Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

Table of Contents

Desjardins' Rationale for Predicted Interest Rate Cuts

Desjardins' prediction of three more interest rate reductions isn't arbitrary; it stems from a careful analysis of several key economic indicators and global trends. The forecast reflects a growing concern about the health of the Canadian economy and the need for further monetary easing.

Weakening Canadian Economy

The Canadian economy is showing signs of significant slowdown. Several key indicators point towards a potential weakening, leading Desjardins and other economists to anticipate further interest rate reductions.

- Slowing GDP Growth: Statistics Canada's recent reports reveal a concerning trend of decelerating GDP growth, signaling a potential economic contraction. For example, Q3 2024 saw a [insert hypothetical percentage]% decrease, significantly lower than previous quarters. This sluggish growth indicates a weakening economy needing further stimulus.

- Weakening Employment Numbers: The employment sector, a key indicator of economic health, is also exhibiting signs of weakness. Job creation has slowed, and the unemployment rate may be rising, hinting at a potential recessionary environment.

- Reduced Consumer Spending: Consumer spending, a major driver of economic growth, shows signs of softening. Factors like inflation and increased borrowing costs are impacting consumer confidence and spending habits.

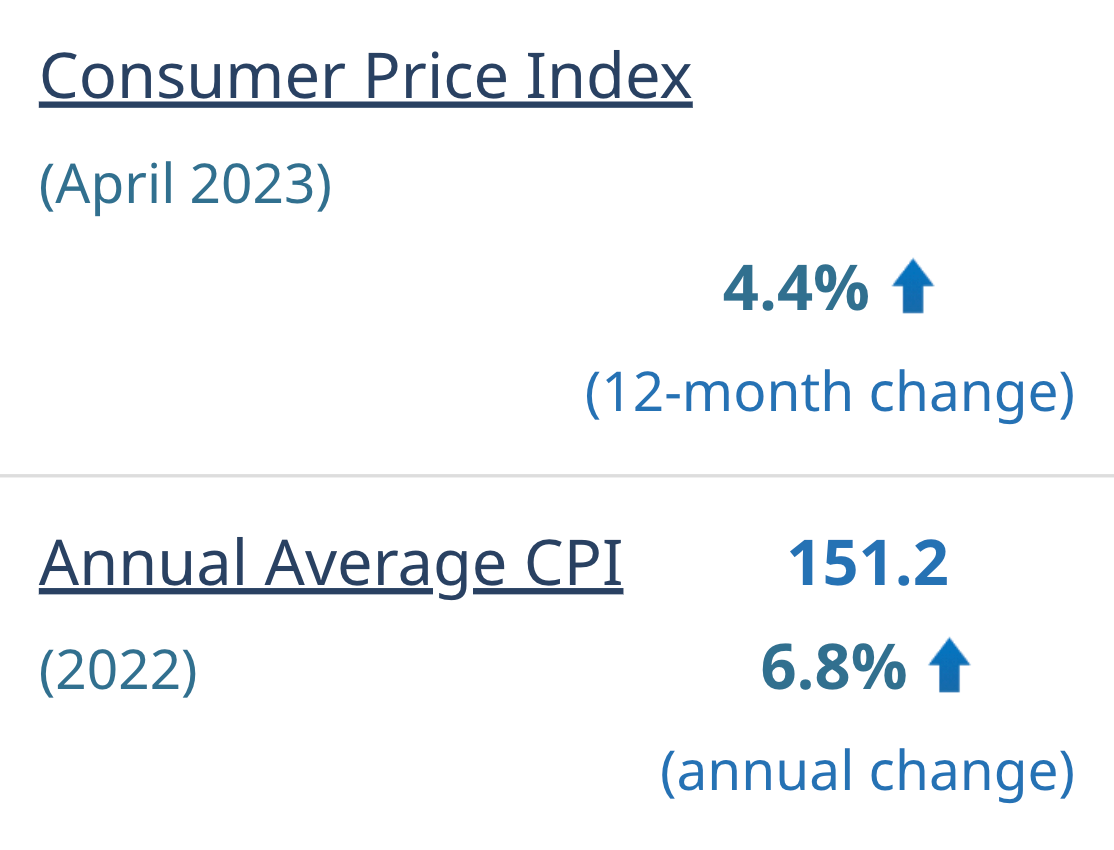

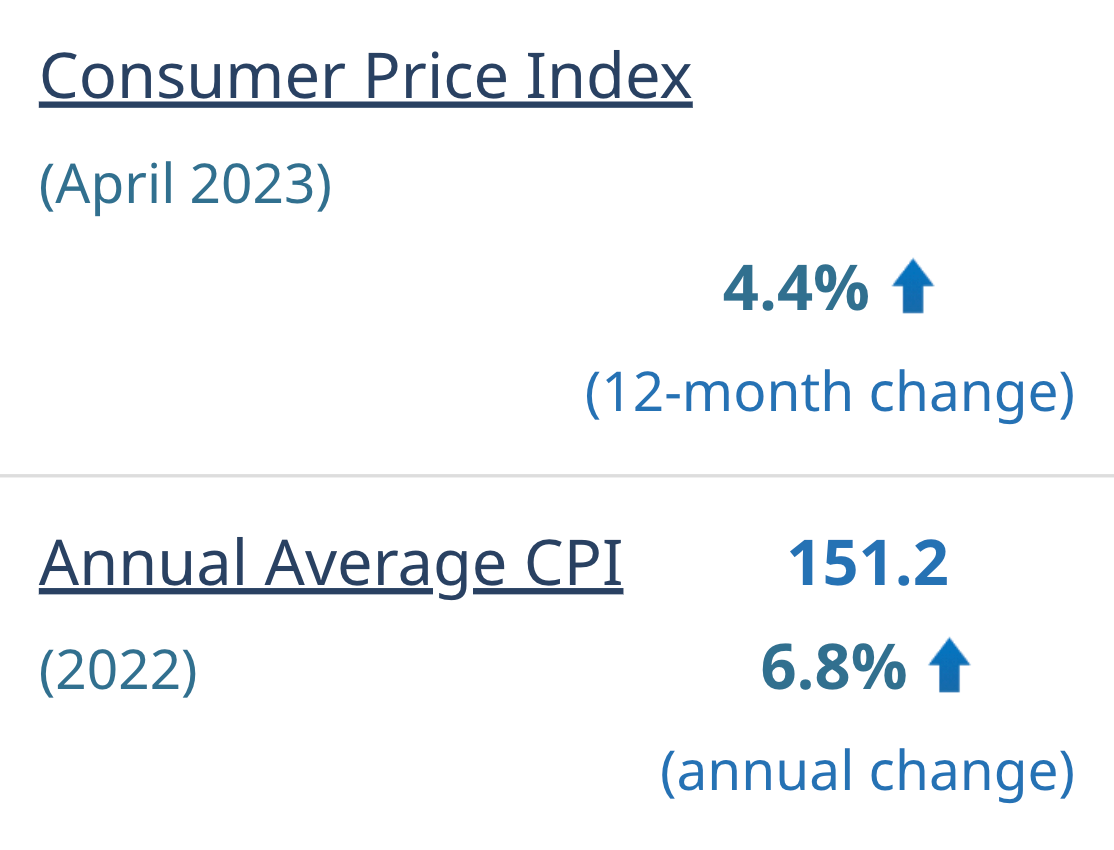

Inflationary Pressures Easing

While inflation remains above the Bank of Canada's target rate, the rate of increase has slowed considerably. This easing of inflationary pressures provides the Bank of Canada with more leeway to consider further interest rate reductions.

- Inflation Rate Decline: Although still elevated, the inflation rate has shown a downward trend in recent months, dropping from [insert hypothetical percentage]% to [insert hypothetical lower percentage]%. This suggests that the Bank of Canada's previous rate hikes are starting to have an effect.

- Supply Chain Improvements: Improvements in global supply chains are contributing to easing inflationary pressures. The reduced bottlenecks in production and distribution are leading to lower prices for goods and services.

- Cooling Demand: Reduced consumer spending, partly due to higher interest rates, is also contributing to the decrease in inflationary pressure. This cooling demand reduces upward pressure on prices.

Global Economic Uncertainty

The Canadian economy is not isolated from global economic headwinds. Concerns about a potential global recession, geopolitical instability, and weakening global demand are influencing Desjardins' forecast.

- Global Recessionary Fears: The threat of a global recession looms large, impacting export markets and investor confidence in the Canadian economy. This external pressure necessitates a more cautious and accommodative approach to monetary policy.

- Geopolitical Instability: Geopolitical tensions and uncertainties in various regions of the world contribute to global economic instability. This uncertainty impacts Canadian businesses and investment decisions.

- Impact on Canadian Exports: Reduced global demand negatively impacts Canadian exports, leading to a slowdown in economic growth and strengthening the case for interest rate cuts.

Potential Implications of Further Interest Rate Reductions

Desjardins' forecast of further interest rate reductions will have significant implications across various sectors of the Canadian economy.

Impact on Borrowing Costs

Lower interest rates will directly impact borrowing costs for consumers and businesses.

- Mortgage Rates: Reduced interest rates will lead to lower mortgage payments, potentially stimulating the housing market and boosting homebuyer confidence.

- Business Loans: Lower borrowing costs for businesses will encourage investment in expansion, hiring, and innovation, potentially boosting economic activity.

- Consumer Credit: Lower interest rates on personal loans and credit cards will improve affordability for consumers.

Impact on the Canadian Dollar

Lower interest rates might weaken the Canadian dollar compared to other currencies.

- Foreign Investment: Lower interest rates can make Canadian assets less attractive to foreign investors, potentially leading to capital outflow and a weaker Canadian dollar.

- Import and Export Prices: A weaker Canadian dollar can make imports more expensive but exports more competitive. This could have complex effects on different sectors of the economy.

- Tourism: A weaker dollar could boost tourism to Canada as it makes the country more affordable for international visitors.

Risks and Uncertainties

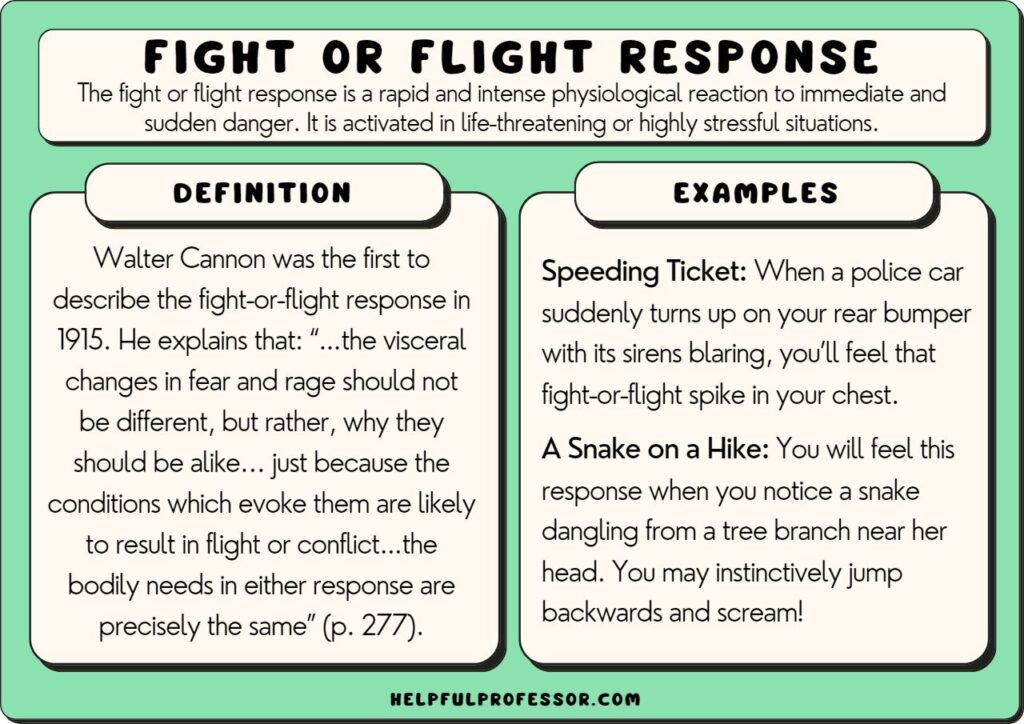

While lower interest rates can stimulate the economy, they also present potential risks and uncertainties.

- Increased Inflation: The primary risk is that lower interest rates could reignite inflationary pressures if they lead to excessive demand exceeding supply.

- Asset Bubbles: Lower interest rates can fuel asset bubbles in the housing market or other sectors, creating financial instability.

- Impact on Savings: Lower interest rates reduce the returns on savings, potentially impacting the financial well-being of individuals who rely on savings income.

Conclusion

Desjardins' forecast of three additional Bank of Canada interest rate reductions is a significant development with far-reaching consequences for the Canadian economy. The rationale behind this prediction, encompassing a weakening economy, easing (but still elevated) inflationary pressures, and global uncertainty, requires careful consideration. While lower interest rates might offer short-term economic benefits, it's crucial to acknowledge the potential risks involved. Staying informed about the Bank of Canada's monetary policy and its implications for your personal finances is vital. Continue monitoring news and analysis on Bank of Canada interest rate reductions and their impact on the Canadian economy. Regularly review your financial strategy and consider consulting with a financial advisor to adapt your plans to the evolving economic landscape.

Featured Posts

-

Sheinelle Jones Absence Colleagues Speak Out

May 24, 2025

Sheinelle Jones Absence Colleagues Speak Out

May 24, 2025 -

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025 -

Escape To The Country Budgeting For Your Rural Relocation

May 24, 2025

Escape To The Country Budgeting For Your Rural Relocation

May 24, 2025 -

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025 -

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Loss Since Wednesdays Open

May 24, 2025

Latest Posts

-

Joe Jonas Responds To Couples Argument About Him

May 24, 2025

Joe Jonas Responds To Couples Argument About Him

May 24, 2025 -

Joe Jonas Responds To Couples Dispute The Hilarious Story

May 24, 2025

Joe Jonas Responds To Couples Dispute The Hilarious Story

May 24, 2025 -

Couples Public Fight Over Joe Jonas His Response

May 24, 2025

Couples Public Fight Over Joe Jonas His Response

May 24, 2025 -

The Joe Jonas Incident A Couples Fight And His Response

May 24, 2025

The Joe Jonas Incident A Couples Fight And His Response

May 24, 2025 -

Couple Fights Over Joe Jonas His Response Is Hilarious

May 24, 2025

Couple Fights Over Joe Jonas His Response Is Hilarious

May 24, 2025