IMF To Review Pakistan's $1.3 Billion Loan Package Amidst India Tensions

Table of Contents

The Stakes of the IMF Review for Pakistan's Economy

Pakistan is currently grappling with a severe economic crisis characterized by high inflation, a rapidly devaluing currency, and an unsustainable debt burden. The IMF bailout package is seen as crucial for Pakistan's immediate economic needs, providing a lifeline to prevent a complete collapse. The potential consequences of a failed review are dire, potentially leading to a further economic downturn, increased poverty, and a heightened risk of default. The IMF's conditions for the loan, which typically include stringent fiscal reforms and structural adjustments, will determine the success or failure of the program.

-

Importance of the IMF Bailout: The $1.3 billion loan is vital for stabilizing Pakistan's economy, allowing it to meet its immediate financial obligations and preventing a default. Without this support, the Pakistan economy could face a catastrophic meltdown.

-

Consequences of a Failed Review: A negative IMF review would likely trigger a sharp devaluation of the Pakistani Rupee, further escalating inflation and making imports even more expensive. It could also lead to a severe credit crunch, hindering economic activity and potentially pushing Pakistan towards default.

-

IMF Conditions: The IMF's conditions typically involve measures like reducing government spending, increasing taxes, and implementing structural reforms aimed at improving the business environment and boosting economic growth. These reforms, while necessary for long-term stability, may be politically challenging to implement.

India-Pakistan Tensions and Their Economic Impact on Pakistan

The ongoing tensions between India and Pakistan create a significant headwind for Pakistan's economy. Recent events have further strained relations, impacting investor confidence and exacerbating existing economic vulnerabilities. This geopolitical instability adds a significant layer of uncertainty to the already fragile economic situation, making it harder for Pakistan to attract foreign investment and stabilize its currency.

-

Impact on Investor Confidence: Heightened tensions deter foreign investors, who are hesitant to commit capital to a region perceived as politically unstable. This lack of investment further hampers economic growth and development.

-

Impact on Trade and Tourism: The strained relationship affects trade between the two countries and discourages tourism to Pakistan, depriving the economy of valuable revenue streams. Cross-border trade and tourism are significant contributors to the Pakistan economy.

-

Diversion of Resources: Increased defense spending due to the ongoing tensions diverts resources from crucial sectors like education, health, and infrastructure, hindering long-term development and growth. This trade-off significantly impacts the country's ability to achieve sustainable economic growth.

The IMF's Conditions and Pakistan's Ability to Meet Them

The IMF has imposed a series of conditions for the disbursement of the $1.3 billion loan, including fiscal consolidation, structural reforms, and improvements in governance. The feasibility of Pakistan implementing these reforms is questionable, given the existing political and economic climate.

-

Feasibility of Reforms: Implementing the required reforms will be a significant challenge for Pakistan, given the political opposition, potential social unrest, and the existing economic fragility.

-

Challenges in Meeting Targets: Meeting the ambitious fiscal targets set by the IMF, including reducing the fiscal deficit and controlling inflation, will require strong political will and effective implementation mechanisms.

-

Potential Compromises and Negotiations: There is a possibility of negotiations and compromises between Pakistan and the IMF to adjust the conditions to suit the prevailing circumstances. The ultimate agreement will depend on various factors, including the political will within Pakistan and the IMF's assessment of the situation.

Potential Outcomes of the IMF Review

Several scenarios are possible following the IMF review. A positive review could lead to the full disbursement of the $1.3 billion loan, providing much-needed relief to Pakistan's economy. However, a partial disbursement or even a complete suspension of the loan are also possibilities, depending on Pakistan's progress in meeting the IMF's conditions. Each scenario carries vastly different implications for Pakistan's economic future. A complete suspension could trigger a major economic crisis.

Conclusion

The IMF review of Pakistan's $1.3 billion loan package is a critical juncture for the country's economy. The ongoing India-Pakistan tensions further complicate the situation, adding to the already significant challenges Pakistan faces in meeting the IMF's conditions. The outcome of this review will have far-reaching implications for Pakistan's economic stability and its relationship with the international financial community. Stay updated on the crucial IMF review of Pakistan's $1.3 billion loan package. The outcome will significantly impact Pakistan's economic future and its relationship with the IMF. Follow our website for continuous updates on the IMF loan Pakistan situation and its implications for regional stability. Learn more about the intricacies of the Pakistan economy and the IMF bailout process by exploring our in-depth analysis.

Featured Posts

-

Exposition Dijon Gustave Eiffel Et Les Racines D Un Genie

May 10, 2025

Exposition Dijon Gustave Eiffel Et Les Racines D Un Genie

May 10, 2025 -

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 10, 2025

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Presidency

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Presidency

May 10, 2025 -

Nottingham Tragedy Survivors Wish After Triple Murder

May 10, 2025

Nottingham Tragedy Survivors Wish After Triple Murder

May 10, 2025 -

2025 Nhl Trade Deadline Impact On Playoff Contenders

May 10, 2025

2025 Nhl Trade Deadline Impact On Playoff Contenders

May 10, 2025

Latest Posts

-

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025 -

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025 -

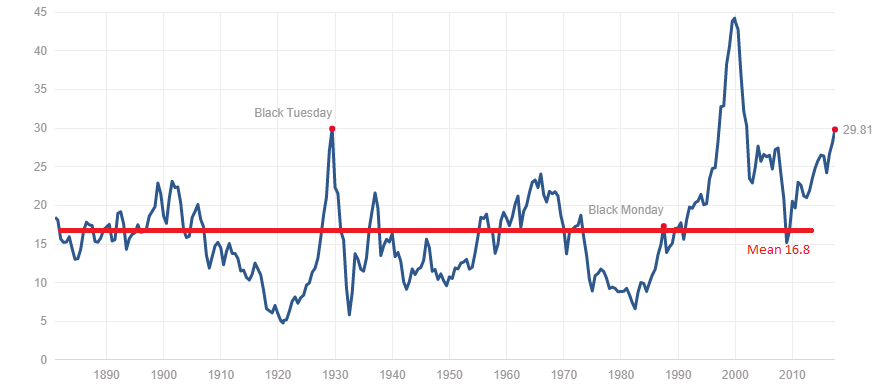

Understanding High Stock Market Valuations Bof As Advice For Investors

May 10, 2025

Understanding High Stock Market Valuations Bof As Advice For Investors

May 10, 2025 -

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 10, 2025

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 10, 2025 -

Exploring The Countrys Fastest Growing Business Hubs

May 10, 2025

Exploring The Countrys Fastest Growing Business Hubs

May 10, 2025