Escape To The Country: Budgeting For Your Rural Relocation

Table of Contents

Property Costs: More Than Just the Purchase Price

Securing your dream rural property is the first, and often largest, hurdle in your escape to the country. However, the purchase price is only the tip of the iceberg. Let's delve into the various costs involved:

Finding Affordable Rural Properties

Finding the right property within your budget requires research and a strategic approach.

- Explore different rural areas: Property prices fluctuate dramatically depending on location, proximity to amenities (schools, hospitals, shops), and the specific character of the area. Research thoroughly to identify areas that offer the best value for your money. Consider less popular, but still charming, locations for potential savings.

- Consider fixer-upper properties: Properties needing renovation can be significantly cheaper than move-in-ready homes. Carefully assess the extent of required work and obtain multiple quotes from contractors before making an offer. Factor these renovation costs into your overall budget.

- Utilize online property portals and local estate agents: Leverage online resources like Rightmove or Zoopla (UK examples, adapt as needed for other countries), and engage local estate agents specializing in rural properties. They possess in-depth knowledge of the local market and can guide you effectively.

- Research property taxes and other local levies: Property taxes and council tax (or equivalent) vary considerably across different regions. Thoroughly research these costs before committing to a purchase to avoid unexpected financial burdens. Also look into potential additional charges, such as water rates, if applicable.

Beyond the Down Payment: Closing Costs and Ongoing Expenses

Even after securing a mortgage, significant additional expenses await.

- Closing costs: These encompass solicitor fees, land registry fees, survey costs, and stamp duty (or equivalent transfer taxes). These costs can add up considerably, so factor them into your budget early on.

- Ongoing maintenance and repairs: Rural properties often require more maintenance than urban counterparts. Older properties, in particular, might necessitate regular repairs. Budget for unexpected repairs and routine maintenance such as roof checks and gutter cleaning.

- Homeowner's insurance: Insurance premiums for rural properties can be higher due to factors like increased distance from emergency services and higher risks of damage from severe weather. Shop around and compare quotes from different insurers.

- Additional expenses: Depending on the property, consider costs associated with well maintenance, septic tank emptying, private road upkeep, and snow removal (in colder climates). These costs can be substantial, particularly in more remote areas.

Relocation Expenses: The Hidden Costs of Moving

Moving to the countryside isn't just about finding a property; it's about physically relocating your belongings and setting up your new life.

Moving Your Belongings

Relocating your possessions can be surprisingly expensive.

- Moving options: You have several options: DIY using a rented van, hiring professional movers, or employing container shipping for long-distance moves. Each option has cost implications that you should carefully evaluate.

- Obtain multiple quotes: Never settle for the first quote you receive. Obtain at least three quotes from different moving companies and compare their services and pricing structures thoroughly.

- Account for hidden costs: Don't forget to include costs such as packing materials, fuel costs (if driving yourself), potential accommodation en route, and potential storage fees.

Setting Up Utilities and Services

Securing essential utilities and services in a rural setting can present unique challenges.

- Rural internet providers: Internet access in rural areas can be limited and expensive. Research providers available in your target area and compare packages. Satellite internet might be your only option in some areas, and it tends to be more costly than traditional broadband.

- Essential utilities: Contact providers for electricity, gas (if applicable), water, and waste disposal services to get quotes and understand the connection process and fees.

- Telephone and television services: Inquire about the availability and cost of telephone and television services, as these might be limited or more expensive in rural locations.

Lifestyle Adjustments: Living Costs in Rural Areas

Life in the countryside brings many joys, but it also necessitates adjustments in your spending habits.

Transportation Costs

Transportation costs can escalate significantly in rural areas.

- Increased reliance on a car: You will likely be more reliant on your car for transportation, leading to higher fuel costs, maintenance expenses, and insurance premiums.

- Public transport limitations: Public transport is often less frequent and covers fewer routes in rural areas. Consider this when calculating travel costs.

- Travel times: Journeys to shops, services, work, and social events will likely take longer, impacting your time and potentially fuel costs.

Everyday Expenses

Day-to-day living expenses may also differ in the countryside.

- Grocery shopping: Grocery shopping could become more expensive due to limited supermarket choices and longer distances to larger stores. Consider the increased fuel costs and potential for higher prices at smaller, local shops.

- Energy bills: Depending on your property's energy efficiency and the climate, energy bills can be higher in rural areas. Older, less insulated properties will naturally require more energy for heating and cooling.

- Local service costs: The cost of services such as plumbers, electricians, and other tradespeople may be higher in rural areas due to fewer providers and increased travel times.

Conclusion

Escaping to the country is a dream for many, but it requires thorough financial planning. By carefully budgeting for property costs, relocation expenses, and adjusting to the lifestyle changes inherent in a rural setting, you can make your rural relocation a successful and financially responsible venture. Don't let the allure of country living overshadow the importance of creating a realistic budget. Start planning your escape to the country today with a well-defined budget, and embrace a more fulfilling and tranquil life!

Featured Posts

-

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 24, 2025

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 24, 2025 -

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

The 10 Fastest Production Ferraris Around Their Own Test Track

May 24, 2025

The 10 Fastest Production Ferraris Around Their Own Test Track

May 24, 2025 -

France Political Push To Ban Hijabs For Girls Under 15 Years Old

May 24, 2025

France Political Push To Ban Hijabs For Girls Under 15 Years Old

May 24, 2025 -

How To Get Bbc Radio 1 Big Weekend 2025 Tickets A Complete Guide

May 24, 2025

How To Get Bbc Radio 1 Big Weekend 2025 Tickets A Complete Guide

May 24, 2025

Latest Posts

-

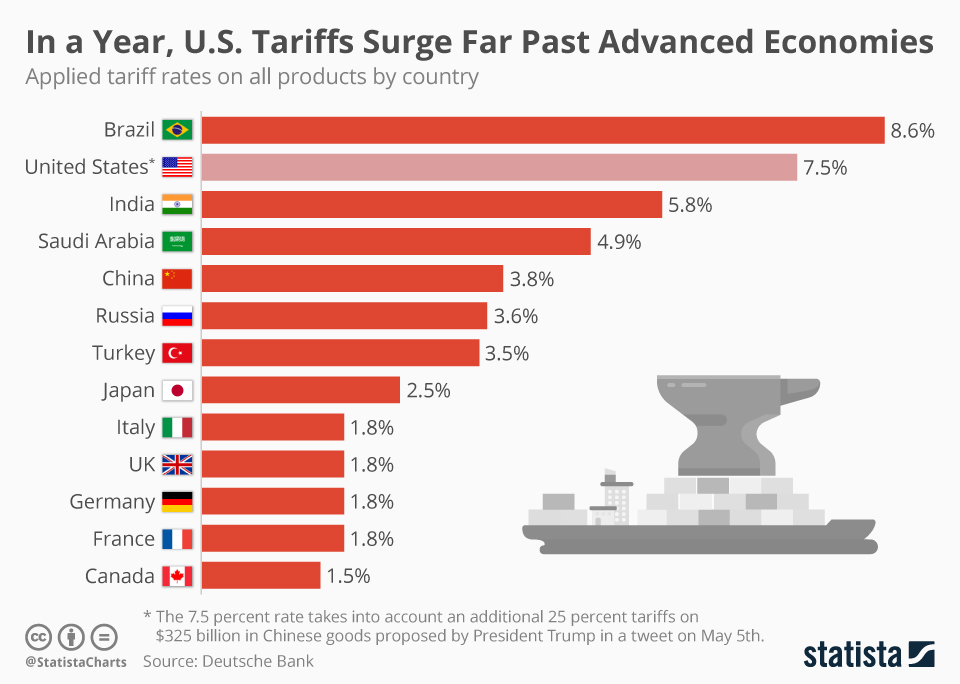

Stock Market News European Shares Up Lvmh Down On Tariff Developments

May 24, 2025

Stock Market News European Shares Up Lvmh Down On Tariff Developments

May 24, 2025 -

European Market Update Tariff Hopes And Lvmhs Decline

May 24, 2025

European Market Update Tariff Hopes And Lvmhs Decline

May 24, 2025 -

Assessing The National Rallys Show Of Support For Le Pen In France A Sunday Report

May 24, 2025

Assessing The National Rallys Show Of Support For Le Pen In France A Sunday Report

May 24, 2025 -

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025 -

National Rallys Le Pen Demonstration A Lower Than Expected Showing In France

May 24, 2025

National Rallys Le Pen Demonstration A Lower Than Expected Showing In France

May 24, 2025