E2open Acquired By WiseTech Global In A $2.1 Billion Transaction

Table of Contents

Details of the E2open Acquisition

The official announcement of WiseTech Global's acquisition of E2open was made [Insert Official Announcement Date]. This significant move involves a substantial investment of $2.1 billion, likely a mix of cash and stock (details to be confirmed upon official filings). While the exact closing date of the transaction is yet to be publicly disclosed, we anticipate it to be finalized within the coming [Number] months, subject to regulatory approvals.

- Acquisition Price Breakdown: Specific details regarding the breakdown of the $2.1 billion purchase price (e.g., percentage allocated to cash vs. stock) are expected to be revealed in subsequent financial reports.

- Funding Sources: WiseTech Global is likely to utilize a combination of existing cash reserves, debt financing, and potentially equity issuance to fund this acquisition.

- Regulatory Approvals: The transaction will be subject to customary regulatory approvals from relevant antitrust and competition authorities in various jurisdictions worldwide before completion.

Strategic Rationale Behind the WiseTech Global Acquisition

WiseTech Global's acquisition of E2open is a strategic masterstroke driven by several key factors. The primary motivations behind this deal include:

-

Market Expansion and Share Increase: By acquiring E2open, WiseTech Global significantly expands its market reach and gains considerable market share in the already competitive supply chain management software market.

-

Access to Advanced Technologies: E2open boasts a cutting-edge portfolio of supply chain planning and execution technologies, including advanced analytics and artificial intelligence capabilities. This acquisition brings these crucial technologies under WiseTech Global's umbrella.

-

Synergies and Portfolio Enhancement: The integration of E2open's product portfolio with WiseTech Global's existing solutions will likely create significant synergies, leading to a more comprehensive and robust offering for customers. This move also strengthens their competitive position against industry giants like Blue Yonder, Oracle, and SAP.

-

Strengthening Competitive Advantage: The combined entity will undoubtedly become a more formidable competitor in the SCM solutions market, better positioned to capture a larger share of the global market.

-

Specific Benefits: WiseTech Global gains access to E2open's extensive customer base, particularly in key industries such as manufacturing and retail, and benefits from its strong brand recognition in the global market.

-

Cross-Selling and Upselling: Significant opportunities exist for cross-selling and upselling existing products and services to the combined customer base, leading to increased revenue streams.

-

Expected ROI: WiseTech Global anticipates a substantial return on investment (ROI) from this acquisition through increased market share, cost synergies, and enhanced revenue generation.

Impact on E2open Customers and Employees

The E2open acquisition will inevitably have implications for both its customers and employees. For customers, we anticipate a gradual integration of E2open's solutions into WiseTech Global's platform. While initial integration might cause minor disruptions, the long-term outlook promises significant improvements, including enhanced functionality and broader support. For E2open's employees, the acquisition might lead to some restructuring and reassignments, but job losses are expected to be minimal, particularly in areas where synergies and growth opportunities exist.

- Product Roadmap Changes: We can expect a revised product roadmap, potentially incorporating features and functionalities from both platforms to create a more unified and improved offering.

- Integration Plans: The integration of E2open's technology into WiseTech Global's existing platform will be a phased process, requiring careful planning and execution to minimize disruptions.

- Customer Benefits: E2open customers will benefit from access to WiseTech Global's broader ecosystem, potentially including enhanced functionalities, extended support, and access to a wider range of integrated supply chain solutions.

Market Analysis and Future Outlook for the Combined Entity

The acquisition significantly alters the competitive dynamics within the supply chain software market. WiseTech Global's enhanced market presence, bolstered by E2open's technology and customer base, positions it for substantial growth. Other key players will need to adapt to this shift, possibly through strategic partnerships or acquisitions of their own.

- Projected Market Share Gains: WiseTech Global is poised to make significant gains in market share, potentially becoming a dominant force in the global supply chain software sector.

- Challenges and Opportunities: The combined entity will face challenges related to integration, cultural alignment, and customer retention. However, the acquisition also presents considerable opportunities for growth, innovation, and expansion into new markets.

- Long-Term Strategic Implications: This acquisition marks a strategic shift in the supply chain software industry, indicating a move towards larger, more integrated platforms providing comprehensive SCM solutions.

Conclusion: The Future of WiseTech Global and E2open After the $2.1 Billion Transaction

The E2open acquisition by WiseTech Global is a landmark event in the supply chain software industry. This $2.1 billion transaction brings together two industry leaders, creating a formidable player with enhanced capabilities and market dominance. While integration challenges exist, the potential benefits for both companies and their customers are significant. This acquisition promises a more efficient, technologically advanced, and integrated approach to supply chain management. Stay updated on the latest developments in the E2open acquisition, explore WiseTech Global's expanded supply chain offerings, and discover how this acquisition impacts your supply chain strategy.

Featured Posts

-

Emegha Transfer Chase Everton Newcastle And West Ham Vie For Signing

May 27, 2025

Emegha Transfer Chase Everton Newcastle And West Ham Vie For Signing

May 27, 2025 -

Paramount Investigative Services Inc In Merger And Acquisition Discussions

May 27, 2025

Paramount Investigative Services Inc In Merger And Acquisition Discussions

May 27, 2025 -

Exclusive Taylor Swift And Blake Lively Amidst The It Ends With Us Lawsuit

May 27, 2025

Exclusive Taylor Swift And Blake Lively Amidst The It Ends With Us Lawsuit

May 27, 2025 -

Happy Face Streaming Guide Watch Every Episode Online

May 27, 2025

Happy Face Streaming Guide Watch Every Episode Online

May 27, 2025 -

Five Individuals Apprehended Drug And Weapon Possession

May 27, 2025

Five Individuals Apprehended Drug And Weapon Possession

May 27, 2025

Latest Posts

-

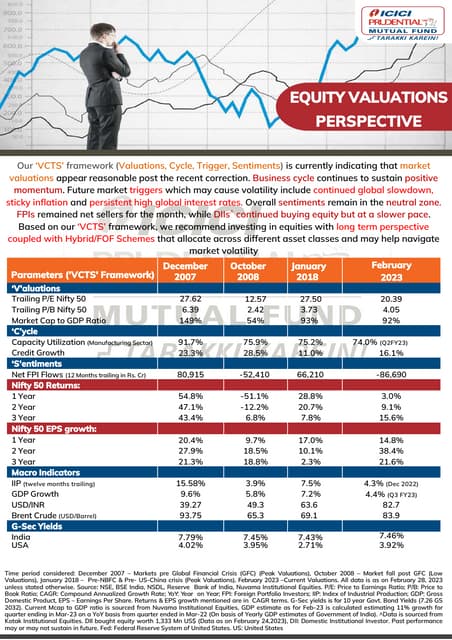

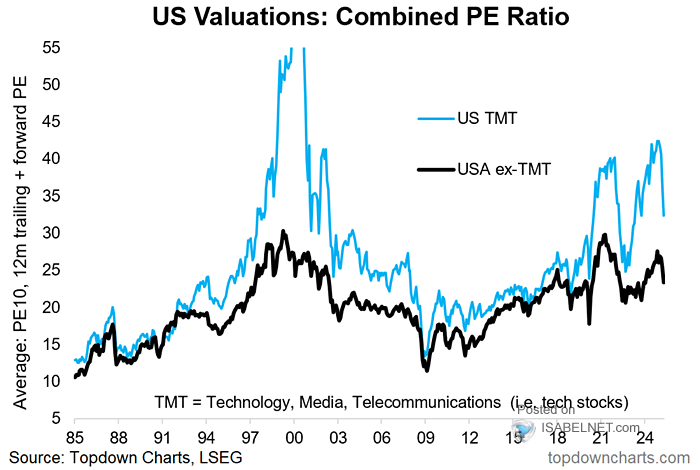

Why Current Stock Market Prices Dont Signal A Crash Bof As View

May 31, 2025

Why Current Stock Market Prices Dont Signal A Crash Bof As View

May 31, 2025 -

Understanding Elevated Stock Market Valuations A Bof A Perspective

May 31, 2025

Understanding Elevated Stock Market Valuations A Bof A Perspective

May 31, 2025 -

High Stock Valuations And Investor Confidence A Bof A Analysis

May 31, 2025

High Stock Valuations And Investor Confidence A Bof A Analysis

May 31, 2025 -

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 31, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 31, 2025 -

Stock Market Valuations Bof As Argument For Why Investors Shouldnt Worry

May 31, 2025

Stock Market Valuations Bof As Argument For Why Investors Shouldnt Worry

May 31, 2025