Should You Invest In Palantir Stock Before The May 5th Earnings Release?

Table of Contents

Palantir's Recent Performance and Growth Trajectory

Analyzing Palantir's recent financial performance is crucial before deciding whether to invest before the May 5th earnings release. Examining key performance indicators (KPIs) such as Palantir revenue growth, operating margin, and customer acquisition provides a clear picture of the company's financial health and future prospects. Looking at the quarterly and annual reports reveals important trends in Palantir's growth.

-

Palantir Revenue: Recent reports should show whether Palantir is meeting or exceeding revenue targets. Consistent revenue growth indicates a healthy and expanding business. A decline, however, could signal underlying problems. Pay close attention to the breakdown of revenue between government and commercial sectors.

-

PLTR Financials: Examining the operating margin reveals Palantir's profitability. Improving margins suggest increased efficiency and cost-cutting measures. A shrinking margin might indicate rising costs or pricing pressures.

-

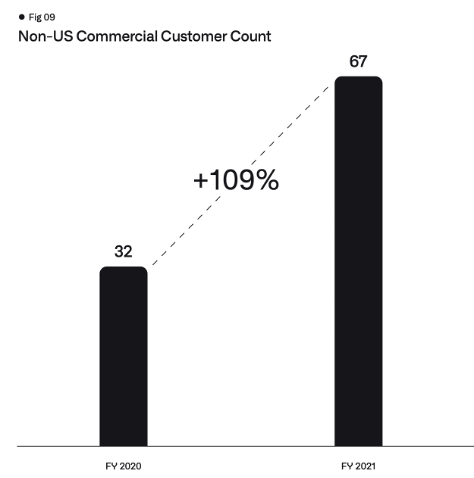

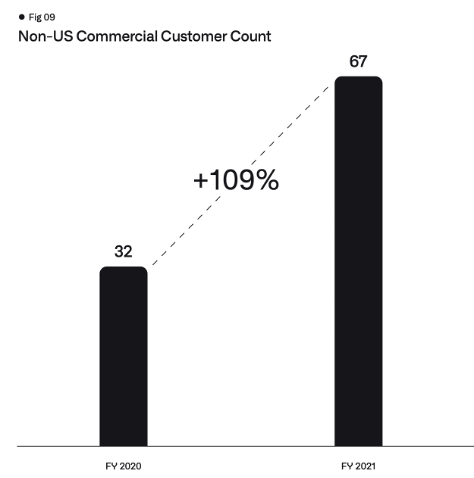

Key Contract Wins: Recent contract wins, especially large government contracts and expansion into the commercial sector, are significant indicators of future revenue streams and market penetration. The size and duration of these contracts are vital data points.

-

Progress on Profitability: Palantir's progress towards achieving profitability is a key factor for investors. Track their progress against projected targets to assess their performance in this crucial area. Are they on track, or are there setbacks?

Analyzing Analyst Expectations and Price Targets

Understanding analyst expectations and price targets for Palantir stock is another critical component of your investment decision. These forecasts offer valuable insights into market sentiment and potential price movements.

-

Palantir Stock Price Target: Leading financial analysts provide price targets that represent their estimate of the stock's value in the future. A range of price targets reflects the uncertainty inherent in stock market predictions.

-

PLTR Analyst Ratings: Analyst ratings (Buy, Hold, Sell) represent the analysts' overall sentiment towards the stock. A high proportion of "Buy" ratings typically suggests bullish sentiment. However, it's important to consider the reasoning behind these ratings.

-

Significant Revisions: Look for any recent upward or downward revisions in price targets. Significant revisions often signal a shift in market sentiment or new information impacting the stock's value.

-

Where to Find Analyst Data: Reputable financial news websites and investment platforms provide access to analyst forecasts. Be sure to review data from multiple sources for a more comprehensive picture. (Example: [Link to a reputable financial news source])

Key Risks and Potential Challenges Facing Palantir

Before investing in Palantir stock, it's essential to acknowledge the potential risks and challenges the company faces. Understanding these risks allows for a more informed investment decision.

-

Geopolitical Risks: Palantir's significant reliance on government contracts exposes it to geopolitical risks. Changes in government policy or international relations can significantly impact their revenue streams.

-

PLTR Challenges: Competition: The data analytics market is competitive. Palantir faces competition from established players with extensive resources and market share. Analyzing the competitive landscape is key to understanding Palantir's potential for market share growth.

-

Dependence on Large Government Contracts: While these contracts provide substantial revenue, over-reliance on them creates vulnerability. A reduction in government spending or a loss of key contracts could severely impact Palantir's financial performance.

Technical Analysis of Palantir Stock

While fundamental analysis is crucial, a brief look at technical analysis can provide additional insights into potential price movements.

-

Palantir Stock Chart: Examining the Palantir stock chart reveals short-term and long-term price trends. Moving averages, RSI (Relative Strength Index), and other technical indicators can suggest potential support and resistance levels. (Optional: Include a relevant chart here).

-

Breakout Points: Technical analysis can identify potential breakout points, signifying a potential significant price movement. However, remember that technical analysis is not a foolproof method.

-

Disclaimer: Technical analysis should be used in conjunction with fundamental analysis and not as the sole basis for investment decisions.

Conclusion

The decision to invest in Palantir stock before the May 5th earnings release requires careful consideration of multiple factors. Analyzing Palantir's recent financial performance, understanding analyst expectations and price targets, acknowledging the potential risks, and reviewing technical indicators are all vital steps in the process. Remember to consider your personal risk tolerance and investment goals. Thorough research and, if needed, consultation with a financial advisor, are recommended before investing in Palantir stock or any other security. Past performance does not guarantee future results. Conduct your own due diligence before making any investment decisions regarding Palantir stock or PLTR.

Featured Posts

-

Municipales Dijon 2026 L Ambition Ecologique

May 10, 2025

Municipales Dijon 2026 L Ambition Ecologique

May 10, 2025 -

Experience Olly Murs Live At A Breathtaking Castle Near Manchester

May 10, 2025

Experience Olly Murs Live At A Breathtaking Castle Near Manchester

May 10, 2025 -

Cite De La Gastronomie De Dijon Independance Et Gestion Des Difficultes D Epicure

May 10, 2025

Cite De La Gastronomie De Dijon Independance Et Gestion Des Difficultes D Epicure

May 10, 2025 -

Can Nigel Farages Reform Party Deliver More Than Just Complaints

May 10, 2025

Can Nigel Farages Reform Party Deliver More Than Just Complaints

May 10, 2025 -

Tarykh Altdkhyn Byn Njwm Krt Alqdm Mn Hm Ashhr Almdkhnyn

May 10, 2025

Tarykh Altdkhyn Byn Njwm Krt Alqdm Mn Hm Ashhr Almdkhnyn

May 10, 2025