Grayscale's XRP ETF Filing And The Subsequent Rise Of XRP Against Bitcoin

Table of Contents

Grayscale's XRP ETF Application: A Detailed Look

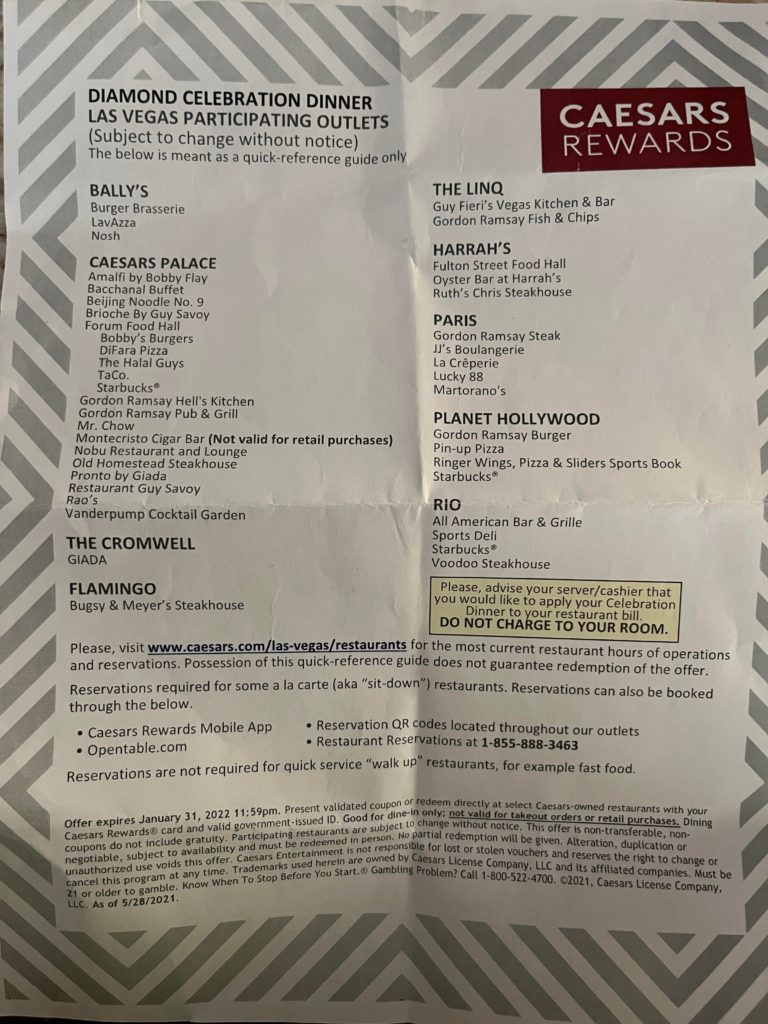

Grayscale Investments, a prominent player in the cryptocurrency investment space, has submitted an application for an XRP exchange-traded fund (ETF). This move signifies a significant step towards greater institutional adoption of XRP, a cryptocurrency often overshadowed by its larger-cap counterparts. Grayscale’s history of successfully launching ETFs for other cryptocurrencies, such as Bitcoin and Ethereum, lends significant weight to this application and fuels anticipation within the market. The XRP ETF filing details the proposed structure of the fund, outlining how it will invest in and manage XRP holdings. However, the application faces considerable regulatory hurdles. Securities and Exchange Commission (SEC) approval is crucial, a process that could take months, or even years, to complete.

The potential implications of ETF approval are substantial:

- Increased institutional investment in XRP: An ETF provides a regulated and accessible entry point for institutional investors, potentially leading to a significant influx of capital into the XRP market.

- Greater price stability for XRP: Increased liquidity and institutional participation often lead to more stable price action, reducing volatility.

- Increased trading volume and market depth: The ETF will likely attract a larger number of traders, boosting trading volume and creating a deeper, more liquid market.

- Enhanced regulatory clarity for XRP: While not a guarantee, the SEC review process could provide more regulatory clarity regarding XRP's status as a security.

XRP's Price Performance Against Bitcoin (XRP/BTC): Pre and Post Filing

Prior to Grayscale's filing, the XRP/BTC trading pair exhibited a relatively subdued performance, fluctuating within a defined range. However, following the announcement, XRP experienced a noticeable surge against Bitcoin. [Insert chart/graph showing XRP/BTC price movements before and after the filing]. This price increase isn't solely attributable to the ETF filing; other factors contributed to the positive market sentiment. These include: improved market sentiment surrounding cryptocurrencies in general, ongoing developments in Ripple's legal battle, and potentially positive media coverage.

- Quantitative data showcasing the XRP/BTC price change: A precise percentage increase in XRP's value against Bitcoin following the filing should be clearly stated here.

- Mention of any significant trading volume spikes: Highlight any notable increases in trading volume correlated with the price surge.

- Discussion of potential correlation with other market events: Mention any other concurrent events in the cryptocurrency market that may have influenced XRP's price.

Market Sentiment and Investor Confidence: The Ripple Effect

Grayscale's XRP ETF filing has demonstrably impacted investor sentiment. Social media platforms show a significant increase in positive commentary and discussions regarding XRP, indicating growing optimism among retail investors. [Include analysis of social media sentiment using data from relevant platforms]. This positive sentiment extends to institutional investors; several hedge funds and investment firms have expressed increased interest in XRP, potentially anticipating the benefits of ETF approval. [Mention specific examples if available, citing reputable sources]. The media coverage surrounding the filing also played a role in shaping investor perception. Positive news reports and expert opinions further fueled investor confidence.

Risk Factors and Considerations

Despite the positive developments, it's crucial to acknowledge potential risks. The ongoing legal challenges facing Ripple Labs continue to cast a shadow over XRP's future. The outcome of these legal battles could significantly impact XRP's price and market adoption. Furthermore, the cryptocurrency market remains inherently volatile, and significant price corrections are always possible.

- Regulatory uncertainty surrounding cryptocurrencies: The regulatory landscape for cryptocurrencies is still evolving, presenting potential challenges for investors.

- Potential for price corrections: The price surge could be followed by a period of consolidation or even a correction, especially given the inherent volatility of the market.

- The inherent risks associated with digital asset investments: Investing in cryptocurrencies involves significant risk, and investors should carefully assess their risk tolerance before investing.

Conclusion: Grayscale's XRP ETF Filing: The Future of XRP/BTC

Grayscale's XRP ETF filing has undoubtedly played a significant role in XRP's recent price appreciation against Bitcoin. The potential for increased institutional investment, enhanced liquidity, and greater regulatory clarity is considerable. While the SEC approval process remains uncertain, the filing itself has injected renewed optimism into the XRP market. However, it's crucial to remain aware of the existing legal challenges and the inherent volatility of the cryptocurrency market. The future trajectory of XRP/BTC will depend on several factors, including the SEC's decision, Ripple's legal battles, and broader market sentiment.

Stay updated on the Grayscale XRP ETF application and monitor the XRP/BTC price action closely. Learn more about investing in XRP and make informed decisions based on your own risk tolerance.

Featured Posts

-

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Futbolli Luis Enrique Ben Pastrimin E Madh Te Psg

May 08, 2025

Futbolli Luis Enrique Ben Pastrimin E Madh Te Psg

May 08, 2025 -

Zasto Se Dzordan I Jokic Ljube Tri Puta Bobi Marjanovic Krivac

May 08, 2025

Zasto Se Dzordan I Jokic Ljube Tri Puta Bobi Marjanovic Krivac

May 08, 2025 -

Analyzing Bitcoins Potential 10x Multiplier A Weekly Chart Perspective

May 08, 2025

Analyzing Bitcoins Potential 10x Multiplier A Weekly Chart Perspective

May 08, 2025 -

Xrp Price Prediction After A 400 Increase Where To Next

May 08, 2025

Xrp Price Prediction After A 400 Increase Where To Next

May 08, 2025