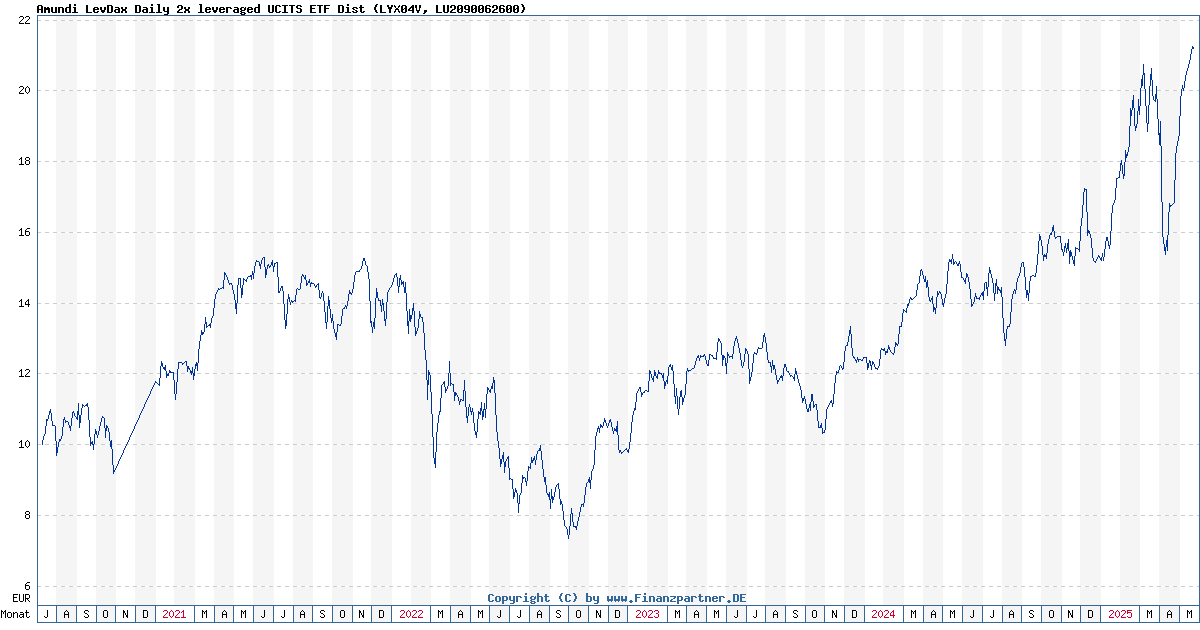

Frankfurt Equities Opening: DAX Continues Record-Breaking Ascent

Table of Contents

Economic Indicators Fueling the DAX's Rise

The DAX's impressive climb isn't arbitrary; it's fueled by a confluence of positive economic data emanating from Germany and the broader Eurozone. These strong fundamentals are bolstering investor confidence and driving significant capital inflows into Frankfurt equities.

-

Stronger-than-expected German GDP growth in Q2 2024: Preliminary reports suggest a robust expansion in the German economy, exceeding initial forecasts and signaling a healthy economic foundation. This growth is being driven by both domestic consumption and increased export activity, contributing directly to the positive sentiment surrounding German equities trading.

-

Positive PMI (Purchasing Managers' Index) readings indicating robust manufacturing activity: The PMI consistently surpasses expectations, suggesting a healthy expansion in the manufacturing sector. This reflects strong demand for German-made goods both domestically and internationally, further supporting the DAX's upward trajectory. This positive outlook impacts many sectors involved in equities trading on the Frankfurt Stock Exchange.

-

Continued low unemployment rates boosting consumer confidence: Low unemployment figures translate into higher consumer spending, strengthening the domestic economy and fueling further growth. This economic stability contributes significantly to investor confidence and willingness to invest in Frankfurt equities.

-

Positive sentiment from the European Central Bank (ECB): While interest rate hikes can sometimes dampen market enthusiasm, the ECB's recent statements suggest a measured approach to monetary policy, mitigating potential risks to the DAX and fostering a climate of relative stability for equities trading.

Key Sectors Driving the DAX's Performance

The DAX's rise isn't solely attributable to macroeconomic factors; specific sectors are significantly outperforming others, contributing disproportionately to the index's gains. Analyzing these key players provides valuable insights into the current market dynamics.

-

Automotive sector boosted by strong global demand and innovative technologies: The German automotive industry, a significant component of the DAX, is experiencing a resurgence driven by both robust global demand and the successful integration of innovative technologies like electric vehicles and advanced driver-assistance systems. This sector's performance is a major catalyst for the overall DAX increase.

-

Technology sector benefits from continued investment in digital transformation: The technology sector continues to thrive, with ongoing investment in digital transformation initiatives across various industries. German technology companies are at the forefront of this trend, leading to substantial growth and driving the DAX higher. Investment in this sector is a significant factor in Frankfurt equities trading.

-

Industrial goods sector showing resilience and positive growth prospects: The industrial goods sector, despite global uncertainties, demonstrates resilience and positive growth prospects. This showcases the strength and adaptability of German manufacturing, a key component of the German economy and the DAX.

-

Financial sector impacted by rising interest rates and global economic uncertainty: The financial sector's performance is more nuanced. Rising interest rates present both opportunities and challenges. While they boost profitability for banks, they also increase the cost of borrowing and can impact investment decisions. The overall impact depends on the specific companies and the broader global economic outlook.

Influence of Global Market Trends on Frankfurt Equities

The DAX's performance is not isolated; global market trends exert a significant influence on Frankfurt equities. Understanding these interdependencies is crucial for a comprehensive analysis.

-

Impact of US Federal Reserve policy on European markets: The decisions made by the US Federal Reserve regarding interest rates and monetary policy have a ripple effect across global markets, including the DAX. Changes in US policy can significantly influence investor sentiment and capital flows into European markets, impacting the performance of Frankfurt equities.

-

Influence of geopolitical events (e.g., the war in Ukraine, trade tensions) on investor sentiment: Geopolitical events often introduce uncertainty into markets. The ongoing war in Ukraine and trade tensions between major global economies create volatility and impact investor sentiment, influencing the DAX's trajectory. These events directly affect equities trading in Frankfurt and globally.

-

Performance of other major global indices (e.g., Dow Jones, Nasdaq) and their correlation with the DAX: The DAX's performance is correlated to a certain extent with other major global indices such as the Dow Jones and Nasdaq. Analyzing the interconnectedness of these markets provides valuable insights into the underlying drivers influencing Frankfurt equities.

Analyst Predictions and Future Outlook for the DAX

Analyzing expert opinions and forecasts provides a valuable perspective on the potential future trajectory of the DAX index. However, it's crucial to remember that market predictions are inherently uncertain.

-

Analyst predictions for DAX performance in the coming weeks/months: Many analysts predict continued growth for the DAX in the near term, citing the positive economic fundamentals and strong performance across key sectors. However, the extent of this growth remains a subject of ongoing debate.

-

Potential risks and challenges that could impact the DAX's growth: Potential risks include escalating inflation, further geopolitical instability, and unexpected shifts in global economic conditions. These factors could negatively impact investor sentiment and lead to market corrections.

-

Investment strategies recommended by financial experts considering the current market conditions: Financial experts suggest a diversified investment strategy that balances risk and reward, given the current market conditions. Careful monitoring of market developments and adjustments to investment portfolios based on new information are recommended.

Conclusion

The Frankfurt equities opening has witnessed the DAX continue its remarkable ascent, driven by positive economic indicators, strong sector performance, and relatively favorable global market sentiment. While risks remain, the near-term outlook for the DAX appears positive. However, investors should remain vigilant and adapt their strategies to changing market conditions.

Call to Action: Stay informed about the dynamic Frankfurt equities market and the DAX's continued performance. Follow our updates for insightful analysis and expert commentary on the Frankfurt Equities Opening and the DAX Index. Keep track of the latest developments in DAX trading to make informed investment decisions.

Featured Posts

-

Amundi Djia Ucits Etf Daily Nav Updates And Investment Strategies

May 25, 2025

Amundi Djia Ucits Etf Daily Nav Updates And Investment Strategies

May 25, 2025 -

What Is Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Auto Sector Rebound Fuels European Market Growth Lvmh Stock Suffers

May 25, 2025

Auto Sector Rebound Fuels European Market Growth Lvmh Stock Suffers

May 25, 2025 -

Escape To The Country Balancing Rural Life And Modern Comforts

May 25, 2025

Escape To The Country Balancing Rural Life And Modern Comforts

May 25, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 25, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 25, 2025

Latest Posts

-

Building Bridges The 2nd Best Of Bangladesh In Europe Showcases Collaboration

May 25, 2025

Building Bridges The 2nd Best Of Bangladesh In Europe Showcases Collaboration

May 25, 2025 -

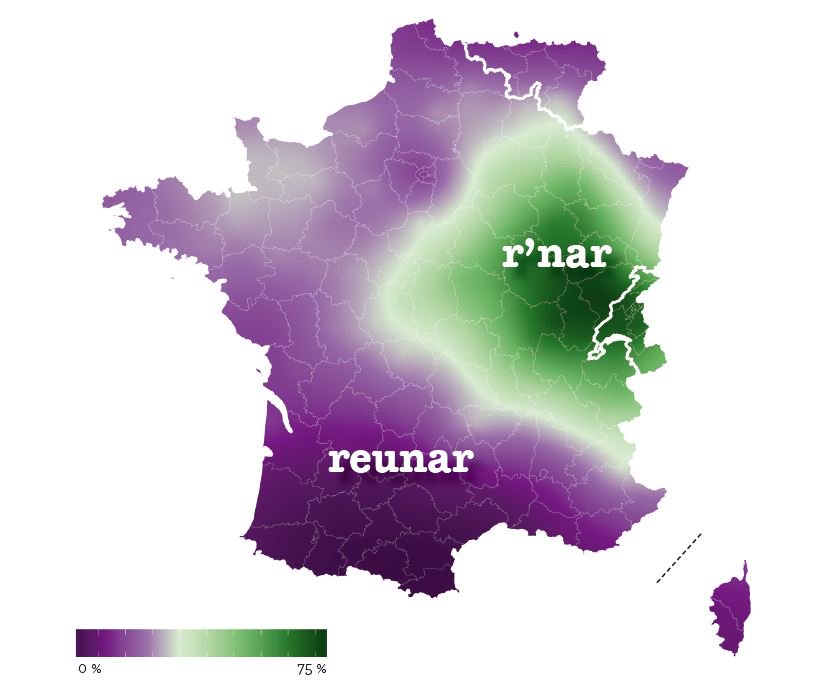

Le Francais Selon Mathieu Avanzi Modernite Et Accessibilite

May 25, 2025

Le Francais Selon Mathieu Avanzi Modernite Et Accessibilite

May 25, 2025 -

Best Of Bangladesh In Europe Growth And Collaboration At The Forefront 2nd Edition

May 25, 2025

Best Of Bangladesh In Europe Growth And Collaboration At The Forefront 2nd Edition

May 25, 2025 -

Mathieu Avanzi L Evolution Du Francais Au Dela De La Salle De Classe

May 25, 2025

Mathieu Avanzi L Evolution Du Francais Au Dela De La Salle De Classe

May 25, 2025 -

Focusing On Collaboration The 2nd Best Of Bangladesh In Europe

May 25, 2025

Focusing On Collaboration The 2nd Best Of Bangladesh In Europe

May 25, 2025