Could You Be Due A HMRC Refund? Simple Payslip Check Reveals All

Table of Contents

Common Reasons for an Unclaimed HMRC Refund

Several factors can lead to an unexpected HMRC refund. Understanding these common reasons is the first step towards reclaiming your money.

Incorrect Tax Code

Your tax code dictates how much Income Tax your employer deducts from your salary. An incorrect tax code is a frequent cause of overpayment. For example, an incorrect code might deduct tax as if you're a higher earner than you are, resulting in a substantial overpayment throughout the tax year. This is especially true if your circumstances have changed, but you haven't updated your tax code accordingly.

- Check your P45 and P60 for accuracy. These documents detail your tax code and earnings for the previous tax year. Any discrepancies should be investigated.

- Look out for discrepancies between your payslip and tax code. If the tax deducted seems unusually high compared to your income and tax code, it's time to investigate.

- Contact HMRC directly if you suspect an error. They can verify your tax code and make any necessary corrections, potentially leading to a significant HMRC refund.

Missing Allowances or Deductions

Several allowances and deductions can reduce your taxable income. Failing to claim these can result in overpaying tax. These include:

-

Marriage Allowance: If you're married or in a civil partnership and one partner earns less than the personal allowance, you could transfer some of their unused allowance to your higher-earning partner, reducing your tax bill.

-

Pension Contributions: Contributions to a registered pension scheme are usually tax-deductible, reducing your taxable income and your overall tax liability.

-

Review your payslip for all deductions and allowances claimed. Ensure all eligible deductions are being applied correctly.

-

Check if you're eligible for additional allowances, like the marriage allowance. The HMRC website provides detailed information on eligibility criteria.

-

Understand how pension contributions reduce your taxable income. The amount of tax relief you receive depends on your tax band.

Changes in Personal Circumstances

Life events significantly impact your tax situation. Failing to inform HMRC about these changes promptly can lead to overpayment or underpayment. Examples include:

-

Marriage or Civil Partnership: This can affect your tax code and eligibility for allowances like the marriage allowance.

-

Divorce or Separation: This can impact your tax code and eligibility for certain benefits.

-

Having Children: You may be entitled to child benefit or other tax credits.

-

Change of Employment: Ensure your new employer has the correct tax code.

-

Inform HMRC of any significant changes in your circumstances. This is crucial to ensure your tax code reflects your current situation.

-

Update your personal details with HMRC regularly. Keep your address, marital status, and other relevant information up-to-date.

-

Keep records of all relevant documentation. This will be helpful if you need to make a claim or provide supporting evidence.

How to Check Your Payslip for Potential HMRC Refunds

Regularly reviewing your payslip is key to identifying potential overpayments.

Key Information to Look For

Focus on these key areas of your payslip:

-

Gross Pay: Your total earnings before deductions.

-

Net Pay: Your earnings after deductions, including tax.

-

Tax Deducted: The amount of Income Tax withheld by your employer.

-

Tax Code: Your unique tax code.

-

Allowances and Deductions: Review all listed allowances and ensure they accurately reflect your entitlements.

-

Check your gross pay, net pay, and tax deducted. Compare these figures to your previous payslips and identify any inconsistencies.

-

Compare your payslips over the tax year for consistency. Look for any unusual patterns or significant changes in tax deductions.

-

Analyze your tax code and allowances. Ensure these are correct and reflect your current circumstances.

Using Online Payslip Portals

Most employers now provide online access to payslips.

- Familiarize yourself with your employer's online payslip system. Learn how to download and save your payslips securely.

- Download and save all your payslips securely. This makes it easy to review and organize your information.

- Organize your payslip data for easy access. Create a system for storing your payslips, perhaps using a dedicated folder on your computer or cloud storage.

Keeping Accurate Records

Maintaining accurate records is crucial for claiming a refund.

- Keep payslips for at least six years. This is the recommended timeframe for retaining tax records.

- Store payslips in a secure and organized manner (both physical and digital copies). Consider using a filing system or cloud storage for easy access.

- Back up digital records to the cloud. This provides an extra layer of security in case of data loss.

Claiming Your HMRC Refund: A Step-by-Step Guide

Once you've identified a potential overpayment, follow these steps to claim your HMRC refund.

Gathering Necessary Documents

Before submitting your claim, gather the following:

-

Payslips: All payslips from the relevant tax year.

-

P60: Your end-of-year tax statement.

-

Personal Details: Ensure your address and National Insurance number are correct.

-

Supporting Documentation: Any additional documents that support your claim (e.g., marriage certificate, proof of pension contributions).

-

Gather all your payslips from the relevant tax year. Ensure you have complete and accurate records.

-

Ensure your personal information is correct. Errors can delay or prevent your claim from being processed.

-

Prepare supporting documentation as needed. This strengthens your claim and speeds up the process.

Submitting Your Claim

You can usually submit your claim online through the HMRC website.

- Use the official HMRC online portal for quick submission. This is generally the fastest and most efficient method.

- Fill out all necessary forms accurately. Double-check all information before submitting your claim.

- Keep a copy of your claim for your records. This provides proof of submission and allows you to track the progress of your claim.

What to Expect After Submitting Your Claim

HMRC aims to process claims within a certain timeframe.

- Allow sufficient time for processing. HMRC processing times can vary, so be patient.

- Track your claim online (if submitted online). Many online portals allow you to check the status of your claim.

- Contact HMRC if you have not received an update after a reasonable time. If your claim is delayed, contact HMRC directly to inquire about its status.

Conclusion

Don't let hard-earned money go unclaimed! A simple review of your payslips could reveal a significant HMRC refund waiting for you. Follow the steps outlined above to identify potential overpayments and claim what's rightfully yours. Take action today and check your payslips – you might be surprised at the results! Use our guide to help you successfully claim your HMRC refund. Start your HMRC refund claim now!

Featured Posts

-

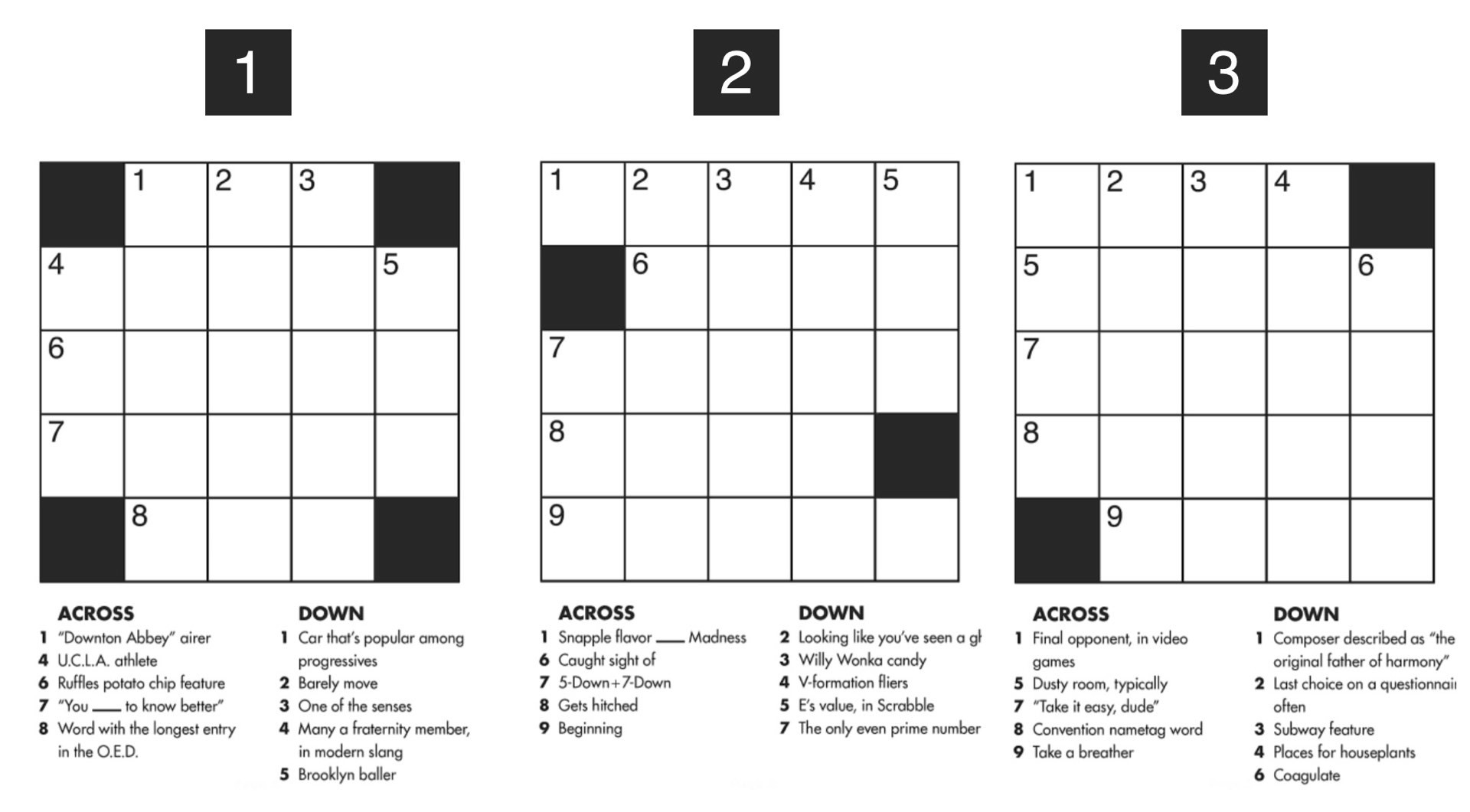

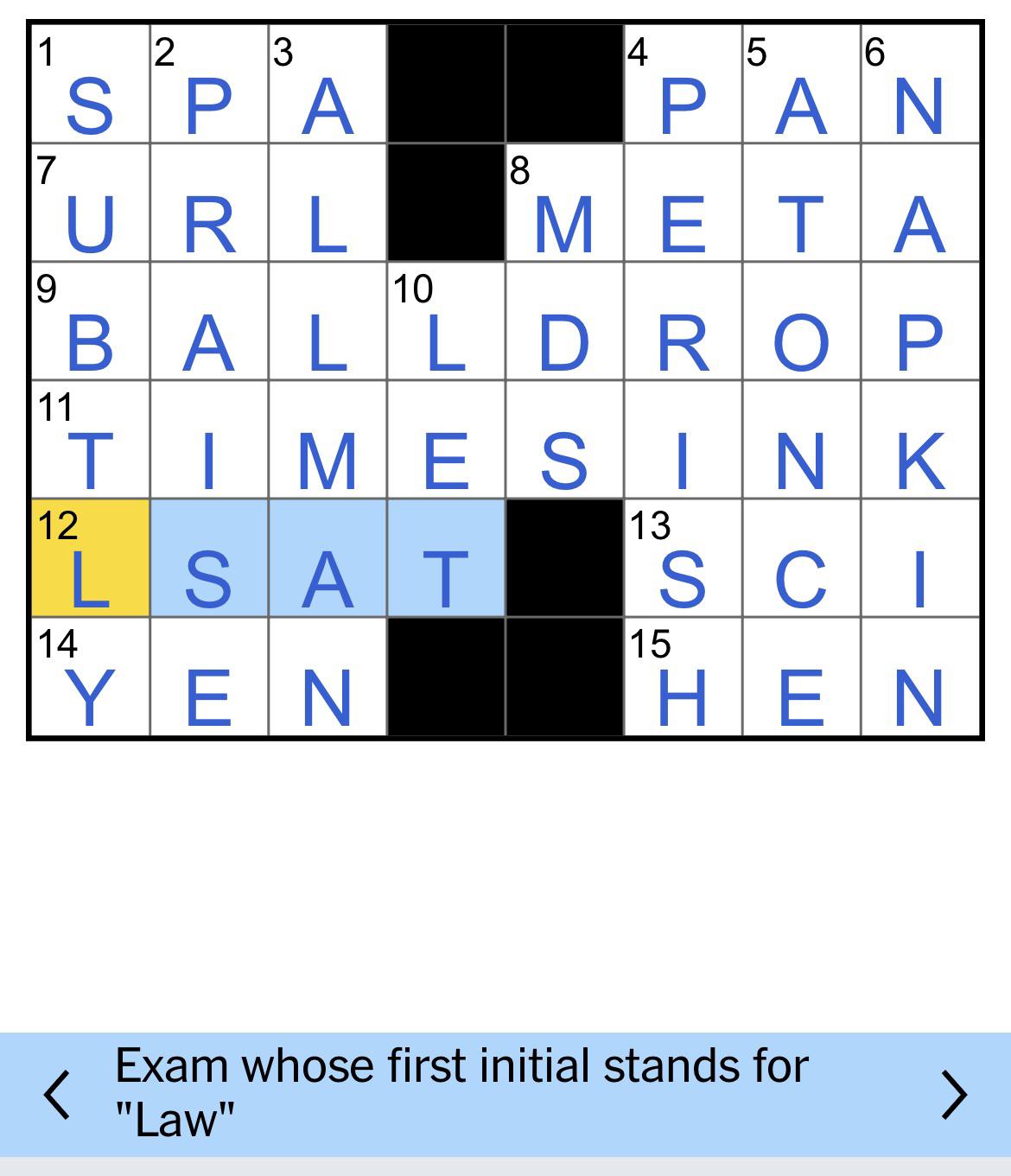

Nyt Mini Crossword Answers March 13 Daily Puzzle Solved

May 20, 2025

Nyt Mini Crossword Answers March 13 Daily Puzzle Solved

May 20, 2025 -

Novaya Sharapova Perspektivy Molodoy Tennisistki Iz Rossii

May 20, 2025

Novaya Sharapova Perspektivy Molodoy Tennisistki Iz Rossii

May 20, 2025 -

Agatha Christies Poirot Critical Analysis And Legacy

May 20, 2025

Agatha Christies Poirot Critical Analysis And Legacy

May 20, 2025 -

Jennifer Lawrence Antrasis Vaiko Gimimas Naujienos Apie Aktores Seima

May 20, 2025

Jennifer Lawrence Antrasis Vaiko Gimimas Naujienos Apie Aktores Seima

May 20, 2025 -

Todays Nyt Mini Crossword Answers For March 13

May 20, 2025

Todays Nyt Mini Crossword Answers For March 13

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025