Potential Liquidation Looms For Lion Electric Company

Table of Contents

Lion Electric Company's Mounting Financial Troubles

Lion Electric's current predicament stems from a confluence of factors that have severely impacted its financial health and raised significant concerns about its long-term viability. The possibility of Lion Electric Company liquidation is no longer a remote possibility but a very real threat.

Declining Stock Prices and Investor Concerns

The sharp decline in Lion Electric's stock price is a clear indicator of eroding investor confidence. The company has experienced a significant drop in share value over the past year, losing over [Insert Percentage]% since [Insert Date]. This dramatic fall reflects the negative investor sentiment reported in various market indices and financial news outlets such as [mention specific sources]. The loss of key investors and a dwindling pool of potential investment opportunities further exacerbate the situation, making it increasingly difficult for the company to secure necessary funding.

- Significant drop in share value over the past 12 months.

- Negative investor sentiment widely reflected in major market indices and financial news reports.

- Loss of several key investors and a significant reduction in available investment opportunities.

Production Shortfalls and Delivery Delays

Lion Electric has struggled to meet its production targets and fulfill orders on time, leading to operational inefficiencies and considerable financial strain. Missed deadlines and delayed deliveries have damaged the company's reputation and strained relationships with customers.

- Missed production targets for several key electric bus and truck models throughout 2023.

- Significant delays in delivering vehicles to both public and private sector customers.

- Supply chain disruptions have severely impacted production capacity and increased costs.

High Debt Levels and Cash Flow Problems

Lion Electric carries a substantial debt burden, exceeding [Insert Amount] as of [Insert Date]. This high level of debt, coupled with negative cash flow for [Insert Time Period], makes it extremely difficult for the company to cover operational expenses and meet its debt obligations. Securing additional financing is proving challenging, further compounding the company's financial woes.

- Total debt exceeding [Insert Amount] significantly impacting the company's financial stability.

- Increasing difficulty in securing additional financing to meet operational needs and debt repayments.

- Negative cash flow reported for the past [Insert Time Period], highlighting the company’s precarious financial position.

Potential Consequences of Liquidation for Lion Electric Company

The potential Lion Electric Company liquidation would have far-reaching consequences, impacting not only the company itself but also the broader EV market and the economy.

Impact on the Electric Vehicle Market

A Lion Electric Company liquidation would represent a significant loss for the electric vehicle market. The company plays a notable role in the electric bus and truck segment, and its absence would create a void.

- Loss of a significant player in the North American electric bus and truck market, leading to reduced competition.

- Potential for industry consolidation as other companies seek to acquire Lion Electric's assets or fill the market gap.

- Negative impact on investor confidence in the electric vehicle sector, potentially hindering future investments and development.

Job Losses and Economic Fallout

The potential liquidation of Lion Electric would result in significant job losses for the company's employees and have broader economic consequences for communities reliant on the company.

- Estimated job losses potentially exceeding [Insert Number] employees.

- Substantial economic impact on local communities dependent on Lion Electric for employment and economic activity.

- Negative ripple effect on supplier companies that rely on Lion Electric for business.

Implications for Customers with Outstanding Orders

Customers who have placed orders with Lion Electric face significant uncertainty should the company liquidate. The fulfillment of outstanding orders is uncertain, and customers may face potential loss of deposits.

- Significant uncertainty surrounding the fulfillment of existing customer orders for electric vehicles.

- Potential loss of deposits paid by customers who have placed orders with Lion Electric.

- Legal recourse options for affected customers might be limited depending on the terms and conditions of their contracts.

Conclusion

The potential Lion Electric Company liquidation represents a serious threat to the company, the EV market, and the wider economy. The company's mounting financial troubles, production shortfalls, and inability to secure funding paint a bleak picture. The consequences of liquidation could be severe, impacting jobs, investment, and the progress of the EV sector. It's crucial for stakeholders to monitor the situation closely and explore alternative solutions to avoid this potential disaster. Staying informed about the latest developments regarding Lion Electric Company liquidation is paramount. Keep up-to-date with the latest news to understand the evolving situation and its impact on the future of electric transportation.

Featured Posts

-

Dame Laura Kennys Fertility Journey Ends With Healthy Baby Girl

May 07, 2025

Dame Laura Kennys Fertility Journey Ends With Healthy Baby Girl

May 07, 2025 -

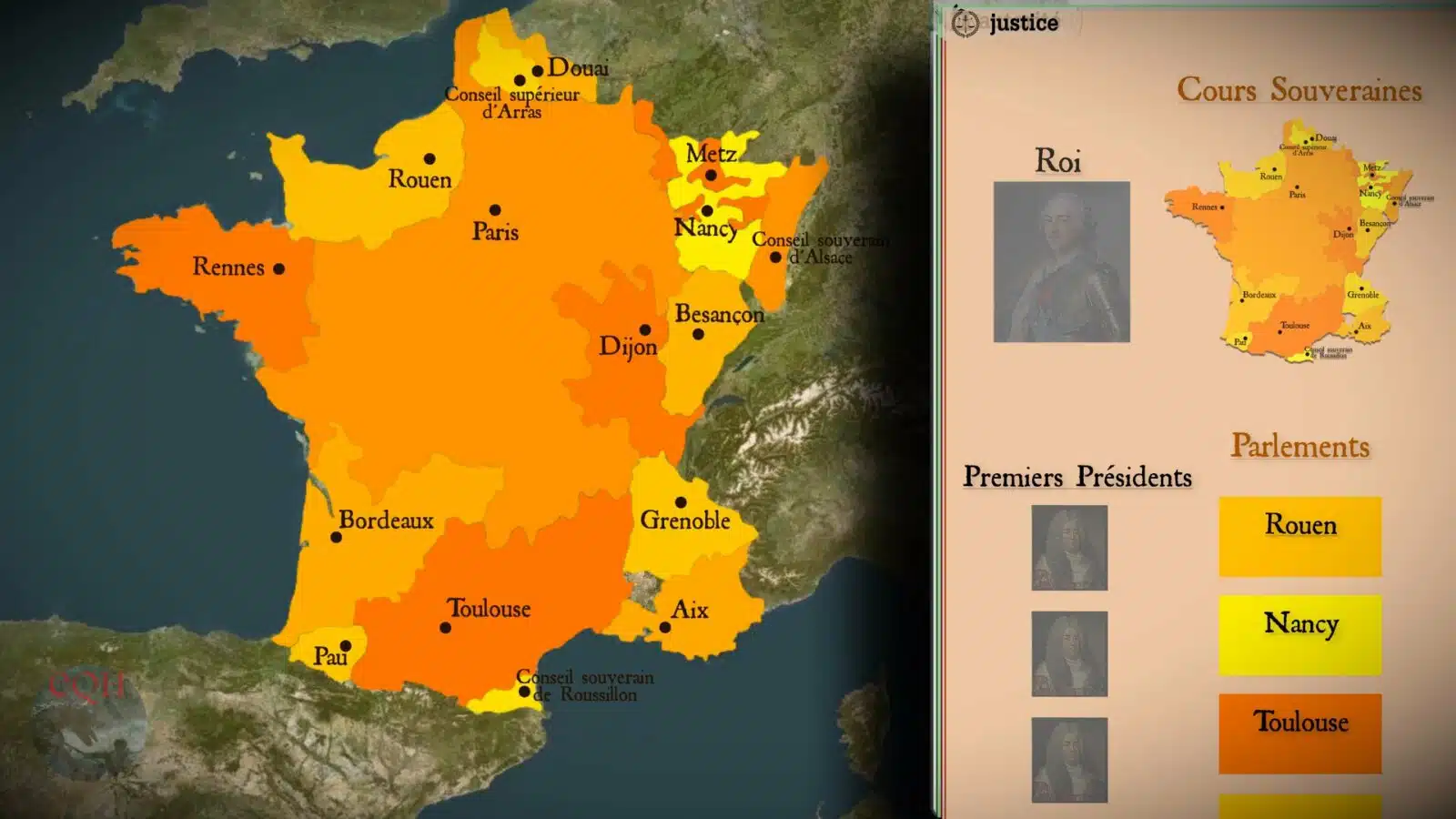

Le Conclave Papal Histoire Regles Et Traditions

May 07, 2025

Le Conclave Papal Histoire Regles Et Traditions

May 07, 2025 -

British Cycling Stars Laura And Jason Kenny Expand Their Family

May 07, 2025

British Cycling Stars Laura And Jason Kenny Expand Their Family

May 07, 2025 -

The Making Of A Scream Queen Why Jenna Ortegas Horror Performances Stand Out

May 07, 2025

The Making Of A Scream Queen Why Jenna Ortegas Horror Performances Stand Out

May 07, 2025 -

Analysis Ripple Xrp And Its Potential To Reach 3 40

May 07, 2025

Analysis Ripple Xrp And Its Potential To Reach 3 40

May 07, 2025

Latest Posts

-

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025 -

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025 -

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025 -

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025 -

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025