Euronext Amsterdam Sees 8% Stock Increase: Impact Of Trump's Tariff Halt

Table of Contents

Understanding the Tariff Halt and its Immediate Impact on Euronext Amsterdam

The ongoing trade dispute between the US and the EU has created significant uncertainty in global markets. For years, tensions simmered over various trade issues, culminating in the threat and imposition of tariffs on billions of dollars worth of goods. President Trump's decision to halt new tariffs, while not entirely resolving the trade war, offered a much-needed respite.

-

The Context: The trade dispute involved retaliatory tariffs imposed by both sides, impacting numerous industries. These tariffs created significant uncertainty for businesses operating across the Atlantic, hindering investment and economic growth.

-

Specific Tariffs Halted: The specific tariffs halted varied but notably included those targeting key European industries such as aerospace and automotive. These sectors are major players on Euronext Amsterdam.

-

Immediate Market Reaction: The news of the tariff halt was met with immediate and enthusiastic buying, resulting in the dramatic 8% jump on Euronext Amsterdam. This sharp increase showcases the market's sensitivity to trade policy shifts.

-

Investor Sentiment: Investor confidence, previously dampened by trade war anxieties, experienced a significant boost. Speculation that this might signal a broader de-escalation in trade tensions further fueled the stock market increase. The Euronext Amsterdam reacted particularly strongly, possibly due to the high concentration of companies heavily impacted by US-EU trade relations.

Sector-Specific Analysis: Which Industries Benefited Most?

The 8% increase on Euronext Amsterdam wasn't uniform across all sectors. Some experienced considerably higher gains than others, highlighting the varying degrees of exposure to US tariffs.

-

Automotive and Aerospace: These sectors, significantly impacted by previous tariff threats, saw some of the most substantial gains. The removal of the threat of further tariffs directly benefited these export-oriented industries.

-

Other Beneficiaries: Companies involved in luxury goods and other consumer products that faced potential import taxes also experienced strong growth.

-

Reasons for Strong Growth: The increased optimism surrounding the potential for improved trade relations and a reduction in operating costs significantly boosted investor confidence in these sectors. The Euronext Amsterdam clearly reflected this shift in sentiment.

-

Continued Growth Potential: Although the tariff halt is positive, the long-term outlook remains contingent on the continued de-escalation of trade tensions. Ongoing uncertainties in the global trade landscape warrant caution, despite the promising short-term gains.

Long-Term Implications for Euronext Amsterdam and European Markets

While the immediate impact of the tariff halt is positive, the long-term implications are complex and require careful consideration.

-

Impact on the European Economy: The halt could contribute to a more positive economic outlook for Europe, boosting investment and potentially increasing GDP growth. However, the full extent of this impact remains to be seen.

-

Lingering Uncertainties: The US-EU trade relationship remains fragile. Future shifts in trade policy could quickly reverse the positive momentum witnessed on Euronext Amsterdam. Geopolitical factors continue to influence investor sentiment.

-

Risks and Opportunities: Investors in Euronext Amsterdam face both risks and opportunities. While the short-term gains are attractive, it's crucial to consider potential future volatility. Careful risk assessment and diversification are essential.

-

Geopolitical Factors: Beyond US-EU relations, broader global geopolitical events could impact the Euronext Amsterdam and European markets in general, underscoring the need for ongoing market monitoring.

Investing in Euronext Amsterdam After the Tariff Halt: Opportunities and Risks

The recent surge on Euronext Amsterdam presents both opportunities and risks for investors.

-

Risk Assessment: Thorough due diligence, including understanding a company's specific exposure to global trade uncertainties, is crucial. Analyzing financial statements and market trends can help in evaluating investment risks.

-

Diversification Strategies: Diversifying your investment portfolio across various sectors and asset classes is key to mitigating risk. Relying solely on Euronext Amsterdam stocks post-tariff halt may prove overly risky.

-

Potential for Further Growth: Despite the uncertainties, the potential for further growth in the Euronext Amsterdam market remains, particularly within sectors that have demonstrated resilience in the face of trade tensions.

-

Stock Market Analysis: Ongoing analysis of market trends and economic indicators is crucial for making informed investment decisions. Staying informed about any changes in trade policy or geopolitical developments is essential for navigating the market.

Conclusion

The 8% stock increase on Euronext Amsterdam following Trump's decision to halt new tariffs underscores the significant impact of trade policy on global markets. While the long-term implications remain uncertain, the immediate market reaction reveals a positive sentiment towards the potential for improved EU-US trade relations. Specific sectors benefited disproportionately, offering opportunities for investors who carefully assess the risks. However, diversification and careful analysis are crucial in navigating the complexities of the Euronext Amsterdam market.

Call to Action: Stay informed on the evolving situation in the Euronext Amsterdam market and learn how to capitalize on potential investment opportunities in the wake of this significant shift in trade relations. Monitor the Euronext Amsterdam index for updates and consider adjusting your investment strategy to capitalize on this dynamic market. Understanding the interplay between trade policy and stock market performance is essential for navigating the complexities of investing in Euronext Amsterdam.

Featured Posts

-

Atfaq Tjary Amryky Syny Ydfe Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 25, 2025

Atfaq Tjary Amryky Syny Ydfe Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 25, 2025 -

Exploring The Four Marriages Of Frank Sinatra

May 25, 2025

Exploring The Four Marriages Of Frank Sinatra

May 25, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Securing Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

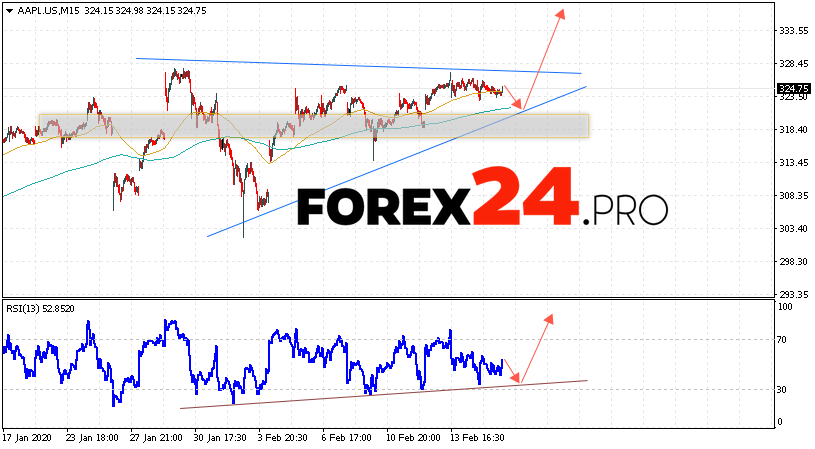

Apple Stock Forecast Q2 Report And Crucial Price Levels

May 25, 2025

Apple Stock Forecast Q2 Report And Crucial Price Levels

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Latest Posts

-

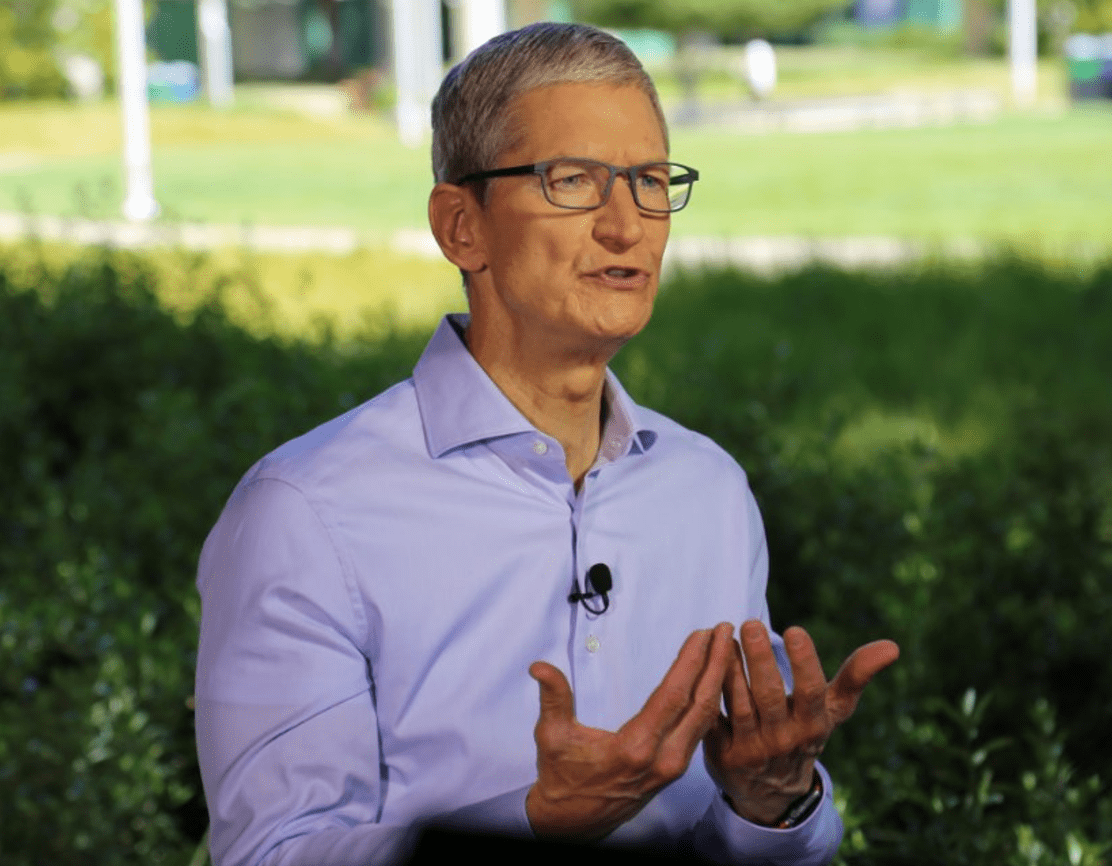

Assessing Tim Cooks Performance As Apple Ceo Amidst Recent Difficulties

May 25, 2025

Assessing Tim Cooks Performance As Apple Ceo Amidst Recent Difficulties

May 25, 2025 -

The Black Lives Matter Plaza From Renaming To Removal

May 25, 2025

The Black Lives Matter Plaza From Renaming To Removal

May 25, 2025 -

Evidence Of Cremation From A Sixth Century Vessel Unearthed At Sutton Hoo

May 25, 2025

Evidence Of Cremation From A Sixth Century Vessel Unearthed At Sutton Hoo

May 25, 2025 -

Trumps Anger Towards Europe A Deep Dive Into His Trade Policies

May 25, 2025

Trumps Anger Towards Europe A Deep Dive Into His Trade Policies

May 25, 2025 -

Apple Stock And Tim Cooks Leadership A 2023 Assessment

May 25, 2025

Apple Stock And Tim Cooks Leadership A 2023 Assessment

May 25, 2025