Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

Higher Initial Interest Rates

One of the primary reasons for the unpopularity of 10-year mortgages in Canada is the higher initial interest rate. Lenders typically charge a premium for the increased risk associated with longer-term loans. This means your monthly payments could be significantly higher compared to a shorter-term mortgage.

- Example: A $500,000 mortgage might have a 5% interest rate for a 5-year term, but a 10-year term could carry a rate of 5.5% or even higher. This seemingly small difference can translate into substantially larger monthly payments and a higher total interest paid over the life of the loan.

- Impact on Borrowing Costs: The difference in interest rates between a 5-year and a 10-year mortgage can significantly impact the overall borrowing costs. A higher interest rate means you'll pay more in interest over the life of the loan, increasing the total cost of your home.

- Supporting Evidence: Data from major Canadian banks and mortgage brokers consistently shows a higher interest rate for longer-term mortgages. (Note: Ideally, you would insert links to credible sources here confirming this information).

Risk of Long-Term Commitment

A 10-year mortgage represents a significant financial commitment. Locking into a specific interest rate for a decade carries substantial risks, particularly in a fluctuating market.

- Interest Rate Fluctuations: Interest rates are constantly subject to change, and locking in for 10 years carries the risk of missing out on potential rate drops. If rates fall during your 10-year term, you'll be stuck with a higher rate than you might have secured with a shorter-term mortgage.

- Unforeseen Circumstances: Life is unpredictable. Job loss, unexpected relocation, or even a change in family circumstances could make a 10-year mortgage a significant burden. The inflexibility can lead to financial strain and potential foreclosure in worst-case scenarios.

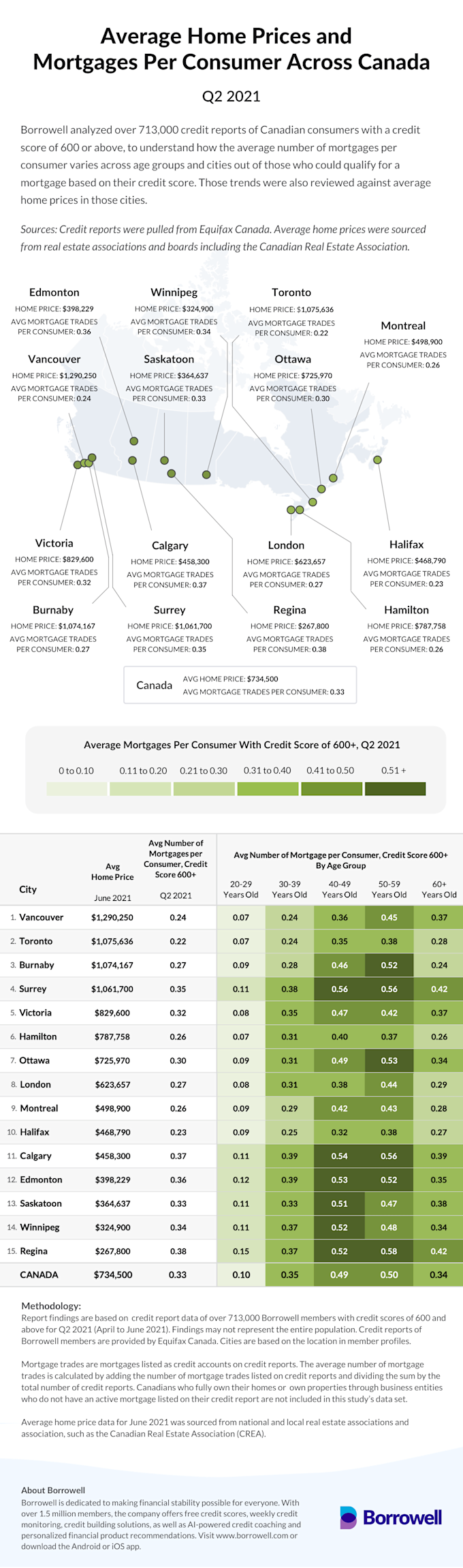

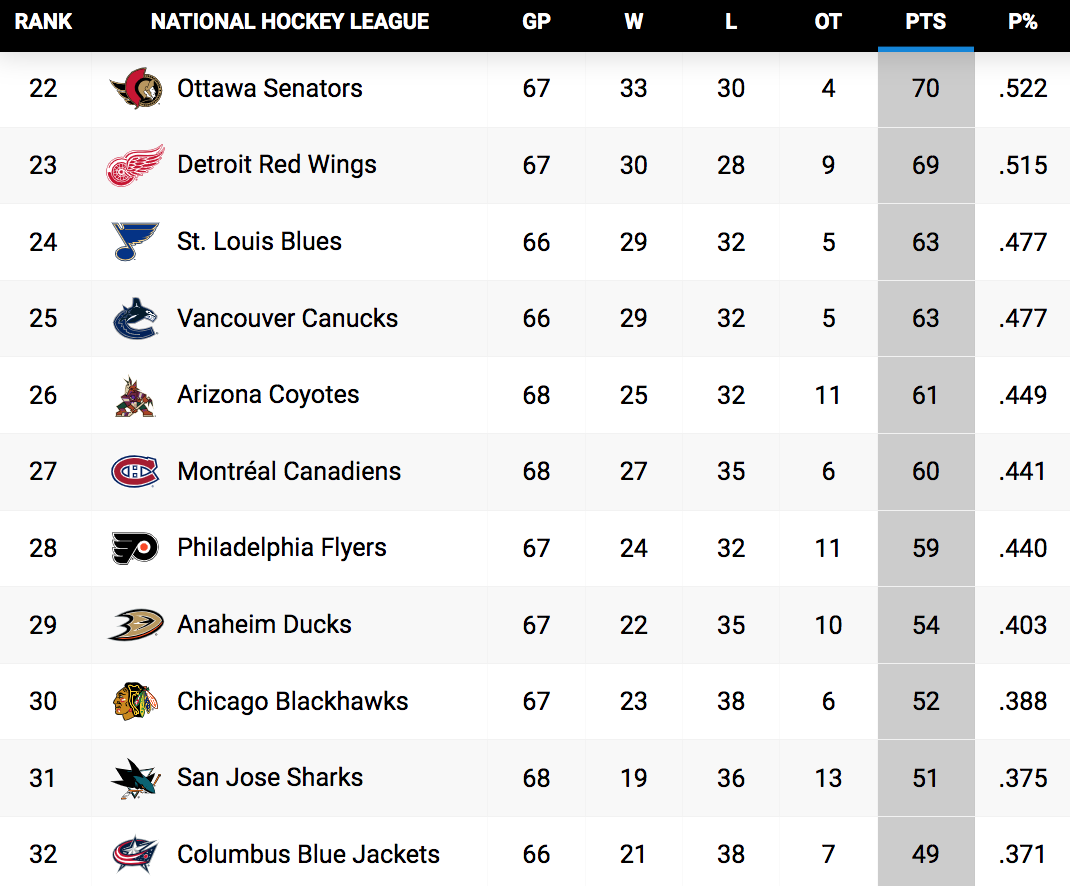

- Market Volatility: The Canadian real estate market can be volatile. A 10-year commitment means you are exposed to potential market downturns that could negatively impact your equity and your ability to refinance.

Limited Flexibility and Prepayment Penalties

The inflexibility of a 10-year mortgage is a major deterrent for many Canadian homebuyers. Prepayment penalties can be substantial, discouraging early repayment or refinancing.

- Prepayment Penalties: These penalties can be significant, often calculated based on the interest rate differential between your current mortgage and the prevailing market rate. This means paying a large sum to break the mortgage early.

- Refinancing Difficulties: Refinancing a 10-year mortgage is more challenging than a shorter-term mortgage. You are locked into your terms for a longer period, limiting your options if your financial circumstances change or better mortgage rates become available.

- Selling Your Property: Selling your property with a 10-year mortgage can also be complicated. Potential buyers may be hesitant due to the long-term commitment, potentially reducing the number of interested buyers and affecting the selling price.

Alternative Mortgage Options in Canada

Canadians generally prefer shorter-term mortgages, offering greater flexibility and renewability.

- 5-Year Mortgages: These are the most popular choice in Canada, offering a balance between stability and flexibility. They provide a longer term than a 1-year mortgage but allow you to re-evaluate your options and potentially secure a lower interest rate when the term ends.

- 1-Year Mortgages: These offer maximum flexibility, allowing you to adjust your mortgage rate annually based on market conditions. However, this comes with the uncertainty of fluctuating monthly payments.

- Shorter-Term Advantages: The flexibility of shorter-term mortgages aligns well with the Canadian financial landscape, allowing borrowers to adapt to changing interest rates and personal circumstances.

The Psychological Factor: Canadian Mortgage Habits

Cultural and psychological factors contribute to the preference for shorter-term mortgages.

- Risk Aversion: Canadians tend to be risk-averse when it comes to major financial decisions like mortgages. The long-term commitment of a 10-year mortgage is perceived as riskier compared to the shorter-term options.

- Interest Rate Sensitivity: The Canadian mortgage market is sensitive to interest rate changes. The possibility of significant rate fluctuations over 10 years makes shorter-term mortgages seem like a safer bet for many Canadians.

- Financial Planning: Shorter-term mortgages align better with the typical Canadian approach to financial planning, which focuses on shorter-term goals and greater flexibility.

Conclusion: Understanding the Canadian Mortgage Landscape and 10-Year Mortgages

In summary, the unpopularity of 10-year mortgages in Canada stems from higher initial interest rates, the inherent risk of a long-term commitment, and limited flexibility regarding prepayment and refinancing. The preference for shorter-term mortgages, such as 5-year or even 1-year terms, reflects a Canadian tendency towards risk aversion and a desire for greater financial control. Understanding Canadian mortgage terms is crucial for making informed decisions. To find the right mortgage for you, explore your mortgage options and consider consulting with a mortgage broker. They can help you understand Canadian mortgage terms and find the best mortgage term to fit your individual financial situation and risk profile.

Featured Posts

-

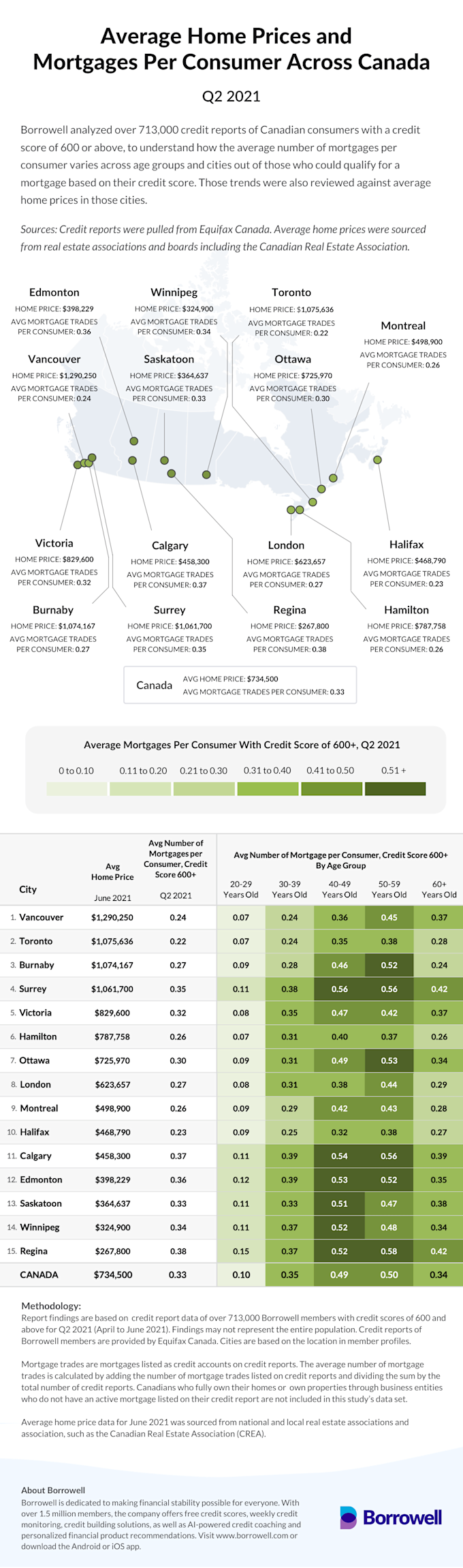

Aritzias Strategy For Navigating Increased Tariffs

May 05, 2025

Aritzias Strategy For Navigating Increased Tariffs

May 05, 2025 -

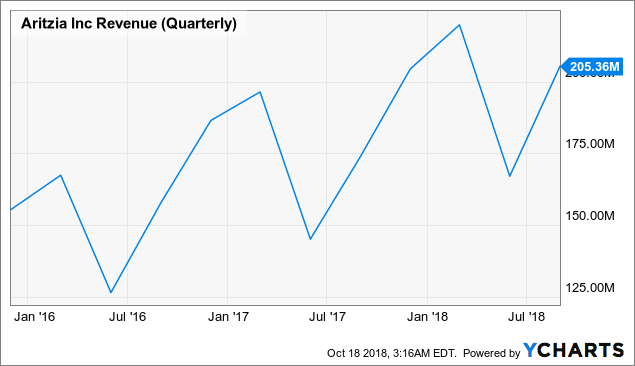

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025 -

Ohio Train Derailment Toxic Chemical Residue In Buildings After Months

May 05, 2025

Ohio Train Derailment Toxic Chemical Residue In Buildings After Months

May 05, 2025 -

Analysis Of Toxic Chemical Persistence In Buildings Following The Ohio Train Derailment

May 05, 2025

Analysis Of Toxic Chemical Persistence In Buildings Following The Ohio Train Derailment

May 05, 2025 -

Google Faces Breakup Demand Us Investigates Online Advertising Monopoly

May 05, 2025

Google Faces Breakup Demand Us Investigates Online Advertising Monopoly

May 05, 2025

Latest Posts

-

Fatal Raiwaqa Fire Woman Perishes In Flames

May 05, 2025

Fatal Raiwaqa Fire Woman Perishes In Flames

May 05, 2025 -

Chicago Med Season 10 Brian Tees Return In Episode 14

May 05, 2025

Chicago Med Season 10 Brian Tees Return In Episode 14

May 05, 2025 -

Torture And Murder Of 16 Year Old Mother Charged With Neglect

May 05, 2025

Torture And Murder Of 16 Year Old Mother Charged With Neglect

May 05, 2025 -

Police Collaboration Leads To Life Sentence For Child Sex Offender

May 05, 2025

Police Collaboration Leads To Life Sentence For Child Sex Offender

May 05, 2025 -

Chicago Med Season 10 Episode 14 Dr Ethan Chois Comeback

May 05, 2025

Chicago Med Season 10 Episode 14 Dr Ethan Chois Comeback

May 05, 2025