Hong Kong Stock Market Rally: Chinese Stocks On The Rise

Table of Contents

Factors Driving the Hong Kong Stock Market Rally

Several interconnected factors are contributing to the current Hong Kong stock market rally. The improved economic outlook for China, coupled with easing regulatory scrutiny and increased foreign investment, has created a perfect storm of positive sentiment.

Easing of Regulatory Scrutiny

The relaxation of regulatory policies impacting Chinese tech companies listed in Hong Kong has significantly boosted investor confidence. This "regulatory easing" has reduced the delisting risk for many companies, making them more attractive to both domestic and international investors.

- Examples: The easing of restrictions on data security and antitrust regulations has led to a significant rebound in the share prices of major tech companies.

- Positive Effects: Reduced regulatory uncertainty has unlocked significant value, attracting foreign capital and boosting market capitalization.

- Benefiting Companies: Companies like Tencent, Alibaba, and Meituan have seen substantial increases in their stock prices following these regulatory changes. This demonstrates the direct correlation between regulatory easing and positive stock market performance. The improved access to capital and reduced operational constraints have allowed these companies to thrive. The removal of the threat of delisting from major US exchanges also contributed to this upward trend. Keyword integration: "Regulatory easing," "China tech stocks," "Hong Kong listing," "delisting risk reduction."

Improved Economic Outlook for China

Positive economic indicators from China are fueling optimism and driving the Hong Kong market growth. Stronger-than-expected GDP growth projections and increased consumer spending are bolstering investor confidence.

- GDP Growth Projections: Recent forecasts suggest a healthy rebound in China's GDP, exceeding initial estimates. This indicates a robust economic recovery and a positive outlook for businesses operating within the Chinese economy.

- Consumer Spending Trends: Increased consumer spending signals a strengthening domestic market, providing support for consumer-oriented businesses listed in Hong Kong. This is a crucial indicator of economic health and consumer confidence.

- Industrial Production Data: Increased industrial production further demonstrates the strength of the Chinese economy, bolstering overall positive economic sentiment. This reflects strong manufacturing activity and growth in various key sectors. Keyword integration: "China economic growth," "positive economic sentiment," "investor confidence."

Increased Foreign Investment

Foreign investment is playing a crucial role in the Hong Kong stock market rally. Attractive valuations and the desire for market diversification are drawing significant capital inflows.

- Statistics on Foreign Investment Inflows: Recent data showcases a notable surge in foreign investment into Hong Kong-listed Chinese companies. This increase suggests growing confidence in the long-term prospects of the Chinese market.

- Reasons for Increased Interest: The relatively attractive valuations of many Chinese stocks, compared to their global counterparts, have made them a compelling investment opportunity for global investors. Furthermore, the desire for greater portfolio diversification, particularly in emerging markets, is driving investment into this sector.

- Hong Kong Market Attractiveness: Hong Kong's status as a major financial hub and its relatively stable regulatory environment continues to attract foreign investment. This provides a degree of comfort and stability for international investors, who may otherwise be hesitant to invest directly in mainland China. Keyword integration: "Foreign investment," "global investors," "portfolio diversification," "Hong Kong market attractiveness."

Performance of Key Sectors in the Rally

The Hong Kong stock market rally is not uniform; some sectors are outperforming others. The technology sector has been a standout performer, but other sectors are also showing significant gains.

Technology Sector Boom

Chinese tech companies listed in Hong Kong have experienced exceptional growth, driven by innovation and strong earnings.

- Top-Performing Tech Stocks: Several major Chinese tech giants have seen their stock prices surge dramatically. These gains highlight the significant potential for growth within this sector.

- Factors Contributing to Growth: Innovation and strong earnings, combined with the easing of regulatory pressure, have created a favorable environment for these companies to flourish. This growth is expected to continue as these companies expand their operations both domestically and internationally. Keyword integration: "Chinese tech giants," "tech stock performance," "Hong Kong tech index."

Other Leading Sectors

While the technology sector dominates the headlines, other sectors are also contributing to the overall market rally.

- Financial Stocks: Strong performance in the financial sector reflects a growing confidence in the Chinese economy. This is important as the financial sector serves as a barometer for the health of the overall economy.

- Consumer Goods Stocks: The growth in consumer goods stocks reflects increased consumer spending and demand for these products. This indicates a strengthening domestic market and positive consumer sentiment. Keyword integration: "Financial stocks," "consumer goods stocks," "Hong Kong market sectors."

Potential Risks and Challenges

Despite the impressive rally, investors need to be aware of potential risks and challenges. Geopolitical uncertainties and inflationary pressures could impact market performance.

Geopolitical Uncertainties

Ongoing geopolitical tensions, particularly those between the US and China, could introduce volatility into the market.

- Specific Geopolitical Events: Trade disputes and other geopolitical events can negatively impact investor sentiment and market stability. This underscores the importance of keeping abreast of geopolitical developments that might impact the Hong Kong Stock Market.

- Potential Impact on Investor Sentiment: Increased uncertainty can lead to capital flight and reduced investment, potentially impacting the overall market performance. This is a crucial factor to consider when assessing the long-term outlook. Keyword integration: "Geopolitical risk," "US-China relations," "market volatility."

Inflationary Pressures

Rising inflation could dampen economic growth and impact company profits, potentially slowing down the market rally.

- Inflation Rate Projections: Monitoring inflation projections is crucial for understanding the potential impact on the market. High inflation could lead to interest rate hikes, which could negatively impact stock valuations.

- Potential Impact on Consumer Spending and Company Profits: High inflation could reduce consumer spending and squeeze company margins, ultimately slowing economic growth and dampening stock market performance. Keyword integration: "Inflationary concerns," "interest rate hikes," "economic slowdown."

Conclusion: Navigating the Hong Kong Stock Market Rally

The Hong Kong stock market rally, driven by easing regulatory scrutiny, an improved economic outlook for China, and increased foreign investment, presents exciting opportunities. The technology sector and other key areas show strong performance. However, investors must carefully consider the potential risks associated with geopolitical uncertainties and inflationary pressures. The Hong Kong stock market rally presents exciting opportunities for investors. Conduct thorough research and consider diversifying your portfolio with carefully selected Chinese stocks in the Hong Kong market. However, remember to weigh the potential risks before making any investment decisions. Understanding the factors driving this Hong Kong stock market rally, and carefully assessing the associated risks, is crucial for navigating this dynamic and potentially rewarding investment landscape. Remember to perform your own due diligence before investing in any market.

Featured Posts

-

Chinese Stocks Strong Performance In Hong Kong

Apr 24, 2025

Chinese Stocks Strong Performance In Hong Kong

Apr 24, 2025 -

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025 -

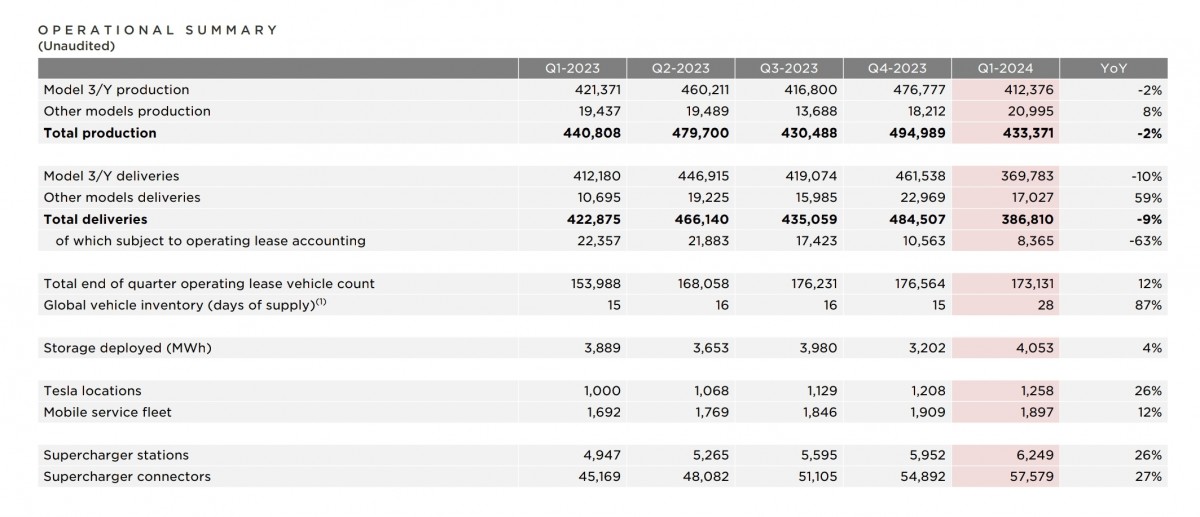

Sharp Drop In Tesla Q1 Profits Musks Political Involvement Takes Toll

Apr 24, 2025

Sharp Drop In Tesla Q1 Profits Musks Political Involvement Takes Toll

Apr 24, 2025 -

Pete Hegseth And Donald Trump A Look At Their Shared Goals And Recent Controversy

Apr 24, 2025

Pete Hegseth And Donald Trump A Look At Their Shared Goals And Recent Controversy

Apr 24, 2025