U.S. Dollar's First 100 Days Under Scrutiny: A Presidential Economic Comparison

Table of Contents

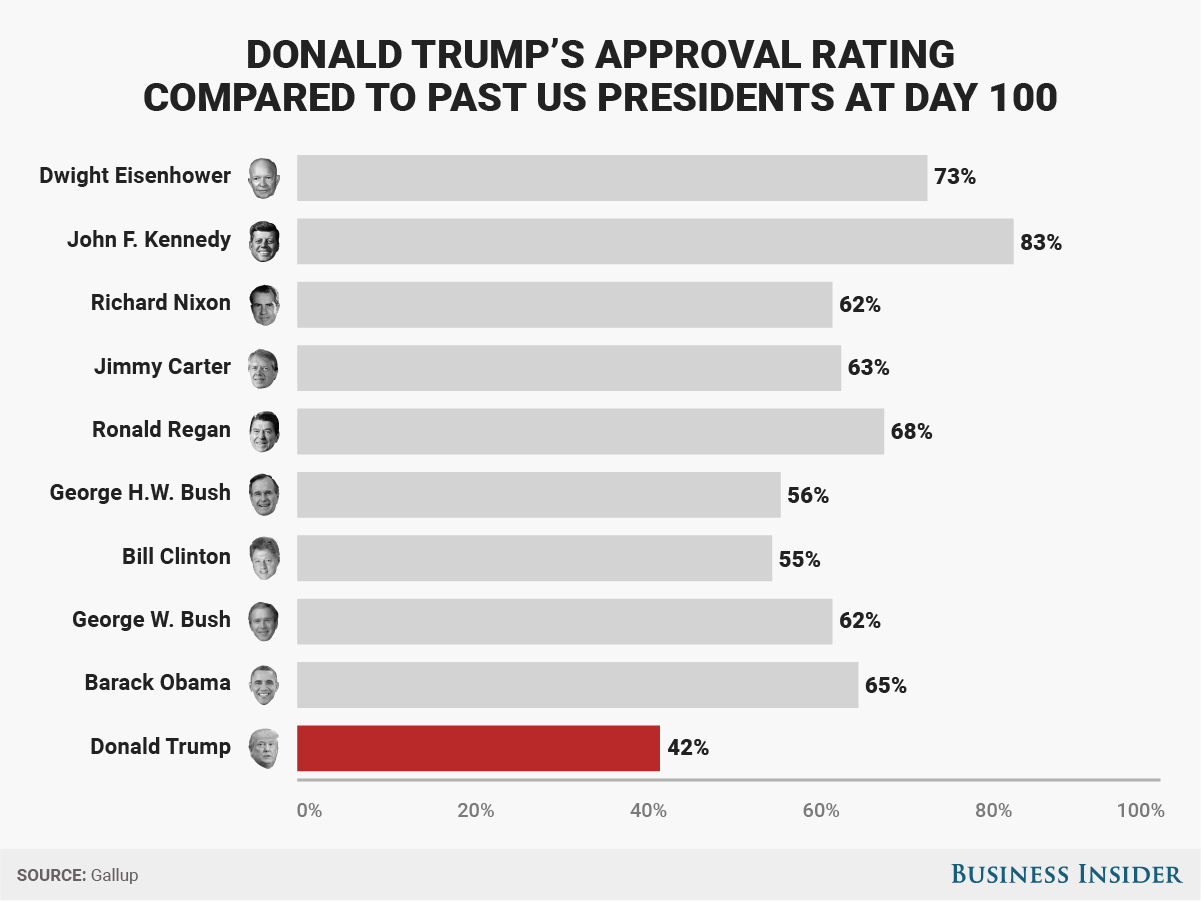

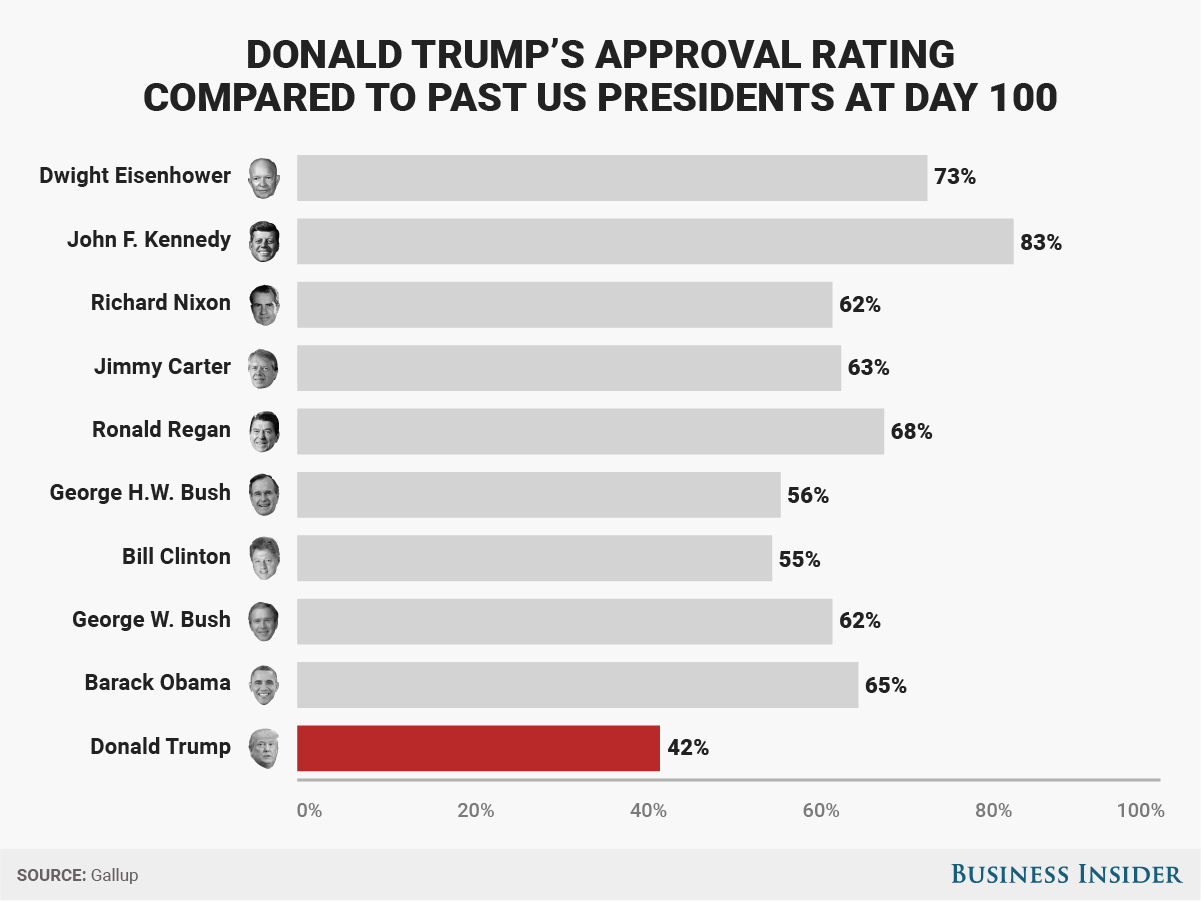

The Trump Administration (2017): A Focus on Deregulation and Tax Cuts

The Trump administration entered office in 2017 promising significant tax cuts and deregulation to boost economic growth. This approach had a notable impact on the U.S. dollar, albeit a complex one.

Impact on the U.S. Dollar: Initial strength followed by volatility.

-

Tax cuts stimulated short-term growth, but also increased the national debt. The significant tax cuts implemented early in the Trump administration led to a short-term boost in economic activity. However, this came at the cost of a substantial increase in the national debt, a factor that ultimately created uncertainty in the financial markets and impacted the value of the U.S. dollar. Investors and economists debated the long-term sustainability of this approach.

-

Deregulation efforts aimed to boost business confidence, but concerns about environmental regulations emerged. The administration's focus on deregulation aimed to reduce the regulatory burden on businesses, fostering economic expansion. However, this approach sparked concerns among environmental groups and some investors about the potential long-term consequences for the environment and sustainability, factors that can indirectly influence the U.S. dollar's value. Concerns regarding potential negative impacts on long-term economic growth due to environmental damage were voiced.

-

Trade wars and protectionist policies created uncertainty in the global markets, affecting the dollar's value. The Trump administration's initiation of trade wars with several countries, including China, introduced significant uncertainty into the global marketplace. These protectionist policies led to retaliatory tariffs and disrupted established trade relationships, impacting the stability of the U.S. dollar and causing significant volatility.

Economic Indicators During the First 100 Days:

During the first 100 days of the Trump administration, the U.S. dollar experienced initial strength, as reflected in the U.S. Dollar Index (DXY). However, this was followed by increased volatility due to the uncertainty created by the administration's policies. While GDP growth was positive, inflation remained relatively low, and unemployment continued to decline. However, these positive economic indicators were often overshadowed by the concerns regarding increasing national debt and trade disputes. A detailed analysis of economic data from this period reveals a nuanced picture of the impact of the administration's policies on the U.S. dollar.

The Obama Administration (2009): Navigating the Great Recession

The Obama administration inherited the worst economic crisis since the Great Depression. The U.S. dollar's performance during its first 100 days reflected the gravity of this situation.

Impact on the U.S. Dollar: Initial weakness due to the ongoing financial crisis, followed by gradual recovery.

-

Stimulus packages and bailouts aimed to stabilize the financial system. Facing a collapsing financial system, the Obama administration implemented large-scale stimulus packages and bank bailouts. These measures aimed to prevent a complete economic collapse, but they also significantly increased government spending and the national debt, initially putting downward pressure on the U.S. dollar. The effectiveness of these interventions in stabilizing the economy and supporting the dollar was a subject of ongoing debate.

-

Increased government spending and debt raised concerns about long-term economic stability. The substantial increase in government spending and the national debt raised concerns among investors and economists about the long-term sustainability of the U.S. economy. These concerns contributed to the initial weakness of the U.S. dollar. The long-term consequences of this debt became a major point of discussion in subsequent years.

-

The dollar’s value fluctuated widely as investors reacted to economic news. The economic uncertainty during this period led to significant volatility in the value of the U.S. dollar. Investors reacted sharply to every piece of economic news, creating a volatile market for the dollar. This volatility reflected the precarious state of the global economy at the time.

Economic Indicators During the First 100 Days:

The first 100 days of the Obama administration saw significantly negative economic indicators: GDP was sharply contracting, unemployment was spiking, and the housing market was in freefall. The U.S. dollar index showed weakness, reflecting the overall global economic uncertainty. Comparing these indicators to the pre-recession period highlighted the depth of the economic crisis.

The Bush Administration (2001): Responding to Economic Slowdown and 9/11

The Bush administration faced a different set of challenges: an economic slowdown and the unprecedented shock of the September 11th terrorist attacks.

Impact on the U.S. Dollar: Initial decline due to economic slowdown, followed by significant impact from 9/11.

-

Tax cuts were enacted to stimulate economic growth. Facing a slowing economy, the Bush administration implemented tax cuts aimed at stimulating economic growth. The effectiveness of these measures in addressing the economic slowdown and supporting the U.S. dollar before 9/11 was debated extensively.

-

The terrorist attacks of September 11th significantly impacted the global economy and the value of the dollar. The 9/11 attacks created widespread uncertainty and fear, causing a sharp decline in the value of the U.S. dollar. The attacks disrupted global trade, increased risk aversion among investors, and led to a massive decline in consumer and business confidence, all of which significantly affected the dollar.

-

Uncertainty about national security and economic stability led to market volatility. The period following 9/11 was characterized by significant market volatility as investors grappled with the implications of the attacks on the U.S. economy and global security. This uncertainty significantly influenced the value of the U.S. dollar.

Economic Indicators During the First 100 Days:

The economic indicators during the Bush administration's first 100 days showed a slowing economy, but the impact of 9/11 dramatically shifted the focus. The attacks overshadowed economic data, creating an unprecedented level of uncertainty and volatility in the markets, making a clear assessment of the purely economic impact difficult to separate from the overall national crisis.

Comparative Analysis: Identifying Trends and Patterns

Comparing the first 100 days of these three administrations reveals some interesting patterns and trends in the relationship between Presidential Economic Policies and the U.S. Dollar.

Similarities and Differences:

All three administrations faced economic challenges during their initial periods. However, the nature of these challenges—a recession, a terrorist attack, and a period of increased national debt and trade uncertainty—differed significantly. Their responses, including tax cuts, stimulus packages, and deregulation, also varied, resulting in different impacts on the U.S. dollar and overall economic performance.

Long-Term Effects:

The long-term effects of the economic policies implemented during the first 100 days of each administration varied. While some policies led to sustained economic growth, others had unintended consequences, such as increased national debt or trade imbalances, impacting the long-term strength and stability of the U.S. dollar.

Predictive Models:

Analyzing historical data and economic trends from these three administrations can provide valuable insights for developing predictive models to assess potential future scenarios based on different Presidential Economic Policies and their likely effect on the U.S. dollar. However, such models must account for the inherent unpredictability of global events and the complexity of economic interactions.

Conclusion

This comparative analysis of the U.S. dollar's performance during the first 100 days of three different presidential administrations reveals a complex relationship between presidential economic policies and the value of the U.S. dollar. Each administration faced unique challenges, and their responses—while often intended to strengthen the economy and the U.S. dollar—had varying degrees of success and unforeseen consequences. Understanding the impact of these policies is critical for future economic planning and navigating the complexities of global finance.

Understanding the impact of presidential economic policies on the U.S. dollar is crucial for investors, businesses, and citizens alike. Further research into the first 100 days of other presidencies and ongoing economic analysis will provide a deeper understanding of the complex relationship between the U.S. dollar and presidential economic policies. Continue your learning by exploring additional resources on the U.S. dollar and presidential economic performance.

Featured Posts

-

Nyt Spelling Bee March 15 2025 Complete Solution Guide

Apr 29, 2025

Nyt Spelling Bee March 15 2025 Complete Solution Guide

Apr 29, 2025 -

Annie Nelson Addresses Misinformation In Recent Media Coverage

Apr 29, 2025

Annie Nelson Addresses Misinformation In Recent Media Coverage

Apr 29, 2025 -

Willie Nelson Documentary Highlights The Unsung Heroes Of Touring

Apr 29, 2025

Willie Nelson Documentary Highlights The Unsung Heroes Of Touring

Apr 29, 2025 -

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 29, 2025

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 29, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Email Theft

Apr 29, 2025

Cybercriminal Accused Of Millions In Office365 Executive Email Theft

Apr 29, 2025

Latest Posts

-

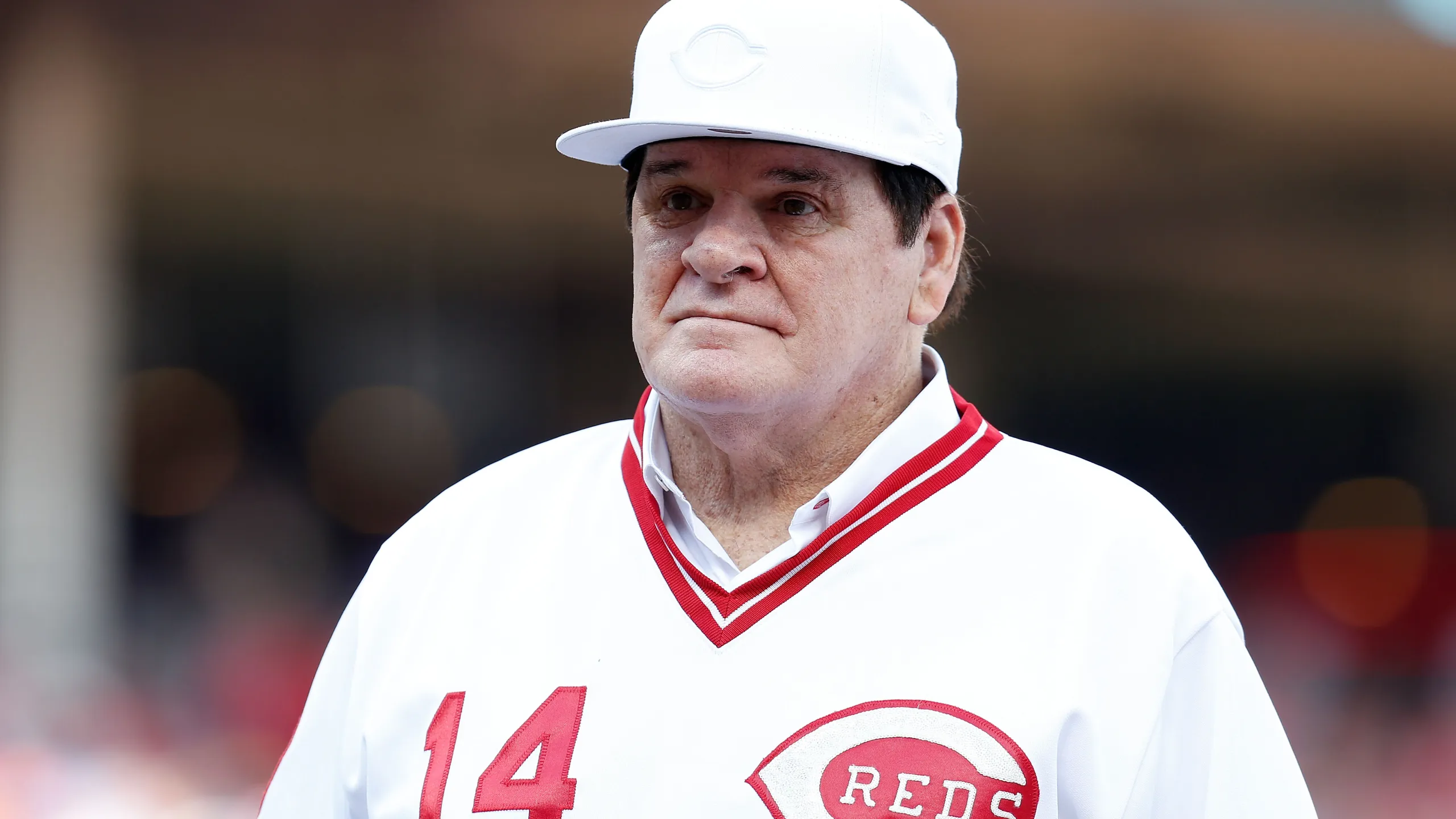

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025 -

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025 -

Will Trump Pardon Pete Rose The Impact On Baseball And Sports Betting

Apr 29, 2025

Will Trump Pardon Pete Rose The Impact On Baseball And Sports Betting

Apr 29, 2025 -

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025