Understanding Elevated Stock Market Valuations: A BofA Perspective

Table of Contents

Macroeconomic Factors Driving Elevated Valuations

Several interconnected macroeconomic factors have contributed significantly to the current state of elevated stock market valuations.

Low Interest Rates and Monetary Policy

Historically low interest rates implemented by central banks globally, including the Federal Reserve, are a primary driver. These low rates influence investor behavior by:

- Increased demand for yield: With lower returns on traditional fixed-income investments like bonds, investors seek higher returns in the equity market, pushing up stock prices.

- Reduced discount rates: Lower interest rates decrease the discount rate used in discounted cash flow models, leading to higher present values of future earnings and thus, higher valuations.

- Increased corporate borrowing and investment: Cheap borrowing costs enable companies to invest more readily, boosting earnings and further fueling stock prices.

BofA's research consistently highlights the significant impact of quantitative easing (QE) programs on market liquidity. While QE injected substantial liquidity into the market, BofA's analysts also caution about potential long-term consequences of these policies on inflation and asset bubbles.

Strong Corporate Earnings and Profitability

Robust corporate earnings have undeniably supported higher stock valuations. Strong consumer demand, coupled with effective cost-cutting measures and increased productivity, have resulted in impressive profit growth for many companies. However:

-

Potential limitations: The sustainability of this earnings growth remains a key question. Factors like rising input costs, supply chain disruptions, and potential economic slowdowns could impact future profitability.

-

BofA's analysis: BofA regularly publishes sector-specific reports analyzing corporate earnings and providing insights into the health and outlook of various industries. These reports offer valuable context for assessing the long-term sustainability of current earnings growth.

-

Increased productivity: Technological advancements and efficiency improvements have contributed to stronger profit margins for several businesses.

-

Strong consumer demand: Healthy consumer spending continues to fuel sales growth across numerous sectors, supporting corporate profitability.

-

Effective cost-cutting measures: Many companies have successfully implemented strategies to control costs, leading to improved margins.

Geopolitical Factors and Safe-Haven Demand

Global uncertainty and geopolitical instability often drive investors towards assets perceived as safe havens, including US equities. Events such as trade wars, political instability in key regions, and global pandemics can significantly influence market sentiment.

- Flight to safety: During periods of uncertainty, investors often reduce their exposure to riskier assets, leading to increased demand for equities perceived as relatively safer.

- Increased demand for US assets: The US dollar and US equities are often seen as safe havens, drawing capital from other regions during times of global instability.

- Uncertainty aversion: Investors' aversion to uncertainty frequently leads to higher valuations for established companies with strong track records, even if their growth prospects are not exceptional.

BofA's geopolitical analysts provide regular assessments of global events and their potential impact on market dynamics, offering insights into the interplay between geopolitical risks and equity valuations.

Assessing Valuation Metrics: A BofA Approach

Evaluating elevated stock market valuations requires a comprehensive assessment of various valuation metrics.

Price-to-Earnings Ratio (P/E)

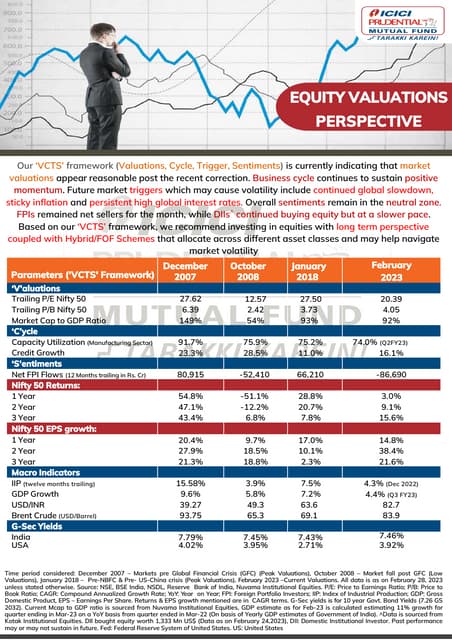

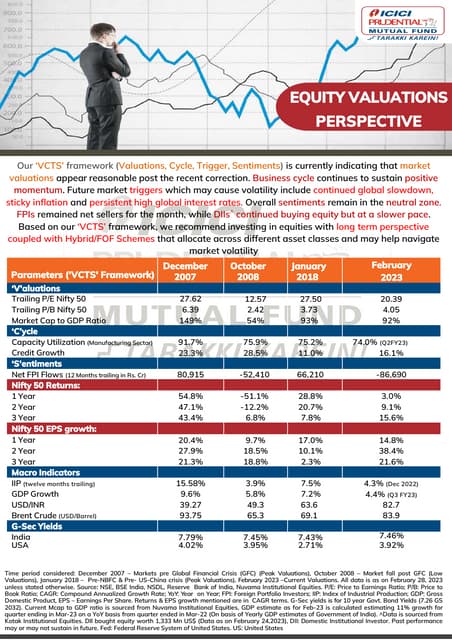

The P/E ratio, a widely used metric, compares a company's stock price to its earnings per share. Currently elevated P/E ratios, when compared to historical averages and industry benchmarks, suggest that stocks are trading at premium valuations. BofA’s analysis often considers forward P/E ratios, which use projected future earnings, to provide a more nuanced picture.

Other Key Valuation Metrics

Beyond P/E, other metrics like Price-to-Sales (P/S), Price-to-Book (P/B), and dividend yield provide additional insights into valuations. Comparing current metrics to historical data and market averages offers a broader context for understanding the overall valuation picture. BofA incorporates these multiple metrics in its comprehensive valuation analysis.

Limitations of Traditional Valuation Metrics

It's crucial to acknowledge the limitations of traditional valuation metrics in today's market environment. Factors like low interest rates and technological disruption can distort traditional metrics, making it challenging to accurately assess valuations. BofA's research often highlights these limitations, advocating for a more nuanced approach to valuation analysis.

Implications and Investment Strategies

The current environment of elevated stock market valuations presents both opportunities and risks.

Potential Risks Associated with Elevated Valuations

Investing in a market with high valuations carries inherent risks. The potential for market corrections or even a downturn remains a significant concern. BofA's analysts regularly assess market volatility and potential risks associated with elevated valuations, providing insights to help investors make informed decisions.

Investment Strategies in a High-Valuation Environment

In this environment, diversified investment strategies are crucial. BofA often recommends a balanced approach, potentially including exposure to alternative asset classes, depending on individual risk tolerance and investment goals. Risk management and diversification remain paramount. BofA's wealth management division offers tailored advice to individual clients on portfolio construction and risk management.

Conclusion: Understanding Elevated Stock Market Valuations: A BofA Perspective

This article has highlighted the key factors driving elevated stock market valuations, including low interest rates, strong corporate earnings, and geopolitical factors, while acknowledging the limitations of traditional valuation metrics. BofA's perspective emphasizes the need for a comprehensive analysis incorporating multiple metrics and a careful consideration of potential risks. Understanding elevated stock market valuations is crucial for informed investment decisions. Stay updated on BofA's market analysis and consider consulting with a financial advisor to develop a robust investment strategy tailored to your risk tolerance and individual financial goals.

Featured Posts

-

Cleveland Fire Station Closure Temporary Shutdown Due To Water Leaks

May 31, 2025

Cleveland Fire Station Closure Temporary Shutdown Due To Water Leaks

May 31, 2025 -

Kansas City Royals Games On Kctv 5 Your 2024 Viewing Guide

May 31, 2025

Kansas City Royals Games On Kctv 5 Your 2024 Viewing Guide

May 31, 2025 -

Man Pleads Guilty Animal Pornography Case In Kelvedon Essex

May 31, 2025

Man Pleads Guilty Animal Pornography Case In Kelvedon Essex

May 31, 2025 -

Banksy Art Prints A 22 7 Million Market Boom

May 31, 2025

Banksy Art Prints A 22 7 Million Market Boom

May 31, 2025 -

Rosemary And Thyme Essential Oils Applications And Precautions

May 31, 2025

Rosemary And Thyme Essential Oils Applications And Precautions

May 31, 2025