Could A 10x Bitcoin Multiplier Reshape Wall Street? A Weekly Chart Review

Table of Contents

Bitcoin's Historical Price Volatility and Potential for a 10x Multiplier

Analyzing Past Bitcoin Price Movements

Bitcoin's history is marked by periods of intense volatility, with significant price surges and crashes. Understanding these past movements is crucial to assessing the possibility of a 10x multiplier.

- Halving Events: The halving of Bitcoin's block reward, which occurs roughly every four years, has historically been followed by significant price increases due to reduced supply.

- Institutional Adoption: Increased investment from large financial institutions like MicroStrategy and Tesla has significantly boosted Bitcoin's price and market capitalization.

- Regulatory Changes: Positive regulatory developments in certain jurisdictions have often led to price increases, while negative news has triggered price corrections.

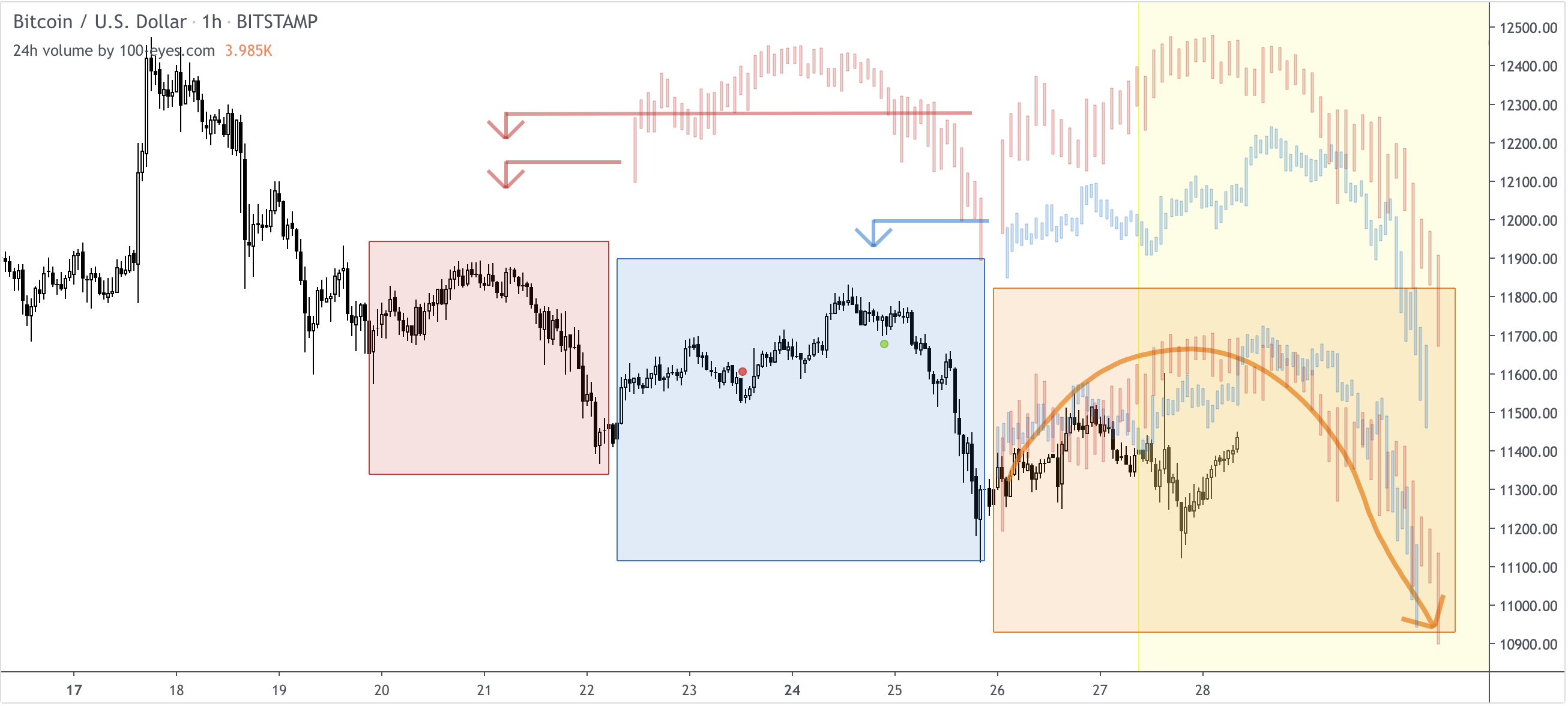

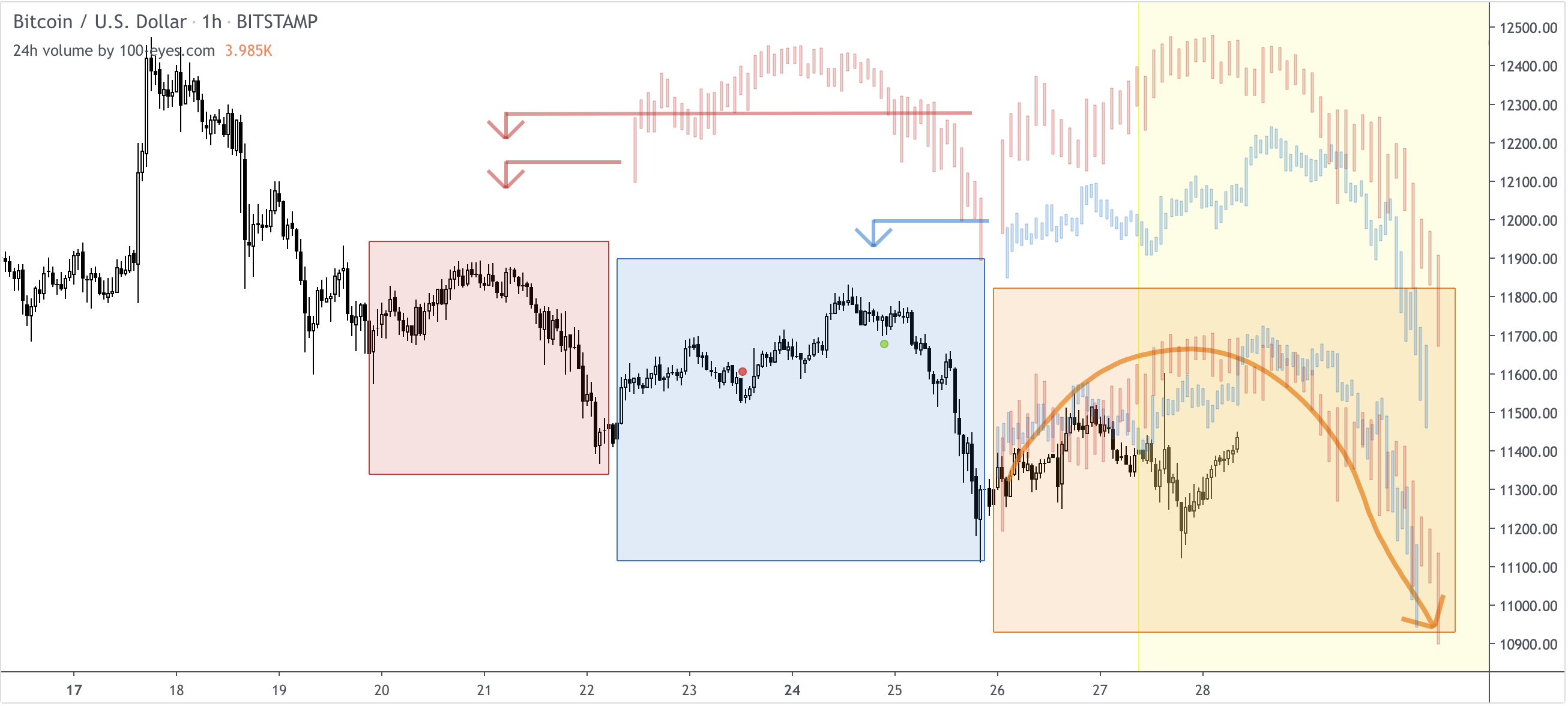

[Insert chart/graph illustrating Bitcoin's historical price volatility, highlighting significant events.]

Technical indicators like moving averages and the Relative Strength Index (RSI) can provide insights into potential price trends. Analyzing these indicators alongside historical events helps predict future price movements.

Assessing the Likelihood of a 10x Multiplier

A 10x Bitcoin price increase is a significant event, and its likelihood depends on several interconnected factors:

- Macroeconomic Trends: Global economic uncertainty and inflation could drive investors towards Bitcoin as a hedge against inflation, potentially fueling price growth.

- Regulatory Landscape: Clearer and more favorable regulatory frameworks globally could boost institutional adoption and investor confidence.

- Competition: The emergence of competing cryptocurrencies could either dilute or enhance Bitcoin's value, impacting its price trajectory.

- Technological Advancements: Developments like the Lightning Network, which improves Bitcoin's scalability and transaction speed, can positively influence its price.

Expert opinions on Bitcoin's future price vary significantly. While some predict a continued upward trend, others express caution, pointing to potential market corrections. It's crucial to consider a range of perspectives when assessing the likelihood of a 10x multiplier.

The Impact of a 10x Bitcoin Multiplier on Wall Street Institutions

Increased Institutional Investment and Portfolio Diversification

A 10x Bitcoin price surge would likely force Wall Street firms to re-evaluate their investment strategies.

- Portfolio Restructuring: Many institutions might significantly increase their Bitcoin holdings to diversify portfolios and capitalize on potential gains.

- New Financial Products: The emergence of new Bitcoin-related financial products, such as Bitcoin-backed ETFs and other derivatives, is highly probable.

- Hedge Fund Strategies: Hedge funds are likely to incorporate Bitcoin more prominently into their strategies, either through direct investment or through leveraged positions.

Regulatory Scrutiny and the Evolution of Financial Regulations

Such a dramatic price increase would inevitably lead to increased regulatory scrutiny.

- Stricter Regulations: Governments might introduce stricter regulations to manage the risks associated with Bitcoin's volatility and potential for market manipulation.

- Increased Oversight: Financial regulators would likely increase their oversight of cryptocurrency exchanges and other Bitcoin-related businesses.

- Framework Adaptation: Existing financial frameworks would need significant adaptation to accommodate the increasing importance of cryptocurrencies in the global financial system.

Disruption of Traditional Financial Markets

A 10x Bitcoin multiplier could significantly disrupt traditional financial markets.

- Gold Market: Bitcoin could potentially challenge gold's position as a safe haven asset, leading to a shift in investor sentiment and capital flows.

- Foreign Exchange Market: The increased adoption of Bitcoin could lead to changes in the foreign exchange market as more transactions occur using Bitcoin instead of traditional fiat currencies.

- Market Stability: The rapid price appreciation could initially cause market instability, but in the long run, a stabilized Bitcoin market could bring increased liquidity and efficiency.

Weekly Chart Review: Key Technical Indicators and Price Predictions

[Insert detailed weekly Bitcoin chart with clearly marked support and resistance levels, moving averages, RSI, etc.]

Our analysis of the weekly Bitcoin chart reveals [mention key observations, e.g., strong upward momentum, potential resistance levels, etc.]. Based on these observations and the technical indicators, we predict [mention short-term and long-term price predictions with caveats, e.g., potential for a short-term correction followed by a sustained upward trend]. However, it’s vital to remember that these are predictions and subject to change based on market dynamics.

Conclusion: Will a 10x Bitcoin Multiplier Reshape Wall Street? Key Takeaways and Next Steps

A 10x Bitcoin multiplier presents a significant possibility with far-reaching consequences for Wall Street. Our analysis highlights the potential for increased institutional investment, regulatory changes, and disruption to traditional financial markets. While a 10x increase is a significant and potentially volatile event, understanding Bitcoin's volatility and potential risks is crucial. The interplay of macroeconomic factors, regulatory developments, and technological advancements will ultimately determine Bitcoin's future price trajectory.

Stay updated on the latest developments in the Bitcoin market. Regularly review our weekly chart analysis for insights into the potential for a 10x Bitcoin multiplier and its effects on Wall Street. Conduct thorough research and understand the risks involved before making any investment decisions related to Bitcoin and the potential for a 10x Bitcoin multiplier.

Featured Posts

-

Gta Vis New Trailer A Bonnie And Clyde Heist In Vice City

May 08, 2025

Gta Vis New Trailer A Bonnie And Clyde Heist In Vice City

May 08, 2025 -

Psg Luis Enrique Shkarkon Pese Yje

May 08, 2025

Psg Luis Enrique Shkarkon Pese Yje

May 08, 2025 -

Inter Vs Barcelona Recalling A Champions League Final Classic

May 08, 2025

Inter Vs Barcelona Recalling A Champions League Final Classic

May 08, 2025 -

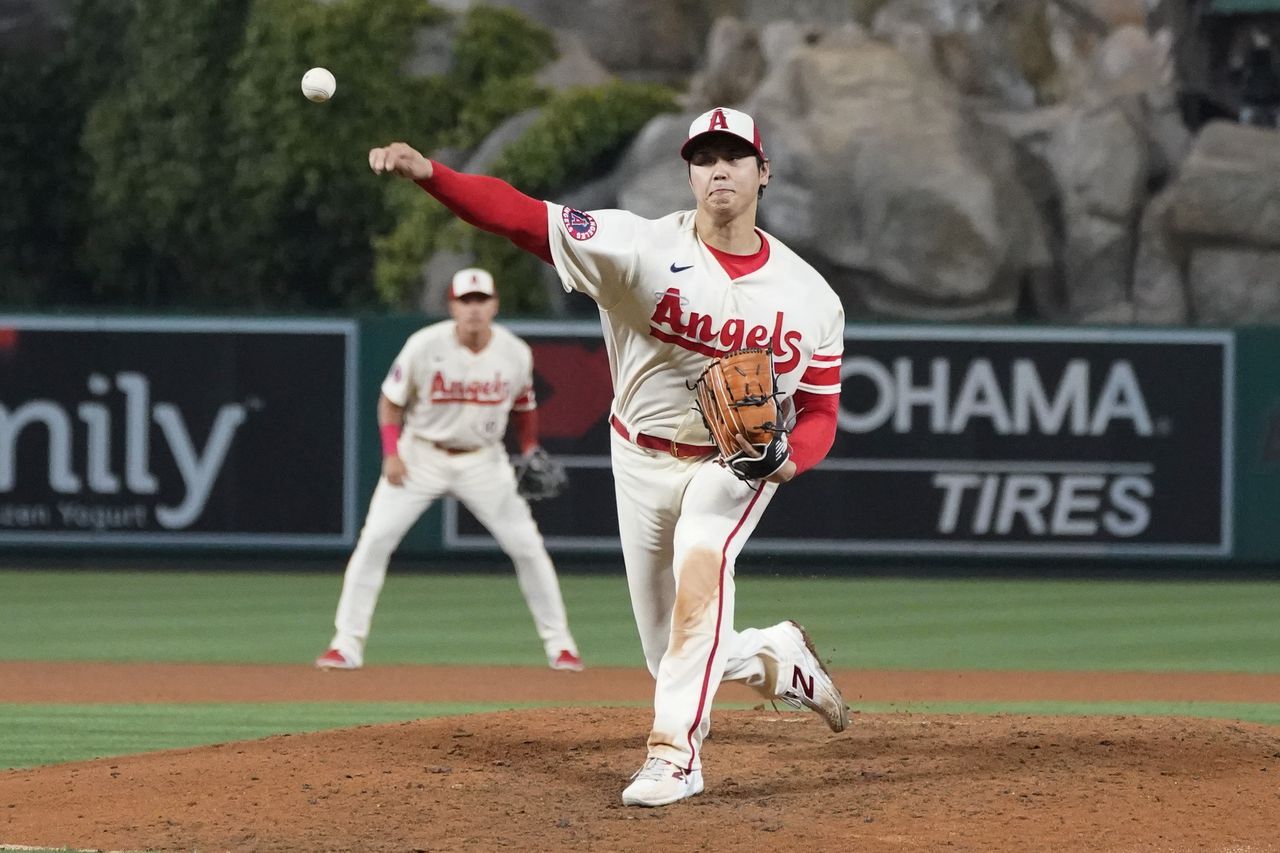

Kyren Paris Heroics Lift Angels Over White Sox Despite Rain Delay

May 08, 2025

Kyren Paris Heroics Lift Angels Over White Sox Despite Rain Delay

May 08, 2025 -

Cantina Canalla Un Viaje Culinario A Mexico En Malaga

May 08, 2025

Cantina Canalla Un Viaje Culinario A Mexico En Malaga

May 08, 2025

Latest Posts

-

Ethereum Cross X Signals Is A 4 000 Price Target Realistic Institutional Accumulation Analysis

May 08, 2025

Ethereum Cross X Signals Is A 4 000 Price Target Realistic Institutional Accumulation Analysis

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators And Institutional Buying Suggest 4 000 Is Possible

May 08, 2025

Ethereum Price Prediction Cross X Indicators And Institutional Buying Suggest 4 000 Is Possible

May 08, 2025 -

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025 -

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025 -

Ethereums Growing Momentum 10 Increase In Address Activity Signals Bullish Trend

May 08, 2025

Ethereums Growing Momentum 10 Increase In Address Activity Signals Bullish Trend

May 08, 2025