BofA's View: Understanding And Managing High Stock Market Valuations

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

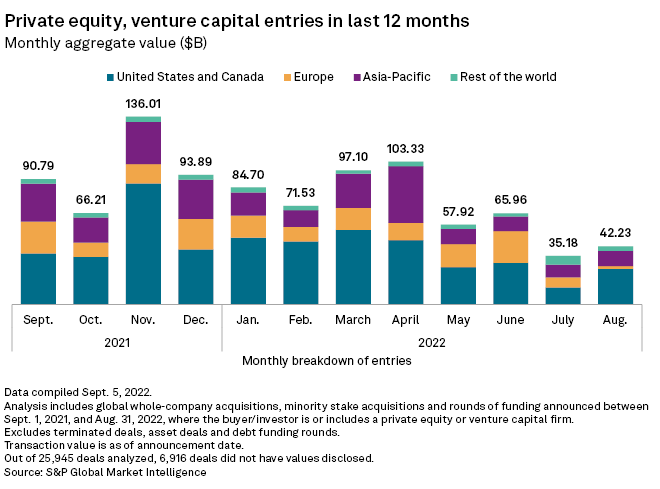

BofA regularly publishes market commentary and research reports assessing stock market valuations. Their stance often fluctuates based on economic indicators and prevailing market sentiment. While specific reports are constantly updated, a common theme is the careful consideration of whether current prices reflect intrinsic value or represent inflated expectations. They typically utilize a multi-faceted approach, combining quantitative and qualitative analysis.

- Key metrics BofA uses to assess valuations: BofA employs a range of metrics to gauge market valuations, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other valuation multiples specific to various sectors. They also consider factors like interest rates, inflation, and economic growth projections.

- BofA's predictions for future market performance based on current valuations: Predictions vary depending on the specific report and timeframe. However, BofA generally cautions investors about the potential risks associated with high valuations, often suggesting a more cautious approach than during periods of lower valuations. They often emphasize the importance of considering long-term trends and cyclical market patterns.

- Specific sectors or asset classes BofA highlights as particularly over/undervalued: BofA's research frequently highlights specific sectors that may be overvalued or undervalued relative to their intrinsic worth. These assessments are often based on individual company performance, industry trends, and macroeconomic forecasts. For example, at certain times, the technology sector might be flagged as potentially overvalued due to high growth expectations, while value stocks in more stable industries may be seen as relatively attractive.

Identifying Risks Associated with High Stock Market Valuations

Investing in a market with high valuations presents several key risks that investors must acknowledge. Understanding these risks is crucial for informed decision-making.

- Increased vulnerability to market corrections or crashes: Highly valued markets are inherently more susceptible to sharp declines. When investor confidence wanes, even slightly, the potential for a significant correction or even a crash increases dramatically.

- Reduced potential for significant returns: High valuations typically mean lower future returns. The potential for substantial capital appreciation diminishes as the price-to-value ratio expands.

- Higher risk of capital loss: In a market correction, investors holding highly valued stocks are more likely to experience significant capital losses compared to those holding assets with lower valuations.

- Impact of rising interest rates on valuations: Rising interest rates directly impact valuations. Higher rates increase the cost of borrowing for companies, potentially reducing their profitability and impacting stock prices. This effect is especially pronounced for growth stocks that rely on future earnings.

- Potential for inflation's influence on stock prices: Inflation erodes purchasing power and can significantly impact corporate earnings. High inflation can reduce consumer spending and business investment, impacting stock prices negatively.

BofA's Recommended Strategies for Managing High Stock Market Valuations

BofA typically advises a cautious and diversified approach to managing investments during periods of high stock market valuations.

- Diversification strategies: Diversification across asset classes (stocks, bonds, real estate, etc.), geographies, and sectors is paramount. This approach helps mitigate risk by reducing the impact of any single asset's underperformance.

- Defensive investment approaches: Value investing and focusing on dividend-paying stocks are often recommended. Value stocks tend to be less susceptible to valuation swings than growth stocks. Dividends provide a steady stream of income, potentially buffering against market downturns.

- Importance of risk assessment and tolerance: Before making any investment decisions, investors must carefully assess their own risk tolerance. Understanding your risk profile is essential for building a portfolio suitable for your individual circumstances.

- Utilizing hedging strategies: Hedging strategies, such as options or inverse ETFs, can help mitigate potential losses during market corrections. These strategies are often more complex and require careful consideration.

- Importance of a long-term investment horizon: Maintaining a long-term perspective is critical. Market fluctuations are inevitable, and a long-term investment horizon can help weather short-term volatility.

The Role of Sector-Specific Analysis in High Valuation Environments

Even in a generally overvalued market, opportunities may exist within specific sectors. BofA's sector-specific analysis is crucial in identifying these pockets of potential.

- Identifying undervalued sectors within an overall overvalued market: Detailed sector analysis allows for the identification of undervalued sectors based on fundamental factors, even if the overall market is considered overvalued.

- Assessing growth potential despite high valuations in specific sectors: Certain high-growth sectors, while exhibiting high valuations, might still offer long-term potential based on their innovation and disruption capabilities. A thorough analysis is necessary to assess this potential risk versus reward.

- Examples of sectors BofA might highlight: BofA might highlight sectors like healthcare (due to aging populations and technological advancements), energy (due to the transition to renewable energy sources), or specific technology sub-sectors based on their growth potential and valuation metrics.

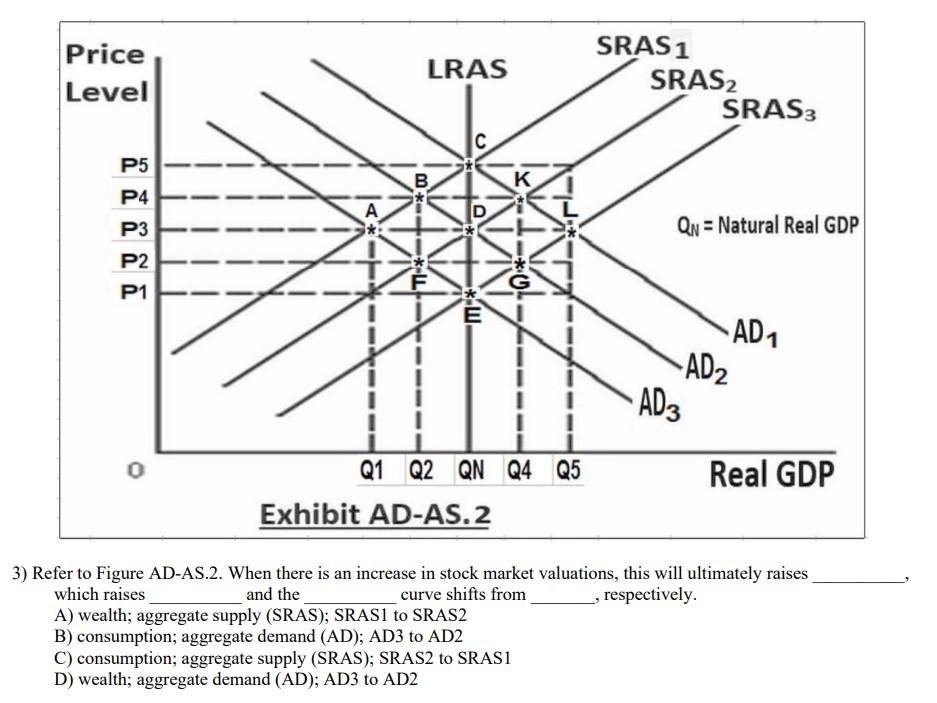

Understanding the Impact of Macroeconomic Factors on High Stock Market Valuations

Macroeconomic factors significantly influence stock market valuations, and BofA's analysis incorporates these factors extensively.

- BofA's views on the current macroeconomic environment: BofA closely monitors inflation rates, interest rate changes, GDP growth, geopolitical events, and other macroeconomic indicators to assess their influence on the market. Their assessments and forecasts directly influence their valuation judgements.

- How these factors might impact investor sentiment and market behavior: Negative macroeconomic factors, such as high inflation or geopolitical instability, can reduce investor confidence, leading to market corrections or a bearish market sentiment.

- The influence of central bank policies on stock valuations: Central bank policies, particularly interest rate adjustments, have a profound effect on stock valuations. Changes in monetary policy can impact borrowing costs for businesses and influence investor behavior, thus affecting market sentiment and valuations.

Conclusion

BofA's perspective on high stock market valuations emphasizes the need for caution and strategic management. Understanding the inherent risks, including vulnerability to market corrections and reduced potential for significant returns, is crucial. BofA recommends diversification, defensive investment strategies, and a long-term investment horizon to navigate this environment. Careful consideration of macroeconomic factors and sector-specific analysis allows for a more nuanced understanding and better-informed decision-making. Stay informed about BofA's ongoing analysis of high stock market valuations and adjust your investment strategy accordingly to navigate this dynamic market environment. Consider consulting with a financial advisor to tailor a plan that aligns with your personal risk tolerance and investment goals.

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 29, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 29, 2025 -

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025 -

Private University Alliance Challenges Trump Administrations Education Agenda

Apr 29, 2025

Private University Alliance Challenges Trump Administrations Education Agenda

Apr 29, 2025 -

The Winning Names Minnesotas Snow Plow Contest Results

Apr 29, 2025

The Winning Names Minnesotas Snow Plow Contest Results

Apr 29, 2025 -

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025

Latest Posts

-

One Plus 13 R Review Performance Camera And Price Compared To Pixel 9a

Apr 29, 2025

One Plus 13 R Review Performance Camera And Price Compared To Pixel 9a

Apr 29, 2025 -

Review One Plus 13 R A Practical Alternative To The Pixel 9a

Apr 29, 2025

Review One Plus 13 R A Practical Alternative To The Pixel 9a

Apr 29, 2025 -

Podcast Production Reimagined Ais Role In Processing Repetitive Scatological Texts

Apr 29, 2025

Podcast Production Reimagined Ais Role In Processing Repetitive Scatological Texts

Apr 29, 2025 -

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025 -

One Plus 13 R In Depth Review And Pixel 9a Comparison

Apr 29, 2025

One Plus 13 R In Depth Review And Pixel 9a Comparison

Apr 29, 2025