DWP Overhaul: Universal Credit Changes And Potential Loss Of Benefits

Table of Contents

Keywords: DWP, Universal Credit, benefit changes, benefit loss, Universal Credit reform, DWP reforms, benefit reduction, income support, claimants, eligibility criteria, housing benefit, sanctions, taper rate, work requirements.

The Department for Work and Pensions (DWP) has significantly overhauled the Universal Credit system, leading to both positive and negative impacts for claimants. Understanding these changes is crucial to avoid potential losses in benefits. This article explores the key alterations and the risks involved, empowering you to safeguard your financial well-being. The DWP's reforms affect millions, so let's delve into the details to help you navigate this complex landscape.

Key Changes to Universal Credit Under the DWP Overhaul

The DWP's Universal Credit overhaul encompasses several key changes that directly impact claimants' benefits. These changes require careful consideration to avoid financial hardship.

Increased Work Requirements

The DWP has significantly increased the required hours of work for claimants to receive full Universal Credit payments. This affects individuals previously exempt due to health conditions or childcare responsibilities.

- Increased minimum weekly hours: The minimum required weekly hours have increased from 16 to 25 hours for many claimants.

- Stricter sanctions for non-compliance: Failure to meet these increased work requirements now carries stricter sanctions, including reduced or suspended payments.

- Changes to the definition of "acceptable work": The definition of what constitutes "acceptable work" has been tightened, potentially leaving some claimants with fewer options.

- Increased emphasis on mandatory job searching activities: Claimants are now required to engage in more intensive job searching activities, including attending appointments and participating in training programs.

Changes to the Taper Rate

The DWP has also adjusted the taper rate, impacting how much benefit claimants receive as their earnings increase. This can lead to a lower net income for some, potentially discouraging work.

- Explanation of the taper rate and its impact on net income: The taper rate determines the amount of Universal Credit reduced for every pound earned. Changes to this rate mean a larger portion of earnings is deducted from benefits.

- Examples illustrating benefit reductions due to the changes: For example, a claimant previously earning £100 per week might have seen a smaller reduction in their Universal Credit payment compared to the current system.

- Analysis of the impact on low-income earners: The changes disproportionately affect low-income earners, potentially trapping them in a cycle of poverty.

Changes to Housing Benefit within Universal Credit

The way housing costs are covered under Universal Credit has also changed, potentially leading to increased rent arrears for some claimants.

- Explanation of changes to housing benefit calculation: The calculation method for housing benefit within Universal Credit has been altered, potentially resulting in lower payments.

- Potential impact on rent payments and housing stability: This could lead to financial difficulties in meeting rent obligations and threaten housing stability.

- Advice on managing potential rent arrears: Claimants should contact their landlord immediately if they anticipate difficulty paying rent and explore options such as negotiating a payment plan.

Identifying Your Risk of Benefit Loss Under the New DWP System

Understanding your risk of benefit loss under the new DWP system requires a thorough assessment of your individual circumstances.

Assessing Eligibility Criteria

The DWP has updated its eligibility criteria for Universal Credit. It is crucial to check if you still meet these criteria.

- Check your current eligibility under the new rules: Carefully review the updated eligibility criteria on the Gov.uk website.

- Identify specific changes that affect your circumstances: Determine how the changes to work requirements, taper rate, or housing benefit affect your individual situation.

- Understand any potential exemptions: Explore any potential exemptions you might qualify for based on your health, disability, or childcare responsibilities.

Understanding Potential Sanctions

It is vital to understand the potential sanctions the DWP can impose for non-compliance.

- Types of sanctions (e.g., reduced payments, temporary suspension): Sanctions can range from reduced payments to a complete temporary suspension of benefits.

- Examples of activities leading to sanctions: Missing appointments, failing to actively seek work, or not reporting a change in circumstances can all lead to sanctions.

- The appeals process if you disagree with a sanction: If you disagree with a sanction imposed by the DWP, you have the right to appeal the decision.

Protecting Yourself Against Universal Credit Benefit Loss

Taking proactive steps can significantly reduce the risk of Universal Credit benefit loss.

Seeking Advice and Support

Seeking professional guidance is essential for navigating the complexities of the updated Universal Credit system.

- List of relevant organizations and their contact information: Contact Citizens Advice, Shelter, or your local Jobcentre Plus for assistance.

- Explanation of the support they can offer: These organizations can offer guidance on eligibility, appeals processes, and budgeting advice.

- Importance of proactive engagement: Don't wait until you are facing financial difficulties; seek advice early.

Careful Budgeting and Financial Planning

Careful budgeting and financial planning are crucial for managing potential income reductions.

- Budgeting tips and resources: Utilize online budgeting tools and resources to create a realistic budget.

- Strategies for managing reduced income: Identify areas where you can reduce spending and explore potential sources of additional income.

- Importance of creating a financial safety net: Build an emergency fund to cover unexpected expenses.

Conclusion

The DWP's Universal Credit overhaul presents significant challenges for many claimants. Understanding the changes to work requirements, taper rate, and housing benefits, as well as potential sanctions, is crucial to avoid benefit loss. By proactively assessing your eligibility, seeking expert advice, and implementing careful budgeting strategies, you can better navigate these complexities and protect your financial well-being. Don’t wait until it’s too late; take action today to understand your rights and responsibilities under the new Universal Credit system and learn how to mitigate the risk of Universal Credit benefit loss. Contact a welfare rights advisor today to ensure you receive the benefits you're entitled to.

Featured Posts

-

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025 -

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025 -

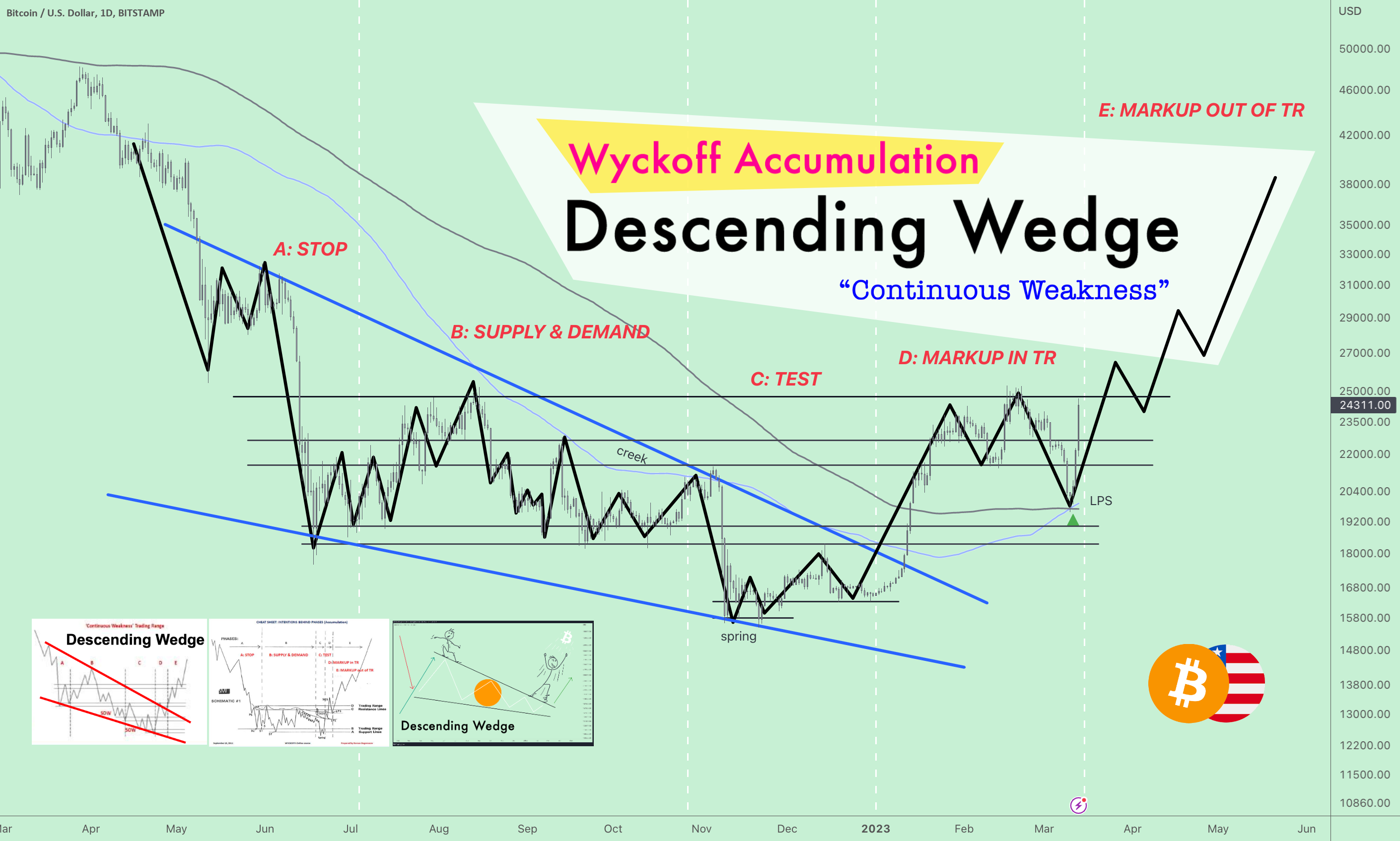

Ethereums Potential 2 700 Surge A Wyckoff Accumulation Perspective

May 08, 2025

Ethereums Potential 2 700 Surge A Wyckoff Accumulation Perspective

May 08, 2025 -

Lyon Psg Macinin Yayin Tarihi Ve Kanali

May 08, 2025

Lyon Psg Macinin Yayin Tarihi Ve Kanali

May 08, 2025