BlackRock ETF: A Billionaire Investment Poised For Massive Growth?

Table of Contents

BlackRock's Market Dominance and Track Record

BlackRock's immense success in the ETF market isn't accidental; it's built on a foundation of extensive offerings and a proven track record of performance.

Extensive ETF Offerings

BlackRock, primarily through its iShares platform, boasts an incredibly diverse range of BlackRock iShares ETFs. This expansive portfolio caters to a wide spectrum of investor needs and risk tolerances.

- Asset Classes: BlackRock iShares ETFs cover stocks, bonds, commodities, real estate, and more, offering unparalleled diversification opportunities within a single platform.

- Indexing Strategies: They utilize various indexing strategies, including market-cap weighted, factor-based (such as value and growth), and smart beta approaches, providing investors with tailored exposure to specific market segments.

- Investment Styles: From aggressive growth to conservative value strategies, BlackRock's ETF offerings span the investment style spectrum, allowing for customized portfolio construction. Examples include iShares Core US Aggregate Bond ETF (AGG) and iShares CORE S&P 500 ETF (IVV).

Proven Performance and History

BlackRock's flagship ETFs have consistently delivered strong performance over the long term. Their vast assets under management (AUM) are a testament to their appeal.

- AUM Growth: BlackRock's AUM in ETFs has shown significant year-on-year growth, indicating sustained investor confidence. (Specific data points would need to be added here, sourced from reliable financial news outlets or BlackRock's official reports).

- Average Returns: While past performance isn't indicative of future results, many BlackRock iShares ETFs have demonstrated competitive average returns compared to their benchmarks over various time periods. (Again, specific data and sourcing are crucial here).

- Long-term Investment: BlackRock's long-standing presence and consistent performance make their ETFs attractive for long-term investment strategies. Many investors view them as a core component of a well-diversified portfolio.

Why Billionaires Might Favor BlackRock ETFs

High-net-worth individuals often seek sophisticated investment vehicles offering transparency, liquidity, diversification, and tax efficiency. BlackRock ETFs deliver on all these fronts.

Transparency and Liquidity

BlackRock ETFs provide exceptional transparency and high liquidity, two key features favored by sophisticated investors.

- Ease of Trading: These ETFs trade on major exchanges, offering seamless buying and selling with minimal transaction costs.

- Readily Available Information: BlackRock provides comprehensive information on its ETFs, including holdings, expense ratios, and performance data, ensuring full transparency.

- Low Transaction Costs: Compared to actively managed funds, BlackRock ETFs generally have lower expense ratios and transaction costs, enhancing returns.

Diversification and Risk Management

BlackRock ETFs are crucial tools for building a well-diversified portfolio and mitigating risk.

- Diversified Portfolio Strategies: By combining various BlackRock ETFs targeting different asset classes and investment styles, investors can create diversified portfolios tailored to their specific risk profiles and investment goals.

- Risk Management ETFs: Specific ETFs are designed to mitigate certain risks, such as interest rate risk or inflation risk, allowing investors to fine-tune their portfolios' risk exposure.

- Strategic Asset Allocation: BlackRock's range facilitates strategic asset allocation, a key element of effective long-term wealth management.

Tax Efficiency

BlackRock ETFs often offer significant tax advantages compared to actively managed mutual funds.

- Low Turnover ETFs: Many BlackRock ETFs have low portfolio turnover, minimizing capital gains distributions and resulting tax liabilities.

- Tax-efficient Investing: This characteristic makes them particularly attractive to high-net-worth individuals in higher tax brackets.

- BlackRock ETF Tax Benefits: The tax efficiency of BlackRock ETFs can significantly improve the overall after-tax returns of a portfolio.

Potential for Massive Growth in BlackRock ETFs

Several factors suggest continued massive growth for BlackRock ETFs in the coming years.

Growing Demand for Passive Investing

The increasing popularity of passive investing strategies is a major driver of ETF growth.

- Lower Fees: ETFs generally have lower expense ratios than actively managed funds, making them a cost-effective investment option.

- Ease of Access: ETFs are readily accessible through most brokerage accounts, simplifying the investment process.

- ETF Market Growth: The overall ETF market is experiencing substantial growth, and BlackRock is well-positioned to benefit from this trend.

Technological Advancements and Innovation

BlackRock continually invests in technological advancements, driving further growth within its ETF offerings.

- BlackRock ETF Innovation: The company is constantly developing new ETF products, incorporating innovative strategies and technologies to meet evolving investor needs.

- Technological Advancements in ETFs: This includes improved trading platforms, advanced analytics, and data-driven investment solutions.

- Future of ETF Investing: BlackRock is at the forefront of shaping the future of ETF investing through continuous innovation.

Global Expansion and Emerging Markets

BlackRock's global reach and expansion into emerging markets offer significant growth opportunities.

- Global ETF Market: BlackRock has a strong global presence, allowing it to capitalize on growth in various international markets.

- Emerging Markets ETFs: The company offers ETFs focused on emerging markets, providing investors with exposure to high-growth regions.

- BlackRock ETF International Growth: This global expansion strategy is a key driver of future growth for BlackRock's ETF business.

Conclusion

BlackRock's market dominance, coupled with the inherent advantages of ETFs—transparency, liquidity, diversification, and tax efficiency—makes its products highly attractive, especially to billionaire investors seeking sophisticated investment solutions. The growing demand for passive investing, coupled with BlackRock's innovation and global expansion, points to a strong potential for massive growth in the BlackRock ETF market. Ready to explore the potential of BlackRock ETFs for your own portfolio? Research the diverse range of BlackRock iShares ETFs available today and discover how they can contribute to your long-term investment goals. Consider the potential of BlackRock ETF investments for significant, diversified growth.

Featured Posts

-

Champions League Inter Milan Defeats Barcelona In Epic Semi Final Clash

May 08, 2025

Champions League Inter Milan Defeats Barcelona In Epic Semi Final Clash

May 08, 2025 -

Bitcoin Price Rebound What To Expect Next

May 08, 2025

Bitcoin Price Rebound What To Expect Next

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

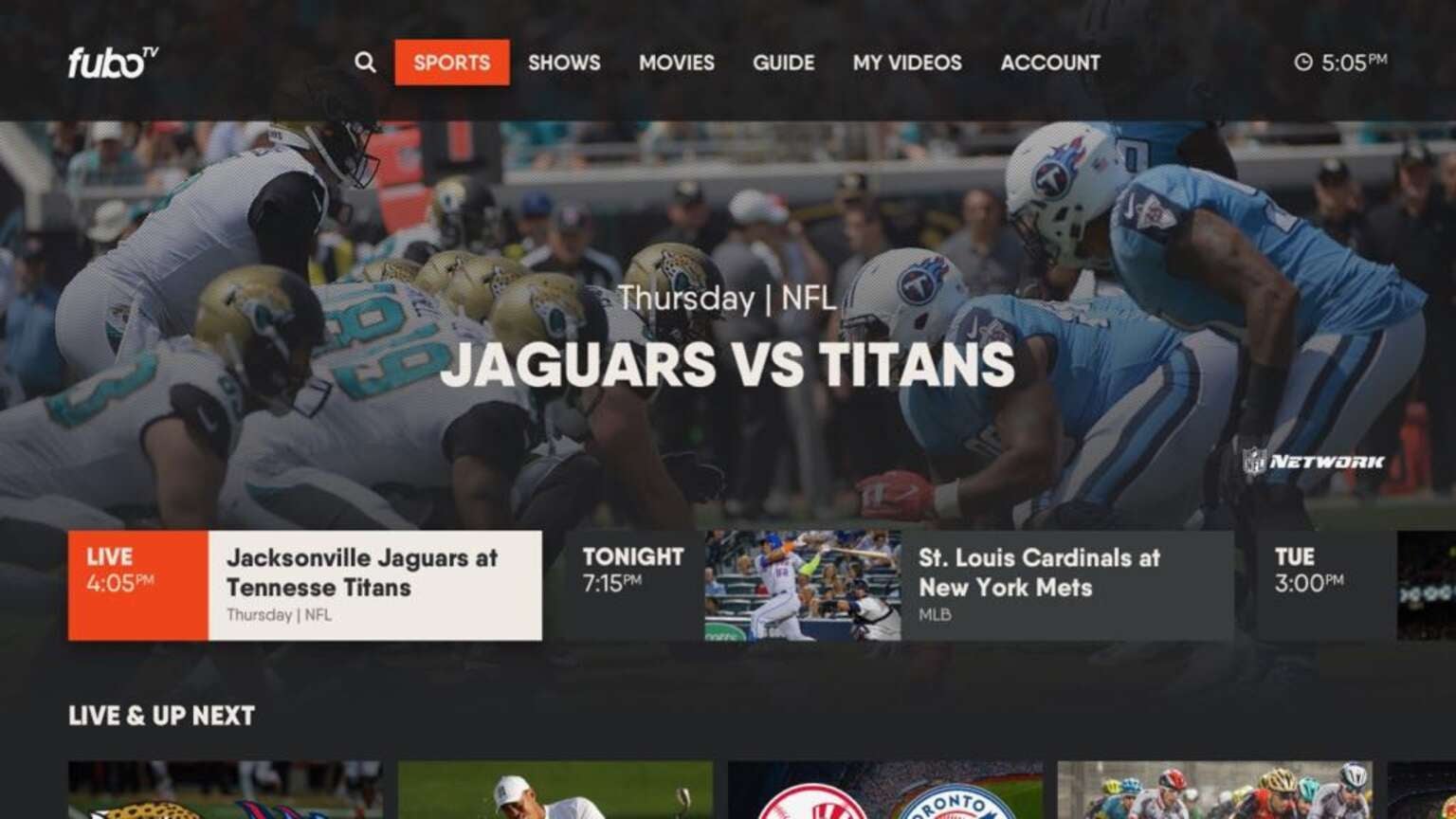

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025 -

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025