Understanding High Stock Market Valuations: BofA's Advice For Investors

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA's assessment of current high stock market valuations is typically nuanced, acknowledging the elevated levels while also considering other economic factors. They don't simply declare the market "overvalued" or "undervalued" but rather analyze the situation through a multifaceted lens. Their analysis usually considers various factors, leading to a more balanced outlook than a simple binary classification.

-

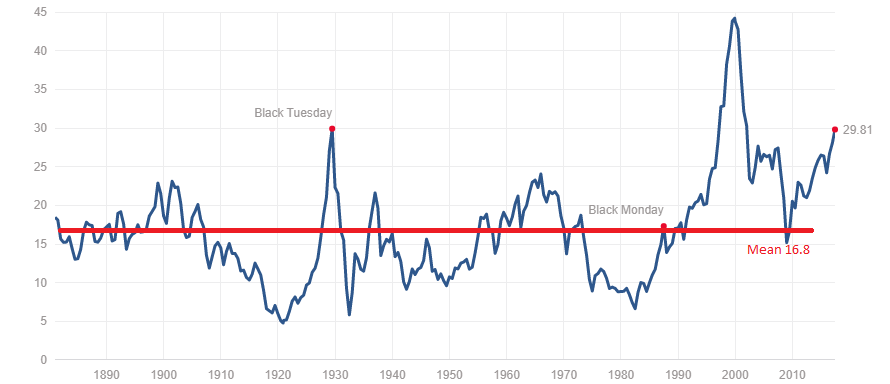

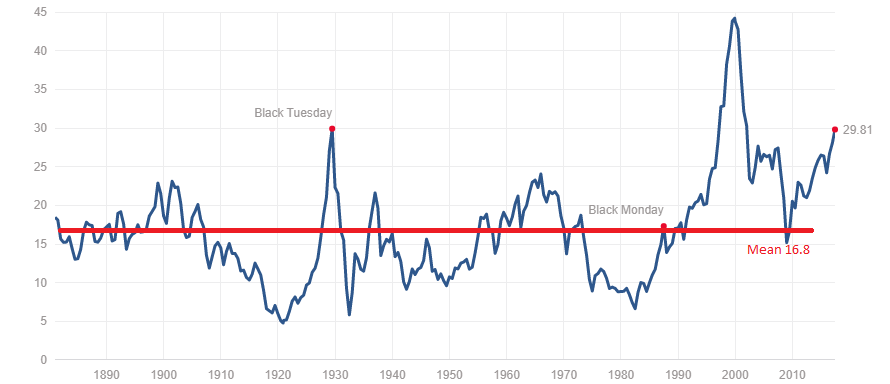

Key Statistics and Data Points: BofA's analysis often incorporates metrics like price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and other valuation multiples across various sectors. They might compare these ratios to historical averages and to those of other global markets to gauge relative valuation. They also closely monitor the Shiller PE ratio (CAPE), which adjusts for inflation and long-term earnings trends, providing a longer-term perspective on valuation.

-

Specific Sectors and Asset Classes: BofA's reports frequently highlight specific sectors or asset classes that appear particularly overvalued or undervalued relative to their perceived intrinsic worth. For instance, certain technology stocks may be flagged as potentially overvalued based on their growth prospects and current pricing, while other sectors like energy or financials might appear relatively more attractive given their valuations and current market conditions.

-

Relevant Economic Indicators: Economic indicators like inflation rates, interest rates (both short-term and long-term), and GDP growth significantly influence BofA's assessment. High inflation can compress valuations, while rising interest rates increase the opportunity cost of investing in stocks, potentially dampening valuations. Conversely, strong GDP growth can support higher valuations.

Strategies for Investors in a High-Valuation Market

Navigating a high-valuation market requires a strategic approach. BofA typically advocates for a diversified portfolio and a focus on long-term growth.

-

Diversification: BofA emphasizes the critical importance of diversification across asset classes (stocks, bonds, real estate, etc.), geographies, and sectors to mitigate risk. A well-diversified portfolio can help cushion against losses in any single asset class.

-

Defensive Stocks and Bonds: In a high-valuation environment, incorporating defensive stocks (those less sensitive to economic downturns) and bonds into your portfolio provides a buffer against market volatility. These assets often perform relatively well during periods of uncertainty.

-

Investment Vehicles: BofA might suggest using exchange-traded funds (ETFs) and mutual funds to achieve diversification and professional management. These vehicles offer access to a broad range of assets with relative ease.

-

Value Investing: Even in a high-valuation market, opportunities for value investing may exist. BofA's analysts may identify undervalued companies with strong fundamentals that are trading below their intrinsic worth. However, this requires diligent research and a thorough understanding of company financials.

Managing Risk in a High Stock Market Valuation Environment

Risk management is paramount when stock valuations are high. BofA’s recommendations focus on proactive strategies to mitigate potential losses.

-

Understanding Risk Tolerance: BofA stresses the importance of knowing your individual risk tolerance before making any investment decisions. This involves understanding your comfort level with potential losses and aligning your portfolio accordingly.

-

Reducing Portfolio Volatility: Strategies for reducing portfolio volatility include diversification (as mentioned above), hedging techniques (such as options strategies), and setting appropriate stop-loss orders.

-

Regular Portfolio Reviews: Regularly reviewing and adjusting your portfolio is crucial. This allows for rebalancing to maintain your desired asset allocation and to capitalize on changing market conditions.

-

Seeking Professional Advice: BofA strongly encourages seeking professional financial advice from a qualified advisor. A financial advisor can help you create a personalized investment plan aligned with your goals, risk tolerance, and financial situation.

Long-Term Investing Perspective in High Stock Market Valuations

Despite high valuations, BofA maintains that a long-term investment perspective is crucial for success.

-

Long-Term Investment Horizon: BofA emphasizes that market fluctuations are normal and that focusing on the long term allows you to weather short-term volatility.

-

Weathering Market Fluctuations: Long-term investors can utilize strategies like dollar-cost averaging to mitigate the impact of market timing. This involves investing a fixed amount of money at regular intervals, regardless of market price.

-

Dollar-Cost Averaging: By investing consistently, you buy more shares when prices are low and fewer when prices are high, averaging out the cost over time.

-

Potential for Long-Term Growth: Even with high valuations today, historical data suggests that the stock market has generated positive returns over the long term.

Conclusion

Understanding high stock market valuations is crucial for making sound investment decisions. BofA's advice emphasizes the importance of diversification, robust risk management strategies, and a long-term investment perspective. By incorporating these key elements into your investment strategy, you can navigate the challenges of a high-valuation market and potentially achieve your long-term financial goals. Utilize BofA's insights to create a robust investment strategy that addresses the challenges presented by high valuations. Stay informed and make informed decisions about your investments.

Featured Posts

-

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Analysis

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Analysis

May 10, 2025 -

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Analysis

May 10, 2025

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Analysis

May 10, 2025 -

Singer Wynne Evans Reveals Health Battle Hints At Stage Return

May 10, 2025

Singer Wynne Evans Reveals Health Battle Hints At Stage Return

May 10, 2025 -

Nnpc Petrol Price Changes The Role Of Dangotes Refinery

May 10, 2025

Nnpc Petrol Price Changes The Role Of Dangotes Refinery

May 10, 2025 -

Nhl Game Prediction Oilers Vs Sharks Best Picks And Odds

May 10, 2025

Nhl Game Prediction Oilers Vs Sharks Best Picks And Odds

May 10, 2025