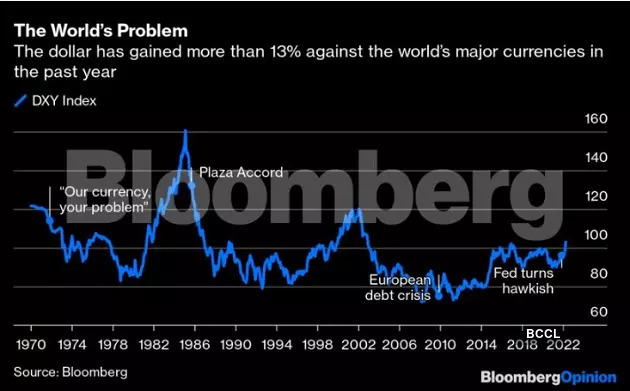

Is The U.S. Dollar Headed For Its Worst Performance Since Nixon's Presidency?

Table of Contents

Inflation and the Erosion of Purchasing Power

Inflation is a primary threat to the US dollar's value. The rising consumer price index (CPI) reflects a steady erosion of purchasing power. This means that each dollar buys less than it did previously. The Federal Reserve's monetary policy response, while intended to curb inflation, can also have unintended consequences on the dollar's value. Aggressive interest rate hikes, for example, might attract foreign investment, strengthening the dollar in the short term, but also potentially triggering a recession and harming long-term US dollar performance.

- Rising consumer price index (CPI): The persistently high CPI indicates a significant decline in the dollar's real value. This impacts consumers' ability to afford goods and services, impacting overall economic health.

- Federal Reserve's monetary policy response: The Fed's actions, including interest rate adjustments and quantitative easing (or the lack thereof), directly influence inflation and consequently the dollar's value. The effectiveness of these policies in managing inflation without severely impacting economic growth remains a key concern.

- Comparison to historical inflation rates: Comparing current inflation rates to historical highs, such as those experienced in the 1970s, offers valuable context for assessing the potential severity of the current situation and its impact on the long-term US dollar performance. The sustained period of high inflation in the 70s led to a significant devaluation of the dollar.

The National Debt and Fiscal Deficit

The burgeoning US national debt poses a considerable risk to the dollar's stability. The sheer scale of the debt and its continuing growth trajectory raise concerns about the government's ability to meet its financial obligations. This can lead to decreased investor confidence, potentially driving down the value of US Treasury bonds and consequently weakening the dollar.

- The scale of the US national debt: The ever-increasing national debt significantly impacts investor confidence in the US economy and the long-term stability of the dollar.

- The impact of government spending and tax revenues: A widening gap between government spending and tax revenues contributes to the national debt and creates pressure on the value of the dollar.

- Investor confidence and its relation to the national debt: High levels of national debt can erode investor confidence, leading to capital flight and a depreciation of the US dollar. Maintaining investor confidence is key to supporting the dollar’s value.

Geopolitical Instability and the Dollar's Reserve Currency Status

Geopolitical instability and shifts in global power dynamics are significant factors affecting the US dollar's dominance as a global reserve currency. The rise of alternative currencies, such as the Chinese yuan, and the development of alternative payment systems, like SWIFT alternatives, challenge the dollar's hegemony. International conflicts and trade wars also contribute to uncertainty, potentially reducing demand for the dollar.

- The rise of alternative currencies and payment systems: The emergence of viable alternatives diminishes the dollar's unique position and reduces its global demand.

- The impact of international conflicts and trade wars: Geopolitical tensions create uncertainty in the global economy, impacting investor confidence and the demand for the dollar as a safe haven asset.

- The role of the US dollar as a global reserve currency and its potential decline: The dollar's status as a reserve currency is not guaranteed. A decline in this status would have significant implications for its value and global influence.

Comparison to the Nixon Shock and its Aftermath

The current economic climate presents intriguing parallels to the conditions that led to the Nixon shock in 1971. The breakdown of the Bretton Woods system, coupled with high inflation and a growing trade deficit, ultimately led to the US abandoning the gold standard and a subsequent devaluation of the dollar. Analyzing the economic factors at play during the Nixon era offers valuable lessons for understanding the potential trajectory of the US dollar today.

- Key economic factors at play during the Nixon era: High inflation, a widening trade deficit, and growing international pressure on the US dollar were key factors leading to the Nixon shock.

- The impact of the Nixon shock on the global economy: The abandonment of the gold standard had profound and lasting effects on the global monetary system.

- Lessons learned from the past that might apply to the current situation: Understanding the factors that contributed to the Nixon shock provides valuable insight into the potential risks facing the US dollar today.

Predictive Modeling and Expert Opinions

Forecasting the future trajectory of the US dollar is inherently complex. Various economic models and expert opinions offer a range of possible outcomes, each with its underlying assumptions and limitations. While some experts foresee a continued decline, others believe the dollar’s strength will persist. Monitoring these diverse perspectives offers a more nuanced understanding of potential risks and opportunities.

- Summary of various predictions and their underlying assumptions: Different models use different parameters and often lead to varying conclusions about the future of the US dollar.

- Mention of key economists or financial institutions: Tracking the analyses from renowned economists and financial institutions provides valuable insight into the prevailing sentiment and the potential for change in the US dollar performance.

- Highlighting the range of possible outcomes: The future remains uncertain. It's important to acknowledge the variability of predictions and plan accordingly.

Conclusion

The potential for a significant decline in US dollar performance is a serious consideration, fueled by inflation, national debt concerns, geopolitical instability, and historical parallels to the Nixon shock. Understanding the future of the US dollar's performance is crucial for investors and anyone concerned with the global economy. Staying informed about key economic indicators, monitoring expert opinions, and diversifying your financial portfolio are essential steps in navigating this uncertain landscape. The potential for the worst US dollar performance since Nixon's presidency is real, and continuous monitoring of the situation is vital.

Featured Posts

-

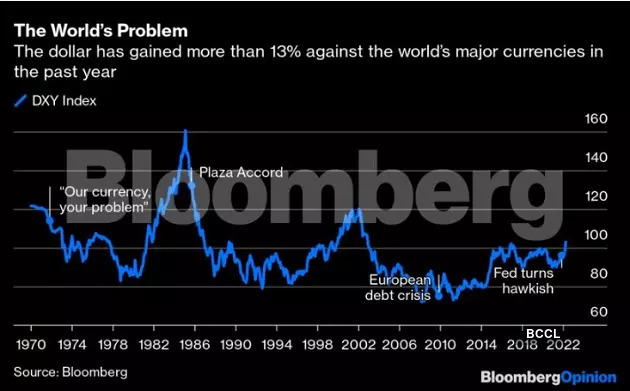

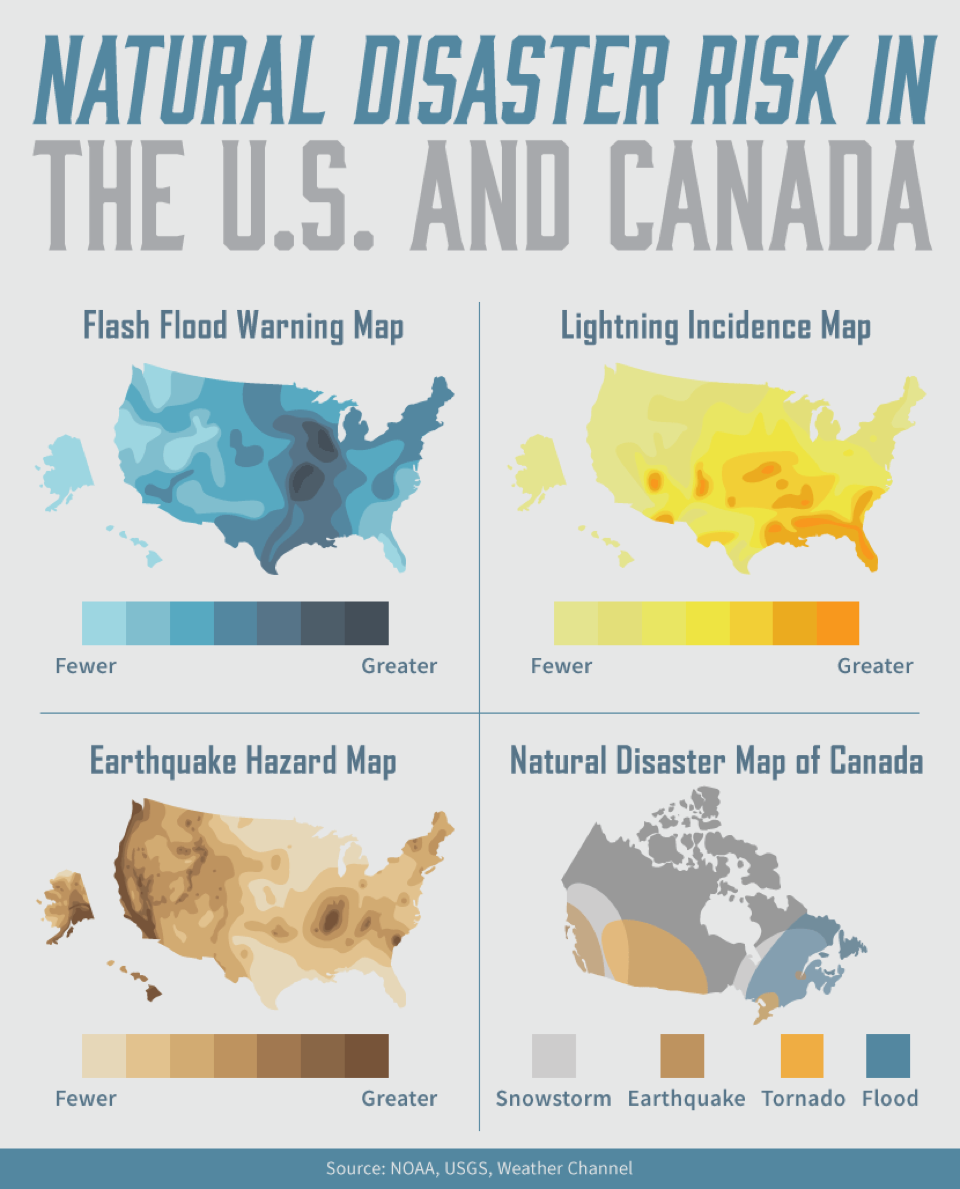

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 29, 2025

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 29, 2025 -

Videos Show Raid On Underground Nightclub Over 100 Immigrants Detained

Apr 29, 2025

Videos Show Raid On Underground Nightclub Over 100 Immigrants Detained

Apr 29, 2025 -

April 27 2025 Nyt Spelling Bee Clues Answers And Strategies

Apr 29, 2025

April 27 2025 Nyt Spelling Bee Clues Answers And Strategies

Apr 29, 2025 -

Wrexhams Rise Ryan Reynolds Reaction To Historic Promotion

Apr 29, 2025

Wrexhams Rise Ryan Reynolds Reaction To Historic Promotion

Apr 29, 2025 -

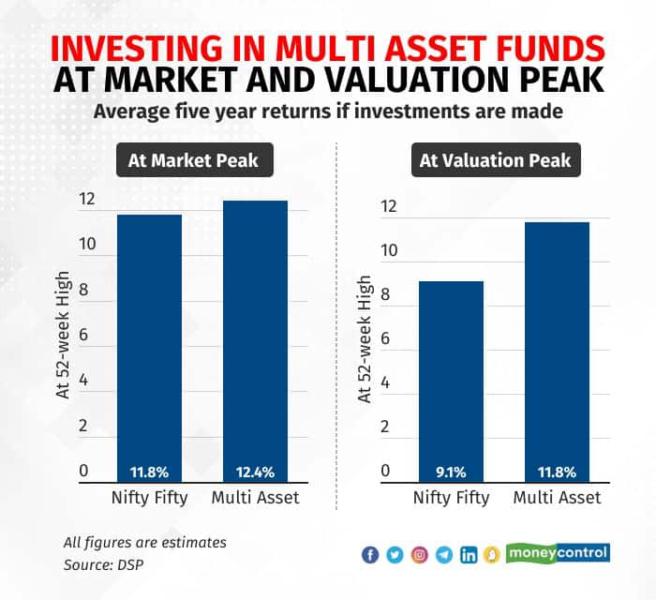

India Fund Manager Dsp Sounds Warning Bell On Equities Boosts Cash Holdings

Apr 29, 2025

India Fund Manager Dsp Sounds Warning Bell On Equities Boosts Cash Holdings

Apr 29, 2025

Latest Posts

-

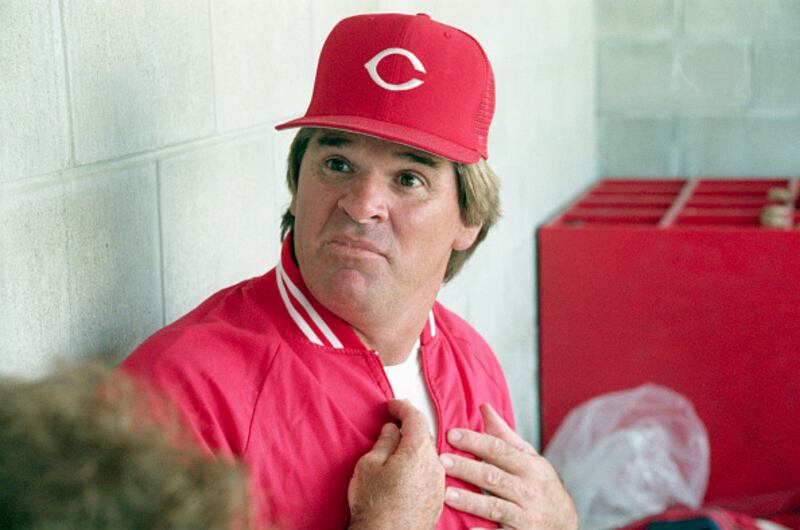

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025 -

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025 -

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025 -

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025 -

February 11th Snow Fox Updates Delays And Closings

Apr 29, 2025

February 11th Snow Fox Updates Delays And Closings

Apr 29, 2025