HMRC Site Outage: Widespread Access Problems For UK Taxpayers

Table of Contents

Extent of the HMRC Site Outage

The current HMRC website problems are significantly impacting taxpayers' ability to manage their tax affairs online. Understanding the scope of this disruption is crucial.

Geographic Impact

The outage appears to be affecting users nationwide. Reports from across the UK, including major cities like London, Manchester, Birmingham, Glasgow, and Cardiff, indicate widespread disruption. Social media platforms are flooded with complaints from users experiencing difficulties accessing HMRC online services, suggesting a nationwide problem. At the time of writing, there has been no official statement from HMRC regarding the geographic extent of the outage.

Services Affected

Numerous crucial HMRC online services are currently unavailable, impacting a wide range of tax-related activities:

- Self Assessment tax return filing: Individuals facing imminent deadlines are unable to submit their returns.

- PAYE online services: Employers are experiencing difficulties managing payroll and submitting PAYE information.

- Corporation tax filing: Businesses are facing delays in submitting their corporation tax returns.

- Checking tax codes: Taxpayers are unable to verify their tax codes online.

- Accessing personal tax accounts: Individuals cannot view their tax summaries and other personal information.

- Contacting HMRC online: The inability to contact HMRC online adds further frustration for those seeking assistance.

Duration of the Outage

The exact duration of the HMRC site outage remains unclear. As of [Insert Current Time and Date], the outage has been ongoing for [Duration of Outage]. There is currently no official statement from HMRC regarding the projected restoration time. News outlets are reporting on the ongoing situation, and we will update this article as soon as more information becomes available. Monitoring official HMRC channels for updates is advised.

Potential Causes of the HMRC Site Outage

Several factors could be contributing to the current HMRC website problems. It's important to note that these are potential causes, and the actual cause may not be revealed until an official statement is released by HMRC.

Technical Issues

A range of technical issues could be responsible for the outage:

- Server failure: A major server failure could render the entire system inaccessible.

- Software glitch: A critical software bug could be disrupting normal operations.

- Cyberattack (DDoS attack): A Distributed Denial of Service (DDoS) attack could be overwhelming the HMRC servers, preventing legitimate users from accessing the site. However, there is no confirmation of this at this time.

- Planned maintenance gone wrong: While unlikely, unforeseen complications during planned maintenance could have resulted in the outage.

Increased User Traffic

The timing of the outage could be related to increased user traffic. Tax deadlines, particularly for self-assessment, often lead to high website traffic. It's possible that an unusually high volume of users attempting to access the site simultaneously overloaded the system.

Advice for Affected Taxpayers

The disruption caused by the HMRC site outage necessitates proactive steps from affected taxpayers.

What to Do if You Can't Access HMRC Online Services

If you are unable to access HMRC online services, you should:

- Avoid repeatedly trying to access the site: This could exacerbate the problem and further delay service restoration.

- Check the official HMRC website and social media channels: Look for updates, announcements, and potential resolutions.

- Contact HMRC via phone (if possible): Try contacting HMRC via their telephone helpline. Be prepared for potential delays.

- Keep records of your attempts to access the site: This documentation could be useful if you face any issues relating to missed deadlines.

Deadline Extensions and Penalties

The impact of the HMRC site outage on filing deadlines is a significant concern. While HMRC has not yet announced any formal extensions, it is crucial to:

- Keep records of your attempts to access the site: This will demonstrate your efforts to meet deadlines despite the disruption.

- Contact HMRC directly: If you miss a deadline due to the outage, contact HMRC immediately to explain the situation. Early communication is key.

- Understand potential penalties: Be aware of the potential penalties for late filing and be prepared to provide evidence of your attempts to comply.

Alternative Ways to Contact HMRC

While online services are down, HMRC offers alternative contact methods:

- Telephone helpline: [Insert relevant HMRC helpline number]

- Postal address: [Insert relevant HMRC postal address]

Conclusion

The current HMRC site outage is causing significant disruption and frustration for UK taxpayers. While the cause and duration remain uncertain, proactive steps are crucial to mitigate potential problems. Regularly check the official HMRC website and social media channels for updates regarding the HMRC site outage. Remember to document your attempts to access online services and utilize alternative contact methods if necessary. Addressing this HMRC website downtime effectively requires staying informed and acting promptly.

Featured Posts

-

Tampoy I Martha Kai I Deyteri Eykairia Ston Gamo Tis

May 20, 2025

Tampoy I Martha Kai I Deyteri Eykairia Ston Gamo Tis

May 20, 2025 -

Jennifer Lawrence Opaet Mamou Potvrdene Druhe Dieta

May 20, 2025

Jennifer Lawrence Opaet Mamou Potvrdene Druhe Dieta

May 20, 2025 -

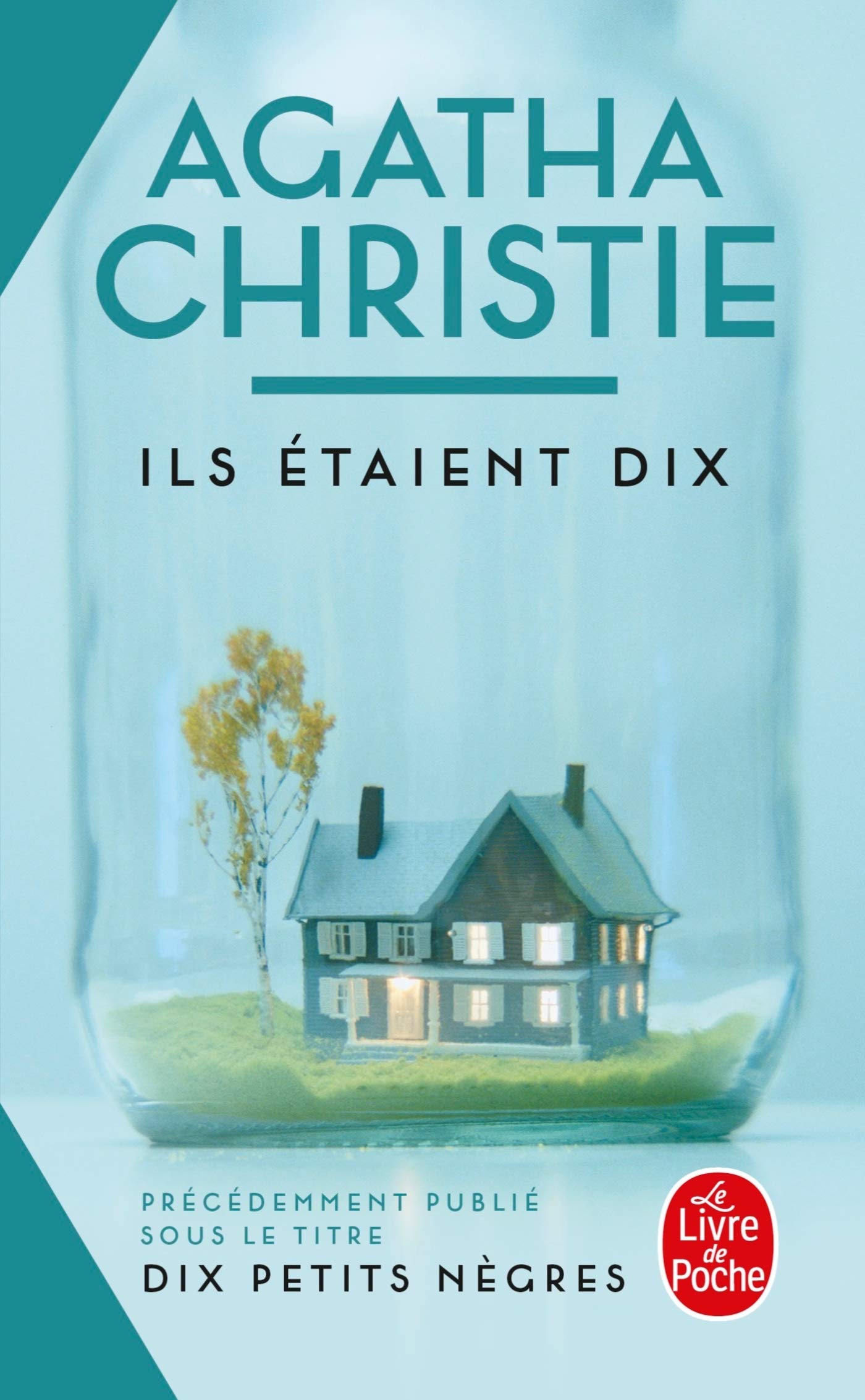

Maitriser L Ecriture Lecons D Agatha Christie Boostees Par L Ia

May 20, 2025

Maitriser L Ecriture Lecons D Agatha Christie Boostees Par L Ia

May 20, 2025 -

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025 -

Jasmine Paolinis Historic Rome Victory A New Era Begins

May 20, 2025

Jasmine Paolinis Historic Rome Victory A New Era Begins

May 20, 2025

Latest Posts

-

I Tzenifer Lorens Kai O Koyki Maroni Goneis Gia Deyteri Fora

May 20, 2025

I Tzenifer Lorens Kai O Koyki Maroni Goneis Gia Deyteri Fora

May 20, 2025 -

Jennifer Lawrence Dvojnasobna Mama V Tajnosti

May 20, 2025

Jennifer Lawrence Dvojnasobna Mama V Tajnosti

May 20, 2025 -

I Tzenifer Lorens Egine Mitera Gia Deyteri Fora Anakoinosi Kai Leptomereies

May 20, 2025

I Tzenifer Lorens Egine Mitera Gia Deyteri Fora Anakoinosi Kai Leptomereies

May 20, 2025 -

Druhe Dieta Jennifer Lawrence Prekvapujuca Sprava Pre Fanusikov

May 20, 2025

Druhe Dieta Jennifer Lawrence Prekvapujuca Sprava Pre Fanusikov

May 20, 2025 -

I Tzenifer Lorens Mia Deyteri Egkymosyni Kai I Xara Tis Mitrotitas

May 20, 2025

I Tzenifer Lorens Mia Deyteri Egkymosyni Kai I Xara Tis Mitrotitas

May 20, 2025