Sharp Decline In Indonesia's Reserves: Two-Year Low Amidst Rupiah Volatility

Table of Contents

Factors Contributing to the Decline in Indonesia's Foreign Exchange Reserves

The sharp drop in Indonesia's foreign currency reserves is a multifaceted issue stemming from a confluence of internal and external pressures. Understanding these factors is crucial to developing effective strategies to mitigate the risks.

Increased Import Costs and Trade Deficit

Soaring global commodity prices, particularly energy, have significantly increased Indonesia's import bill. This, combined with robust domestic demand, has widened the trade deficit, putting immense pressure on the country's foreign exchange reserves.

- Rising energy prices: The global energy crisis has driven up the cost of crucial imports, impacting Indonesia's energy-intensive industries and overall trade balance.

- Import dependence: Indonesia's reliance on imported goods, especially in key sectors, exacerbates the impact of rising global prices.

- Impact of global inflation on import costs: Global inflation has increased the cost of imported goods, further widening the trade gap and straining foreign exchange reserves.

- Weakening terms of trade: The rising cost of imports relative to the price of Indonesia's exports has negatively impacted the terms of trade, putting downward pressure on foreign exchange reserves.

Capital Outflows and Foreign Investment

Global economic uncertainty and risk aversion have fueled significant capital outflows from Indonesia, reducing foreign exchange reserves. This outflow is partly driven by investor concerns about global growth prospects and rising interest rates in developed economies.

- Impact of US interest rate hikes: Increased interest rates in the US have attracted capital away from emerging markets like Indonesia, leading to capital outflows.

- Global recession fears: Concerns about a potential global recession have prompted investors to seek safer havens, reducing foreign direct investment (FDI) in Indonesia.

- Decreased foreign direct investment (FDI): Uncertainty about the global economic outlook has discouraged FDI, further impacting foreign exchange reserves.

- Portfolio investment outflows: Investors have withdrawn portfolio investments from Indonesia, contributing to the decline in foreign currency reserves.

Rupiah Depreciation and Central Bank Intervention

The weakening Rupiah has forced Bank Indonesia (BI), the central bank, to intervene in the foreign exchange market to maintain some degree of exchange rate stability. These interventions, however, have depleted the country's foreign exchange reserves.

- BI's role in maintaining exchange rate stability: BI's primary mandate includes maintaining the stability of the Rupiah, necessitating interventions during periods of high volatility.

- Effectiveness of intervention measures: The effectiveness of BI's interventions remains a subject of debate, as prolonged interventions can strain foreign exchange reserves.

- Cost of intervention on reserves: Every intervention by BI to support the Rupiah directly reduces the level of foreign exchange reserves.

Impact of Declining Reserves on the Indonesian Economy

The decline in Indonesia's foreign exchange reserves has far-reaching implications for the Indonesian economy, increasing its vulnerability to external shocks and potentially impacting economic growth.

Increased Vulnerability to External Shocks

Lower reserves make Indonesia more susceptible to global economic downturns and sudden capital flight. This reduced buffer against external shocks poses a significant risk to macroeconomic stability.

- Reduced ability to cushion against sudden capital flight: Lower reserves limit Indonesia's ability to respond effectively to sudden capital flight, potentially leading to sharp currency depreciation.

- Impact on sovereign credit rating: Declining reserves can negatively impact Indonesia's sovereign credit rating, increasing borrowing costs.

- Vulnerability to speculative attacks on the Rupiah: Lower reserves increase the vulnerability of the Rupiah to speculative attacks, potentially leading to further depreciation.

Inflationary Pressures

The weakening Rupiah increases the cost of imports, fueling inflationary pressures. This can erode purchasing power and negatively affect consumer confidence.

- Pass-through effect of currency depreciation: The depreciation of the Rupiah directly translates into higher import prices, impacting inflation.

- Impact on consumer prices: Higher import prices lead to higher consumer prices, reducing real incomes and potentially impacting social stability.

- Role of monetary policy in managing inflation: BI needs to carefully manage monetary policy to control inflation while balancing the need to support the Rupiah.

Impact on Investment and Economic Growth

Declining reserves and Rupiah volatility can discourage both domestic and foreign investment, potentially slowing economic growth. Uncertainty undermines business confidence and reduces investment.

- Uncertainty and risk aversion: The uncertainty created by declining reserves and Rupiah volatility discourages both domestic and foreign investors.

- Impact on business confidence: Declining reserves and a weak Rupiah erode business confidence, leading to reduced investment and economic activity.

- Reduced FDI inflows: The unstable economic environment deters FDI, hindering long-term economic growth.

Potential Solutions and Outlook for Indonesia's Foreign Exchange Reserves

Addressing the decline in Indonesia's foreign exchange reserves requires a multi-pronged approach involving fiscal, monetary, and structural reforms.

Strengthening Domestic Production and Export Diversification

Boosting domestic production and reducing reliance on imports is crucial. This requires strategic investments in key sectors and a diversification of export markets.

- Investment in key sectors: Investing in sectors with high export potential can help reduce reliance on imports and increase foreign exchange earnings.

- Export promotion strategies: Implementing effective export promotion strategies can help boost exports and improve the trade balance.

- Diversification of export markets: Reducing reliance on a few key export markets can make Indonesia less vulnerable to external shocks.

Attracting Foreign Direct Investment (FDI)

Attracting sustainable FDI inflows is essential for strengthening the economy and bolstering foreign exchange reserves. This requires creating a favorable investment climate and reducing bureaucratic hurdles.

- Improving investment climate: Creating a transparent, predictable, and stable investment climate is crucial for attracting FDI.

- Reducing bureaucratic hurdles: Simplifying regulations and reducing bureaucratic hurdles can make Indonesia a more attractive investment destination.

- Promoting specific sectors: Targeted policies to attract FDI in specific sectors can boost economic growth and increase foreign exchange earnings.

Maintaining Prudent Monetary Policy

Bank Indonesia needs to maintain a prudent monetary policy to manage exchange rate stability and inflation. This includes carefully managing interest rates and coordinating with fiscal policy.

- Interest rate adjustments: Adjusting interest rates to manage inflation and support the Rupiah is crucial.

- Managing inflation expectations: Effectively managing inflation expectations can help stabilize the Rupiah and reduce the need for frequent interventions.

- Coordination with fiscal policy: Close coordination between monetary and fiscal policy is essential for maintaining macroeconomic stability.

Conclusion

The sharp decline in Indonesia's foreign exchange reserves to a two-year low, coupled with persistent Rupiah volatility, presents a significant challenge to the Indonesian economy. The confluence of factors, including rising import costs, capital outflows, and central bank interventions, has created a precarious situation. Addressing this requires a comprehensive strategy focusing on strengthening domestic production, diversifying exports, attracting FDI, and maintaining a prudent monetary policy. Understanding the dynamics of Indonesia's foreign exchange reserves is crucial. Stay updated on the latest developments regarding Indonesia's foreign exchange reserves and the Rupiah by following reputable news sources and economic analyses to better understand this important issue and its potential impact.

Featured Posts

-

Microsoft Activision Deal Ftc Files Appeal

May 10, 2025

Microsoft Activision Deal Ftc Files Appeal

May 10, 2025 -

Real Id Compliance Impact On Your Summer Travel Plans

May 10, 2025

Real Id Compliance Impact On Your Summer Travel Plans

May 10, 2025 -

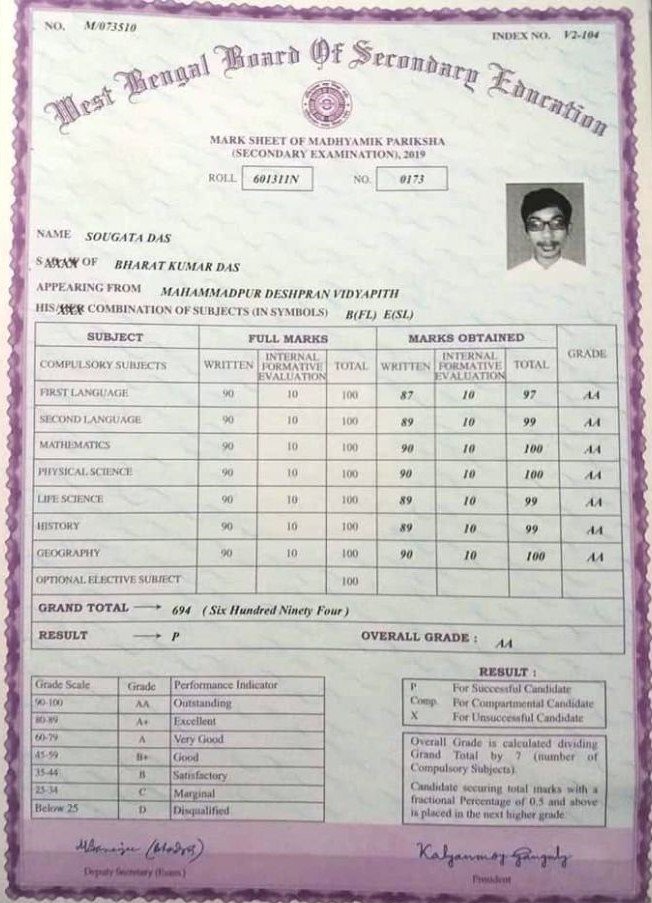

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025 -

Transgender Girls Excluded Ihsaa Implements Trumps Sports Ban

May 10, 2025

Transgender Girls Excluded Ihsaa Implements Trumps Sports Ban

May 10, 2025 -

25 Million Shortfall Analysing West Hams Financial Situation

May 10, 2025

25 Million Shortfall Analysing West Hams Financial Situation

May 10, 2025