Chinese Stocks' Strong Performance In Hong Kong

Table of Contents

Economic Growth and Policy Support Fuels Chinese Stock Performance in Hong Kong

The performance of Chinese stocks listed in Hong Kong is intrinsically linked to the mainland's economic growth and government policies. Strong GDP growth translates directly into increased profitability for many Chinese companies, boosting their stock prices on the Hong Kong exchange.

-

Correlation between China's Economic Growth and Stock Performance: China's consistent economic expansion, even amidst global uncertainty, fuels the growth trajectory of numerous listed companies. This positive correlation is a major driver of the strong performance witnessed in Hong Kong. Robust sectors like technology and infrastructure significantly contribute to this growth.

-

Supportive Government Policies: The Chinese government actively implements policies designed to stimulate economic activity and market stability. These include fiscal stimulus packages, tax incentives for specific sectors, and significant investments in infrastructure projects. Such initiatives create a supportive environment for businesses, impacting stock valuations positively.

-

Regulatory Reforms and Market Stability: Regulatory reforms aimed at improving market transparency and investor protection have enhanced confidence within the market. These efforts contribute to a more stable and predictable investment environment, attracting both domestic and international capital.

-

High-Growth Sectors: Specific sectors, such as technology (especially fintech and AI), infrastructure development, and consumer goods, have shown exceptional growth, significantly contributing to the overall strong performance of Chinese stocks listed in Hong Kong.

Attractive Valuation and Investment Opportunities in Hong Kong-Listed Chinese Companies

Many Hong Kong-listed Chinese companies offer attractive valuations compared to their global counterparts. This presents compelling investment opportunities for those seeking exposure to the Chinese economy.

-

Valuation Analysis: A comparative analysis of valuations reveals that many Chinese stocks traded in Hong Kong may be undervalued relative to their growth potential and earnings compared to similar companies in other markets. This creates a potentially lucrative entry point for investors.

-

Identifying Investment Opportunities: Sector-specific analysis and an understanding of future growth prospects are vital for identifying promising investment opportunities. Thorough due diligence is crucial to select companies with robust fundamentals and promising long-term growth trajectories.

-

Risk-Reward Profile: While the potential returns are significant, investing in Chinese stocks entails inherent risks. Investors need to carefully assess the risk-reward profile of each investment before committing capital. Diversification is key to mitigating these risks.

-

Diversification Strategy: Diversifying across various sectors and companies is crucial for reducing overall portfolio risk. This approach minimizes exposure to sector-specific downturns and enhances the likelihood of achieving satisfactory long-term returns.

Increased Accessibility and Trading Liquidity in the Hong Kong Market

The Hong Kong stock market's accessibility and liquidity play a pivotal role in the strong performance of Chinese stocks.

-

Stock Connect Programs: Initiatives like the Stock Connect programs have significantly broadened access for international investors to the Chinese market. These programs facilitate easier trading between the Hong Kong and mainland Chinese stock exchanges.

-

Trading Volume and Liquidity: Increased trading volume and market liquidity contribute to price stability and reduced volatility. A liquid market enables investors to buy and sell shares readily, minimizing transaction costs and maximizing efficiency.

-

Benefits of the Hong Kong Market: Hong Kong's well-established regulatory framework, robust infrastructure, and transparent trading environment provide a secure and reliable platform for global investors. The market's established reputation adds to investor confidence.

-

Trading Platforms and Resources: Numerous reputable trading platforms and financial resources are readily available to facilitate investment in Hong Kong-listed Chinese stocks. This accessibility further enhances the market's appeal to a wider range of investors.

Risks and Challenges in Investing in Chinese Stocks Listed in Hong Kong

Despite the attractive opportunities, investors should be aware of potential risks and challenges.

-

Geopolitical Risks: Geopolitical tensions between China and other nations can significantly impact market sentiment and stock prices. International relations and political stability are significant considerations.

-

Regulatory Uncertainty: Changes in regulatory policies in both China and Hong Kong can influence investment decisions and create uncertainty for investors. Keeping abreast of regulatory developments is essential.

-

Market Volatility: The stock market, particularly emerging markets like those in mainland China, is subject to periods of significant volatility. Effective risk management strategies are essential to navigate such fluctuations.

-

Due Diligence and Risk Management: Thorough due diligence, including a careful assessment of a company's financials, management team, and industry outlook, is paramount before investing. Implementing effective risk management strategies is essential for mitigating potential losses.

Conclusion

The strong performance of Chinese stocks in Hong Kong is a multifaceted phenomenon, driven by robust economic growth, supportive government policies, increased market accessibility, and attractive valuations. While significant investment opportunities exist, investors must carefully consider the inherent risks, including geopolitical uncertainties and market volatility. Understanding the dynamics of this market is crucial for making informed investment choices. Learn more about navigating the opportunities and challenges presented by Chinese stocks' strong performance in Hong Kong and make strategic investment choices today.

Featured Posts

-

The Bold And The Beautiful Liams Promise Hopes Shocking Twists And Lunas Rising Stakes

Apr 24, 2025

The Bold And The Beautiful Liams Promise Hopes Shocking Twists And Lunas Rising Stakes

Apr 24, 2025 -

Court Challenges Mount Against Trump Administrations Immigration Actions

Apr 24, 2025

Court Challenges Mount Against Trump Administrations Immigration Actions

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liam Hope And Bridgets Storylines

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liam Hope And Bridgets Storylines

Apr 24, 2025 -

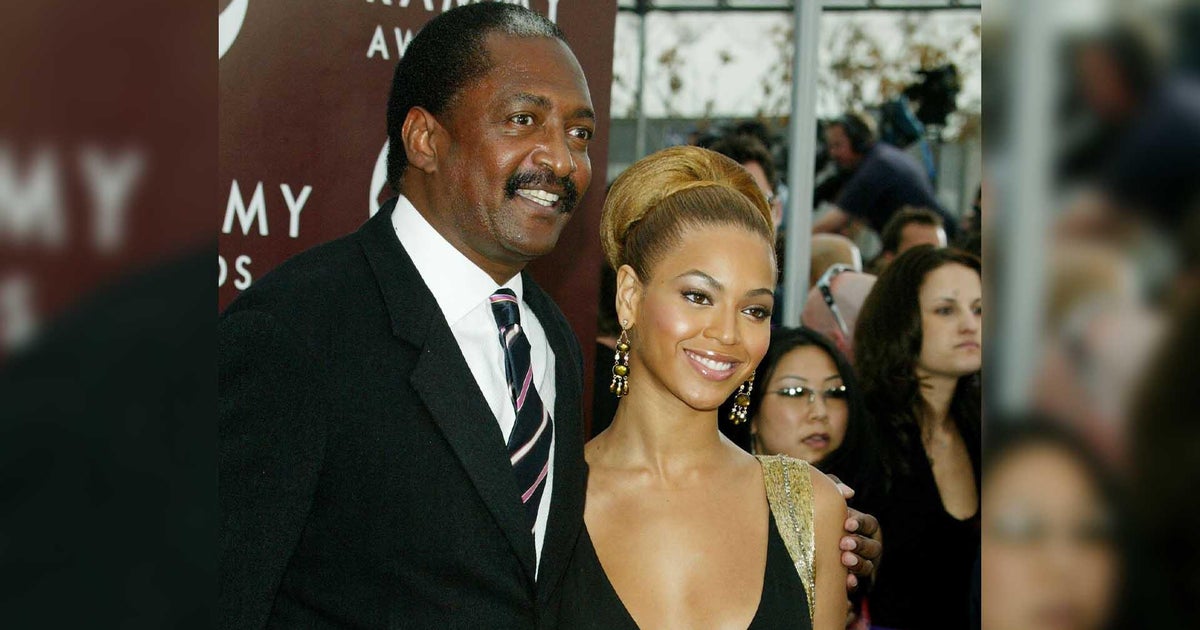

Delaying Mammograms Tina Knowles Story And The Risks Of Breast Cancer

Apr 24, 2025

Delaying Mammograms Tina Knowles Story And The Risks Of Breast Cancer

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025