Is The Recent Bitcoin Price Rebound Sustainable? Expert Predictions And Analysis

Table of Contents

Factors Contributing to the Recent Bitcoin Price Rebound

Several interconnected factors have contributed to the recent Bitcoin price rebound. Understanding these factors is crucial for assessing the sustainability of this upward movement.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin's price. The current inflationary environment, coupled with fears of a looming recession, has pushed some investors towards alternative assets like Bitcoin.

- Increased institutional investment in Bitcoin as a hedge against inflation: Major financial institutions are increasingly viewing Bitcoin as a store of value and a hedge against inflation, driving up demand.

- Flight to safety during economic uncertainty: During periods of economic uncertainty, investors often seek safe haven assets. Bitcoin, despite its volatility, has shown resilience and is increasingly considered a safe haven by some.

- Correlation (or lack thereof) with traditional stock markets: While some correlation exists, Bitcoin's price doesn't always mirror traditional stock market performance, offering diversification benefits to investors. This lack of perfect correlation is a key factor in its appeal as a portfolio diversifier.

The interplay of these macroeconomic factors suggests that Bitcoin's price can be influenced by global economic trends, making it vital to consider broader financial market conditions when predicting future Bitcoin price movements. The Bitcoin price, therefore, is intricately linked to global economic health.

Regulatory Developments

Regulatory clarity and developments significantly impact investor confidence and Bitcoin adoption. Positive regulatory announcements can boost prices, while uncertainty can lead to price drops.

- Positive regulatory developments in specific countries: Countries like El Salvador's adoption of Bitcoin as legal tender, and other nations' moves toward clearer regulatory frameworks, positively impact investor sentiment.

- Clarity on regulatory frameworks: A clear and well-defined regulatory framework can attract institutional investors who prefer regulatory certainty.

- Negative impacts of regulatory uncertainty: Conversely, regulatory uncertainty and unclear governmental policies can create hesitancy among investors, impacting the Bitcoin price negatively.

Analyzing regulatory developments across various jurisdictions is critical for understanding potential future price movements. Understanding Bitcoin regulation is key to predicting future price trends.

Technological Advancements

Technological improvements are enhancing Bitcoin's functionality and scalability, making it more attractive to a broader range of users and institutions.

- Improved transaction speed and lower fees: Layer-2 scaling solutions, like the Lightning Network, are addressing Bitcoin's scalability challenges, improving transaction speeds and reducing fees.

- Enhanced security and scalability: Ongoing development and improvements in Bitcoin's underlying technology enhance its security and scalability, further boosting its appeal.

- Increased accessibility for institutional investors: The development of institutional-grade custody solutions provides institutional investors with the necessary infrastructure to securely hold and manage their Bitcoin holdings. This increased accessibility plays a vital role in fueling institutional investment in Bitcoin.

These technological advancements are making Bitcoin a more robust and efficient system, contributing to its long-term viability and potential for price appreciation. Bitcoin scalability and security are key factors contributing to the recent price rebound.

Market Sentiment and Investor Behavior

Market sentiment, driven by factors like FOMO (fear of missing out) and speculation, significantly influences Bitcoin's price volatility.

- Analysis of social media sentiment: Social media sentiment analysis can offer insights into the prevailing market mood and investor expectations.

- Impact of whale activity on price fluctuations: Large Bitcoin holders ("whales") can significantly impact price fluctuations through their buying and selling activities.

- Shifts in investor confidence: Changes in overall investor confidence in the cryptocurrency market can trigger significant price movements.

Understanding investor behavior and market sentiment is crucial for analyzing the potential sustainability of the recent price increase. Bitcoin FOMO, driven by market sentiment, plays a significant role in the price's volatility.

Expert Predictions and Analysis

Analyzing expert opinions offers valuable insights into potential future price trajectories. However, remember that these are predictions, not guarantees.

Bullish Predictions

Many analysts predict continued Bitcoin price growth, citing factors like increased institutional adoption and macroeconomic uncertainty.

- Price targets: Some experts predict Bitcoin could reach significantly higher price targets in the coming years.

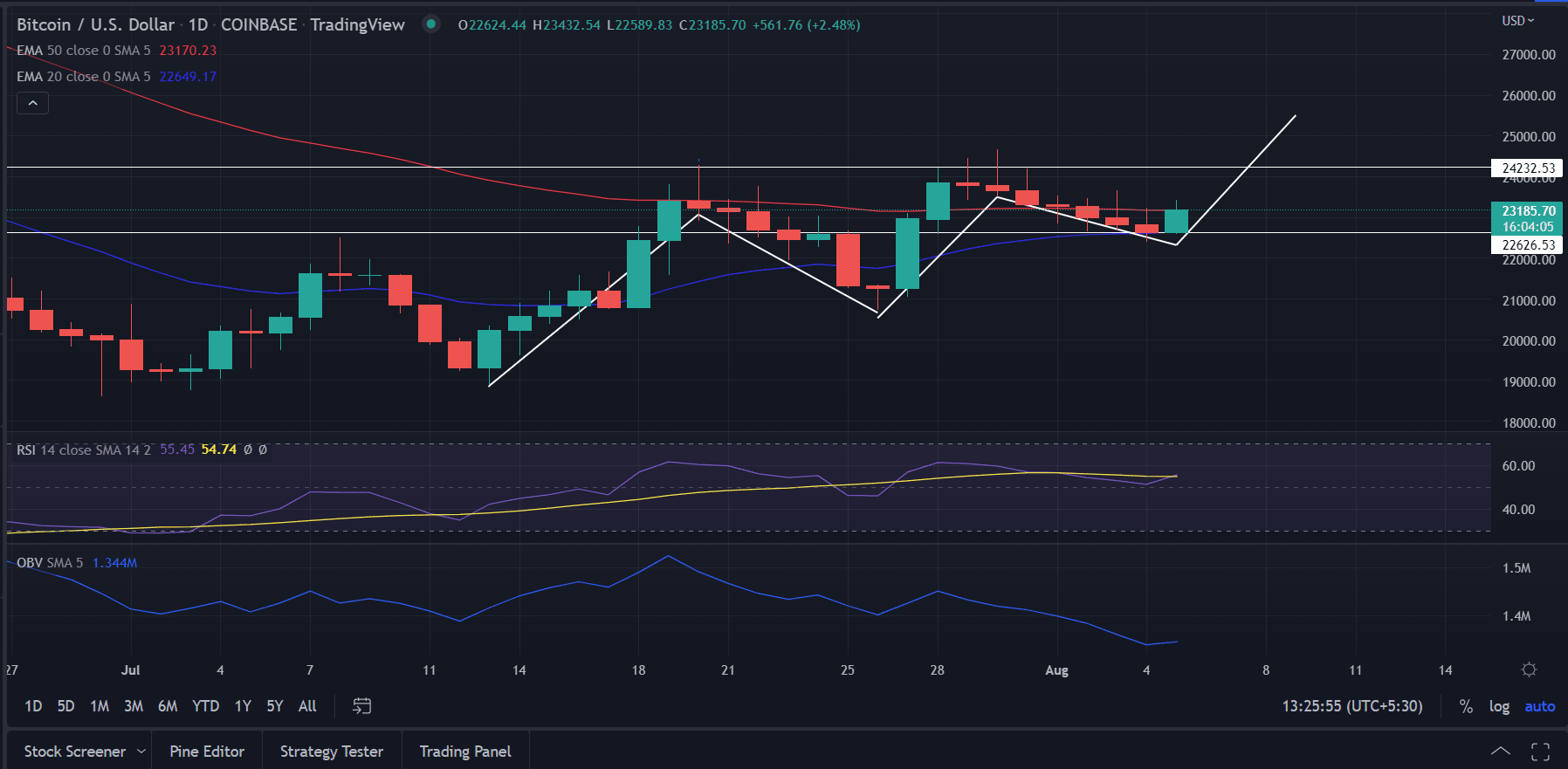

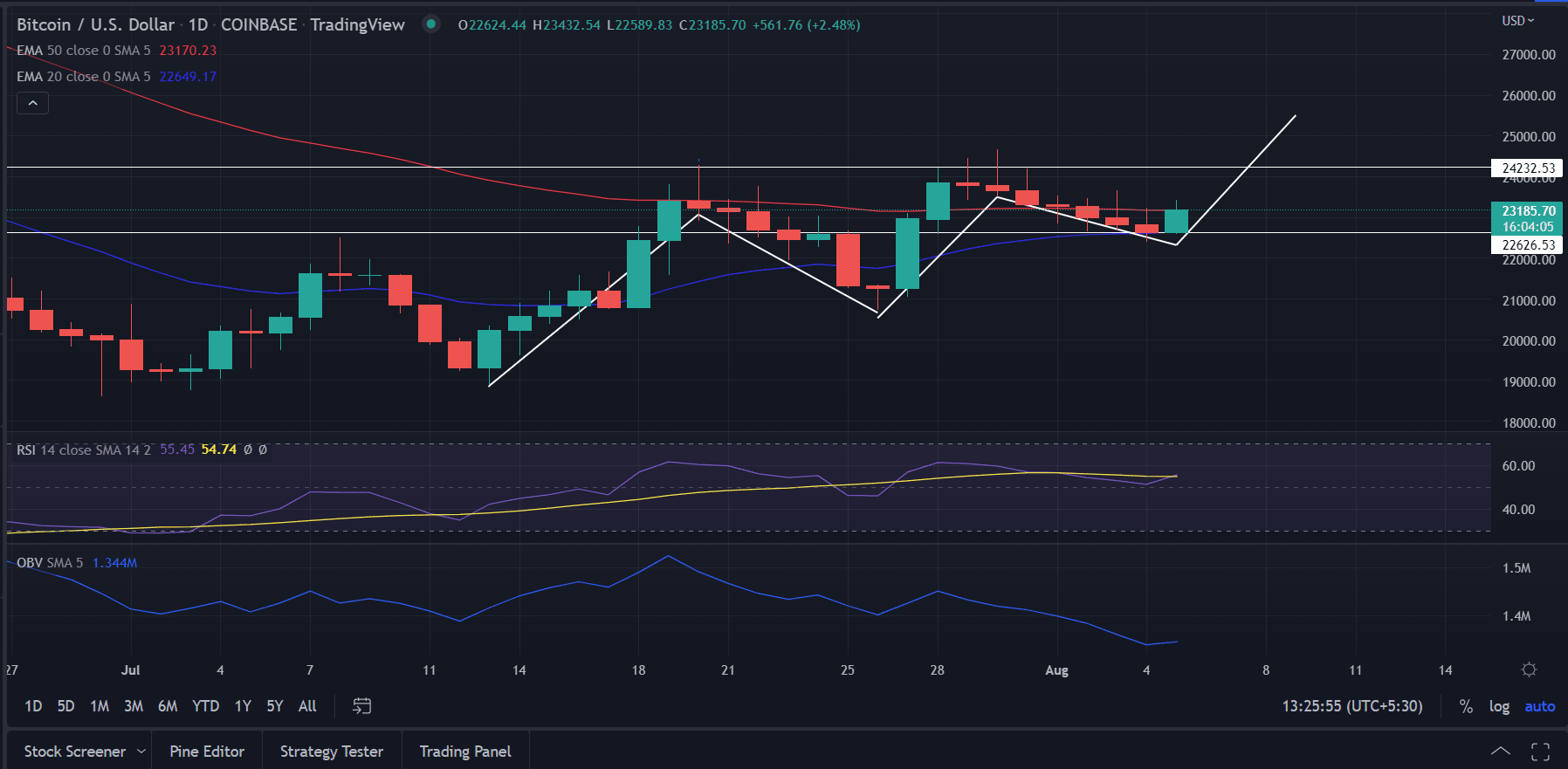

- Predictions based on technical analysis: Technical analysts often use charts and historical data to forecast future price movements.

- Expert opinions supporting a bullish outlook: Several renowned experts and analysts express bullish sentiments, citing factors such as increased institutional adoption and the potential for Bitcoin to act as an inflation hedge.

However, bullish Bitcoin predictions should be viewed with caution and should not be the sole basis for investment decisions.

Bearish Predictions

Conversely, some experts remain cautious, citing potential regulatory hurdles and market volatility as reasons for a bearish outlook.

- Price targets: Bearish predictions often include significantly lower price targets than current levels.

- Predictions based on fundamental analysis: Fundamental analysts consider factors like adoption rates, technological developments, and regulatory risks to predict future price movements.

- Expert opinions supporting a bearish outlook: Some experts remain skeptical, pointing to historical volatility and the potential for significant price corrections.

Bearish Bitcoin predictions highlight the inherent risks associated with investing in this volatile asset.

Neutral Predictions

Some analysts adopt a more neutral stance, suggesting a period of consolidation or sideways price movement before any significant price increase or decrease.

- Reasons for a sideways movement in Bitcoin's price: Factors like regulatory uncertainty and market consolidation could lead to a sideways trend.

- Factors contributing to uncertainty: The current macroeconomic climate and evolving regulatory landscape contribute to market uncertainty.

Neutral Bitcoin price predictions highlight the unpredictable nature of the cryptocurrency market.

Risk Factors and Potential Challenges

Despite the recent rebound, several risk factors could negatively impact Bitcoin's price.

Regulatory Risks

Increased regulatory scrutiny and potential bans or restrictions in various jurisdictions pose significant risks to Bitcoin's price. Unpredictable regulatory environments can lead to investor uncertainty and price volatility.

Market Volatility

The cryptocurrency market is inherently volatile, with the potential for sharp price corrections. Historical data demonstrates Bitcoin's significant price swings, highlighting the risks associated with investing in this asset. Investors should be prepared for potential significant price drops.

Technological Risks

While technological advancements are beneficial, potential vulnerabilities in the underlying technology remain. Security concerns, potential for hacking or exploits, and the need for continuous development and improvement all represent ongoing risks.

Conclusion

The sustainability of the recent Bitcoin price rebound remains uncertain. While several factors suggest potential for further growth, significant risks and challenges persist. Macroeconomic conditions, regulatory developments, technological advancements, and market sentiment all play crucial roles in shaping Bitcoin's future trajectory. Careful analysis of expert predictions and a thorough understanding of these factors are essential for informed decision-making. Before making any investment decisions, conduct thorough research and consider your personal risk tolerance. Remember to stay informed about the latest developments in the Bitcoin market to understand the potential ups and downs of this volatile asset. Further research on the current Bitcoin price and future predictions will help you make the best investment choices based on your financial goals.

Featured Posts

-

Diego Luna On Andor Season 2 A Star Wars Story That Will Redefine The Franchise

May 08, 2025

Diego Luna On Andor Season 2 A Star Wars Story That Will Redefine The Franchise

May 08, 2025 -

Famitsu March 9 2025 Dragon Quest I And Ii Hd 2 D Remake Tops Most Wanted List

May 08, 2025

Famitsu March 9 2025 Dragon Quest I And Ii Hd 2 D Remake Tops Most Wanted List

May 08, 2025 -

1 500 Ethereum Price Target Evaluating The Current Support Level

May 08, 2025

1 500 Ethereum Price Target Evaluating The Current Support Level

May 08, 2025 -

Lahwr Py Ays Ayl Ke Baeth Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025

Lahwr Py Ays Ayl Ke Baeth Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Cost Surge

May 08, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Cost Surge

May 08, 2025