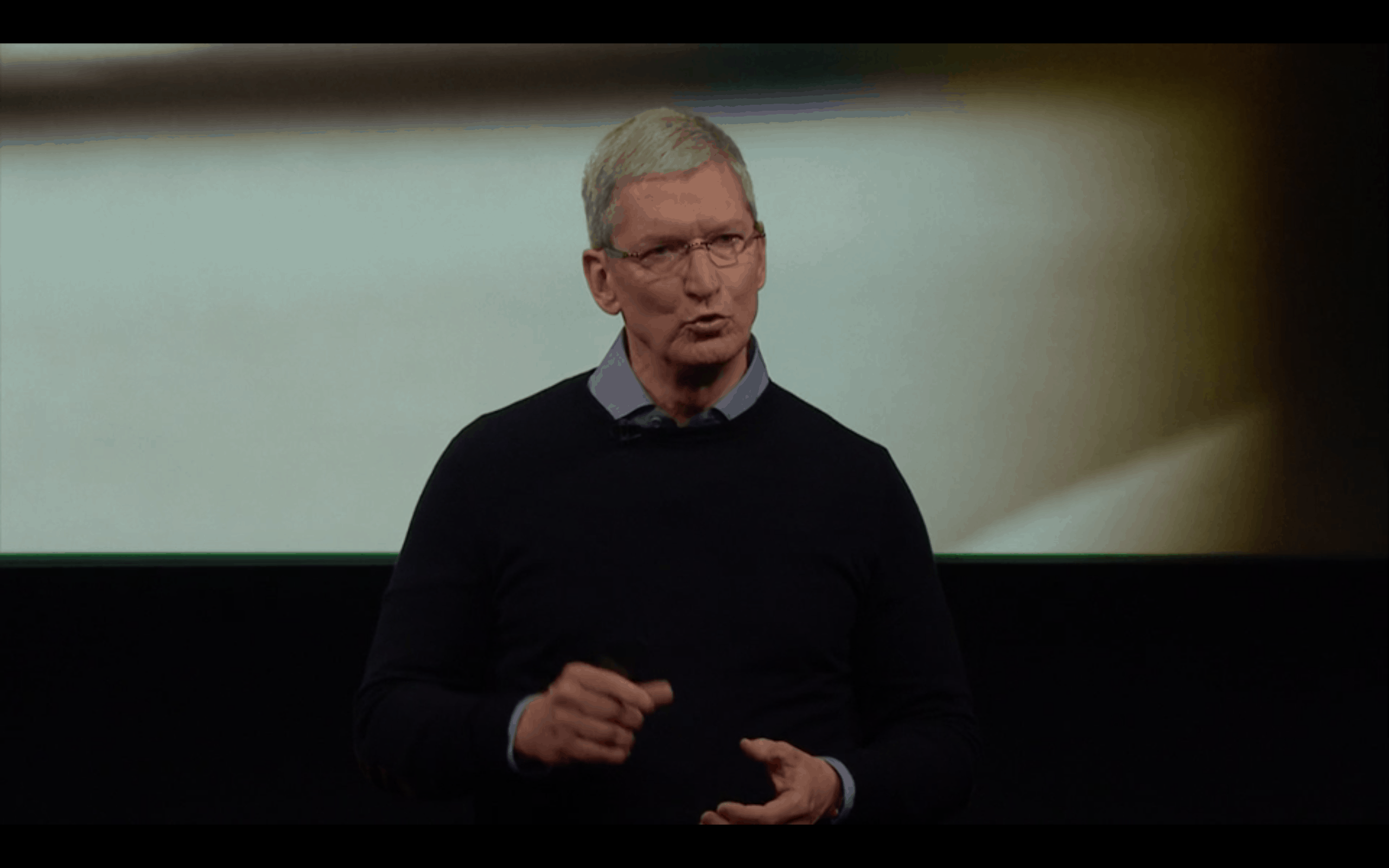

Apple Stock And Tim Cook's Leadership: A 2023 Assessment

Table of Contents

Tim Cook's Leadership Style and its Impact on Apple Stock

Tim Cook's leadership style has profoundly impacted Apple's financial success and, consequently, its stock price. His approach, characterized by a focus on long-term strategies and operational efficiency, has been instrumental in sustaining Apple's growth.

Strategic Vision and Long-Term Planning

Cook's strategic vision extends beyond the immediate product cycle. He has prioritized long-term growth strategies that have significantly boosted Apple's valuation. This strategic approach is evident in several key areas:

- Apple Services Expansion: The aggressive growth of Apple Services, encompassing Apple Music, iCloud, Apple TV+, and more, has created a recurring revenue stream, mitigating reliance on hardware sales alone. This diversification has provided stability and predictable growth, positively impacting Apple stock.

- Wearables Market Dominance: Apple's expansion into the wearables market with the Apple Watch and AirPods has proven remarkably successful. These products have tapped into a growing consumer demand for connected devices, contributing significantly to revenue growth and bolstering investor confidence in Apple stock.

Data Points: Apple Services revenue consistently shows year-over-year growth, exceeding expectations. The wearables segment has become a significant revenue contributor, further diversifying Apple's income streams and enhancing its overall financial stability, directly reflected in a sustained and strong Apple stock performance.

Operational Efficiency and Cost Management

Cook's emphasis on operational excellence and cost management has translated into improved profitability and higher shareholder returns. His focus on efficiency has streamlined Apple's operations, maximizing profit margins and minimizing waste.

- Supply Chain Optimization: Apple's supply chain management has been meticulously refined under Cook's leadership, leading to improved efficiency and reduced production costs. This contributes to higher profit margins and ultimately, a healthier Apple stock price.

- Internal Process Improvements: Internal process improvements have been implemented across the board, maximizing efficiency and minimizing redundancies. These improvements contribute directly to enhanced profitability and strong Apple stock performance.

Data Points: Apple’s consistently high profit margins and strong return on investment (ROI) demonstrate the effectiveness of Cook's operational strategies. These metrics directly contribute to a higher valuation for Apple stock.

Apple's 2023 Product Performance and its Stock Price Correlation

The success of Apple's 2023 product releases has directly correlated with the performance of its stock. While challenges exist, the overall impact on Apple stock has been largely positive.

Successes and Market Reception

The launch of new iPhones, particularly the iPhone 14 series, met with strong market reception, boosting sales and reinforcing Apple's position in the premium smartphone segment. Other successful launches in 2023 include updated iPad models and MacBook Pros.

- iPhone 14 Series Sales: Strong initial sales figures for the iPhone 14 series demonstrated continued demand for Apple's flagship products, contributing positively to Apple stock performance.

- MacBook Pro and iPad Updates: The updated MacBook Pro models and iPad Pro devices continued to receive positive reviews, indicating continued innovation and product strength.

Data Points: Sales figures for the iPhone 14 surpassed expectations in many markets, demonstrating the continued strength of the brand and its influence on Apple stock.

Challenges and Market Competition

Despite successes, Apple faced challenges in 2023. Increased competition from Android manufacturers, particularly in the mid-range segment, presented a challenge to maintaining market share. Supply chain disruptions, though less severe than in previous years, also impacted production and sales.

- Increased Competition: The competitive landscape continues to evolve, with Android manufacturers launching increasingly competitive devices, putting some pressure on Apple's market share in certain segments.

- Supply Chain Issues: While less impactful than in previous years, lingering supply chain disruptions have periodically affected production levels and delivery timelines.

Data Points: While market share data may show minor fluctuations due to competition, Apple maintains a strong position, and the overall impact on Apple stock has been limited compared to the positive influence of product launches.

The Future of Apple Stock Under Tim Cook's Continued Leadership

The future of Apple stock under Tim Cook's leadership appears bright, driven by significant growth opportunities, while potential risks remain.

Growth Opportunities

Apple possesses significant growth potential in several key areas:

- Augmented Reality (AR) and the Metaverse: Apple is rumored to be heavily investing in AR/VR technology, a potential game-changer with substantial growth potential, positively impacting Apple stock.

- Expansion of Services: Continued expansion and innovation in Apple Services will remain a vital engine of revenue growth, providing further diversification and strengthening the long-term outlook for Apple stock.

Data Points: Market research forecasts indicate significant growth in the AR/VR market, positioning Apple to capitalize on this emerging technology. Continued growth in Apple Services revenue is expected to contribute to overall company profitability.

Potential Risks and Challenges

Despite a positive outlook, several factors could pose challenges:

- Economic Slowdown: A potential global economic slowdown could affect consumer spending, impacting demand for Apple products.

- Geopolitical Uncertainty: Geopolitical instability and trade tensions could disrupt supply chains and affect production.

- Regulatory Scrutiny: Increased regulatory scrutiny concerning antitrust and data privacy could impact Apple's operations and financial performance.

Data Points: Economic forecasts and geopolitical risk assessments are key factors influencing the outlook for Apple stock. Market analysts closely track regulatory developments impacting the tech sector.

Conclusion

This assessment of Apple Stock and Tim Cook's leadership in 2023 reveals a complex picture. While Cook's strategic vision and operational efficiency have contributed significantly to Apple's success, challenges related to competition and macroeconomic factors remain. The strength of Apple's brand, its innovative product pipeline, and the diversification driven by Apple Services all suggest a positive outlook for Apple stock in the coming years. However, understanding the potential risks is crucial.

Key Takeaways: Tim Cook's leadership has been instrumental in Apple's continued success. Apple's strong product lineup and strategic expansion into services create a positive outlook for Apple stock. However, external factors such as economic conditions and geopolitical events could influence future performance.

Call to Action: Stay informed on the future of Apple stock and Tim Cook's leadership by following reputable financial news sources and conducting your own thorough research. Understanding the interplay between Apple's product innovation, market positioning, and broader economic trends is key to a comprehensive assessment of Apple stock and Tim Cook's continuing impact.

Featured Posts

-

Escape To The Country Tips For A Smooth Relocation

May 25, 2025

Escape To The Country Tips For A Smooth Relocation

May 25, 2025 -

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

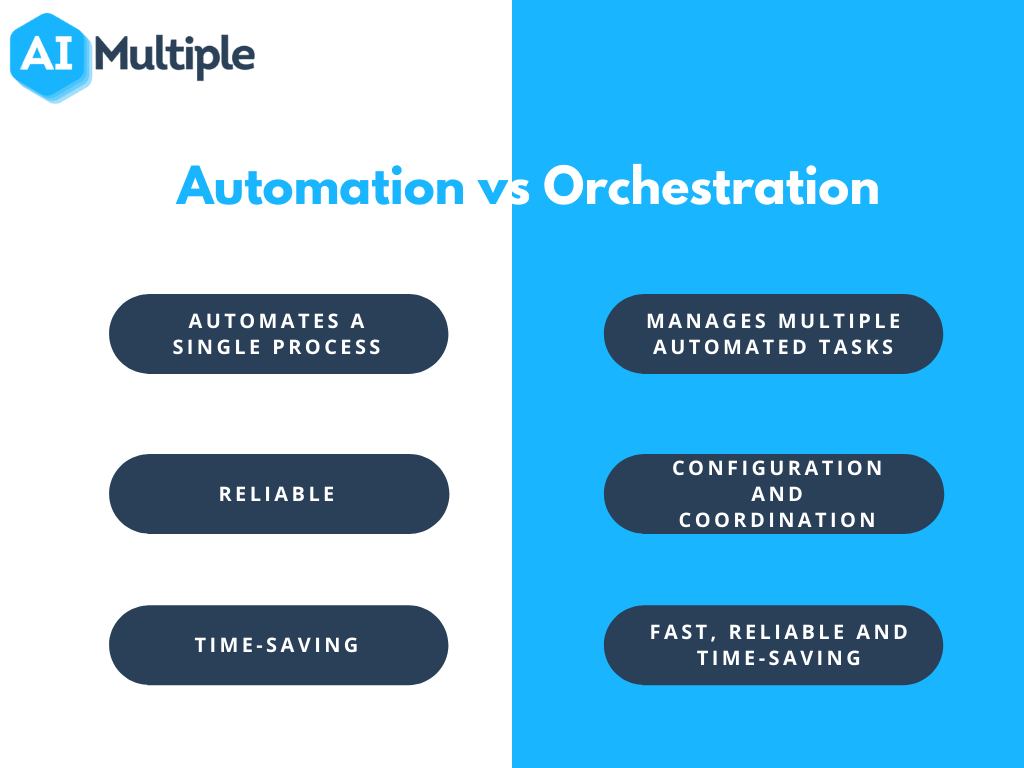

Camunda Con 2025 Amsterdam Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025

Camunda Con 2025 Amsterdam Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025 -

The Nvidia Rtx 5060 Launch Lessons For Gamers And Reviewers

May 25, 2025

The Nvidia Rtx 5060 Launch Lessons For Gamers And Reviewers

May 25, 2025 -

Onzekere Amerikaanse Beurs Aex Toont Veerkracht Een Diepgaande Analyse

May 25, 2025

Onzekere Amerikaanse Beurs Aex Toont Veerkracht Een Diepgaande Analyse

May 25, 2025

Latest Posts

-

Michael Schumacher And His Rivals A Complex Dynamic In F1

May 25, 2025

Michael Schumacher And His Rivals A Complex Dynamic In F1

May 25, 2025 -

The Schumacher Legacy A Critical Look At His Relationships With Fellow Drivers

May 25, 2025

The Schumacher Legacy A Critical Look At His Relationships With Fellow Drivers

May 25, 2025 -

Le Clash Ardisson Baffie Retour Sur Une Replique Memorable

May 25, 2025

Le Clash Ardisson Baffie Retour Sur Une Replique Memorable

May 25, 2025 -

Was Michael Schumacher Unfair To Other Drivers Examining The Evidence

May 25, 2025

Was Michael Schumacher Unfair To Other Drivers Examining The Evidence

May 25, 2025 -

Ardisson Vs Baffie L Echange Tendu Qui A Marque Le Plateau

May 25, 2025

Ardisson Vs Baffie L Echange Tendu Qui A Marque Le Plateau

May 25, 2025