Analyzing Bitcoin's Potential 10x Multiplier: A Weekly Chart Perspective

Table of Contents

Historical Bitcoin Price Rallies & 10x Multipliers

Analyzing past Bitcoin price performance is crucial to assessing the likelihood of another significant rally. Bitcoin's history boasts several instances of remarkable growth, with 10x or even greater increases. Studying these "Bitcoin 10x" events provides valuable insights.

- 2010-2011: Bitcoin's early days saw explosive growth, rising from mere cents to over $30, representing a massive increase—far exceeding a 10x multiplier. This period was characterized by early adoption and increasing awareness.

- 2013-2014: Another significant Bitcoin price rally, driven by increased media attention and growing exchange adoption, resulted in a price surge of several magnitudes, again far surpassing a 10x multiplier from its previous lows.

- 2016-2017: The pre-2017 bull run saw Bitcoin's price skyrocket from under $1,000 to nearly $20,000—a clear example of a historical Bitcoin price rally and a significant multiple increase. This period was marked by increased institutional interest and the emergence of Initial Coin Offerings (ICOs).

These historical Bitcoin price rallies, while impressive, highlight the volatility inherent in Bitcoin's price action and the periods of significant price appreciation. However, simply looking at these "Bitcoin 10x" events doesn't guarantee a repeat performance. Understanding the underlying factors driving these previous bull runs is just as crucial.

Technical Analysis of the Weekly Bitcoin Chart

Technical analysis plays a crucial role in predicting potential price movements. By examining the Bitcoin weekly chart, we can identify potential support and resistance levels, as well as the trends indicated by key technical indicators. "Bitcoin weekly chart analysis" provides a longer-term perspective than daily charts.

- Support and Resistance: Identifying key support and resistance levels on the Bitcoin weekly chart can help determine potential price reversal points. Breaching significant resistance levels often signals a potential upward trend.

- Moving Averages: Studying moving averages (e.g., 50-week and 200-week) can help identify the overall trend. A bullish crossover (shorter-term moving average crossing above the longer-term moving average) could indicate a potential upward momentum.

- RSI and MACD: The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are momentum indicators that can signal overbought or oversold conditions. Analyzing these indicators on the Bitcoin weekly chart can provide insights into potential price reversals.

(Insert chart/graph here visually representing the technical analysis discussed above)

Analyzing "Bitcoin chart patterns" such as head and shoulders or double bottoms within the context of the weekly timeframe can further enhance this analysis.

On-Chain Metrics & Bitcoin's Future Potential

Examining on-chain metrics provides additional insights into Bitcoin's potential for a 10x multiplier. These metrics offer a more fundamental perspective on Bitcoin's adoption and network activity.

- Hash Rate: The Bitcoin hash rate reflects the computational power securing the network. A consistently increasing hash rate suggests a healthy and growing network, often correlated with price increases.

- Transaction Volume: High transaction volume often indicates increased usage and adoption, which can positively influence price.

- Miner Behavior: Analyzing miner behavior (e.g., mining difficulty adjustments) can offer clues about future price trends. A steady increase in mining difficulty often suggests a healthy and robust network.

The correlation between "Bitcoin on-chain metrics" and price movements isn't always direct, but these metrics provide a valuable context for assessing the underlying health and adoption of the Bitcoin network, factors that are instrumental in determining its long-term price. Furthermore, factors such as increasing institutional investment and regulatory developments contribute to "Bitcoin adoption" and ultimately influence its price.

Risks and Considerations

While a Bitcoin 10x multiplier is theoretically possible, several factors could hinder or prevent such a dramatic price increase. A thorough "Bitcoin risk assessment" is crucial.

- Regulatory Uncertainty: Changes in regulatory landscapes can significantly impact Bitcoin's price. Government interventions, such as outright bans or stringent regulations, could negatively affect its price.

- Market Corrections: Bitcoin's price is inherently volatile, subject to significant corrections. "Bitcoin price correction" periods can wipe out significant gains.

- Competition: The emergence of alternative cryptocurrencies could divert investment away from Bitcoin.

- Macroeconomic Factors: Global economic conditions significantly influence investor sentiment towards Bitcoin and other risk assets. A broader economic downturn could negatively impact Bitcoin's price. Understanding "Bitcoin market volatility" is critical for any investor.

Thoroughly assessing "Bitcoin regulatory risk" and other potential drawbacks is paramount before making any investment decisions.

Conclusion

Analyzing Bitcoin's potential 10x multiplier through a weekly chart perspective requires a multifaceted approach, considering historical data, technical indicators, on-chain metrics, and potential risks. While historical Bitcoin price rallies provide some precedent for significant price increases, the current market conditions and potential headwinds cannot be ignored. A "Bitcoin price prediction" is never guaranteed. Careful consideration of all these factors is crucial before making any investment decisions. While a 10x multiplier is certainly a possibility, carefully analyzing Bitcoin's potential 10x multiplier through a weekly chart perspective and considering all factors is crucial before making any investment decisions. Continue your own in-depth research into Bitcoin's price action to stay informed about "Bitcoin investment" opportunities and risks.

Featured Posts

-

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025 -

Escandalo En El Flamengo Vs Botafogo Batalla Campal Entre Jugadores

May 08, 2025

Escandalo En El Flamengo Vs Botafogo Batalla Campal Entre Jugadores

May 08, 2025 -

Dwp Overpayments How Universal Credit Recipients Can Claim Refunds

May 08, 2025

Dwp Overpayments How Universal Credit Recipients Can Claim Refunds

May 08, 2025 -

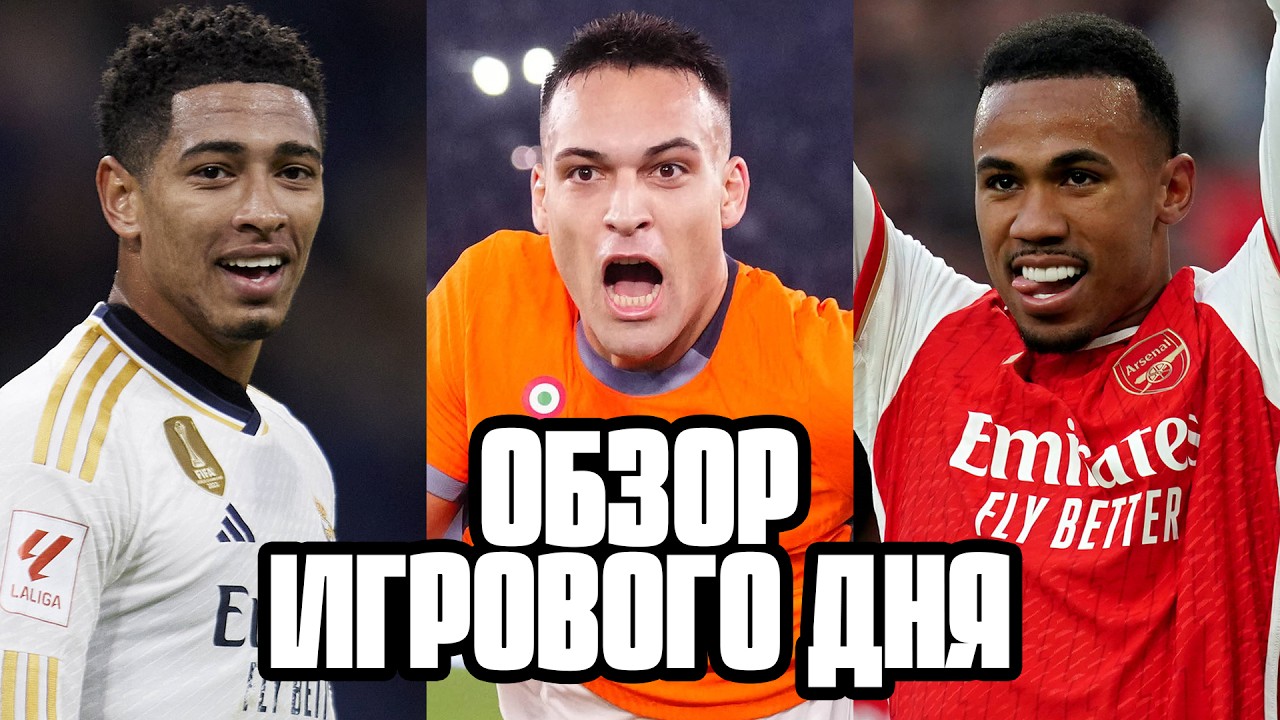

Uber Stock Forecast Assessing The Impact Of Autonomous Vehicle Technology

May 08, 2025

Uber Stock Forecast Assessing The Impact Of Autonomous Vehicle Technology

May 08, 2025 -

Xrp Price Up 400 Predicting Future Growth

May 08, 2025

Xrp Price Up 400 Predicting Future Growth

May 08, 2025