Stock Market Valuations: BofA's Argument For Why Investors Shouldn't Worry

Table of Contents

BofA's Justification: Strong Earnings Growth Outpaces Valuation Concerns

BofA's central argument rests on the robust growth of corporate earnings. They contend that current stock market valuations are justified by the strong and sustained increase in corporate profits, effectively outpacing any concerns about inflated prices. This isn't simply a blanket statement; BofA supports this claim with data. For instance, they point to significant revenue growth across key sectors like technology and consumer discretionary, driven by factors such as increased consumer spending and digital transformation.

- Strong revenue growth across key sectors: Technology companies, in particular, have shown exceptional revenue growth, fueled by the ongoing digital shift and increasing demand for cloud-based services.

- Improved profit margins due to increased efficiency: Many companies have streamlined operations and implemented cost-cutting measures, leading to improved profit margins, even in the face of rising input costs.

- Positive future earnings projections: Analysts' projections for future earnings remain positive, suggesting that the current growth trajectory is sustainable in the medium to long term. This positive outlook supports the current stock market valuations.

These factors, when considered collectively, contribute to a compelling narrative of sustained earnings growth that justifies the current levels of stock market valuations. Key to understanding this is analyzing corporate profits and revenue growth alongside other economic indicators.

The Role of Low Interest Rates in Supporting Valuations

Low interest rates play a crucial role in supporting current stock market valuations. When interest rates are low, the cost of borrowing money is reduced, making it cheaper for companies to invest and expand. This, in turn, can fuel further economic growth and boost corporate earnings. More importantly, low interest rates make stocks more attractive compared to bonds.

- Lower discount rates increase present value of future earnings: Lower interest rates translate to lower discount rates used in valuation models. This means that the present value of future earnings is higher, making stocks appear more appealing.

- Investors seek higher returns in the stock market due to low bond yields: With low yields on bonds, investors are driven to seek higher returns in the stock market, increasing demand and potentially pushing up prices.

- Impact of potential interest rate hikes on stock valuations (and BofA’s perspective): While future interest rate hikes are a potential risk, BofA believes that the overall strength of the economy and corporate earnings will be sufficient to offset any negative impacts. They see this as a gradual adjustment, not a catastrophic event.

Understanding the interplay between interest rates, bond yields, and monetary policy is crucial for interpreting stock market valuations accurately.

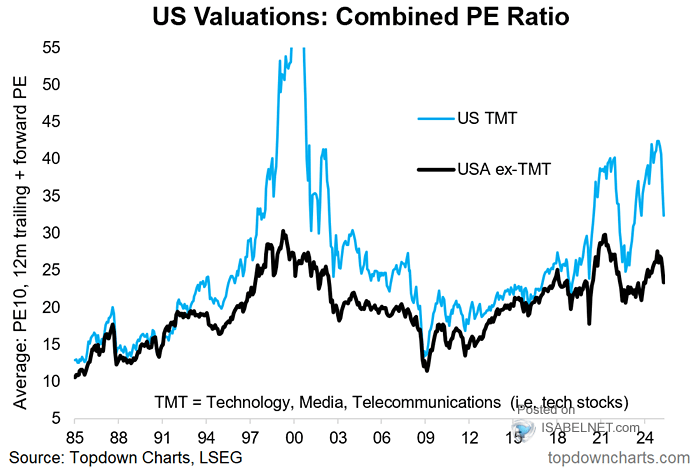

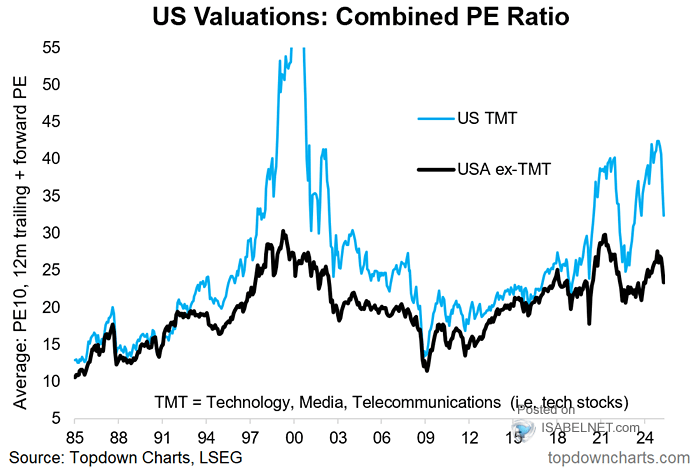

Addressing the "Overvalued" Narrative: A Deeper Look at Valuation Metrics

The common perception of an "overvalued" market often relies on a single metric, typically the Price-to-Earnings (P/E) ratio. However, BofA argues that relying on a single valuation metric is overly simplistic and potentially misleading. A more comprehensive assessment requires analyzing multiple valuation metrics.

- Analysis of Price-to-Sales ratio: The Price-to-Sales (P/S) ratio provides a different perspective, often less sensitive to short-term earnings fluctuations.

- Examination of Price-to-Book ratio: The Price-to-Book (P/B) ratio offers insights into the value of a company's assets relative to its market capitalization.

- Discussion of other relevant valuation metrics and their implications: Other metrics like dividend yield, free cash flow yield, and PEG ratio provide further context, painting a more complete picture of the market's valuation.

By considering these diverse market multiples and valuation metrics, investors gain a more balanced and accurate understanding of the current stock market environment.

Long-Term Growth Prospects and Technological Innovation

The long-term growth prospects fueled by technological innovation are also key to BofA's optimistic outlook on stock market valuations. Disruptive technologies continue to emerge, creating new industries, boosting productivity, and driving future earnings potential. These innovations, combined with other long-term growth trends, are expected to support sustained earnings growth and justify current valuations. The potential for future earnings from these disruptive technologies significantly impacts the overall picture of stock market valuations.

Conclusion: Navigating Stock Market Valuations with Confidence

BofA's perspective on stock market valuations emphasizes a balanced approach. Their analysis suggests that concerns about overvaluation are unwarranted when considering the strong earnings growth, the influence of low interest rates, and a comprehensive examination of various valuation metrics. Don't let concerns about stock market valuations deter you from a well-researched investment strategy. Understanding the nuances of stock market valuations, considering multiple perspectives, and employing a long-term view are crucial for making informed decisions for your portfolio. Conduct thorough research and understand the factors influencing stock market valuations before making any investment choices.

Featured Posts

-

Solve The Nyt Mini Crossword May 13 2025 Answers And Guide

May 31, 2025

Solve The Nyt Mini Crossword May 13 2025 Answers And Guide

May 31, 2025 -

Retour Sur 22 Ans Du Tip Top One A Arcachon

May 31, 2025

Retour Sur 22 Ans Du Tip Top One A Arcachon

May 31, 2025 -

What Is The Good Life Exploring Concepts Of Meaning And Purpose

May 31, 2025

What Is The Good Life Exploring Concepts Of Meaning And Purpose

May 31, 2025 -

Rekorun Yeni Sahibi Djokovic Nadal I Geride Birakti

May 31, 2025

Rekorun Yeni Sahibi Djokovic Nadal I Geride Birakti

May 31, 2025 -

Canelo Vs Golovkin Start Time Full Ppv Fight Card And Details

May 31, 2025

Canelo Vs Golovkin Start Time Full Ppv Fight Card And Details

May 31, 2025