EBay, Vinted, Depop Sellers: New HMRC Nudge Letter Campaign Explained

Table of Contents

What is the HMRC Nudge Letter Campaign?

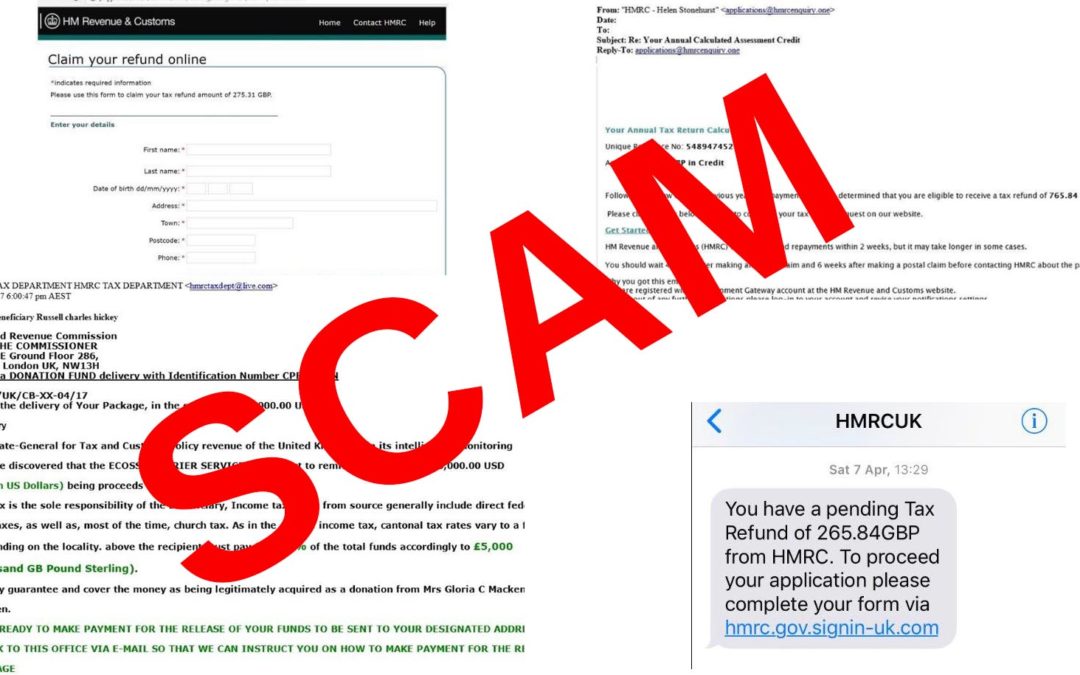

The HMRC nudge letter campaign aims to improve tax compliance among online sellers. HMRC recognizes the significant increase in individuals using platforms like eBay, Vinted, and Depop to generate income, and they're working to ensure everyone is paying their fair share of tax. This campaign isn't just targeting high-volume sellers; even those making smaller sales need to be aware of their obligations.

HMRC's Aim: The primary goal is to encourage voluntary tax compliance. Rather than immediately issuing penalties, HMRC is using nudge letters as a first step to prompt sellers to review their tax affairs.

Target Audience: The campaign primarily targets sellers on popular online marketplaces like eBay, Vinted, and Depop. However, any individual generating income through online sales could potentially receive a nudge letter. The focus is widening to encompass a broader range of online sellers, not just those with high sales volumes.

Content of the Letter: An HMRC nudge letter typically includes:

- Details of your sales activity obtained from online marketplaces.

- An estimate of your potential tax liability.

- Information on how to report your income correctly.

- Guidance on relevant tax regulations and allowances.

- Links to helpful resources and support.

Example: A section of a hypothetical HMRC nudge letter might read: "Our records indicate you made sales totalling £X on eBay during the tax year 2022-2023. Based on this information, you may owe additional tax. Please review your records and ensure your Self Assessment tax return accurately reflects your income."

Why are eBay, Vinted, and Depop Sellers Targeted?

The rapid growth of online selling platforms like eBay, Vinted, and Depop has created a significant increase in unreported income. These platforms provide a relatively easy avenue for generating income, but also one where tax compliance can be easily overlooked.

Growth of Online Selling: The sheer volume of transactions occurring on these platforms makes them a prime target for HMRC's efforts to increase tax collection.

Data Sharing: HMRC is increasingly accessing sales data directly from these online marketplaces, enabling them to identify sellers who may not be accurately reporting their income. This data sharing allows for more efficient and targeted tax investigations.

Ease of Non-Compliance: The relative anonymity and ease of setting up online shops can contribute to non-compliance. Some sellers may be unaware of their tax obligations or deliberately attempt to underreport their earnings.

- Reasons for HMRC Focus:

- Ease of accessing sales data.

- High volume of transactions.

- Potential for significant unreported income.

- Increased public awareness of online selling.

What Should You Do if You Receive an HMRC Nudge Letter?

Receiving an HMRC nudge letter shouldn't be ignored. Prompt action is crucial to avoid potential penalties.

Don't Ignore It: Failing to respond can lead to further action from HMRC, including larger penalties.

Review Your Records: Thoroughly review your sales records to ensure accuracy. This includes bank statements, PayPal transactions, and any other relevant documentation.

Calculate Your Tax Liability: Use HMRC's online tools or seek professional advice to accurately calculate your tax liability.

Seek Professional Advice (if needed): If you're unsure about your tax obligations, consulting a qualified accountant or tax advisor is highly recommended. They can provide personalized guidance and ensure you comply with all regulations.

- Steps to Take:

- Read the letter carefully.

- Gather all relevant sales records.

- Calculate your tax liability.

- File the necessary tax returns.

- Contact HMRC or a tax professional if needed.

Useful Resources: [Link to HMRC guidance on Self Assessment] [Link to HMRC online tax calculator]

Avoiding HMRC Nudge Letters: Best Practices for Online Sellers

Proactive steps can help you avoid receiving an HMRC nudge letter in the future.

Accurate Record Keeping: Maintain detailed records of all sales, expenses, and stock. This will greatly simplify your tax calculations and demonstrate your compliance.

Understanding Tax Obligations: Familiarize yourself with the relevant tax laws and thresholds for online sellers. HMRC offers resources to help you understand your responsibilities.

Using Accounting Software: Consider using accounting software to manage your sales, expenses, and tax calculations. This can automate many processes and help maintain accurate records.

Regular Tax Returns: File your Self Assessment tax returns accurately and on time. This demonstrates your commitment to complying with tax regulations.

- Proactive Steps:

- Keep detailed sales records.

- Understand relevant tax laws.

- Use accounting software.

- File tax returns promptly and accurately.

Penalties for Non-Compliance

Failing to comply with HMRC regulations can result in significant consequences.

Financial Penalties: HMRC can impose penalties for late or inaccurate tax returns, ranging from a percentage of the unpaid tax to fixed penalties.

Legal Consequences: In severe cases of tax evasion, legal repercussions can include prosecution and potentially imprisonment.

- Potential Penalties:

- Financial penalties (percentage of unpaid tax).

- Late filing penalties.

- Interest charges on unpaid tax.

- Criminal prosecution (in cases of tax evasion).

Conclusion: Taking Action on Your HMRC Nudge Letter

The HMRC nudge letter campaign highlights the increasing scrutiny of online selling platforms. Understanding your tax obligations as an online seller on platforms like eBay, Vinted, and Depop is crucial. Don't ignore your HMRC nudge letter. Review your records, calculate your tax liability, and seek professional advice if needed. Take control of your online selling tax and act now to avoid HMRC penalties. Proactive tax planning and accurate record-keeping are essential for avoiding future issues. Don't delay – take action today to ensure compliance with HMRC regulations.

Featured Posts

-

Ferrari Nin Cin Grand Prix Felaketi Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025

Ferrari Nin Cin Grand Prix Felaketi Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025 -

Cote D Ivoire Abidjan Systeme D Adressage Et Numerotation Des Immeubles

May 20, 2025

Cote D Ivoire Abidjan Systeme D Adressage Et Numerotation Des Immeubles

May 20, 2025 -

Hl Yeyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025

Hl Yeyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025 -

Could You Be Due A Hmrc Refund Simple Payslip Check Reveals All

May 20, 2025

Could You Be Due A Hmrc Refund Simple Payslip Check Reveals All

May 20, 2025 -

New Drone Truck System Could Launch Usmc Tomahawk Missiles

May 20, 2025

New Drone Truck System Could Launch Usmc Tomahawk Missiles

May 20, 2025

Latest Posts

-

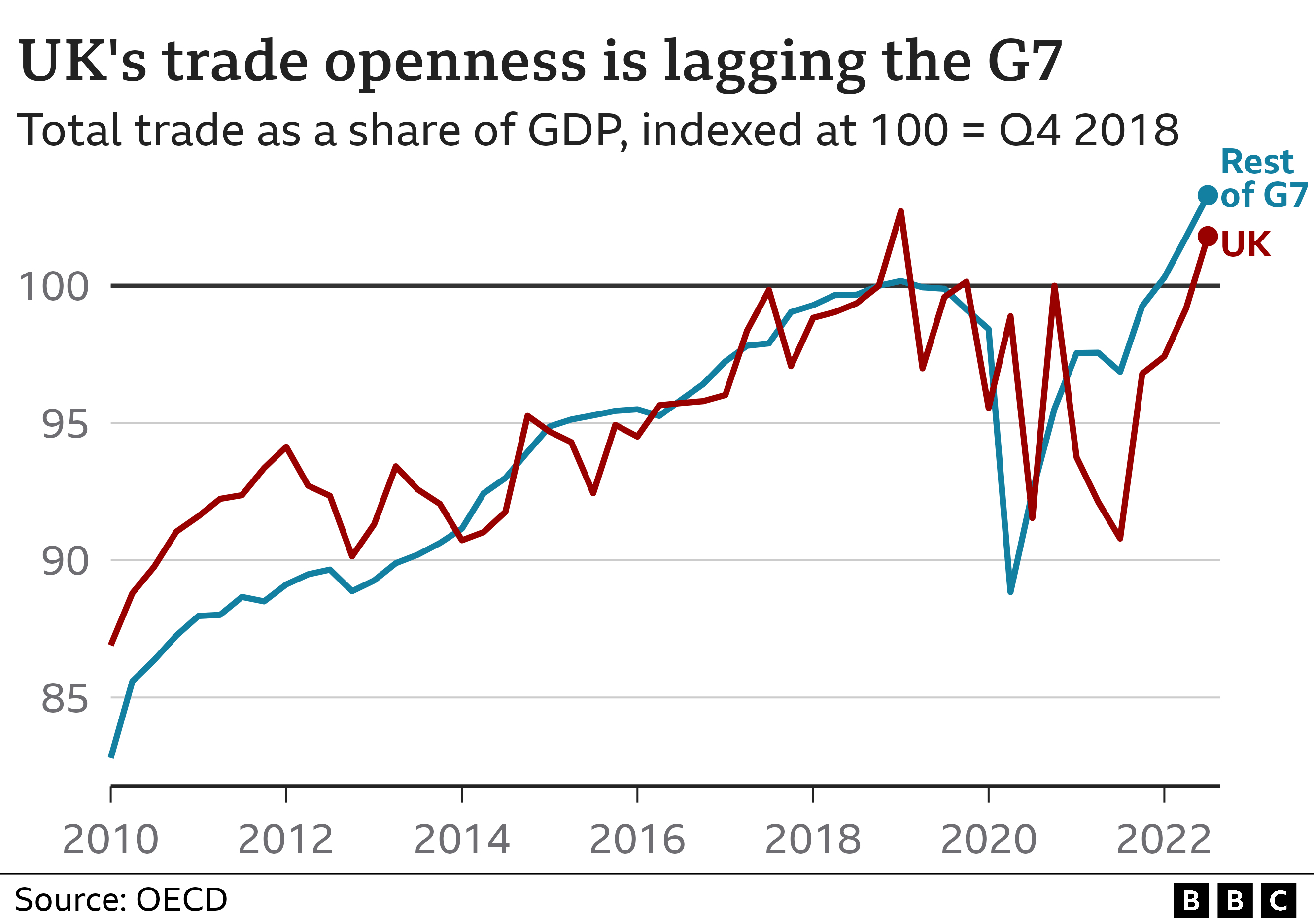

Uk Luxury Lobby Links Brexit To Export Slowdown In The Eu

May 20, 2025

Uk Luxury Lobby Links Brexit To Export Slowdown In The Eu

May 20, 2025 -

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025 -

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025 -

The Economic Impact Of Bringing Factory Jobs Back To The Us

May 20, 2025

The Economic Impact Of Bringing Factory Jobs Back To The Us

May 20, 2025 -

The Countrys Top Business Hot Spots Growth Trends And Opportunities

May 20, 2025

The Countrys Top Business Hot Spots Growth Trends And Opportunities

May 20, 2025