Sharp Drop In Tesla Q1 Profits: Musk's Political Involvement Takes Toll

Table of Contents

Elon Musk's Political Distractions and Their Impact on Tesla's Performance

Elon Musk's recent political forays have undeniably generated significant headlines, but at what cost to Tesla? His outspoken views and actions on various political issues have drawn both fervent support and intense criticism, creating a climate of uncertainty surrounding the company. This distraction from Tesla's core business operations, some argue, may have negatively impacted its financial performance. The resulting negative publicity has undoubtedly shaken investor confidence and potentially damaged Tesla's brand image.

- Specific examples of controversial tweets or actions: Musk's involvement in the Twitter acquisition saga, his political endorsements, and controversial statements on various social media platforms have all contributed to the negative perception.

- Negative media coverage and its impact on Tesla's stock price: The intense media scrutiny surrounding Musk's political activities has directly translated into volatility in Tesla's stock price, impacting investor sentiment and overall market valuation. Numerous news outlets have directly linked negative headlines to declines in the stock.

- Loss of potential investors due to reputational damage: The negative publicity surrounding Musk could deter potential investors concerned about the company's long-term stability and brand image, hindering future growth and investment opportunities.

Decreased Sales and Increased Competition

The decline in Tesla's Q1 profits is further compounded by a decrease in sales and the intensification of competition within the EV market. While Tesla remains a leader, rivals like BYD and Volkswagen are rapidly gaining ground, pressuring Tesla's market share and profitability. The ongoing price wars, initiated by Tesla itself, have further squeezed profit margins, contributing to the overall decline.

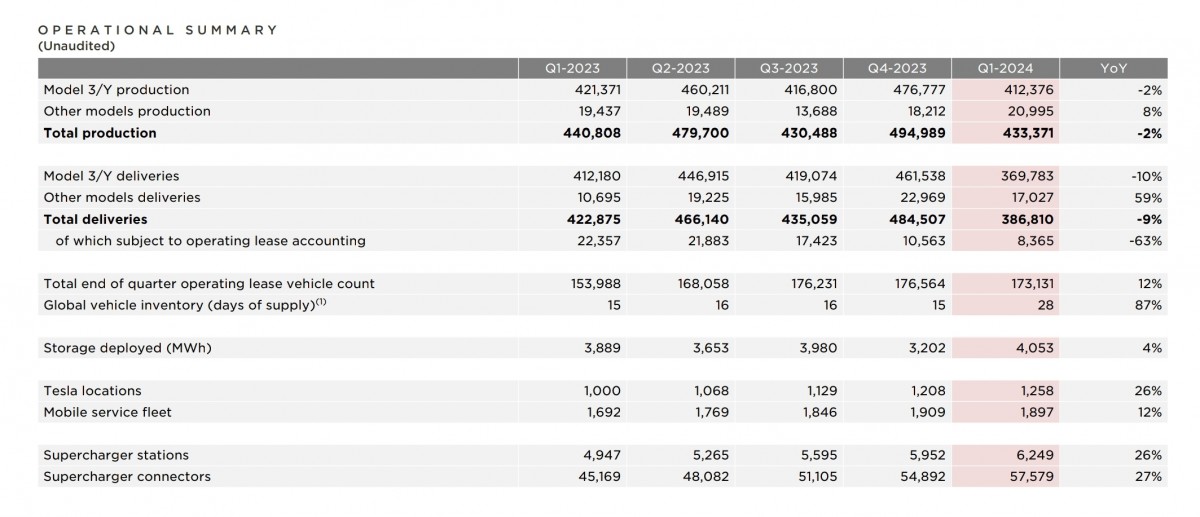

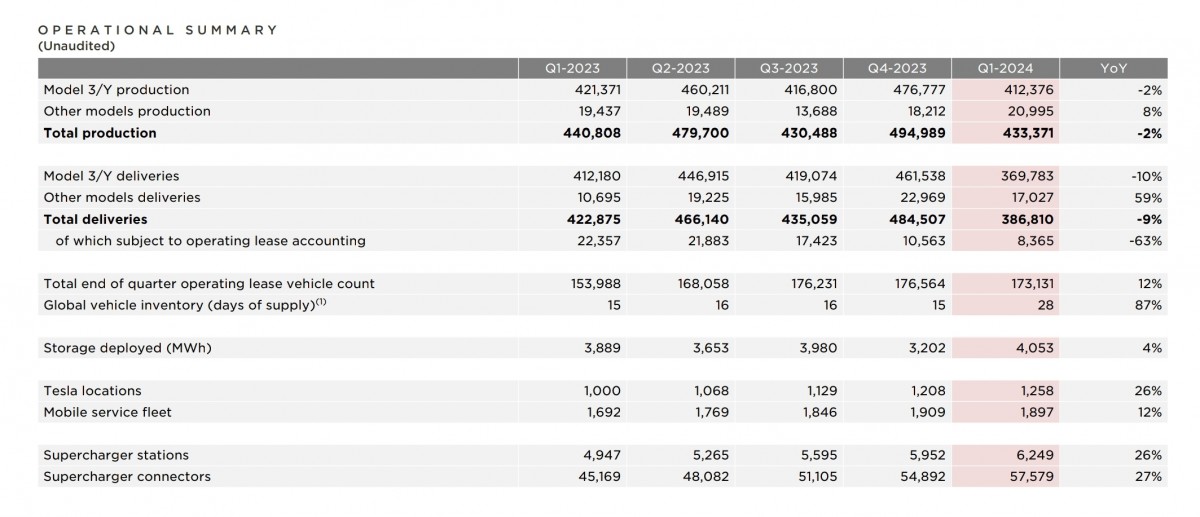

- Sales figures comparison with previous quarters: Comparing Q1 sales figures to previous quarters reveals a noticeable downturn, indicating a slowing growth trajectory for the company.

- Market share analysis compared to competitors like BYD and Volkswagen: The increasing market share of competitors, particularly in key markets like China, demonstrates the intensifying competitive landscape and its impact on Tesla's dominance.

- Price cuts and their effect on profit margins: Tesla's aggressive price cuts, while aimed at boosting sales volume, have significantly reduced profit margins, directly contributing to the lower overall profitability.

Rising Production Costs and Supply Chain Issues

The challenges facing Tesla extend beyond sales and competition. The company has also grappled with rising production costs, driven by increased prices for raw materials like lithium, a crucial component in EV batteries. Supply chain disruptions, coupled with inflationary pressures, have further exacerbated these challenges, impacting production efficiency and overall operating expenses.

- Specific examples of increased costs for raw materials: The escalating prices of lithium, cobalt, and other critical materials have significantly increased the cost of manufacturing Tesla vehicles.

- Details about supply chain bottlenecks and their solutions: Disruptions to the supply chain, impacting the timely delivery of essential components, have hindered production and increased costs. Tesla's efforts to mitigate these issues through diversification and strategic partnerships are crucial for future success.

- Impact of inflation on labor costs and other expenses: General inflationary pressures have increased Tesla's operating expenses across the board, from labor costs to energy and logistics, further squeezing profitability.

The Interplay of Political Involvement and Financial Performance

Connecting the dots between Musk's political activities and Tesla's financial struggles requires careful consideration. While correlation doesn't equal causation, the timing of the sharp drop in Tesla Q1 profits alongside Musk’s increased political engagement suggests a potential relationship that warrants further analysis. It's crucial to acknowledge other contributing factors, but the negative impact of the controversy on investor confidence and brand image cannot be ignored.

Understanding the Sharp Drop in Tesla Q1 Profits

In conclusion, the sharp drop in Tesla's Q1 profits is a multifaceted issue stemming from a combination of factors. Decreased sales, intensifying competition, rising production costs, and supply chain disruptions have all played a significant role. Furthermore, the impact of Elon Musk's political involvement on investor confidence and brand perception cannot be overlooked as a contributing factor to this challenging quarter. The outlook for Tesla's future performance remains uncertain, but the company's ability to navigate these challenges will be key to its continued success. Stay tuned for further updates on the evolving situation surrounding the sharp drop in Tesla Q1 profits and the ongoing impact of Elon Musk's political involvements, and keep a close watch on Tesla’s financial performance and Elon Musk’s activities for further insights.

Featured Posts

-

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 24, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 24, 2025 -

Nbas Investigation Of Ja Morant A Timeline Of Events

Apr 24, 2025

Nbas Investigation Of Ja Morant A Timeline Of Events

Apr 24, 2025 -

Negotiation Looms Harvard Lawsuit Forces Trump Administration To The Table

Apr 24, 2025

Negotiation Looms Harvard Lawsuit Forces Trump Administration To The Table

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liam Hope And Bridgets Storylines

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liam Hope And Bridgets Storylines

Apr 24, 2025 -

Warriors Defeat Blazers Hield And Payton Shine Off The Bench

Apr 24, 2025

Warriors Defeat Blazers Hield And Payton Shine Off The Bench

Apr 24, 2025