Could Buying XRP (Ripple) Today Set You Up For Life? A Realistic Look

Table of Contents

Understanding XRP (Ripple) and its Technology

XRP is a cryptocurrency designed to facilitate fast and cost-effective cross-border payments. Unlike Bitcoin, which operates on a decentralized blockchain, XRP utilizes a unique, centralized ledger called the XRP Ledger, managed by Ripple Labs. This centralized structure allows for faster transaction speeds and lower fees compared to traditional banking systems and many other cryptocurrencies. RippleNet, Ripple's payment network, connects banks and financial institutions globally, enabling seamless international transactions.

- RippleNet: This network leverages XRP to provide a faster, cheaper, and more transparent alternative to the SWIFT network used by most banks for international transfers.

- Technological Advancements: The XRP Ledger is constantly being upgraded, with improvements focusing on scalability, security, and efficiency. These advancements are crucial for its continued relevance in the competitive cryptocurrency landscape.

- Regulatory Landscape: The regulatory status of XRP is constantly evolving and presents a significant factor impacting its price and potential for adoption. Ongoing legal battles and regulatory scrutiny must be considered.

The Volatility of XRP and Investment Risks

Cryptocurrencies, including XRP, are notoriously volatile. Their prices can fluctuate dramatically in short periods due to market sentiment, news events, and technological developments. While this volatility presents the potential for substantial profits, it also carries the risk of significant losses. Investing in XRP requires a high-risk tolerance and a clear understanding of the potential downsides.

- Historical Price Fluctuations: A review of XRP's price history reveals periods of explosive growth followed by sharp corrections. This highlights the unpredictable nature of the cryptocurrency market.

- Influencing Factors: News regarding regulatory actions, partnerships with financial institutions, and technological upgrades can significantly impact XRP's price. Negative news can lead to rapid price drops.

- FOMO and Emotional Investing: The fear of missing out (FOMO) can drive impulsive investment decisions, often leading to poor outcomes. Maintaining emotional detachment and sticking to a well-defined investment strategy is crucial.

Analyzing the Potential for Long-Term Growth of XRP

The long-term growth of XRP hinges on several factors. Widespread adoption by banks and financial institutions is crucial for its success. Continued technological advancements, making the XRP Ledger more efficient and secure, will also play a vital role. Positive regulatory developments could significantly boost XRP's price. However, competition from other cryptocurrencies and established payment solutions presents a significant challenge.

- Market Predictions: While many analysts offer optimistic predictions for XRP's future, it's essential to approach such forecasts with caution. The cryptocurrency market is highly unpredictable.

- Potential Price Scenarios: Predicting XRP's price in 5-10 years is highly speculative. Scenarios range from substantial price increases to a decline in value.

- Inherent Uncertainty: The inherent uncertainty in the cryptocurrency market necessitates a diversified investment approach to mitigate potential losses.

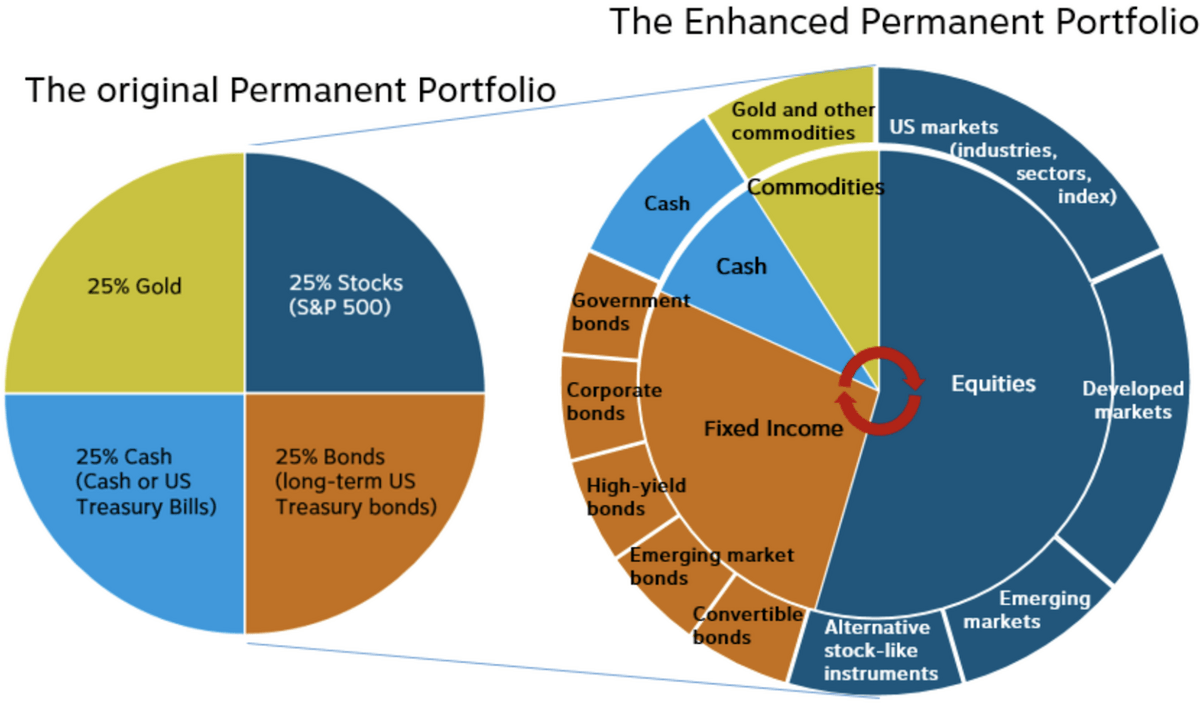

Building a Diversified Investment Portfolio that Includes XRP (Ripple)

A crucial aspect of responsible investing is diversification. Never put all your eggs in one basket, especially in a volatile market like cryptocurrencies. A well-balanced investment portfolio should include a mix of asset classes, such as stocks, bonds, real estate, and potentially, a small allocation to cryptocurrencies like XRP.

- Risk Tolerance: Your risk tolerance will influence the percentage of your portfolio allocated to higher-risk assets like XRP.

- Integrating XRP: XRP could form a small part of a diversified portfolio for investors with a high-risk tolerance and a long-term investment horizon.

- Professional Advice: Before making any significant investment decisions, it's essential to seek professional financial advice tailored to your individual circumstances and financial goals.

Conclusion

Buying XRP (Ripple) offers the potential for significant returns, driven by its innovative technology and ambitious goals within the cross-border payment sector. However, it's crucial to acknowledge the inherent volatility and risks associated with cryptocurrency investments. Thorough research, a realistic risk assessment, and a well-diversified investment portfolio are essential for mitigating potential losses. Before considering buying XRP (Ripple) or any other cryptocurrency, remember to thoroughly research the market and consult with a financial advisor to make informed decisions about your investment strategy. The potential for life-changing gains exists, but only with careful planning and a considered approach to risk management.

Featured Posts

-

Analysis Xrp Price Surge After Us Presidents Post About Trump And Ripple

May 07, 2025

Analysis Xrp Price Surge After Us Presidents Post About Trump And Ripple

May 07, 2025 -

Gears Of War Remaster Officially Announced For Play Station And Xbox

May 07, 2025

Gears Of War Remaster Officially Announced For Play Station And Xbox

May 07, 2025 -

Apo Group Press Release Minister Tavios Upcoming Visit To Zambia And Ldc Forum

May 07, 2025

Apo Group Press Release Minister Tavios Upcoming Visit To Zambia And Ldc Forum

May 07, 2025 -

Simone Biles Stern Warning No More Unwanted Touching After Paris Olympics Incident

May 07, 2025

Simone Biles Stern Warning No More Unwanted Touching After Paris Olympics Incident

May 07, 2025 -

Potential Liquidation Looms For Lion Electric Company

May 07, 2025

Potential Liquidation Looms For Lion Electric Company

May 07, 2025

Latest Posts

-

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025