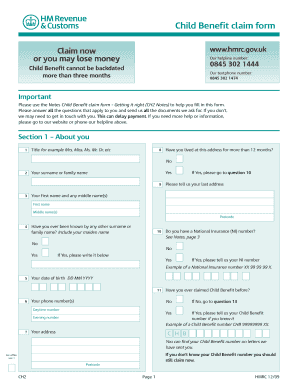

Don't Ignore: Crucial HMRC Child Benefit Communication

Table of Contents

Understanding Your HMRC Child Benefit Letters and Emails

Effectively managing your Child Benefit starts with understanding how HMRC communicates with you. This includes recognizing legitimate correspondence and deciphering the information provided.

Identifying Genuine HMRC Communications

It's vital to distinguish official HMRC communications from fraudulent attempts (phishing). Legitimate HMRC Child Benefit communications will always include specific identifiers:

- Official Letterhead: HMRC letters use distinctive letterheads with their logo and contact details.

- Secure Email Addresses: Emails will originate from a @gov.uk address. Never click links or open attachments from suspicious emails.

- Unique Reference Number: Each communication will include a unique reference number relating to your Child Benefit claim.

- Check the HMRC Website: Regularly visit the official HMRC website to find updates and announcements. Look for contact information and alerts concerning Child Benefit directly on their site.

Beware of phishing scams attempting to mimic official HMRC communications. Never share personal or financial information unless you are completely certain of the communication's authenticity.

Deciphering HMRC Child Benefit Statements

Understanding your Child Benefit statement is essential for managing your finances. These statements detail:

- Payment Amount: The total amount of Child Benefit you received.

- Payment Dates: When payments were made to your account.

- Tax Year: The tax year to which the payment relates.

- Payment Frequency: Whether you receive payments weekly or monthly.

- Changes or Adjustments: Any reductions or increases due to changes in your circumstances.

Variations in payments might result from changes in your circumstances (e.g., change in income, number of children) or corrections to previous payments. You can access your online statements through your HMRC online account, providing a convenient and secure way to manage your Child Benefit records.

Responding to HMRC Child Benefit Enquiries

Prompt and accurate responses to HMRC's requests are critical for avoiding potential issues with your Child Benefit.

Responding to HMRC Requests for Information

HMRC may occasionally request additional information to verify your entitlement or address any discrepancies. This might include:

- Proof of Address: Evidence confirming your current residential address.

- Income Details: Supporting documentation related to your earnings.

- Details of Children: Information confirming the ages and details of your children.

Failure to respond promptly or provide accurate information can lead to delays or suspension of your Child Benefit. Respond to requests through the preferred method indicated in the communication—usually online, by post, or by phone. Always ensure your response is secure and includes all requested documentation.

Understanding and Appealing HMRC Decisions

If you disagree with a decision concerning your Child Benefit claim, you have the right to appeal. This typically involves:

- Submitting a Formal Appeal: Follow the instructions provided in the original decision notice.

- Providing Supporting Evidence: Gather any documents that support your appeal.

- Meeting Deadlines: Adhere to the time limits outlined in the appeal process.

If you need assistance navigating the appeal process, consider seeking help from independent advisors specializing in benefits.

Avoiding HMRC Child Benefit Penalties and Issues

Proactive management of your Child Benefit claim is key to avoiding penalties and complications.

Maintaining Accurate Information

It's crucial to inform HMRC immediately of any changes that may affect your Child Benefit entitlement:

- Change of Address: Report any change of address promptly to ensure payments are delivered correctly.

- Changes in Income: Update HMRC on significant changes in your income, as this can impact your eligibility.

- Changes in Family Circumstances: Report any changes to the number of children in your care.

Failing to report these changes can result in overpayments, which you may be required to repay, or even discontinuation of your benefit.

Staying Updated on HMRC Policy Changes

HMRC regularly updates its policies and regulations regarding Child Benefit. It's crucial to stay informed:

- Check the HMRC Website Regularly: Look for announcements and policy changes on the official website.

- Subscribe to Email Alerts: Sign up for email alerts to receive notifications about relevant updates.

- Proactive Checking: Make it a habit to review your account regularly for any notices or updates.

By staying vigilant about potential changes, you can ensure continued receipt of your benefits without interruption.

Conclusion

Prompt attention to all HMRC Child Benefit communications is paramount. Knowing how to verify communication authenticity, respond to requests for information, and appeal decisions are crucial for preventing delays and penalties. Ignoring HMRC Child Benefit communication can have serious financial consequences. Stay informed about your HMRC Child Benefit payments by proactively checking your online account, and respond immediately to all official communications. Don't delay responding to your HMRC Child Benefit communications – your family's financial well-being depends on it.

Featured Posts

-

Hmrc Site Outage Widespread Access Problems For Uk Taxpayers

May 20, 2025

Hmrc Site Outage Widespread Access Problems For Uk Taxpayers

May 20, 2025 -

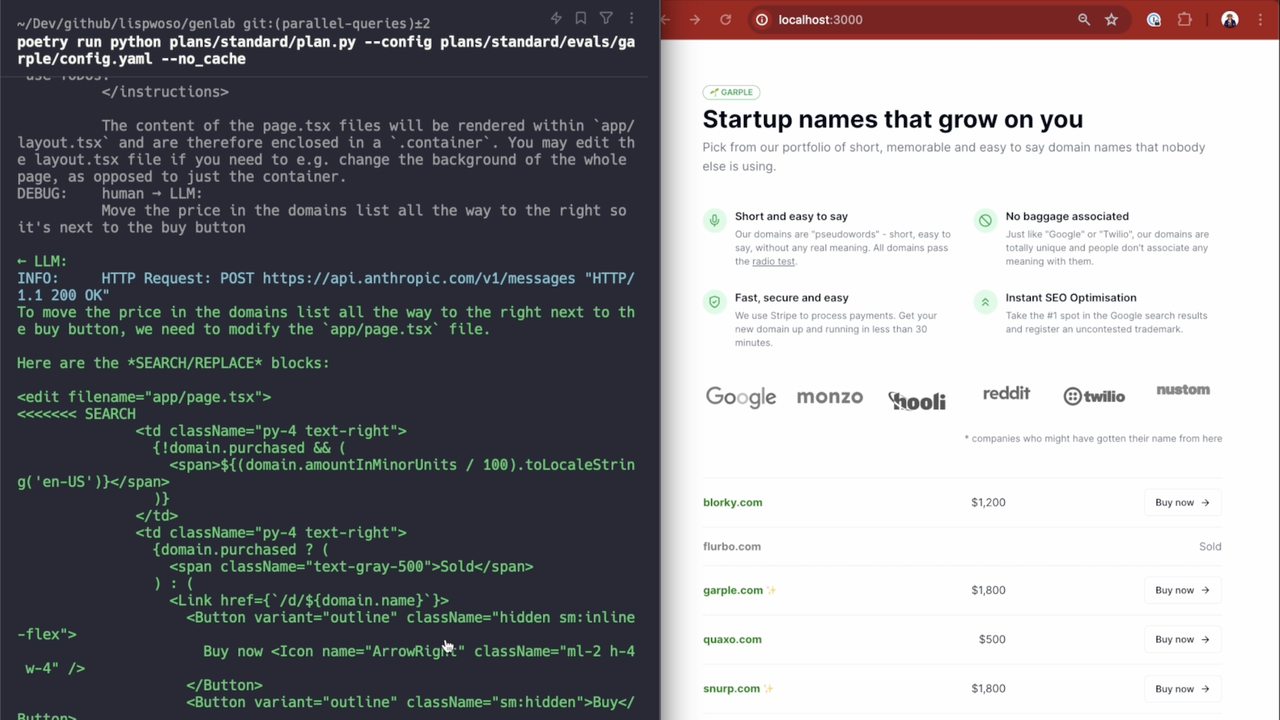

Coding Made Easier Chat Gpt Integrates Ai Coding Agent

May 20, 2025

Coding Made Easier Chat Gpt Integrates Ai Coding Agent

May 20, 2025 -

Sabalenkas Winning Start At The Madrid Open

May 20, 2025

Sabalenkas Winning Start At The Madrid Open

May 20, 2025 -

Towards Zero Episode 1 Analyzing The Absence Of Murder

May 20, 2025

Towards Zero Episode 1 Analyzing The Absence Of Murder

May 20, 2025 -

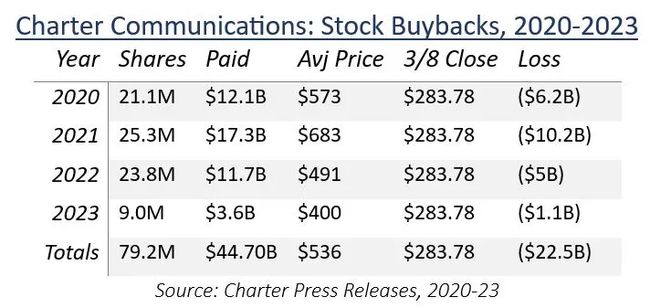

Impact Of Tariff Wars On Ryanairs Growth A Buyback Strategy Response

May 20, 2025

Impact Of Tariff Wars On Ryanairs Growth A Buyback Strategy Response

May 20, 2025

Latest Posts

-

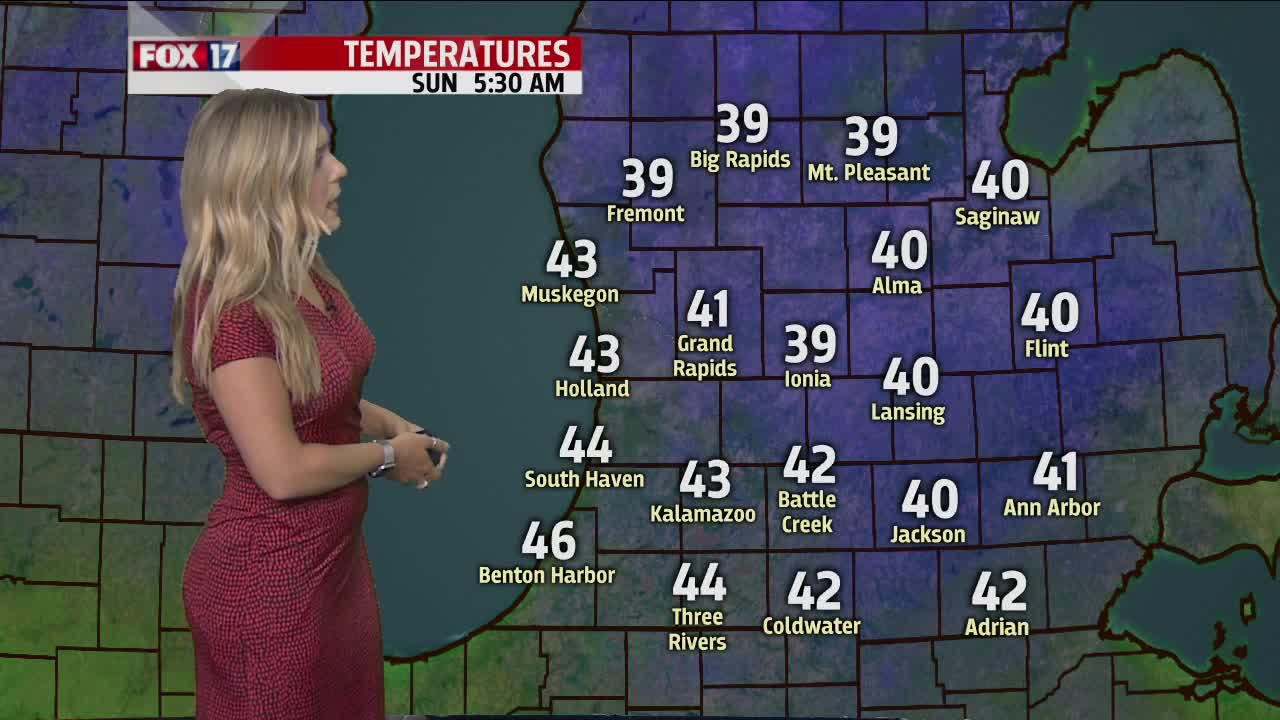

Updated Rain Forecast Latest On And Off Chances

May 20, 2025

Updated Rain Forecast Latest On And Off Chances

May 20, 2025 -

Precise Rain Predictions Know When To Expect Showers

May 20, 2025

Precise Rain Predictions Know When To Expect Showers

May 20, 2025 -

12 Ai Stocks From Reddit Should You Invest

May 20, 2025

12 Ai Stocks From Reddit Should You Invest

May 20, 2025 -

When To Expect Rain Updated Forecasts And Timing

May 20, 2025

When To Expect Rain Updated Forecasts And Timing

May 20, 2025 -

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025