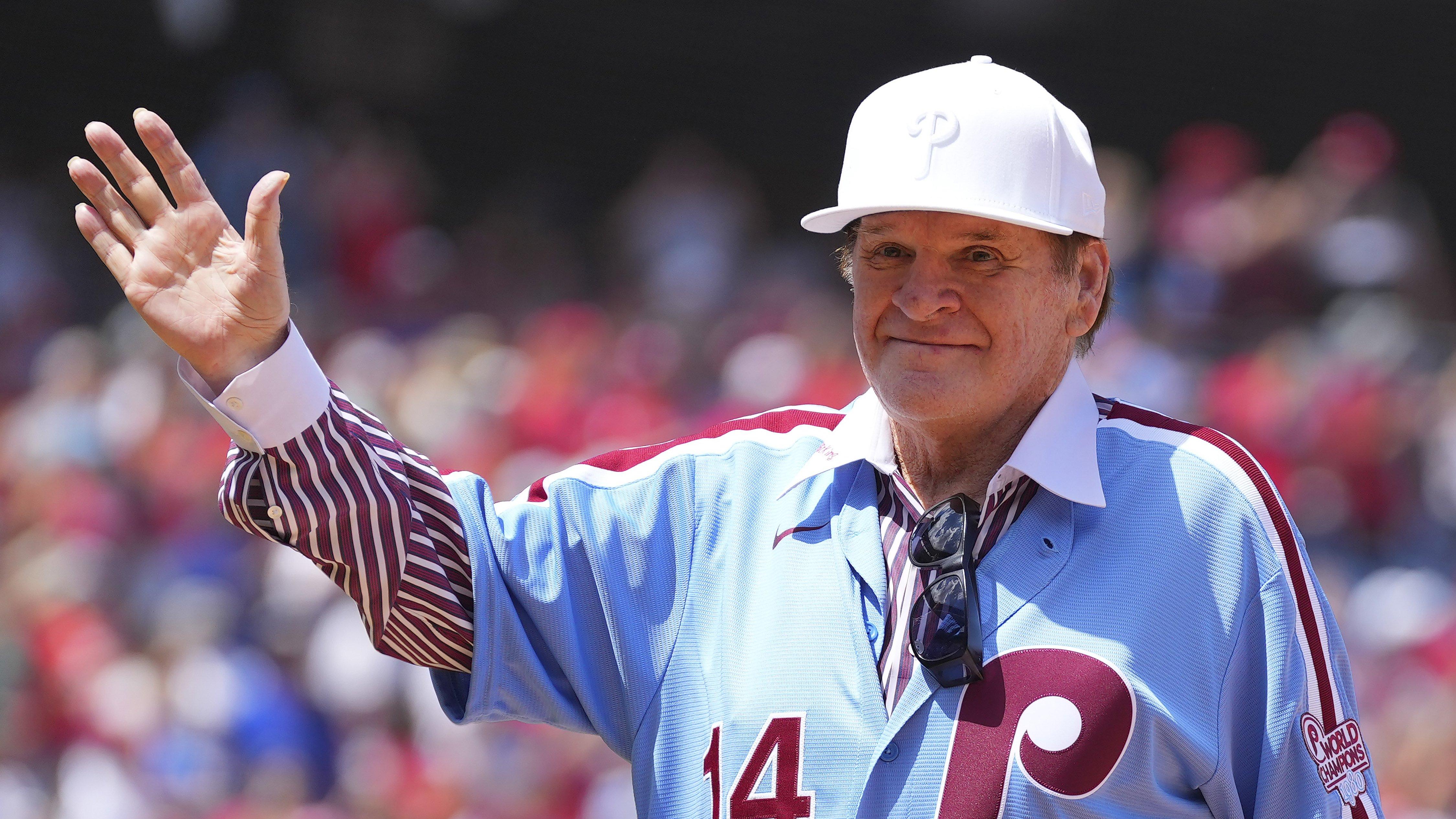

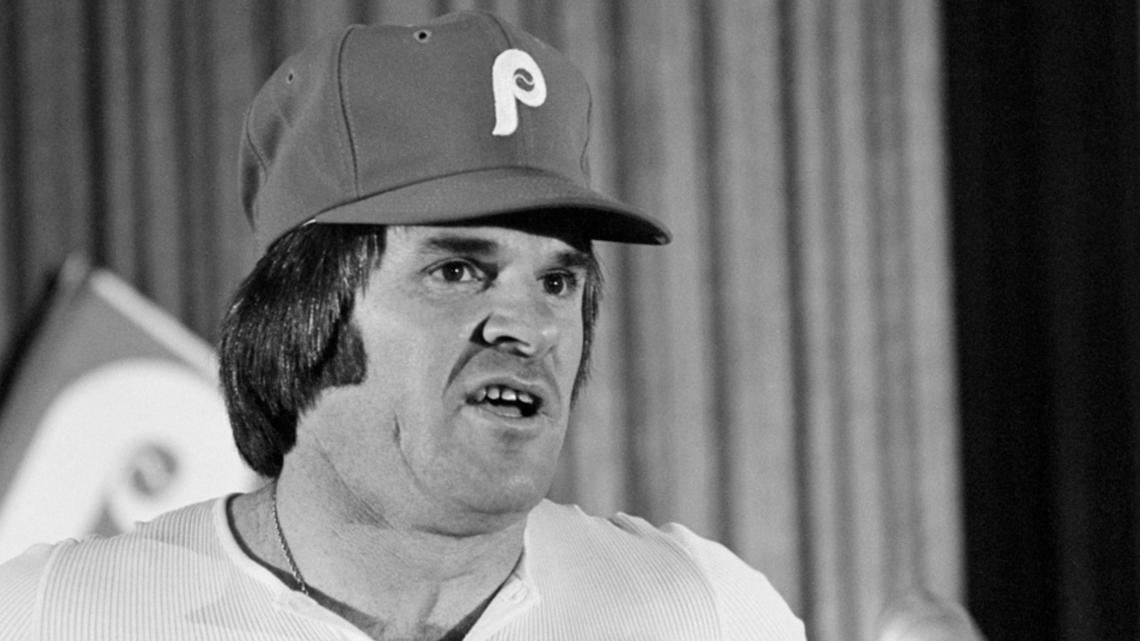

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025 -

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025 -

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025