Harvard's Tax-Exempt Status: President's Strong Warning Against Revocation

Table of Contents

The President's Concerns Regarding Harvard's Tax-Exempt Status

The president's warning regarding Harvard's tax-exempt status stems from concerns about the university's alignment with the criteria for tax exemption. These concerns question whether Harvard adequately fulfills its public benefit obligations, a crucial element for maintaining its 501(c)(3) status. The specific issues raised include:

-

Allegations of Insufficient Financial Aid for Low-Income Students: Critics argue that Harvard's financial aid policies, despite significant endowments, don't sufficiently address the needs of low-income students, potentially failing to meet the charitable mission expected of a tax-exempt institution. This raises questions about equitable access to higher education and the fairness of the current system. The debate centers on whether Harvard’s financial aid model genuinely promotes equal opportunity or serves primarily to attract high-achieving students regardless of socioeconomic background.

-

Questions about the University's Endowment Management and Investment Strategies: The vast size of Harvard's endowment has drawn intense scrutiny. Questions have been raised about the ethical implications of investment strategies and the overall transparency in managing such significant assets. Concerns exist regarding whether these investments align with the university's charitable mission or prioritize profit maximization over public benefit. A lack of transparency could be viewed as a violation of the public trust associated with tax-exempt status.

-

Scrutiny of Harvard's Lobbying Activities: The president's concerns also encompass Harvard's lobbying efforts. While universities engage in advocacy, excessive lobbying, potentially for the benefit of specific interests, could be seen as contradicting the principles of a tax-exempt, charitable organization. This raises questions about the balance between legitimate advocacy and activities that primarily serve the university's financial interests rather than the public good.

Understanding Harvard's Tax-Exempt Status and its Legal Basis

Harvard, like other universities, operates under Section 501(c)(3) of the Internal Revenue Code. This section grants tax exemption to organizations deemed "charitable" and operating for the public benefit. Maintaining this status requires adhering to strict criteria:

-

Key Requirements for Maintaining Tax-Exempt Status: These include demonstrating a clear charitable purpose, operating exclusively for that purpose, serving the public interest, and maintaining appropriate financial transparency. Regular audits and adherence to IRS guidelines are critical.

-

Examples of Activities That Could Jeopardize Tax-Exempt Status: Engaging in excessive political lobbying, prioritizing private gain over public benefit, and a lack of transparency in financial practices are examples of actions that could lead to the revocation of tax-exempt status. This includes using endowment funds for purposes unrelated to the educational mission.

-

The Process of Revocation of Tax-Exempt Status: The IRS initiates an investigation if concerns arise about a 501(c)(3) organization's compliance. If violations are confirmed, the organization may face penalties, including the loss of its tax-exempt status, leading to significant financial repercussions.

Potential Consequences of Revoking Harvard's Tax-Exempt Status

The revocation of Harvard's tax-exempt status would have far-reaching and devastating consequences:

-

Increased Tuition Costs for Students: The loss of tax exemption would dramatically increase Harvard's operating costs, almost certainly leading to substantial tuition hikes, making higher education even less accessible. This would disproportionately affect low- and middle-income families.

-

Potential Budget Cuts and Program Reductions: To offset increased costs, Harvard might be forced to implement significant budget cuts, potentially leading to the elimination of programs, departments, and research initiatives, harming both the academic environment and broader societal advancement.

-

Impact on Research and Development Initiatives: Reduced funding would inevitably hinder groundbreaking research across various fields, with significant ramifications for scientific progress and technological innovation.

-

Loss of Charitable Donations and Investment Opportunities: The loss of tax-exempt status would likely discourage charitable donations and may limit investment opportunities, further impacting Harvard's financial health and its ability to fulfill its educational mission.

Arguments in Favor of Maintaining Harvard's Tax-Exempt Status

Despite the concerns raised, strong arguments exist for preserving Harvard's tax-exempt status, highlighting its substantial contributions to society:

-

Harvard's Contributions to Scientific Advancements: Harvard's research has fueled countless breakthroughs, benefiting humanity in areas ranging from medicine to technology. Revoking its tax exemption would severely limit this critical work.

-

Harvard's Role in Educating Future Leaders: Harvard has consistently educated leaders across various fields, contributing significantly to global progress and societal development. Denying its tax-exempt status undermines this crucial educational role.

-

Harvard's Commitment to Public Service and Community Outreach: Harvard engages in substantial community outreach and public service initiatives, impacting local communities and contributing to social betterment. Maintaining its tax-exempt status ensures the continuation of this commitment.

-

Economic Impact of Harvard on its Surrounding Community: Harvard’s presence has a positive economic impact on its surrounding area, employing many individuals and contributing to the local economy. The loss of its tax-exempt status could negatively affect this contribution.

The Future of Harvard's Tax-Exempt Status – A Call to Action

The debate over Harvard's tax-exempt status is complex and far-reaching. While concerns about financial aid, endowment management, and lobbying activities are legitimate and require careful consideration, the potential consequences of revoking this status are equally significant. Maintaining Harvard’s tax exemption is crucial for preserving its educational mission and its contributions to research and societal advancement. We urge readers to learn more about this critical issue, engage in informed discussions, and contact their representatives to voice their opinions on the debate over Harvard’s tax-exempt status and its implications for higher education and the future of charitable organizations. The preservation of Harvard’s tax exemption, and similar cases, demands our collective attention and thoughtful engagement.

Featured Posts

-

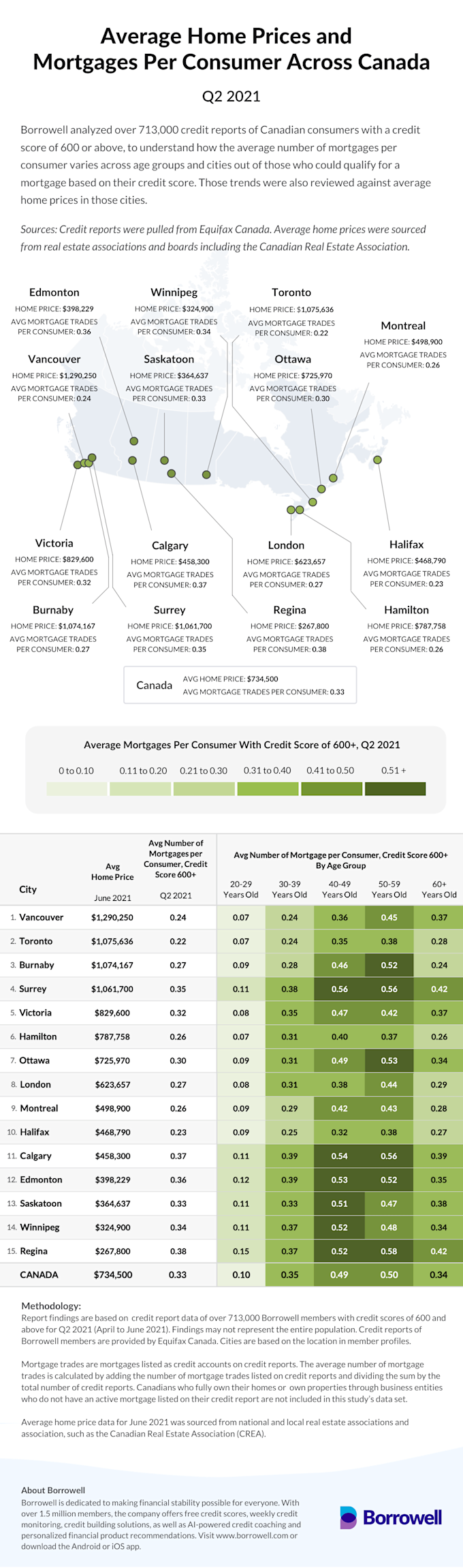

Why 10 Year Mortgages Arent Popular In Canada

May 05, 2025

Why 10 Year Mortgages Arent Popular In Canada

May 05, 2025 -

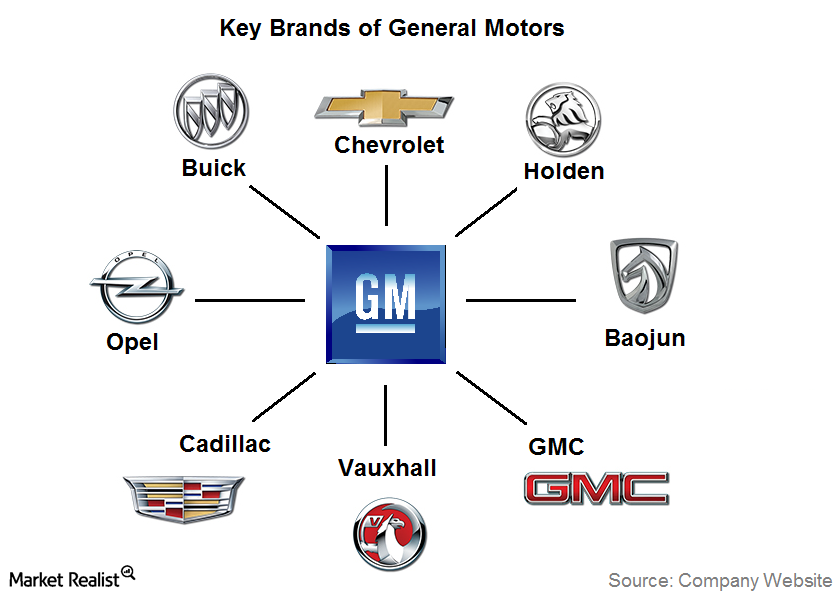

The Future Of Electric Motors Diversifying Global Manufacturing

May 05, 2025

The Future Of Electric Motors Diversifying Global Manufacturing

May 05, 2025 -

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025 -

Harvards Tax Exempt Status Presidents Strong Warning Against Revocation

May 05, 2025

Harvards Tax Exempt Status Presidents Strong Warning Against Revocation

May 05, 2025 -

Prince Harry Speaks Out Royal Rift Deepens Over Security Concerns

May 05, 2025

Prince Harry Speaks Out Royal Rift Deepens Over Security Concerns

May 05, 2025

Latest Posts

-

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025 -

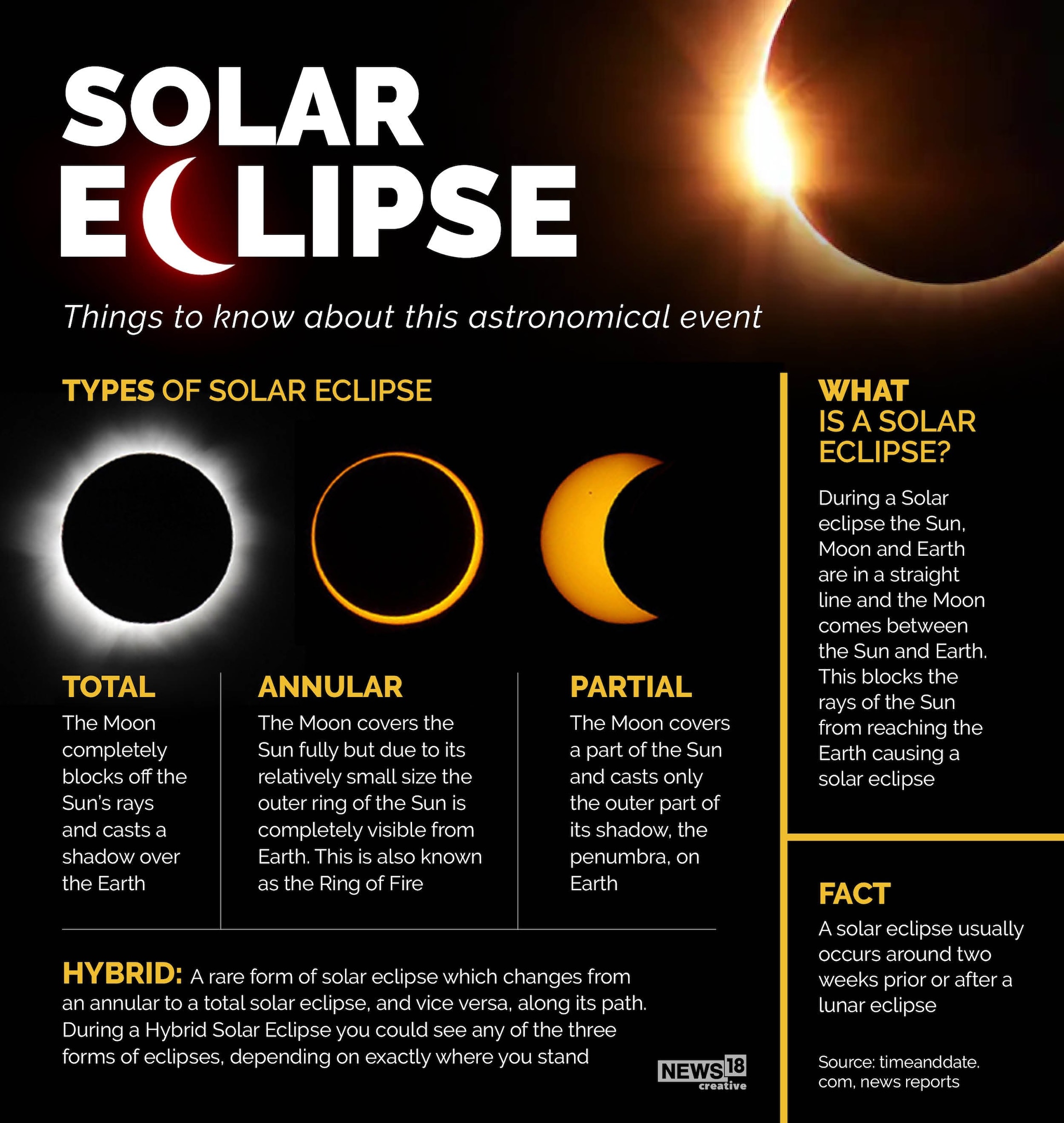

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025 -

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025 -

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025