Apple Stock Forecast: Q2 Report And Crucial Price Levels

Table of Contents

Q2 Earnings Expectations and Market Sentiment

The upcoming Apple Q2 report will be a key indicator of the company's health and future prospects. Analyst predictions and recent market trends offer valuable clues for predicting Apple stock price movements.

Revenue Projections

Analysts' estimates for Apple's Q2 revenue vary, but most predict continued growth, albeit perhaps at a slower pace than previous quarters. Several factors contribute to these projections:

- Estimates from reputable analysts: Leading financial institutions like Goldman Sachs, Morgan Stanley, and JP Morgan have released their Apple stock predictions, with revenue forecasts ranging from [Insert range of realistic revenue estimates].

- Potential impact of iPhone sales: iPhone sales remain a cornerstone of Apple's revenue. Predictions for iPhone 14 sales and potential demand for a new iPhone model will heavily influence the overall Q2 revenue.

- Services revenue growth: Apple's services segment (including App Store, Apple Music, iCloud) continues to demonstrate robust growth. Sustained growth in this area will be crucial for mitigating any potential slowdown in hardware sales.

- Impact of supply chain issues: While supply chain issues have eased compared to previous years, any lingering disruptions could affect production and revenue.

Profitability Analysis

Analyzing Apple's profitability requires examining gross margin expectations and potential pressures on operating expenses.

- Gross margin expectations: Analysts generally expect Apple to maintain healthy gross margins, reflecting the premium pricing of its products and strong brand loyalty. However, fluctuations in component costs and currency exchange rates could impact this.

- Operating expenses: Research and development spending, along with marketing and sales expenses, will influence profitability. Increased investment in new technologies could temporarily pressure margins.

- Impact of currency fluctuations: As a global company, Apple is vulnerable to currency fluctuations. A stronger US dollar could negatively impact revenue reported in other currencies.

Market Sentiment and Investor Confidence

Market sentiment surrounding Apple stock significantly impacts its price.

- Recent news and events impacting Apple's image: Any negative publicity, regulatory scrutiny, or product recalls could negatively affect investor confidence.

- Competitor performance: The performance of key competitors such as Samsung and Google influences Apple's market share and investor perception.

- Overall market conditions: Broader economic factors, including interest rate hikes and inflation, can influence investor risk appetite and overall market performance, thus affecting Apple stock price.

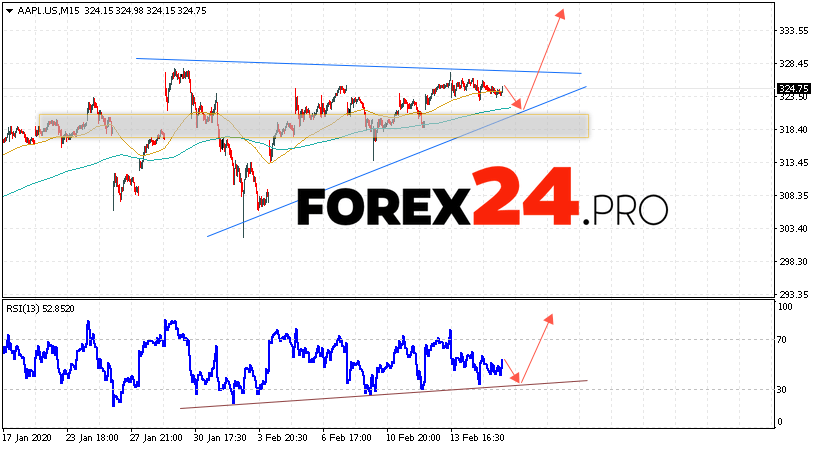

Crucial Price Levels to Watch

Technical analysis helps identify key support and resistance levels that could dictate Apple stock price movements.

Support Levels

These are price levels where buying pressure is expected to outweigh selling pressure, potentially preventing a significant price drop.

- Technical analysis of past support levels: Historical price charts reveal previous support levels that could act as barriers to further declines.

- Volume analysis at these levels: High trading volume at support levels indicates strong investor interest, reinforcing the potential for a bounce.

- Potential bounce-back scenarios: If the Apple stock price falls to a key support level, a rebound is possible, offering a potential buying opportunity.

Resistance Levels

These are price levels where selling pressure could overwhelm buying pressure, hindering further price increases.

- Technical analysis of past resistance levels: Identifying previous resistance levels on price charts helps predict potential hurdles for future price increases.

- Volume analysis at these levels: High volume at resistance levels suggests significant selling pressure, potentially capping price gains.

- Potential breakout scenarios: A decisive break above a key resistance level could signal a strong upward trend for Apple stock price.

Moving Averages and Indicators

Technical indicators like moving averages and Relative Strength Index (RSI) provide further insights.

- Interpretation of moving average crossovers: Crossovers of short-term (e.g., 50-day) and long-term (e.g., 200-day) moving averages can signal potential trend changes.

- Use of RSI, MACD, or other relevant indicators: These indicators provide supplementary information about momentum and potential overbought or oversold conditions.

Factors Influencing Apple Stock Forecast

Several factors beyond the Q2 report itself significantly influence Apple stock predictions.

Product Launches and Innovation

New product releases and upcoming innovations are crucial drivers of Apple stock performance.

- Anticipation for new iPhones: The launch of new iPhone models typically generates significant excitement and demand, impacting Apple stock price.

- Potential impact of new services: The expansion of Apple's services portfolio, such as new subscriptions or features, can boost revenue and attract investors.

- Influence of AR/VR advancements: Apple's potential entry into the augmented reality (AR) and virtual reality (VR) markets could be a major catalyst for future growth.

Global Economic Conditions

Macroeconomic factors heavily influence Apple's performance and investor sentiment.

- Inflation: High inflation can reduce consumer spending and affect demand for Apple's products.

- Interest rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and affecting Apple's sales.

- Global supply chain disruptions: Geopolitical instability or unforeseen events can disrupt global supply chains, impacting Apple's production and delivery timelines.

- Geopolitical risks: International conflicts and political uncertainty create economic volatility that can negatively impact stock markets.

Competition and Market Share

The competitive landscape and Apple's market share influence its stock price.

- Performance of major competitors: The success of competitors like Samsung and Google in key product categories impacts Apple's market share and growth potential.

- Market share trends in key product categories: Monitoring Apple's market share in smartphones, tablets, and wearables provides insights into its competitive strength.

Conclusion

The Apple Q2 report will provide crucial data for assessing Apple stock's short-term trajectory. However, the forecast also hinges on broader market sentiment, crucial price levels, and long-term growth drivers like product innovation and global economic conditions. Remember to carefully consider the support and resistance levels discussed, alongside the influence of moving averages and other technical indicators. Analyzing these factors is essential for formulating an informed Apple stock prediction.

Call to Action: Stay informed about the upcoming Apple Q2 report and continue monitoring these crucial price levels to make informed decisions regarding your Apple stock investments. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to Apple stock or other investments. Remember, this Apple stock forecast is for informational purposes only and should not be considered financial advice.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Implications For The Gaming Industry

May 25, 2025

Ftc Appeals Activision Blizzard Acquisition Implications For The Gaming Industry

May 25, 2025 -

Frankfurt Equities Opening Dax Continues Record Breaking Ascent

May 25, 2025

Frankfurt Equities Opening Dax Continues Record Breaking Ascent

May 25, 2025 -

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 25, 2025

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

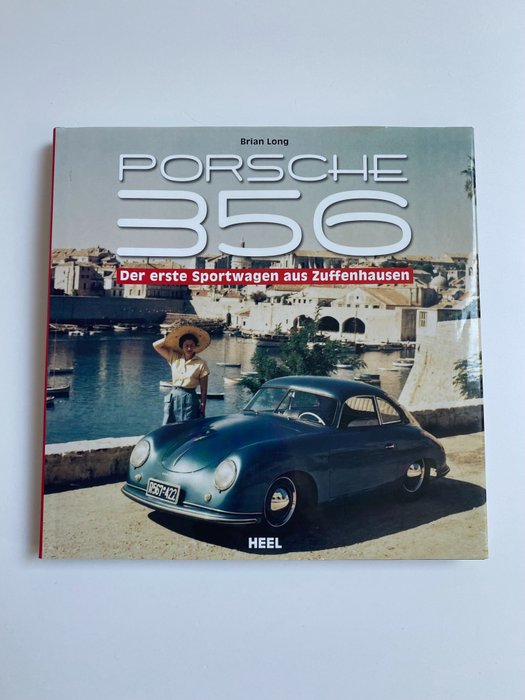

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Latest Posts

-

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025 -

Urgent Flash Flood Warning Active For Cayuga County Until Tuesday

May 25, 2025

Urgent Flash Flood Warning Active For Cayuga County Until Tuesday

May 25, 2025 -

Cayuga County Flash Flood Warning Extended Through Tuesday

May 25, 2025

Cayuga County Flash Flood Warning Extended Through Tuesday

May 25, 2025 -

Flood Warning This Morning Key Safety Advice From The Nws

May 25, 2025

Flood Warning This Morning Key Safety Advice From The Nws

May 25, 2025 -

Urgent Flood Warning Heed These Safety Guidelines From Nws

May 25, 2025

Urgent Flood Warning Heed These Safety Guidelines From Nws

May 25, 2025