Amundi DJIA UCITS ETF: Daily NAV Updates And Investment Strategies

Table of Contents

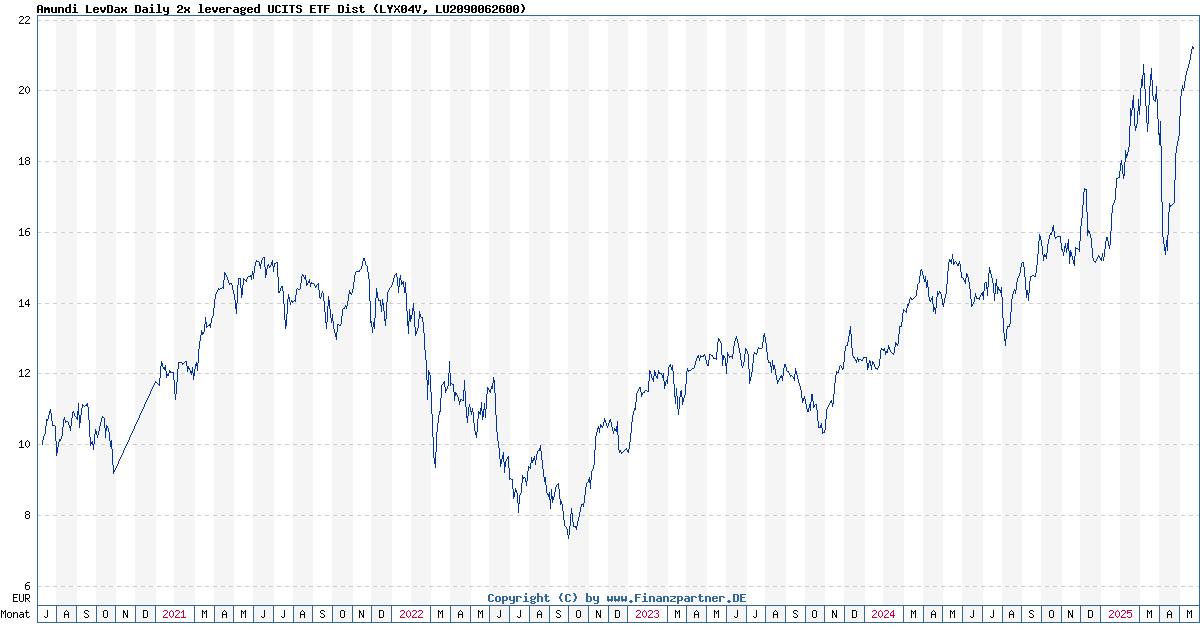

Understanding the Amundi DJIA UCITS ETF

The Amundi DJIA UCITS ETF is an exchange-traded fund that tracks the performance of the Dow Jones Industrial Average. Understanding what a UCITS ETF is crucial. UCITS stands for Undertakings for Collective Investment in Transferable Securities. This designation signifies that the ETF is regulated under the European Union's UCITS Directive, providing investors with a high level of regulatory protection and ensuring standardized investor safeguards across various European markets. The Amundi DJIA UCITS ETF's primary investment objective is to replicate the performance of the DJIA, offering investors a simple and transparent way to gain exposure to 30 of the largest and most influential companies in the United States.

The ETF's expense ratio is a key factor to consider. The expense ratio represents the annual cost of owning the ETF, expressed as a percentage of your investment. A lower expense ratio translates to higher returns over the long term. It's essential to compare the expense ratio of the Amundi DJIA UCITS ETF to similar ETFs tracking the DJIA to ensure you're getting competitive pricing.

- Low-cost access to the DJIA: Gain exposure to the DJIA without the high fees associated with directly investing in individual stocks.

- Transparent and regulated investment vehicle: Benefit from the regulatory oversight and transparency provided by the UCITS framework.

- Diversification across 30 leading US companies: Reduce risk by investing in a basket of established US blue-chip companies.

- Suitable for long-term investment strategies: The Amundi DJIA UCITS ETF is ideally suited for investors with a long-term investment horizon seeking exposure to the US equity market.

Daily NAV Updates and Where to Find Them

Monitoring the daily NAV of the Amundi DJIA UCITS ETF is crucial for tracking its performance and making informed investment decisions. The NAV reflects the net asset value of the ETF per share at the close of the trading day. Regularly checking the NAV allows you to gauge the ETF's performance relative to the DJIA and to understand the impact of market fluctuations.

Reliable sources for obtaining daily NAV updates include:

- The Amundi website: The official Amundi website provides up-to-date information on the ETF's NAV and other key performance indicators.

- Financial news sources: Major financial news websites and platforms usually provide real-time or end-of-day NAV data for various ETFs, including the Amundi DJIA UCITS ETF.

- Brokerage platforms: If you hold the ETF through a brokerage account, your platform will typically provide access to real-time or historical NAV data.

Interpreting NAV data involves comparing the daily NAV to previous days' NAVs to track performance and understanding the reasons behind any significant changes. This can help in making informed buy/sell decisions. Consider setting up alerts for significant NAV changes, enabling you to react promptly to market events.

- Regular NAV checks help track performance: Monitor the ETF's growth and compare it to your investment goals.

- Understand market fluctuations' impact on the ETF's value: Analyze how market events affect the NAV and your investment.

- Use NAV data for buy/sell decisions (within a defined investment strategy): Inform your investment decisions based on market trends reflected in the NAV.

- Consider using automated alerts for significant NAV changes: Stay informed and react swiftly to notable market shifts.

Investment Strategies using the Amundi DJIA UCITS ETF

Several investment strategies can be employed effectively with the Amundi DJIA UCITS ETF.

Long-Term Buy-and-Hold Strategy

A long-term buy-and-hold strategy involves purchasing the Amundi DJIA UCITS ETF and holding it for an extended period, regardless of short-term market fluctuations. This strategy leverages the historical performance of the DJIA, which has shown consistent long-term growth.

- Minimizes transaction costs: Reduces brokerage fees associated with frequent buying and selling.

- Benefits from long-term market growth: Captures the potential for long-term capital appreciation.

- Suitable for risk-tolerant investors: Requires patience and acceptance of potential short-term market downturns.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the ETF's price. This strategy mitigates the risk of investing a lump sum at a market high.

- Reduces the impact of market volatility: Averaging the purchase price over time reduces the risk of buying high.

- Suitable for investors with consistent savings: Requires a disciplined approach to regular investment.

- Less susceptible to market timing risks: Eliminates the need to predict market peaks and troughs.

Strategic Asset Allocation

Strategic asset allocation involves integrating the Amundi DJIA UCITS ETF into a diversified portfolio that includes other asset classes such as bonds, real estate, and alternative investments. This diversification strategy reduces overall portfolio risk.

- Reduces portfolio volatility: Diversification minimizes the impact of poor performance in any single asset class.

- Improves risk-adjusted returns: Maximizes returns while mitigating overall risk.

- Requires understanding of different asset classes and their correlations: Requires research and understanding of asset class relationships.

Risks Associated with Investing in the Amundi DJIA UCITS ETF

Investing in the Amundi DJIA UCITS ETF, like any equity investment, carries inherent risks.

- Market risk – potential for loss of capital: The value of the ETF can fluctuate significantly, leading to potential capital losses.

- US market specific risks (e.g., economic downturns): The ETF's performance is directly tied to the US economy, making it susceptible to economic downturns.

- Currency risk (if applicable): If investing in a currency other than the USD, fluctuations in exchange rates can impact returns.

- No guarantee of returns: Past performance is not indicative of future results.

Conclusion

The Amundi DJIA UCITS ETF provides accessible exposure to the prestigious Dow Jones Industrial Average. By understanding daily NAV updates and employing appropriate investment strategies such as buy-and-hold, dollar-cost averaging, and strategic asset allocation, you can effectively manage your investment in this ETF. Remember to carefully consider the risks involved and align your strategy with your personal financial goals and risk tolerance. Start exploring the potential of the Amundi DJIA UCITS ETF today and make informed investment decisions. Learn more about daily NAV updates and the Amundi DJIA UCITS ETF investment strategies available to you!

Featured Posts

-

Chto Udalos Nashemu Pokoleniyu Analiz Uspekhov I Neudach

May 25, 2025

Chto Udalos Nashemu Pokoleniyu Analiz Uspekhov I Neudach

May 25, 2025 -

Avrupa Piyasalari Ecb Faiz Kararinin Piyasa Uezerindeki Etkisi

May 25, 2025

Avrupa Piyasalari Ecb Faiz Kararinin Piyasa Uezerindeki Etkisi

May 25, 2025 -

Avoid Crowds Smart Travel Tips For Memorial Day Flights 2025

May 25, 2025

Avoid Crowds Smart Travel Tips For Memorial Day Flights 2025

May 25, 2025 -

Bbc Radio 1 Big Weekend How To Secure Your Tickets

May 25, 2025

Bbc Radio 1 Big Weekend How To Secure Your Tickets

May 25, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktbeweging

May 25, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktbeweging

May 25, 2025

Latest Posts

-

Pilbara Iron Ore Mining Rio Tintos Sustainability Efforts And Addressing Criticism

May 25, 2025

Pilbara Iron Ore Mining Rio Tintos Sustainability Efforts And Addressing Criticism

May 25, 2025 -

Uk Inflation Slows Boe Rate Cut Expectations Diminish Pound Rises

May 25, 2025

Uk Inflation Slows Boe Rate Cut Expectations Diminish Pound Rises

May 25, 2025 -

Los Angeles Wildfires Exploring The Ethics Of Disaster Gambling

May 25, 2025

Los Angeles Wildfires Exploring The Ethics Of Disaster Gambling

May 25, 2025 -

Traders Pare Bets On Boe Cuts Pound Strengthens After Uk Inflation Data

May 25, 2025

Traders Pare Bets On Boe Cuts Pound Strengthens After Uk Inflation Data

May 25, 2025 -

2002 Submarine Bribery Scandal French Prosecutors Name Malaysias Ex Pm Najib

May 25, 2025

2002 Submarine Bribery Scandal French Prosecutors Name Malaysias Ex Pm Najib

May 25, 2025