Ethereum Buy Signal: Weekly Chart And Price Implications

Table of Contents

Analyzing the Ethereum Weekly Chart

The Ethereum weekly chart provides a valuable long-term perspective on ETH price movements, allowing us to identify significant trends and potential turning points. Let's examine several key indicators to assess the current situation.

Key Support and Resistance Levels

Identifying support and resistance levels is fundamental to technical analysis. These levels represent price points where buying or selling pressure is historically strong, potentially influencing future price action.

- $1,800: This level has acted as robust support on multiple occasions in the past, indicating strong buyer interest at this price point. A break below this level could signal further downside, while holding above it suggests strength.

- $2,000: A break above $2,000 would represent a significant bullish breakout, potentially triggering further upward momentum. This level has acted as resistance in the past, but overcoming it suggests a shift in market sentiment.

- $2,500: This level could be a short-term price target if the bullish momentum continues after breaking through $2,000.

[Insert image/chart of Ethereum weekly chart highlighting $1800, $2000, and $2500 levels]

Moving Average Convergence Divergence (MACD)

The MACD is a momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend in a stock's price. It helps confirm price trends and potential reversals.

- Bullish Crossover: A bullish MACD crossover occurs when the MACD line crosses above the signal line, suggesting increasing buying pressure and potential upward price movement. This is a classic buy signal.

- Histogram Analysis: Analyzing the MACD histogram can provide further confirmation. An expanding positive histogram strengthens the bullish signal.

[Insert image/chart of Ethereum weekly chart showing the MACD indicator]

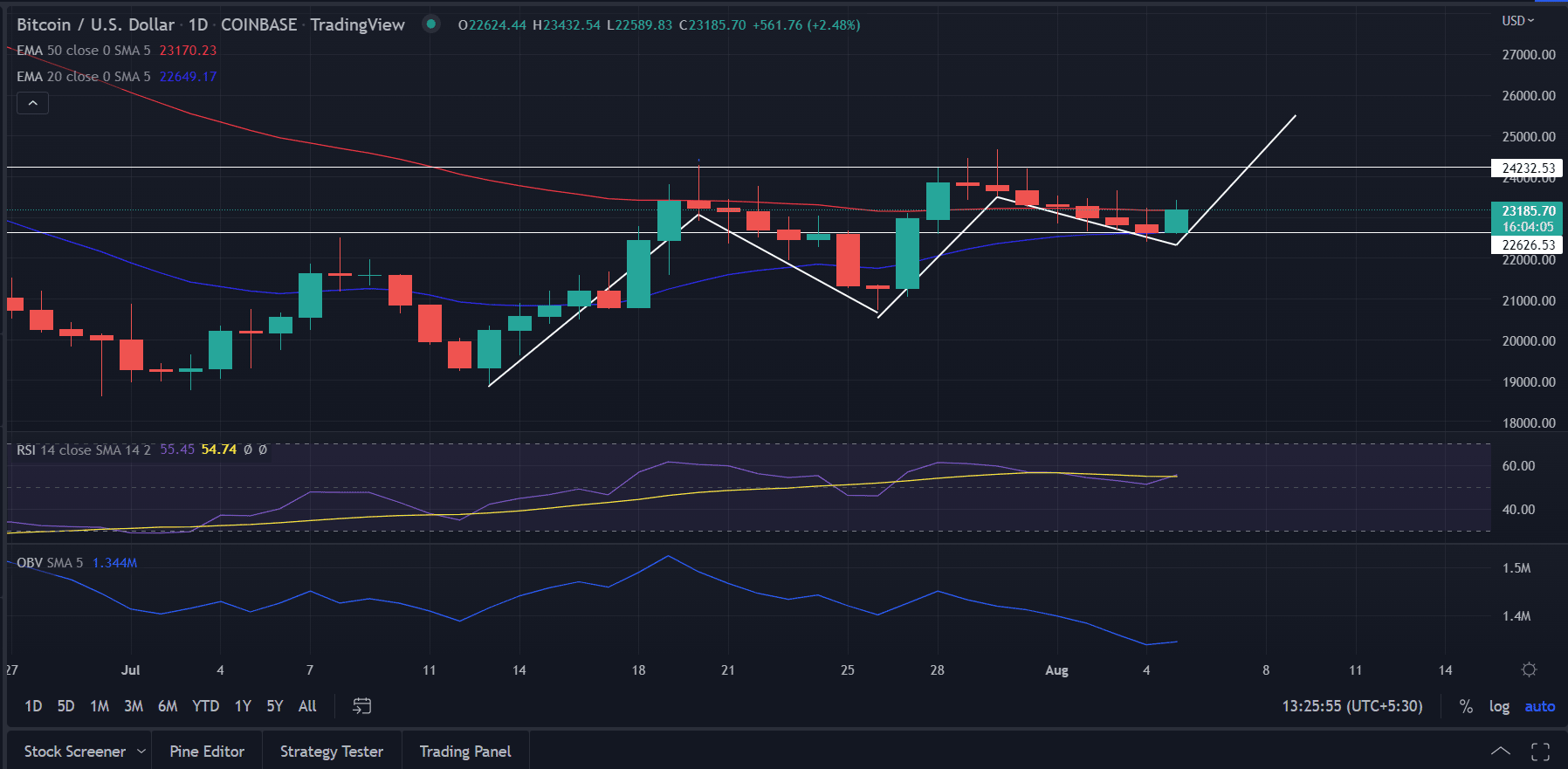

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. It helps gauge the speed and change of price movements.

- Oversold Condition: An RSI reading below 30 often signifies an oversold condition, potentially indicating a buying opportunity. However, it’s essential to consider other indicators before making any investment decisions based solely on RSI.

- Confirmation Needed: While an oversold RSI can be promising, it doesn't guarantee a price reversal. Confirmation from other indicators is crucial.

[Insert image/chart of Ethereum weekly chart showing the RSI indicator]

Volume Analysis

Volume analysis provides crucial context to price movements. High volume during a price increase confirms strong bullish momentum, while low volume suggests weak price action and potential vulnerability.

- Increasing Volume: Increasing volume accompanying price increases signifies strong buying pressure and supports the potential for sustained upward movement.

- Decreasing Volume: Conversely, decreasing volume during price increases raises concerns about the sustainability of the rally.

[Insert image/chart illustrating volume alongside price movement on the Ethereum weekly chart]

Price Implications of an Ethereum Buy Signal

Based on the analysis of the Ethereum weekly chart, several price implications emerge.

Potential Price Targets

- Short-Term Target: A successful break above $2,000 could propel ETH towards $2,500 in the short term.

- Long-Term Targets: Long-term price targets depend significantly on broader market conditions, technological advancements within the Ethereum ecosystem (e.g., Ethereum 2.0 upgrades), and overall crypto market sentiment. Positive developments could potentially push ETH considerably higher.

Risk Management Strategies

Cryptocurrency investment carries inherent risk. Employing effective risk management strategies is paramount.

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses. Setting a stop-loss order protects your investment if the price unexpectedly moves against your position.

- Diversification: Diversify your cryptocurrency portfolio across various assets to mitigate risk. Don't put all your eggs in one basket.

Factors Affecting Ethereum Price

Several external factors can impact Ethereum's price:

- Regulatory Changes: Clearer regulatory frameworks could positively influence investor confidence and Ethereum's price.

- Adoption Rates: Increased adoption by institutional investors and broader market acceptance will drive demand and price appreciation.

- Competitor Performance: The performance of competing blockchain platforms also influences Ethereum's market position and price.

Conclusion

Our analysis of the Ethereum weekly chart reveals several indicators suggesting a potential Ethereum buy signal. The confluence of a possible bullish MACD crossover, an RSI approaching oversold territory, and the potential for a break above key resistance levels warrants attention. However, remember that technical analysis is just one piece of the puzzle. Before making any investment decisions, carefully consider the volume analysis, potential price targets, and risk management strategies discussed. Remember, external factors can significantly influence the price. Thorough research and due diligence are crucial. While this analysis points to a potential Ethereum buy signal, it is vital to conduct your own comprehensive research and consult with a financial advisor before investing in any cryptocurrency. Continue to monitor the Ethereum weekly chart and other key indicators for further insights into potential Ethereum buy signals and price movements.

Featured Posts

-

Sermaye Ve Guevenlik Odakli Spk Nin Kripto Para Platformlarina Yoenelik Yeni Duezenlemesi

May 08, 2025

Sermaye Ve Guevenlik Odakli Spk Nin Kripto Para Platformlarina Yoenelik Yeni Duezenlemesi

May 08, 2025 -

Kendrick Raphael Decommits From Nc State What Went Wrong

May 08, 2025

Kendrick Raphael Decommits From Nc State What Went Wrong

May 08, 2025 -

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025 -

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025 -

Buy A Ps 5 Now Avoiding The Predicted Price Increase

May 08, 2025

Buy A Ps 5 Now Avoiding The Predicted Price Increase

May 08, 2025

Latest Posts

-

Is The Recent Bitcoin Price Rebound Sustainable Expert Predictions And Analysis

May 08, 2025

Is The Recent Bitcoin Price Rebound Sustainable Expert Predictions And Analysis

May 08, 2025 -

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025 -

Bitcoin Seoul 2025 The Future Of Cryptocurrency In Asia

May 08, 2025

Bitcoin Seoul 2025 The Future Of Cryptocurrency In Asia

May 08, 2025 -

Bitcoin Price Rebound Potential For Further Growth And Investment Opportunities

May 08, 2025

Bitcoin Price Rebound Potential For Further Growth And Investment Opportunities

May 08, 2025 -

Bitcoin Madenciligi Karliligini Kaybediyor Mu

May 08, 2025

Bitcoin Madenciligi Karliligini Kaybediyor Mu

May 08, 2025