Hengrui Pharma Secures China Regulator Approval For Hong Kong IPO

Table of Contents

Hengrui Medicine, a leading pharmaceutical company in China, has received crucial approval from Chinese regulators for its highly anticipated initial public offering (IPO) on the Hong Kong Stock Exchange. This landmark decision marks a significant milestone for both Hengrui and the broader Chinese pharmaceutical industry, opening doors for substantial growth and international investment. This article delves into the implications of this approval and what it means for the future of Hengrui Pharma.

<h2>The Significance of the China Regulator Approval</h2>

This approval from Chinese regulatory bodies signifies a critical step towards Hengrui's Hong Kong listing. It demonstrates confidence in the company's robust operational practices, financial stability, and future prospects. Overcoming this key hurdle paves the way for a successful IPO and grants Hengrui access to the vast capital markets of Hong Kong and beyond. This opens opportunities for significant investment and expansion.

- Rigorous Review Process: The approval highlights the rigorous review process undergone by Hengrui Pharma, underscoring the commitment to high regulatory standards within the Chinese pharmaceutical sector. This process ensures investor confidence and strengthens Hengrui's international credibility.

- Regulatory Compliance: The approval emphasizes the importance of regulatory compliance for Chinese pharmaceutical companies seeking international expansion. It sets a precedent for other companies aiming for global reach, demonstrating that stringent adherence to regulations is a crucial factor in achieving international market access.

- Impact on Future IPOs: This successful approval is expected to have a positive ripple effect, potentially encouraging more Chinese pharmaceutical companies to pursue Hong Kong IPOs or other international listings. It demonstrates a pathway to success for companies meeting the high standards of global markets.

<h2>Expected Impact on Hengrui Pharma's Growth</h2>

The successful Hong Kong IPO will inject substantial capital into Hengrui Pharma, fueling its growth trajectory in several key areas. The influx of funds will be instrumental in bolstering its research and development (R&D) efforts, expanding its operational capabilities, and facilitating strategic acquisitions.

- Increased R&D Investment: The potential funding amounts raised through the IPO could reach significant figures, allowing Hengrui to significantly accelerate its drug development pipeline. This could lead to faster innovation and the introduction of new therapies to the market.

- Expanded Market Reach: Access to international investors significantly increases Hengrui's global profile and broadens its market reach. This international exposure will attract partnerships and collaborations, further driving growth.

- Strategic Acquisitions & Partnerships: The IPO proceeds could be used for strategic acquisitions of promising biotech companies or to forge lucrative partnerships to enhance its product portfolio and technological capabilities.

<h2>Implications for the Chinese Pharmaceutical Sector</h2>

Hengrui's successful IPO serves as a powerful catalyst for the entire Chinese pharmaceutical sector. It signals a growing international confidence in the quality, innovation, and potential of Chinese pharmaceutical companies.

- Catalyst for Other IPOs: Hengrui’s success could trigger a wave of similar IPOs from other Chinese pharmaceutical companies seeking international capital. This could significantly reshape the global pharmaceutical landscape.

- Increased Foreign Investment: The IPO is a strong indicator of increased international confidence in China’s pharmaceutical industry, potentially attracting further foreign investment and fostering collaboration on a global scale.

- Enhanced Competition and Innovation: The increased competition brought about by more Chinese companies entering the international market will likely spur greater innovation within the sector, benefiting patients worldwide.

<h3>Challenges and Opportunities for Hengrui Pharma</h3>

While the Hong Kong IPO presents significant opportunities, Hengrui will inevitably face challenges. Navigating the intensely competitive global pharmaceutical market requires a strategic approach.

- Global Competition: Hengrui will face fierce competition from established global pharmaceutical giants. Successful navigation requires robust strategies for differentiation and market penetration.

- Sustained R&D Commitment: Maintaining a commitment to continuous R&D is crucial for remaining competitive. This requires careful resource allocation and a focus on innovative drug discovery.

- Risk Mitigation: Potential risks, such as regulatory hurdles in different markets and fluctuations in global economic conditions, need careful planning and mitigation strategies.

<h2>Conclusion</h2>

Hengrui Pharma's secured approval for its Hong Kong IPO represents a momentous achievement, not only for the company itself but also for the wider Chinese pharmaceutical landscape. The influx of capital and increased international exposure will undoubtedly fuel further growth and innovation within the company and the sector at large. This successful IPO is a testament to Hengrui's strength and the increasing recognition of China's pharmaceutical capabilities on the global stage.

Call to Action: Stay informed on the latest developments in the Hengrui Pharma Hong Kong IPO and the evolving landscape of the Chinese pharmaceutical industry. Follow our updates on the Hengrui Pharma IPO and related news for further insights into the impact of this significant development on the global pharmaceutical market.

Featured Posts

-

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 29, 2025

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 29, 2025 -

Underground Nightclub Bust Over 100 Immigrants Detained In Police Raid

Apr 29, 2025

Underground Nightclub Bust Over 100 Immigrants Detained In Police Raid

Apr 29, 2025 -

Analyzing The China Market The Experiences Of Bmw Porsche And Their Competitors

Apr 29, 2025

Analyzing The China Market The Experiences Of Bmw Porsche And Their Competitors

Apr 29, 2025 -

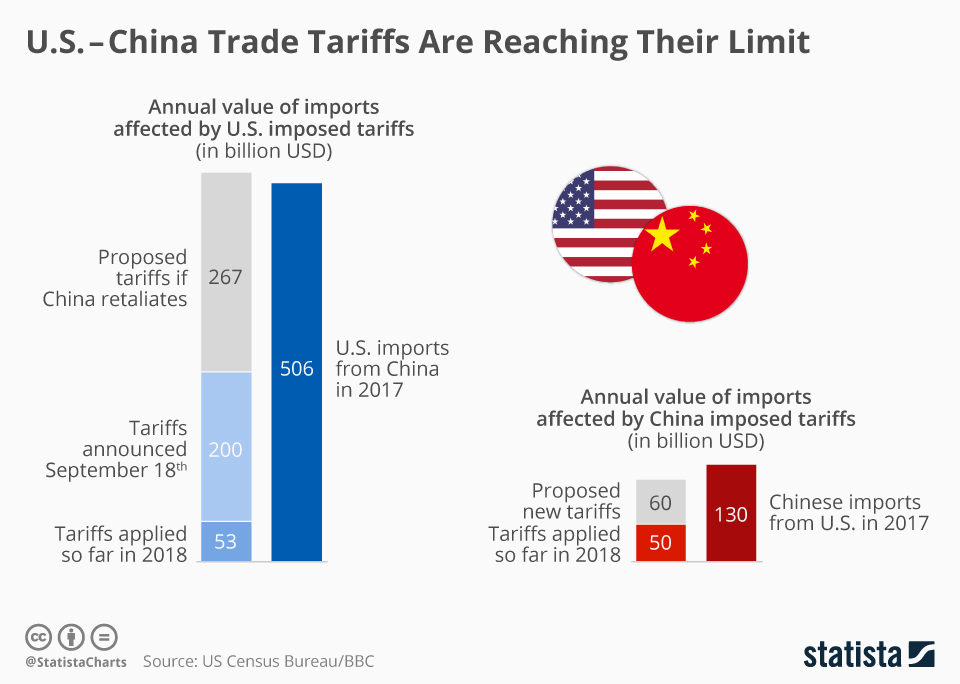

The Economic Impact Of Trumps China Tariffs Higher Costs And Scarcity

Apr 29, 2025

The Economic Impact Of Trumps China Tariffs Higher Costs And Scarcity

Apr 29, 2025 -

Car Ramming Attack Grief And Outrage In Canadas Filipino Community

Apr 29, 2025

Car Ramming Attack Grief And Outrage In Canadas Filipino Community

Apr 29, 2025

Latest Posts

-

Crook Accused Of Multi Million Dollar Office365 Executive Email Theft Scheme

Apr 29, 2025

Crook Accused Of Multi Million Dollar Office365 Executive Email Theft Scheme

Apr 29, 2025 -

Office365 Security Failure Millions Stolen From Executive Inboxes

Apr 29, 2025

Office365 Security Failure Millions Stolen From Executive Inboxes

Apr 29, 2025 -

Millions Lost Office365 Executive Email Accounts Targeted In Major Data Breach

Apr 29, 2025

Millions Lost Office365 Executive Email Accounts Targeted In Major Data Breach

Apr 29, 2025 -

Inside Job Millions Stolen Via Office365 Executive Account Hacks

Apr 29, 2025

Inside Job Millions Stolen Via Office365 Executive Account Hacks

Apr 29, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Email Theft

Apr 29, 2025

Cybercriminal Accused Of Millions In Office365 Executive Email Theft

Apr 29, 2025