Impact Of Tariff Wars On Ryanair's Growth: A Buyback Strategy Response

Table of Contents

Rising Fuel Costs and Tariff Impacts on Ryanair

Tariff wars create ripple effects across global markets, and the airline industry is highly susceptible. One major area of impact is fuel costs.

Increased Fuel Prices

Tariff wars often lead to higher fuel prices due to import taxes on crude oil and refined products. This directly impacts Ryanair's operational costs, squeezing profit margins.

- Correlation between global trade tensions and crude oil price fluctuations: Increased geopolitical uncertainty, often a byproduct of tariff wars, can disrupt oil supply chains and lead to price volatility. This makes it difficult for airlines like Ryanair to accurately predict and budget for fuel expenses.

- Increased fuel surcharges affect ticket pricing and passenger demand: Airlines are forced to pass some of these increased costs onto consumers through higher ticket prices, potentially reducing passenger demand, especially for price-sensitive travelers.

- Ryanair's fuel hedging strategies and their effectiveness: Ryanair, like other airlines, employs hedging strategies to mitigate fuel price volatility. However, the effectiveness of these strategies can be limited during periods of extreme price fluctuations caused by major geopolitical events.

Aircraft Manufacturing and Maintenance Costs

Tariffs on aircraft parts and components, from engines to avionics, significantly increase manufacturing and maintenance costs for airlines like Ryanair.

- Specific components affected by tariffs: Tariffs can impact a wide range of components, including engines, landing gear, and sophisticated onboard technology.

- Estimated impact of these increased costs on Ryanair’s bottom line: Precise quantification is difficult without access to Ryanair's internal financial data, but even small percentage increases in component costs can translate to substantial overall expense increases for a large fleet operator.

- How these cost increases affect Ryanair's fleet expansion plans and overall capacity: Higher costs may lead Ryanair to reassess its fleet expansion plans, potentially slowing down growth or altering its aircraft acquisition strategy.

Impact on Passenger Demand and Route Optimization

The economic uncertainty created by tariff wars extends beyond direct cost increases for airlines. It significantly affects passenger demand and route optimization strategies.

Reduced Consumer Spending

Economic uncertainty caused by tariff wars can lead to decreased consumer spending, directly impacting air travel demand, a discretionary expense for many.

- Link between economic downturns and discretionary spending on air travel: During times of economic uncertainty, consumers often cut back on non-essential spending, including leisure travel.

- How Ryanair adjusts its pricing strategy in response to decreased demand: Ryanair may employ dynamic pricing, offering lower fares to stimulate demand during periods of reduced consumer confidence.

- Potential shift in passenger routes and destinations due to changing market conditions: Demand for travel to specific regions might decline due to tariff-related economic instability in those areas, necessitating route adjustments.

Geopolitical Instability and Travel Restrictions

Tariff wars often exacerbate geopolitical tensions, leading to travel restrictions and decreased tourist activity, further impacting Ryanair's operations.

- Examples of how trade disputes have influenced travel patterns: Trade disputes can lead to sanctions or travel advisories, discouraging travel to certain regions.

- Ryanair's contingency plans to navigate such uncertainties: Ryanair needs flexible operational strategies to adapt to sudden changes in travel demand and potential route closures.

- Impact of these factors on revenue streams and profitability: Geopolitical instability poses a significant risk to Ryanair’s revenue streams and overall profitability.

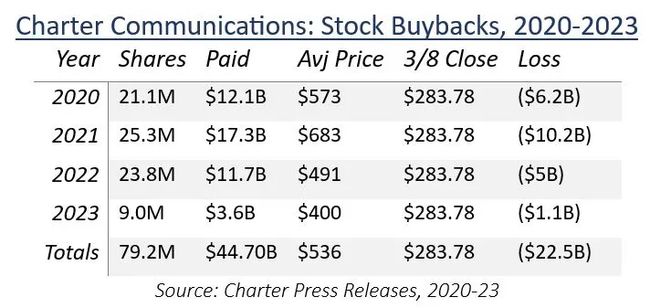

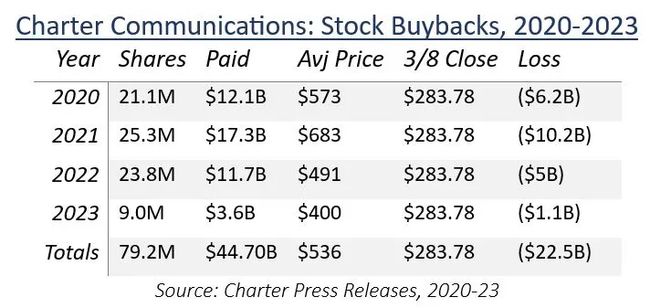

Ryanair's Buyback Strategy as a Response

In response to these challenges, Ryanair has employed a stock buyback program.

Rationale behind the Buyback Program

The buyback program serves multiple purposes in the context of tariff war challenges.

- Financial health and capacity for buybacks: Ryanair's strong financial position enables it to allocate capital to buybacks even amidst economic headwinds.

- Enhancing shareholder value and signaling confidence: Buybacks demonstrate confidence in the company's future prospects and aim to increase shareholder value by reducing the number of outstanding shares.

- Impact on the company’s earnings per share: Buybacks typically increase earnings per share, a key metric for investors.

Effectiveness and Long-Term Implications

The effectiveness of Ryanair's buyback strategy in mitigating the negative effects of tariff wars is a complex issue.

- Impact on Ryanair’s stock price and market capitalization: The impact on stock price depends on multiple factors, including market sentiment and investor confidence.

- Potential alternatives or complementary strategies: Other strategies, such as cost-cutting measures or route diversification, might complement the buyback program.

- Long-term implications of the buyback and its contribution to Ryanair's resilience: The long-term impact will depend on the duration and severity of tariff wars and the overall resilience of the airline industry.

Conclusion

This analysis demonstrates how tariff wars significantly impact Ryanair's growth through increased fuel and aircraft manufacturing costs, alongside reduced passenger demand and geopolitical instability. Ryanair's strategic response, in part, involved a share buyback program intended to enhance shareholder value and demonstrate confidence in its long-term prospects despite external economic headwinds. However, ongoing vigilance and adaptability remain crucial for navigating the unpredictable landscape of international trade disputes. To stay informed about the latest developments and the ongoing impact of Ryanair tariff wars impact, follow our blog for regular updates and analysis.

Featured Posts

-

The Evolving Landscape Of Tariffs A Look At Fp Videos Analysis

May 20, 2025

The Evolving Landscape Of Tariffs A Look At Fp Videos Analysis

May 20, 2025 -

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025 -

Biarritz Celebre Le 8 Mars Parcours De Femmes

May 20, 2025

Biarritz Celebre Le 8 Mars Parcours De Femmes

May 20, 2025 -

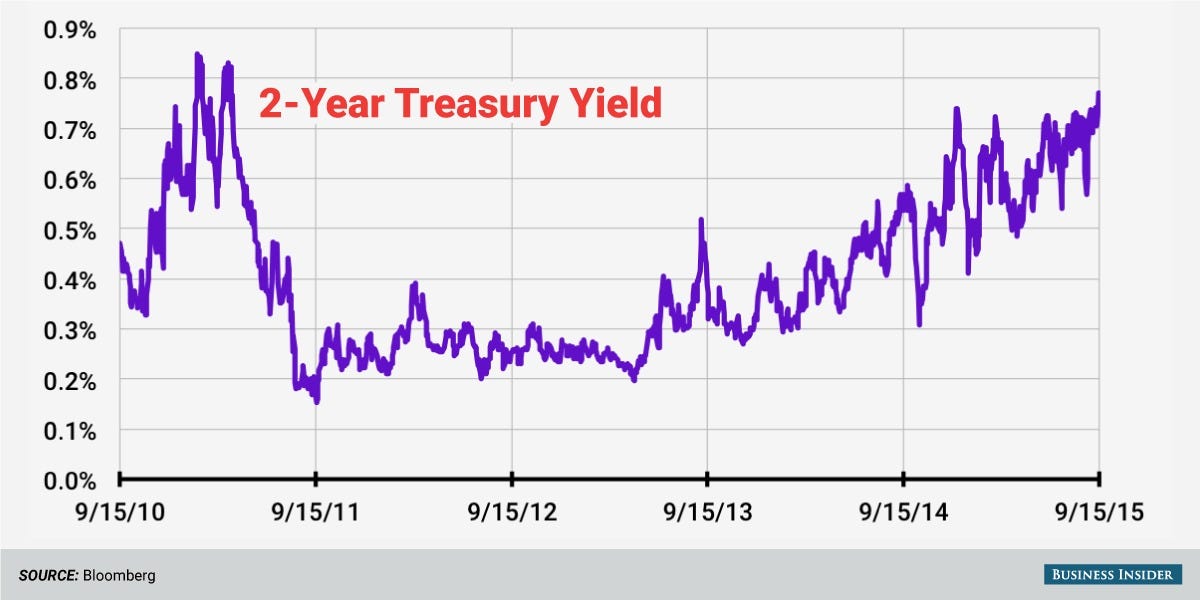

Americas Bond Market 5 30 Year Yield And Its Impact On Sales

May 20, 2025

Americas Bond Market 5 30 Year Yield And Its Impact On Sales

May 20, 2025 -

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025

Latest Posts

-

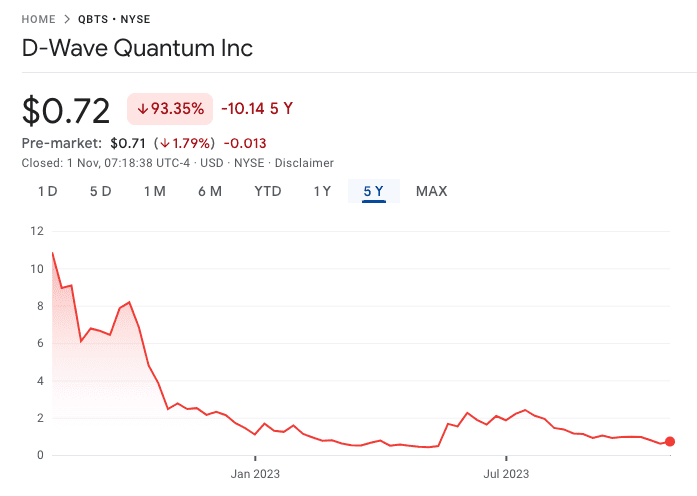

Investigating The Reasons Behind D Wave Quantum Inc Qbts Stocks Recent Growth

May 20, 2025

Investigating The Reasons Behind D Wave Quantum Inc Qbts Stocks Recent Growth

May 20, 2025 -

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Defense Spending Growth

May 20, 2025

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Defense Spending Growth

May 20, 2025 -

Recent D Wave Quantum Qbts Stock Market Performance Explained

May 20, 2025

Recent D Wave Quantum Qbts Stock Market Performance Explained

May 20, 2025 -

D Wave Quantum Qbts Stock Soared Analyzing The Factors

May 20, 2025

D Wave Quantum Qbts Stock Soared Analyzing The Factors

May 20, 2025 -

Analyzing D Wave Quantum Qbts A Quantum Computing Stock Evaluation

May 20, 2025

Analyzing D Wave Quantum Qbts A Quantum Computing Stock Evaluation

May 20, 2025